piranka

Datadog, Inc. (NASDAQ:DDOG) recently reported a very strong start to the year with revenue and margins handily beating expectations, leading to an impressive Rule of 100 score for the quarter. The combination of revenue growing 83% and non-GAAP operating margins of 23% are unparalleled in the market, and the company’s historically conservative guidance makes upside in upcoming quarters appear likely.

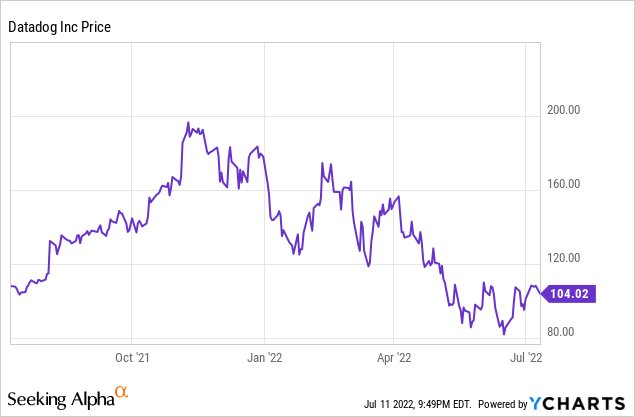

So far this year, investors have rotated out of fast-growth technology stocks as fears around a potential recession, rising rates, and a global macro slowdown have weighed on sentiment. However, the strong combination of revenue growth and profitability gives me confidence in the long-term outlook.

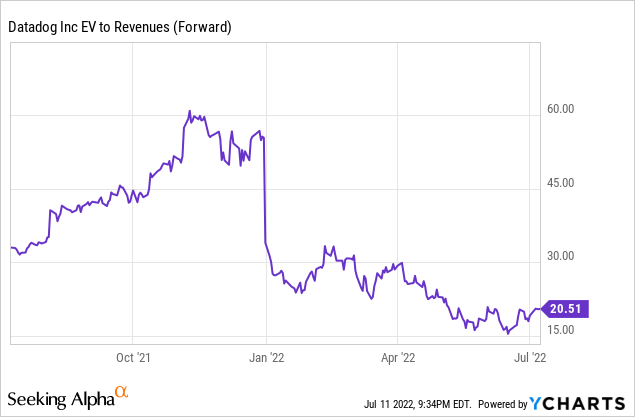

Currently, the stock trades at 23x 2022 revenue and at face value, that appears very expensive. Dialing in a bit further, Datadog has historically been conservative around guidance, and after assuming small beat and raises for the remainder of the year and revenue growth slowing to 50% in 2023, valuation seems more attractive at under 15x my estimated 2023 revenue.

While that may still be a difficult valuation to justify, investors should take note of the company’s Rule of 100 score and FCF margin above 30%. Even if we were to take our growth estimate out to 2024 and assume even more revenue declaration, the stock currently trades around 10x 2024 revenue.

There are many companies in the market that achieve a Rule of 40 score that trade at mid-teens revenue multiples. Datadog achieves a Rule of 100 score and trades at 15x my estimated 2023 revenue.

The stock may continue to be volatile over the company quarters as investors right-size around a potential economic slowdown and the company’s valuation. However, I believe there continues to be a lot of value left to be created over the long-term.

Financial Review

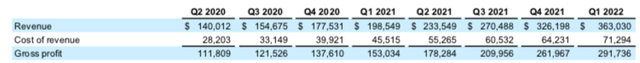

During the company’s recent earnings, they reported revenue growth of $363 million, which grew 83% YOY and beat expectations by $25 million with consensus expecting 75% YOY growth. In addition, revenue growth remained fairly consistent with last quarter’s 84% YOY growth. The company continues to report revenue nearly doubling each quarter even as they approach a $1.5 billion run-rate, a very impressive feat that should not be glanced over.

As the company continues to scale revenue, investors should see this through the gross and operating income, which has been clearly demonstrated in recent quarters. Non-GAAP gross margin was 80% during the quarter, which improved from 77% in the year-ago period and was above the recent trend of high-70% range.

While it’s not likely that gross margins expand much from current levels, the high revenue flow through will ultimately help operating income margin expand. This high flow-through and scale was seen during the most recent quarter, with non-GAAP operating margin of 23%, improving significantly from 10% in the year-ago period.

