z1b/iStock via Getty Images

Product

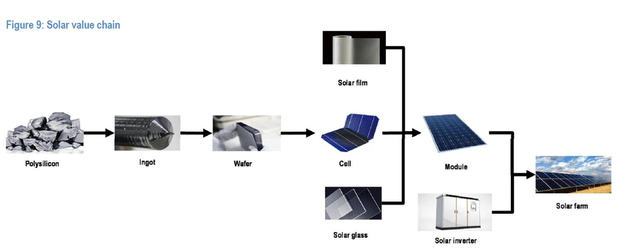

Daqo New Energy Corp. (NYSE:DQ) is a producer of polycrystalline silicon (hereafter simply silicon), which is used in the manufacture of solar cells. Green energy is the trend of the last decade. And solar power remains one of the main drivers of green energy. The first players in the supply chain are the polysilicon players – the process involves processing raw materials (quartzite, silicon) to produce polysilicon (high frequency silicon). The key players in this market are Chinese companies: Daqo (listed on US platforms), Tongwei, Asia Silicon. Generally, polysilicon is a silvery grey crystal made from industrial silicon using chemical reactions that purify the silicon to a certain degree of purity (99.9%). The production process requires a high degree of processability.

solar value chain (company presentation)

Recent key results

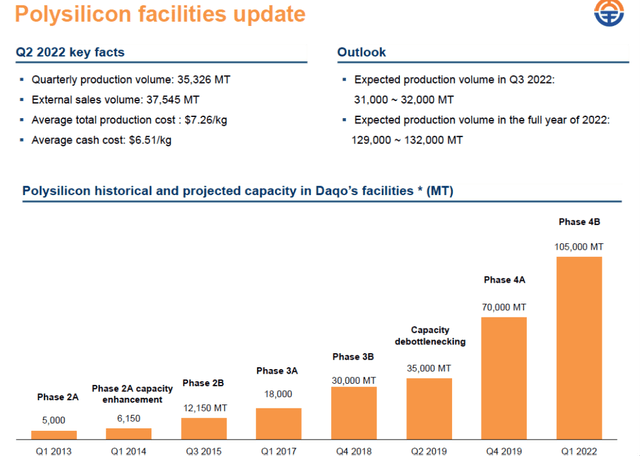

Successfully brought the new Phase 4B facility to full capacity and further optimised its operational characteristics. In June 2022, the Xinjiang Daqo subsidiary received total gross proceeds of approximately RMB11 billion from a private placement on the Shanghai Stock Exchange. The proceeds from the offering will be used mainly for the Phase 5A polysilicon project with a capacity of 100,000 tons in Inner Mongolia.

Thanks to favourable trends in the first half of this year, the global solar industry saw strong demand. Demand both in China and abroad continues to exceed market expectations. According to the China Photovoltaic Industry Association, production of polysilicon and solar modules in China in the first half of this year was approximately 365,000 tonnes and 123.6 GW, respectively, an increase of 53.4% and 54.1% over the same period last year. The board approved a $120m buyback in June. To date, ADRs worth $50 mn have already been repurchased. It is believed that the current ADR price is seriously undervalued and does not reflect the position of an industry leader with high profitability and strong operating cash flow. To protect US shareholders, the board is considering a Hong Kong listing.

market info (company presentation)

