philip_hens/iStock via Getty Images

Introduction

It’s time to talk about one of the most tricky investments on the market: coal. Coal was declared dead prior to the pandemic due to its impact on the environment. Yet, after the pandemic, something changed. Governments started to push harder for net-zero, energy demand came back roaring, and Putin started to reduce natural gas exports to Europe in the second half of 2021 (prior to the war). The result is a global surge in oil, natural gas, and coal. After all, “dirty” coal has not only paved the road for our “Western” prosperity, but it is still a cheap alternative that’s currently being used as natural gas in Europe is skyrocketing. Especially the war in Ukraine is making things worse as countries are considering boycotting natural gas. The impact would be devastating as I will explain in this article covering US coal giant Arch Resources (NYSE:ARCH). What used to be Arch Coal has a massive metallurgical coal footprint in Europe, which has done wonders to the stock price. In this article, I invite you to read my thoughts on the matter using geopolitical and macro developments that show that Arch has more upside potential despite ongoing risks.

Allow me to elaborate.

Coal Is Back

I always highlight this, but I’m not biased. I’m not generally speaking a fan of coal energy. I like that utilities in the US (I have covered a lot) are slowly moving away from coal to renewables, nuclear, and natural gas. However, the keyword here is “slowly”. If there’s one thing I dislike more than anything else, it’s rising energy prices because we’re creating our own supply issues.

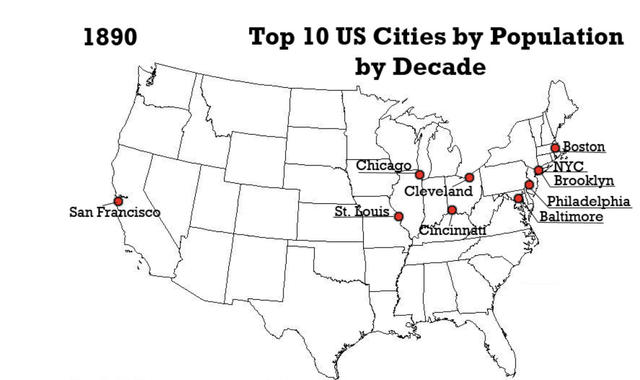

Coal is the backbone of western wealth. It helped fuel the American industrial revolution. The same happened in Europe and it’s now happening in Asia.

The map below shows that during these booming times, the biggest cities in the US were mainly industrial. Back then, West Virginia had a much better reputation as it was the home of quality and affordable coal.

Now, we’re creating our own problems as the transition from coal and oil to renewables is going too fast.

In my daily newsletter on Intelligence Quarterly, I included a few comments on the global coal industry that apply here as well:

The surge in natural gas prices has caused countries to switch to cheaper, but polluting coal supply: Another unintended consequence of Europe’s energy crisis has reared its ugly head halfway across the world, in the mountains of northern Pakistan. After a key supplier of liquefied natural gas cancelled deliveries, the country has found themselves unable to pay the very high spot price that LNG currently commands. To cover the shortfall, Pakistan’s energy-hungry industries have turned to coal, and Afghan coal specifically. Exports from its northern neighbor have shot up from nothing last summer to 500,000 tons a month now.

That Europe’s gas crunch is driving up demand for coal is evident from looking at how dramatically price points for major coal exporters have increased. South African coal skyrocketed to a high of about $400 a ton following the invasion: it’s normally between $50-100. The widely-used Australian Newcastle coal benchmark hit similar highs to South Africa, and is trading far above its pre-invasion peak.

Herein lies a big problem that Russia’s invasion of Ukraine presents. Diversifying away from Russian gas as quickly as possible, without enough increased gas production, renewables use, or energy demand reduction to replace it, will drive global LNG prices up. For European gas consumers, this will be bad enough: firms could have to shut, and poorer households will struggle financially without government assistance.

Even Germany is now coming out saying that it needs to extend the planned coal phase-out. Merkel initially wanted a coal exit by 2038. The new coalition moved that target to 2030. Now, they are figuring out that this isn’t possible.

Germany on Wednesday declared an “early warning” of a possible gas supply emergency, a sign of concern about possible disruption or stoppage of natural gas flows from Russia.

