marchmeena29

Introduction

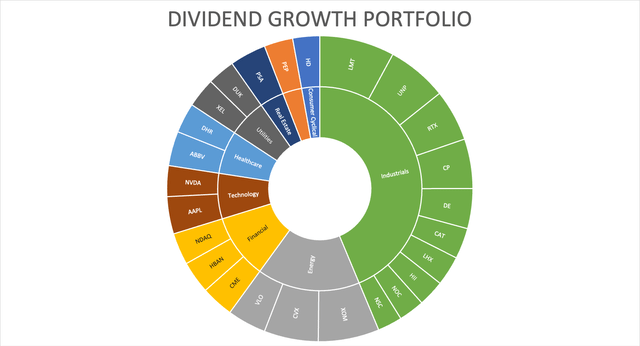

The Danaher Corporation (NYSE:DHR) is one of the stocks that I added to my long-term dividend growth portfolio during the most recent stock market sell-off. In an article I wrote this year, I highlighted the value this company brings to the table based on its low volatility and high dividend growth characteristics. In this article, I will reiterate that call and focus on the company’s just-released earnings, which display tremendous strength, underlining why I bought this company. “Unfortunately”, the stock price has taken off as investors have recognized the value this company brings to the table, which makes expanding an existing position or buying new exposure less attractive – but not unattractive as I will explain in this article.

So, without further ado, let’s look at the details!

A Total Return Play

I have used this year’s stock price weakness to add a number of new companies to my dividend growth portfolio – holding 95% of my total net worth. I mainly went for dividend growth companies with high growth rates over high yields as I believe that bear markets are best to add stocks that usually “never” look cheap.

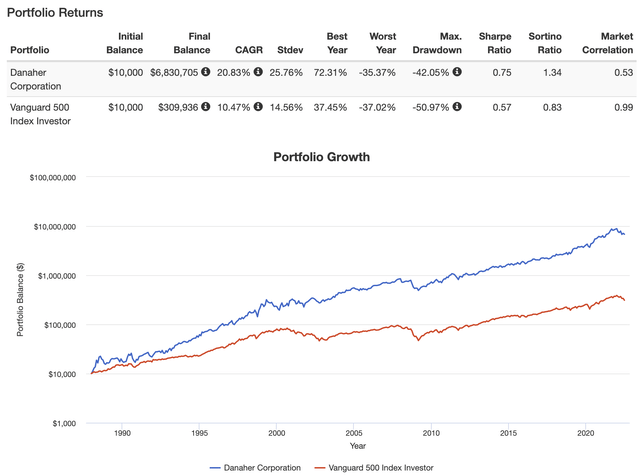

Danaher is one of these stocks. The company has returned 20.8% per year since 1985, which is more than 10 points higher than the S&P 500 total return. The standard deviation during this period was just 25.8% with max drawdowns being less steep than the ones S&P 500 index investors experienced.

In my most recent Danaher article, I started by explaining why I wanted to buy the company in the first place.

Historically speaking, companies with consistent dividend growth and low volatility profiles generate the highest returns. That’s based on the fact that dividend growth underlines a company’s ability to generate value for its shareholders. It’s a stamp of approval that – in a lot of cases – provides investors with income that often grows faster than the rate of inflation.

Low volatility is a huge benefit as it tends to protect investors during bear markets. Stocks that outperform in bear markets have a good shot at long-term outperformance as downside protection is everything when building long-term wealth.

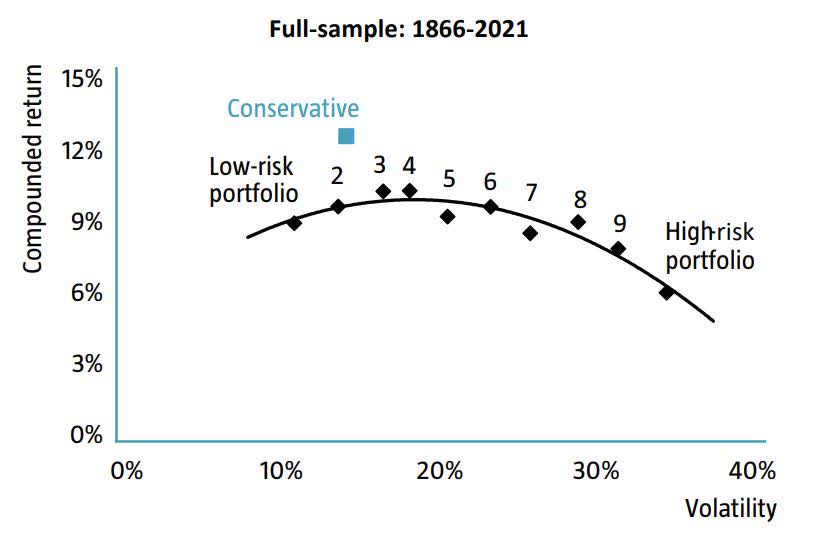

Going all the way back to 1866, low volatility stocks have indeed generated better returns. Danaher proves this.

