ETF Overview

The SPDR S&P Dividend ETF (SDY), which seeks to track the S&P High Yield Dividend Aristocrats Index, focuses on U.S. stocks that have over 20 consecutive years of dividend growth. However, the selection criteria does not include any screening for a stock’s payout ratio nor financial strength. Fortunately, SDY has limited concentration risk. SDY is currently undervalued. We think this is a good fund for investors seeking dividend growth.

Data by YCharts

Fund Analysis

SDY’s focus on dividend growth is beneficial

SDY seeks to track the investment results of the S&P High Yield Dividend Aristocrats Index. The index selects companies from the S&P 1500 Index that have at least 20 consecutive years of dividend growth. We like this approach because stocks that are able to increase their dividends for more than 20 consecutive years are likely stocks that are able to consistently grow their businesses in different phases of the economic cycle. In other words, they have at least been through several economic recessions and know how to handle a crisis without cutting their dividends.

However, its construction method is based on past information

Although these are companies that are able to grow their dividends for over 20 consecutive years, past performance does not equate to future dividend growth. SDY’s portfolio selection methodology does not do any additional screening. For example, there is no screening on a stock’s balance sheet nor its dividend payout ratio. Therefore, stocks in SDY’s portfolio are still susceptible to a dividend cut if they already have a high payout ratio and a deteriorating balance sheet.

No concentration risk

Fortunately, SDY has limited each stock’s weighting to a maximum of 4%. As can be seen from the table below, its top 10 holdings only represent about 17.65% of its total portfolio. Therefore, concentration risk is limited and a dividend cut may not result in a big fluctuation in SDY’s fund performance.

|

Ticker |

Company Name |

Morningstar Moat Rating |

Financial Health |

Weighting |

|

AT&T |

Narrow |

Moderate |

2.20% |

|

|

AbbVie |

Narrow |

Moderate |

2.20% |

|

|

People’s United Financial Inc. |

Narrow |

Moderate |

1.75% |

|

|

J.M. Smucker Company |

None |

Moderate |

1.74% |

|

|

IBM Corp. |

Narrow |

Moderate |

1.73% |

|

|

National Fuel Gas |

None |

Moderate |

1.69% |

|

|

Clorox |

Wide |

Strong |

1.63% |

|

|

Cardinal Health |

Narrow |

Moderate |

1.59% |

|

|

Franklin Resources |

Narrow |

Strong |

1.57% |

|

|

Consolidated Edison |

None |

Moderate |

1.55% |

|

|

TOTAL |

17.65% |

Source: Created by author

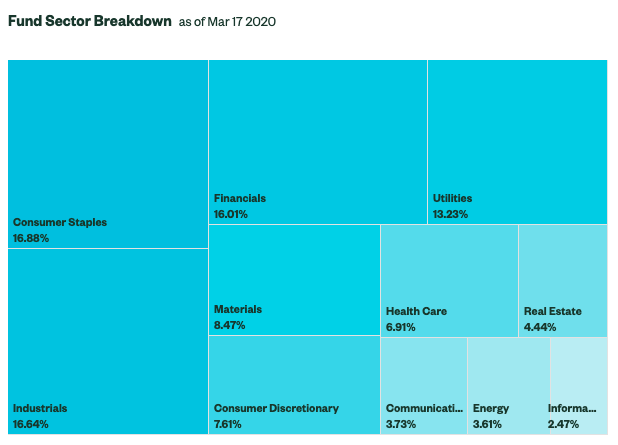

SDY has high exposure to cyclical stocks

SDY has a high exposure to cyclical sectors. In other words, many stocks in its portfolio may be impacted negatively in an economic downturn. As can be seen from the illustration below, industrials, financials, materials, consumer discretionary, energy and real estate sectors represent nearly 57% of SDY’s total portfolio. This is an important factor to know as the outbreak of COVID-19 may significantly impact many stocks that belong to the cyclical sector. Therefore, we think SDY may face more downside risk than other dividend ETFs that focus more on defensive sectors.

Source: SPDR Website

SDY is now undervalued

Below is a table that shows the forward P/E ratios and 5-year P/E ratios of SDY’s top 10 holdings. As can be seen from the table, SDY’s weighted forward P/E ratio of 12.30x is lower than the weighted 5-year average P/E ratio of 14.55x. This shows that SDY is undervalued.

|

Ticker |

Company Name |

Forward P/E |

5-Year P/E |

Weighting |

|

T |

AT&T |

9.08 |

11.51 |

2.20% |

|

ABBV |

AbbVie |

7.18 |

11.18 |

2.20% |

|

PBCT |

People’s United Financial Inc. |

10.41 |

15.19 |

1.75% |

|

SJM |

J.M. Smucker Company |

14.49 |

16.04 |

1.74% |

|

IBM |

IBM Corp. |

7.74 |

10.36 |

1.73% |

|

NFG |

National Fuel Gas |

11.27 |

16.24 |

1.69% |

|

CLX |

Clorox |

28.65 |

23.62 |

1.63% |

|

CAH |

Cardinal Health |

8.74 |

12.52 |

1.59% |

|

BEN |

Franklin Resources |

8.05 |

12.80 |

1.57% |

|

ED |

Consolidated Edison |

20.83 |

18.38 |

1.55% |

|

TOTAL |

12.30 |

14.55 |

17.65% |

Source: Created by author

Risks and Challenges

These stocks may not be immune to a dividend cut

As mentioned earlier in our article, investors should keep in mind that SDY’s focus on selecting stocks based on their consecutive years of dividend growth may not screen-out high payout ratio stocks. In an economic downturn, many stocks may be forced to cut their dividends. We believe if COVID-19 cannot be contained quickly, and if it lasts for the entire 2020, there is a potential for many companies in SDY’s portfolio to cut their dividends.

Investor Takeaway

SDY’s focus on dividend stocks with over 20 years of consecutive dividend growth is advantageous. Although a dividend cut by any stock in its portfolio is still possible, SDY has limited concentration risk. The fund is currently undervalued. We think this is a good fund to hold for the long term. However, given limited visibility due to the outbreak of COVID-19, it is possible that the fund’s price could get worse before it gets better.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Be the first to comment