“Our phones are ringing off the hook,” said Erik Passow, who builds furnaces and fireplaces, adding that supply shortages were also making it difficult to keep up with orders. “People want security, because freezing isn’t fun.” – Source: Zawya

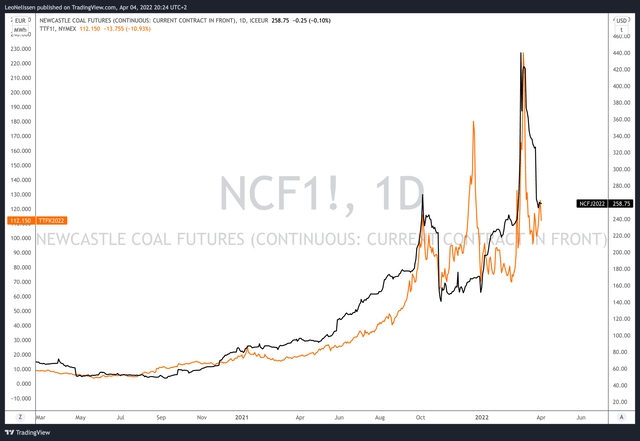

The graph below shows Newcastle coal futures (Australia-based), which I like to use as a benchmark for coal in general as well as Dutch TTF natural gas futures (orange), which is a good benchmark for European natural gas prices. Right now, both are well off their highs, but still at unsustainable levels that require alternatives like coal.

So, what does this mean for Arch?

Arch Resources Is Back As Well

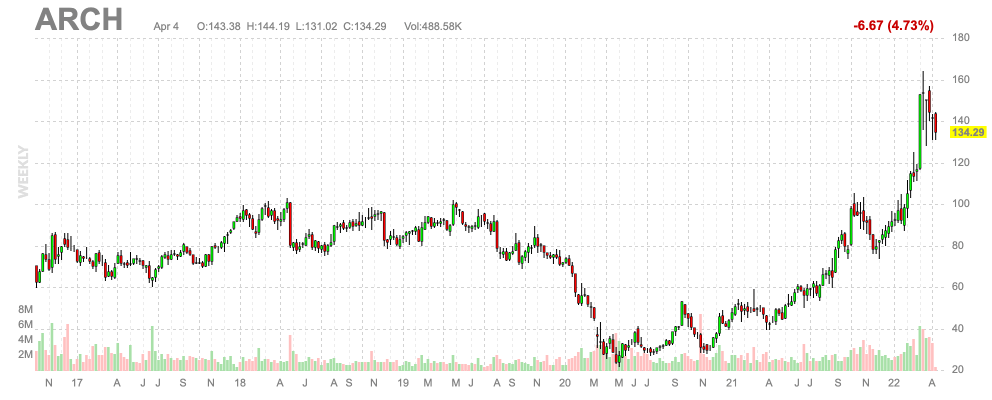

Prior to the pandemic, Arch traded close to $90 per share. The stock plummeted to less than $30 as the world’s economic hotspots shut down. Since then, the stock has rebounded to currently more than $130. The top was closer to $160 last month.

FINVIZ

Arch has a $2.1 billion market cap. Based in St. Louis, Missouri, Arch is a leader in the metallurgical coal industry. Unlike thermal coal, metallurgical coal is used in the production of steel.

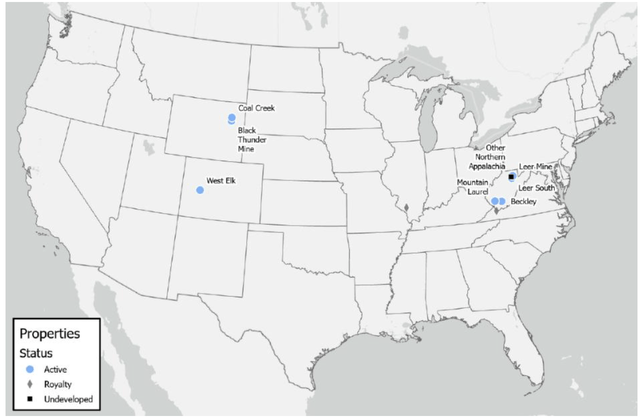

In this case, Arch produces roughly 11% of the total annual US metallurgical coal supply, which was estimated to be close to 65 million tons in 2021. The company sold its product to six North American customers and exported it to 24 customers overseas in 15 countries last year. All of the company’s metallurgical coal is produced in the state of West Virginia. Thermal coal is produced in Wyoming and Colorado.