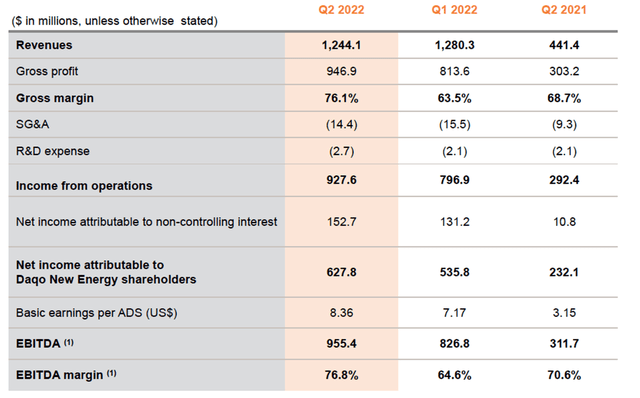

Financials

A very strong report and especially valuable is the increase in production volume, the economies of scale, resulting in a multiple of the financials. Revenues reached $1.24 b$, gross profit was $947 m$ with a margin of 76%. Net profit was $628 m$, +17.2% Q/Q and +170% y/y. Continuing to ramp up production volumes, looking to increase capacity by 50% annually over the next three years. Average selling price has also increased due to strong demand in end markets. According to the China Silicon Association, the average price including VAT for high-density mono-grade polysilicon increased by 29.3%. Despite the price increase, they have a large order book. Many newly built wafer fabrication plants are idle because of the shortage of polysilicon, as plant capacity expansions are much faster than in the polysilicon sector.

The company did not provide a forecast; analysts’ consensus forecast is for revenue to rise to $4.42 bn (+163% YoY) in 2022. Increased annual production forecast to 129,000-132,000 tonnes.

Financial report (company presentation)

Valuation

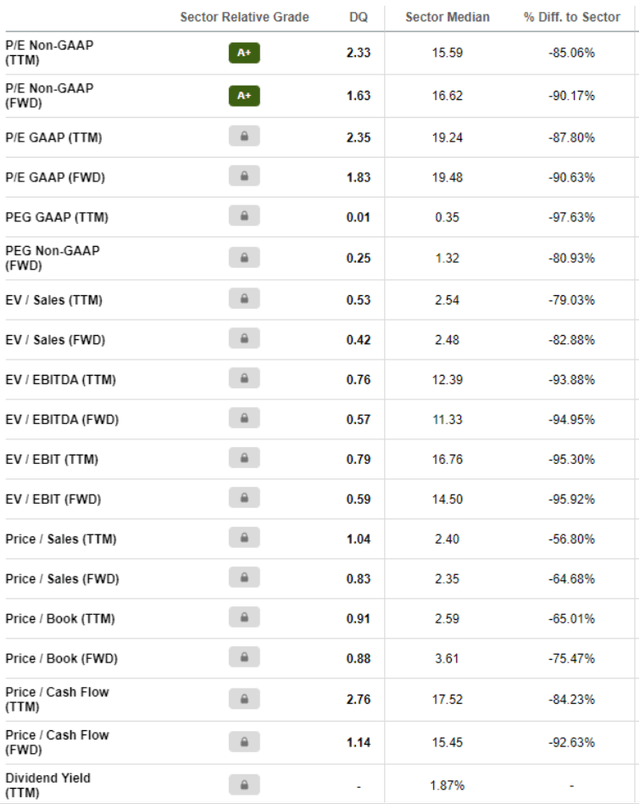

Multiples are unusually cheap even for Chinese companies, FWD P/E 1.8, FWD EV/EBITDA 0.6, by historical absolute lows, 3-year revenue CAGR of 130%, but this year will be even higher at around 160%. The financials are chic, and the main contributor to this was the price of polysilicon, which is now at highs.

Valuation multiple (company presentation)

Main takeaway

Now, there are many polysilicon producers, and new players are entering this market, despite the high entry barriers, because the product prices are so attractive. The management itself also sees this and expects prices to go down starting in the second half of 2023. Naturally, halving prices from current ones would have a significant impact on the company’s profitability and bring profitability down to normal levels. Probably, we will see a revenue peak in the next 1-2 quarters, and if the price decline is justified, there will be a further deterioration in performance. Daqo, on the other hand, is ramping up production significantly, which will offset the price decline to some extent. Additionally, it should be noted that thanks to the significant amount of cash and customer deposits, and it is highly unlikely that the price will fall below 30$. From an investment point of view, levels around $30-40 look safer, because prices are unpredictable, and a sharp decline will automatically pull the company’s quotation. One should not forget the mono-listing in America, which imposes infrastructural risks on all Chinese companies.

Be the first to comment