ROBECO

The problem is that while DHR is one of my favorite dividend growth stocks, it doesn’t have a high yield.

Danaher pays its investors $1 per share per year. That’s a 36 basis points dividend yield (0.36%). Needless to say, you need to be very rich in order to pay expenses with DHR dividends. Hence, I do understand that people avoid DHR – especially when they depend on income like retired investors or the ones close to retirement.

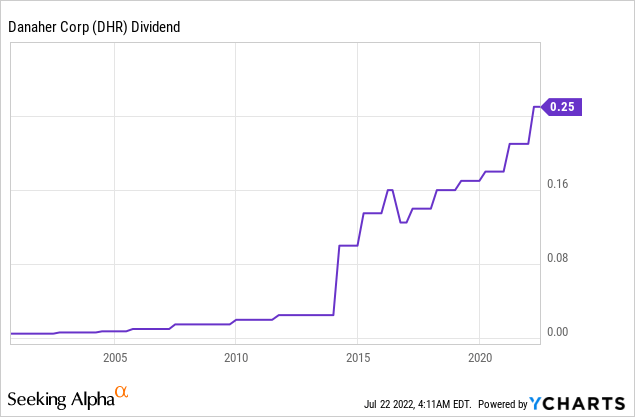

That’s why I care about the “growth” in dividend growth. After all, that’s what is driving the total return. Over the past 10 years, the average annual dividend growth was 29%. The most recent hike was announced on February 23, when Danaher hiked by 19% to the aforementioned $1 per year.

Please note that the company did NOT cut its dividend in 2015. This was the effect of a business spin-off.

With all of this in mind, the just-released earnings confirm everything I like about this company.

2Q22 (Blowout) Earnings

Let’s start with the headline numbers. In 2Q22, Danaher did $7.75 billion in revenue. That’s 7.3% higher compared to the prior-year quarter and $460 million higher than expected. In other words, it’s a 6.3% revenue beat, which is quite impressive given the size of Danaher ($203 billion market cap).

The company did $2.76 in non-GAAP EPS, which beat estimates by no less than $0.42. This is an increase of 12.0%

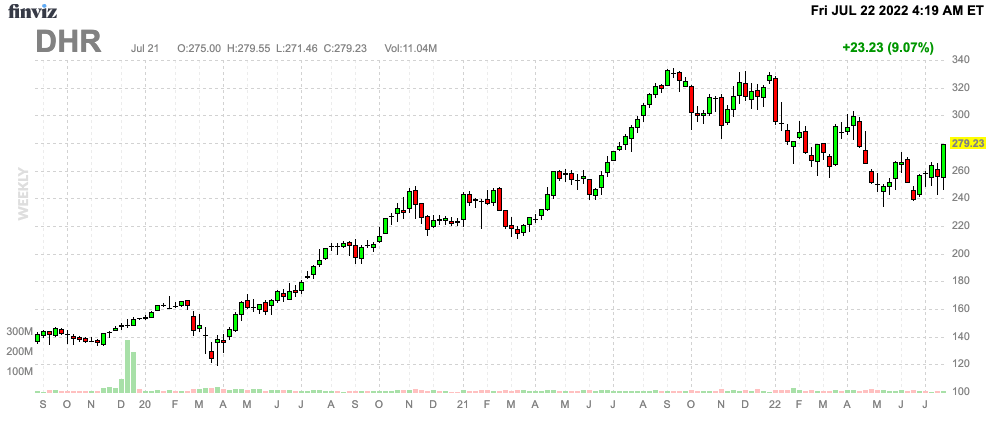

Right off the bat, investors liked these numbers as the DHR ticker on Wall Street rose by roughly 9% after earnings, pushing the year-to-date performance to -15%.

FINVIZ

With that, let me share a quote from the company’s recent earnings call, which perfectly highlights why I like Danaher.

Our second quarter results also highlights the strength and resilience of the businesses that make up Danaher today. Our portfolio is comprised of leading franchises positioned in attractive end markets with strong, secular growth drivers, all united by a common set of durable business models. In fact, nearly 75% of our revenues today are recurring, the majority of which are consumables that are specified into highly regulated manufacturing processes or specific to the equipment that we supply.