Even with the very strong YOY improvement, I believe there continues to be room for more margin expansion in future quarters. With a Rule of 40 score in excess of 100 during the most recent quarter, there clearly is a healthy balance of revenue growth and profitability.

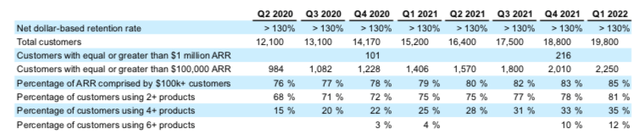

In addition, billings growth during the quarter was 103% YOY and tends to be a great leading indicator of revenue growth. On the earnings call, management talked about strong customer growth, especially among customers with >$100k of ARR, which grew 60% YOY.

Total customers grew 30% year-over-year and customers with $100,000 or more of ARR grew 60% year-over-year. In addition, we saw strong growth in $1 million customers.

We are pleased to be serving more customers and believe we are still in the early stages of our opportunity in worldwide customer acquisition. New logo ARR was very robust, particularly given that our sales teams participate in sales kickoff and other planning processes at the beginning of Q1. Remember that given our usage-based revenue model, new logo wins generally do not immediately transfer into meaningful revenue.

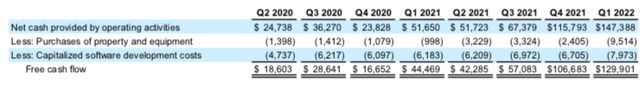

On top of the strong operating performance and customer adds, Datadog also reported $130 million of free cash flow (“FCF”), representing a margin just under 36%. With this strong FCF, the company is able to invest into their growth, including their recent acquisition of Hdiv Security, a leading security-testing software provider.

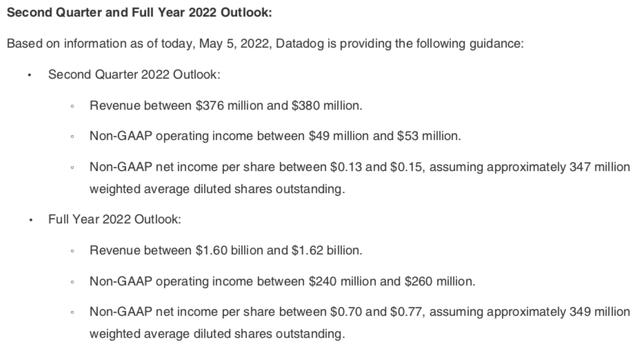

For Q2, the company is expecting revenue of $376-380 million, which is nicely above expectations for $362 million. As we have seen in the past, the company typically guides conservatively and has shown a pattern of big beats.

For the full year, revenue is expected to be $1.6-1.62 billion, which is ~$80 million above expectations for $1.53 billion, a nice guidance raise even when accounting for the $25 million beat in Q1. Non-GAAP operating income of $240-260 million implies a margin around 15.5% at the midpoint. I wouldn’t be shocked to see both revenue and margin upside throughout the year.

Valuation

However, this is where Datadog differs. With the company reporting a Rule of 100 score in the most recent quarter, in addition to free cash flow margins nicely above 30%, I believe there continues to be a lot of long-term value left to be created.

The company has a current market cap around $37.8 billion and with around $1 billion of net cash, the company has an enterprise value of $36.8 billion.

When looking at 2022 revenue guidance of $1.6-1.62 billion, this implies a 2022 revenue multiple of around 23x. Yes, this remains very expensive, but there are few companies in the market with a Rule of 40 score above 100 with FCF margins above 30%.

For the current year, revenue growth is expected to be 55-57%, though I believe this ultimately comes in above 60% given the company’s history of beat and raise quarters.

If 2022 revenue comes in closer to $1.7 billion and growth decelerates to 50% in 2023, we could see revenue reaching $2.55 billion next year, which implies a 2023 revenue multiple of under 15x.

Again, this remains expensive, but there are other fast-growth tech companies in the market that are around the Rule of 40 guideline that trade at mid-teens forward revenue multiples. Given Datadog’s superior revenue growth and high levels of profitability, the company rightfully deserves to trades at a noticeable premium.

With the stock currently just over $100, I believe investors will be rewarded with long-term holding positions. The stock may continue to be volatile in the short-term, but their history of strong execution likely leads to upside to guidance and a bullish trend over the coming quarters and years.

Be the first to comment