Arch Resources (via. SEC 10-K)

This year and going forward, Arch aims to generate 80% of its EBITDA from metallurgical coal. Note that thermal coal volumes are higher, but due to lower margins the impact from metallurgical coal is higher.

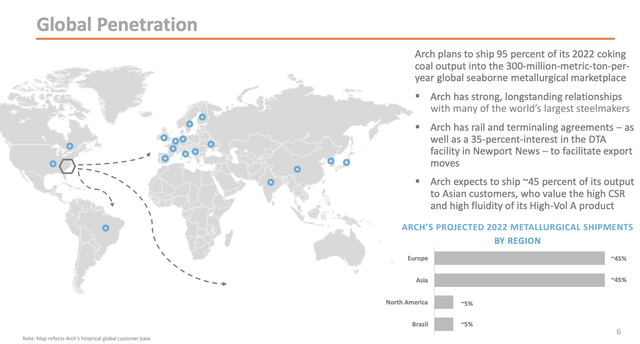

With regard to the aforementioned coal exports, the company ships roughly half of its volumes to Europe and the other half to Asia. Just 10% of metallurgical volumes remain in North America or go to Brazil. I like that stat as this makes the company an important player in satisfying coal demand in Europe and Asia, where prices are rising faster than in the US because of energy price differentials.

Moreover, the company supplies roughly 30% of the world’s high-vol A coking coal, which is high-quality input for steel producers.

Like its energy peers in oil, Arch benefits from subdued supply on a bigger scale. Australia, for example, saw coking coal exports drop by 17 million tons in 2021 compared to pre-pandemic 2019. In the US, production fell from 74.7 million tons in 2019 to 64.5 million tons in 2021. Canadian coking coal exports were down to 26.3 million tons from 34.9 million tons in 2019.

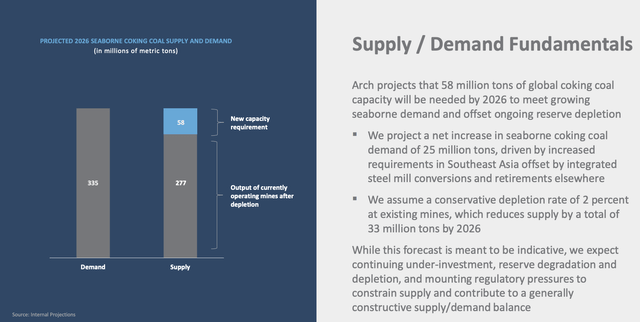

In 2026, the company expects roughly 58 million metric tons of shortages based on an increase of 25 million tons of export demand and a depletion rate of 2% at existing mines, reducing supply by 33 million tons. This is, of course, an estimate, but the fact that underinvestments are a problem makes this very plausible. After all, in times of “net-zero”, there’s not a lot of available financing.

So, what does this mean in terms of valuation?

Valuation

Expectations are tricky for a number of reasons. One of them is that coal prices are volatile. That’s a fact in general. However, now it’s made worse due to geopolitical issues. If Europe boycotts Russian natural gas and oil, coal prices are set to explode higher – from already elevated levels. If Russia suddenly pulls out of Ukraine, prices will plummet. Both of these things are longshots in the mid-term, but they are risks – both to the upside and downside.