Unlike a lot of other companies, Danaher benefits from high recurring revenue. This requires less effort to keep sales going. Companies that do not have a lot of recurring sales need to invest way more to generate sales. It also helps that the company is operating in niches. I’ve spent a lot of time looking into the company’s recent acquisitions. All of them have one thing in common: they dominate certain niches. This keeps competition somewhat low and provides the company with pricing power. According to the company:

We’re also using DBS tools to execute price actions, and we achieved approximately 400 basis points of price increases in the quarter, a significant acceleration from our historical price realization.

Hence, we’re dealing with impressive numbers. In 2Q22, core revenue growth was 9.5%, which means organic sales were up 9.5%. When adding acquisitions, revenue growth was 12.0%. However, total revenue growth was 7.5% as forex headwinds accounted for a 4.5% decline. Bear in mind that Danaher generates less than 40% of total sales in the United States, which means that a stronger dollar has a negative impact on its sales.

COVID-19 testing added 150 basis points to core growth according to the company.

With that said, strength was provided by all segments.

This segment saw 6.0% revenue growth, 7.0% organic revenue growth, 4.0% growth provided by acquisitions, and a 5.0% revenue headwind due to currency translations. This segment includes major brands like Beckman Coulter, Sciex, Leica, and Aldevron. Due to new acquisitions, the operating profit margin fell by 100 basis points to 29.6%.

The company was especially pleased with it bioprocessing business:

In our bioprocessing business, we continue to see record activity levels from early-stage research to later stage development and production, which drove a combined core revenue growth rate of high single digits at Cytiva and Pall Biotech.

Our backlog and our order levels remain very healthy. And as always, we’re working closely with customers to ensure they have the right inventory levels to support their planned activity.

With brands like Cepheid, Beckman Coulter, and Leica, revenue growth of 9.5% was achieved. Organic sales growth was 12.5%(!) with 1.0% growth provided by acquisitions. Currency headwinds were 4.0%.

The operating profit margin rose by 340 basis points to 31.2%.

- Environmental & Applied Solutions

This is my favorite segment as I’ve spoken to people who have done business with Danaher (i.e., M&A). Companies like X-Rite are in a truly fantastic position to benefit from secular growth beyond healthcare. X-Rite, for example, focuses on color management and optimization for major corporations with a position that won’t allow competitors to come close.

This segment did 6.5% in revenue growth. Organic revenue growth was 10.0%. Forex headwinds were 3.5%. The operating profit margin rose by 70 basis points to 25.1%.

According to the company:

In water quality ChemTreat, Trojan and Hach each group double-digits during the second quarter. Robust growth in our analytical chemistries and consumables was broad-based across all major end markets. Equipment sales remained strong with healthy levels of project activity at both industrial and municipal customers.

Outlook

With all of this in mind, the company expects core/organic growth to be in the low-single-digit range in 3Q22.

According to Seeking Alpha:

For Q3, Danaher expects a +Mid-single digit impact of COVID related testing, compared to Q3 2021; and +Low-single digit% impact for full year 2022 versus 2021.

For full year 2022: Danaher’s expects Core sales growth (non-GAAP) to be in the +Mid-single digit range; while it continues to anticipate non-GAAP base business core revenue growth to be in the high-single digit percent range.

