Darden Restaurants (DRI) has turned into one of the saddest stories on the market. Not because of its management – which continued to do a tremendous job – but because of the current circumstances. Darden just released its third-quarter earnings of the fiscal year 2020. The company once again beat estimates and reported strength across the board. Unfortunately, it doesn’t matter as the market and economy have entered a stage of peak fear and uncertainty. Nobody on earth knows how bad the virus is going to get and how many hotels, restaurants, and companies, in general, will go bankrupt. In this article, I will tell you why I believe that Darden will not go bankrupt. I believe the company should be on everyone’s radar who is currently holding cash. The company will be a tremendous buy in the future. However, for now, it’s important to keep a very conservative investing approach.

Source: Darden Restaurants

Q3 Was Great, But It Doesn’t Matter

Discussing earnings for the months prior to March is going to be one of the most depressing things I have to do as the next earnings season is rapidly approaching. Most companies did very well in the first weeks of the first quarter before the coronavirus took everyone by surprise.

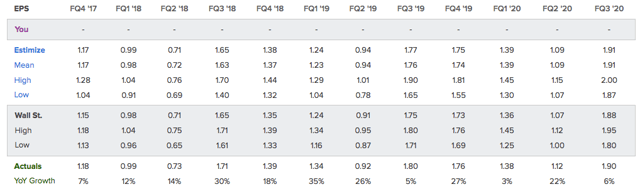

In Darden’s case, the third fiscal quarter is the first quarter of the 2020 calendar year. As you can see below, the company once again managed to beat earnings expectations. Earnings per share came in at $1.90. This is slightly above expectations and 6% higher compared to the prior-year quarter.

Source: Estimize

Source: Estimize

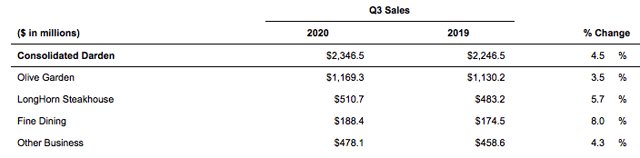

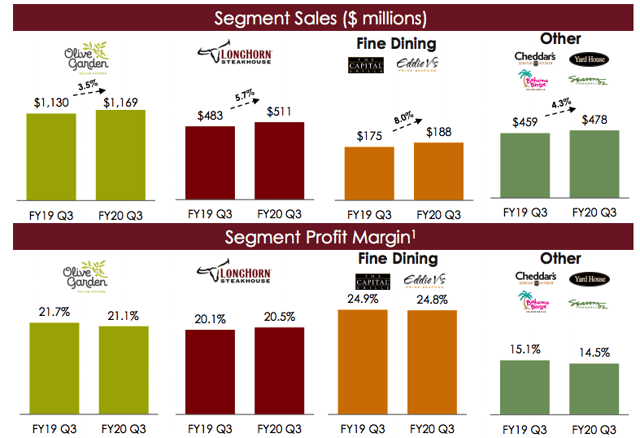

Strength started all the way at the top as consolidated sales were up 4.5% to $2.35 billion. The overview below shows sales per segment. As you can see, the numbers in all segments were strong. Especially, fine dining did well with an 8.0% growth rate.

Source: Darden Restaurants Q3/2020 Earnings Presentation

Source: Darden Restaurants Q3/2020 Earnings Presentation

While these numbers do not necessarily indicate structural strength as adding more restaurants (almost) always leads to higher sales, there is more good news as comparable store sales (hereafter referred to as ‘comps’) were up across the board. While 4.5% higher sales were boosted by 40 net new stores, the company reported 2.3% higher comps. Olive Garden saw 2.1% higher comps, LongHorn Steakhouse outperformed with 3.9% higher comps while Cheddar’s Scratch Kitchen continues to decline with 1.6% lower comps. Note that this is still one of the company’s biggest projects and expected to turn the current weakness into long-term growth.

On top of this, it is also important to mention that comps were not only higher because of pricing. In its third quarter, Darden saw 0.2% higher traffic in Olive Garden restaurants. LongHorn Steakhouse traffic improved by 1.6%. Pricing at olive garden locations was up 1.8% while prices at LongHorn Steakhouse locations were raised by 1.9%.

Margins were relatively stable. While LongHorn Steakhouse was the only segment with higher margins, it’s hard to call the other declines a sign of trouble. The company-wide restaurant-level EBITDA margin declined by 40 basis points to 19.9% as higher restaurant labor costs and higher marketing expenses more than offset a 40 basis points boost from higher food and beverage prices.

Source: Darden Restaurants Q3/2020 Earnings Presentation

Source: Darden Restaurants Q3/2020 Earnings Presentation

Now What?

Normally, this is the part where I discuss the company’s outlook and give you my view based on macroeconomic indicators. Unfortunately, my indicators are not useful right now. While they helped me to predict the Q1/2020 growth bottom, they turned useless when the virus started to accelerate at the end of February.