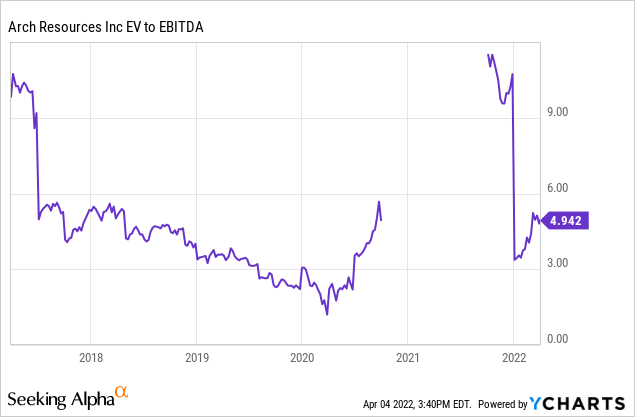

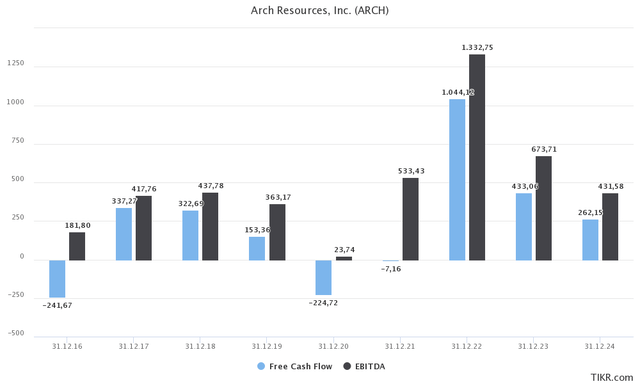

Based on current estimates, Arch is expected to do close to $1.3 billion in EBITDA. Pre-pandemic, the company did not make it above $440 million. The problem is that it’s hard to pick a number for the valuation. After all, both EBITDA and free cash flow are highly dependent on the price of coal. Free cash flow is also a big driver of net debt.

Going into this year, the company had $240 million in net debt. Pension and related liabilities were $75 million. Adding this to the $2.1 billion market cap gives us an enterprise value of $2.4 billion. That’s just 1.9x this year’s expected EBITDA. Adding to that, the company could use its free cash flow to push net debt to $830 million in net CASH. In that case, the valuation moves towards 1x EBITDA.

If that number were sustainable, I would slap a 400% price target on this stock and call it a day. However, this is based on current coal prices. If coal and natural gas remain this high on a long-term basis, the economic damage would be so severe that it would destroy demand.

In this case, I’m using $600 million in longer-term EBITDA. This is doable if prices remain elevated, but not too high. It prices in a supply/demand imbalance, but not the destruction of demand.

Using these numbers, we get a multiple of 4.0x using 2021 net debt. In this case, I think it’s fair to say that net debt will be erased. I’m going to use zero in net debt to give us a margin of error. This would give us a 3.5x multiple.

While a longer-term bull market can easily cause the stock to double, I’m applying a more moderate 30-40% upside target over the next 6-12 months. Again, it could happen 2 months from now if things escalate in Ukraine.

With that being said, please do not go overweight coal. There is no need to own coal stocks in the first place. It’s only something for people who trade with an above-average tolerance for risk.

And again, if coal remains sky-high, I see demand-related headwinds on the horizon. For example, the European steel industry is currently trying to become “net-zero” as well. While it’s hard to tell, I expect that European steel becomes less competitive globally with more power to US and Asian steel producers. That would hurt ARCH a bit.

However, right now, it’s all about margins. That’s where ARCH shines.

Takeaway

Arch Resources is a fascinating stock. Its business model is very straightforward as it sells met and thermal coal to domestic and international customers. Right now, the company benefits from a growing supply/demand imbalance as countries around the globe move from natural gas to coal to deal with skyrocketing prices.

In this case, it’s more than offsetting lower steel production due to supply chain issues.

Even on a long-term basis, we’re dealing with tailwinds as coal is seeing significant underinvestment due to climate measures while demand is expected to remain high.

However, I do not recommend Arch coal as a long-term investment. It is way too volatile and risky. It’s mainly a margin play at this point. We also cannot underestimate the bigger risks tied to the war in Ukraine. Big headlines move coal stocks and related.

If you’re interested in buying coal, please keep your position very limited. I’m seeing close to 40% upside on a mid-term basis. However, this could be much higher if natural gas prices continue their uptrend and/or remain high going into next year. If that were the case, the valuation would change.

(Dis)agree? Let me know in the comments!

Be the first to comment