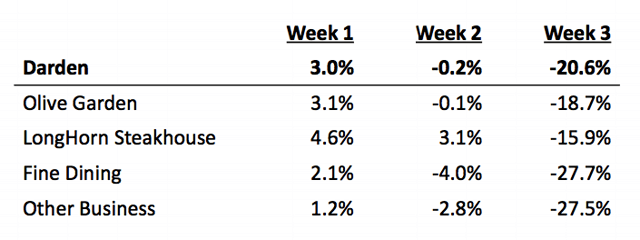

As the company is also unable to predict the impact of this global virus, management has pulled its full-year outlook and given us dramatic results for the first weeks of the fourth fiscal quarter.

“The Company is withdrawing its full-year financial outlook for fiscal 2020. For the fourth quarter to date through Sunday, March 15, Darden same-restaurant sales declined -5.9%. Same-restaurant sales were +3.0%, -0.2%, and -20.6% for the first three weeks of the quarter, respectively.”

While the quote above already highlights the numbers, I think seeing the numbers shows the disastrous trend even better. We are currently dealing with an implosion that could easily get worse as the virus continues to spread.

Source: Darden Restaurants Q3/2020 Earnings Presentation

Source: Darden Restaurants Q3/2020 Earnings Presentation

Basically, comps could technically come in anywhere between 0% and -60%. It completely depends on the pace of the virus and the response from governments. It would be likely to see a widespread approach that only allows takeout food.

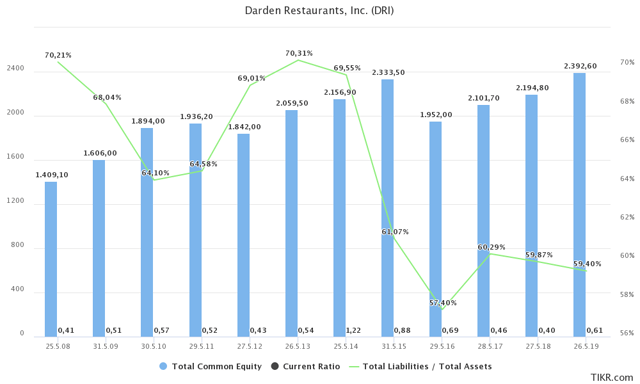

It’s a good thing that Darden Restaurants has always had a conservative way of handling its balance sheet during the most recent expansions. Liabilities are valued at slightly less than 60% of assets and the current ratio (the number all the way at the bottom) is at 0.61. That’s below the healthy (1.0) level. The company has operated on a somewhat tight liquidity position for many years. In addition to that, the business expansion has caused total equity to rise instead of suffering as we see from a lot of companies that debt-financed new restaurants.

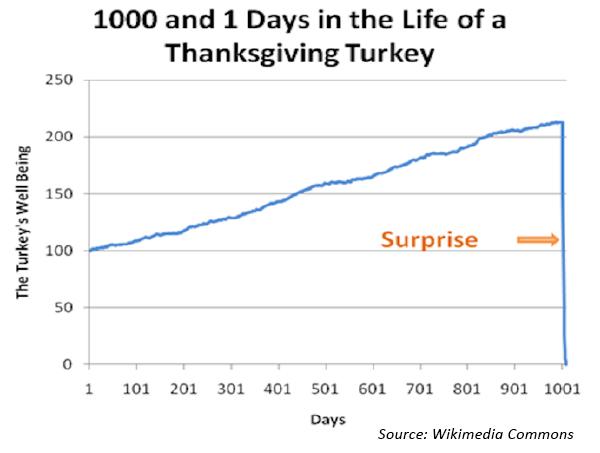

With all of this said, I was not surprised the company did so well in its third quarter. Housing was strengthening, consumer confidence was high and people were having a good time at the company’s many restaurants. Then, everything imploded at a pace we have never witnessed in history. It really makes me think of the graph below. Not even the most accurate economic model includes factors like viruses that rapidly spread.

Retrieved from Seeking Alpha Article

I wish I could give you a price at which I expect the company to bottom. Unfortunately, I cannot. It needs to be seen how bad the situation is going to get. For now, the only certainty is that management will do everything in its power to protect its employees and customers. This means restaurants will remain open as long as possible. It really is up to the speed of the virus. If new daily cases are able to peak in April, I believe this thing can be turned around in the third quarter without doing too much damage to the economy.

Source: FINVIZ

My advice, therefore, is to keep the DRI ticker in your mind. Write it down. If the virus peaks and you are looking for cyclical consumer exposure, Darden is the absolute way to go. In my opinion, it’s the best non-fast food stock on the market. Do not try to buy the bottom. Nobody buys the bottom, and if this stock starts a new uptrend again, there will still be enough ‘meat on the bone’.

For now, I wish everyone the best. Stick to your risk management and stay healthy!

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below! My long-term investments are stated in my Seeking Alpha biography.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.

Be the first to comment