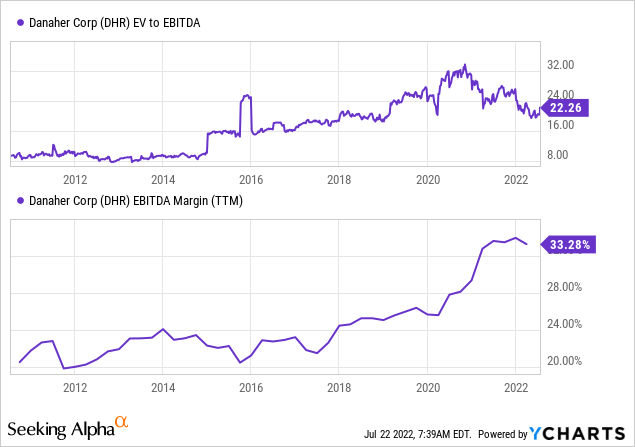

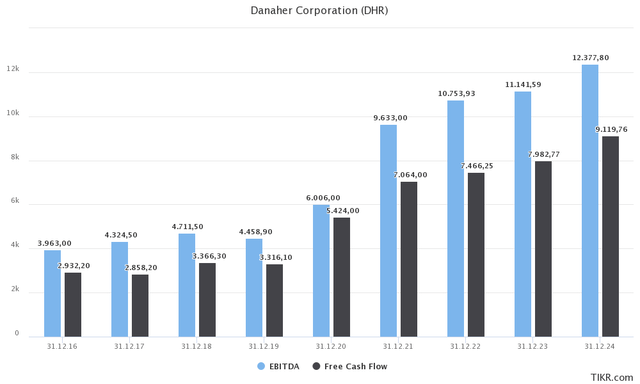

Other than that, longer-term targets (analyst estimates) are pretty much unchanged compared to the numbers I showed in May. The company is expected to boost EBITDA to $11.1 billion next year. Moreover, going towards 2024, EBITDA margins are expected to reach 35%. Prior to the pandemic, margins were less than 25%. That’s a huge deal given that margin growth is getting further support from high organic growth – and pricing power in an inflationary environment.

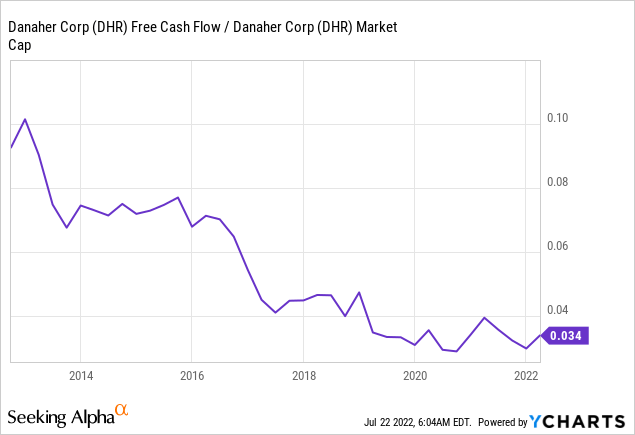

Free cash flow is set to come close to $8.0 billion, indicating a 4.0% free cash flow yield. That’s not very high (it’s back to pre-pandemic levels, which is good), but investors won’t let that number go high as free cash flow growth is high. Over the past 5 years, the average annual levered free cash flow growth was 17.9%. That’s up from 8.8% on a 10-year basis.

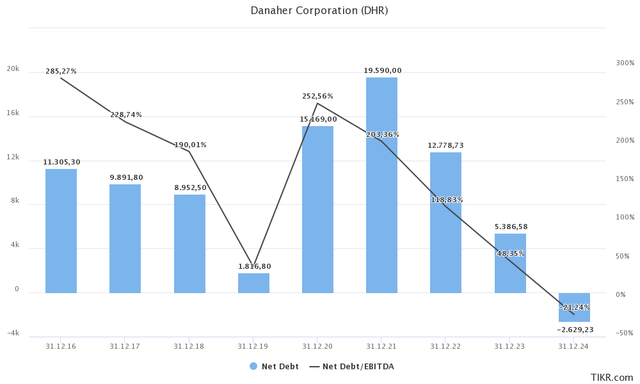

Moreover, what’s impressive is that net debt is expected to fall to $5.4 billion next year. That’s just 0.5x EBITDA. What this means is that Danaher has perfected M&A-fueled growth. It buys successful companies in niche markets with pricing power. These companies generate high free cash flow allowing the company to reduce debt again while improving post-acquisition earnings power.

It’s a fantastic business model that comes with high organic growth. Unfortunately, Danaher isn’t cheap. The company has a $211 billion enterprise value based on its $203 billion market cap, $880 million in pension-related liabilities, $5.4 billion in expected 2023 net debt, and $1.7 billion in preferred stock.

This gives us an 19.0x 2023 EBITDA multiple. While this valuation is at pre-pandemic levels, it’s not what people consider to be “cheap”. However, that makes sense. The company is now running a business with >30% EBITDA margins. That’s up from the low 20% range when the company was trading below 14x EBITDA. Moreover, sales growth is high enough to provide long-term sustainable double-digit earnings growth. There’s really no reason to let this company drop to levels that may seem cheap.

Yet, it’s still somewhat unfortunate that the stock has taken off. Right now, the company has an average size in my portfolio with a weighting close to 4%. However, I would like that number to be higher. Hence, I will buy weakness if the market gives us another opportunity.

Takeaway

Sometimes things just work out perfectly. Danaher’s just-released quarterly result reveal everything I was hoping to see. The company beat both sales and EPS estimates by a wide margin. Organic growth was high in all segments and supported by secular trends in various niche markets like biopharma. Margins were strong as the company has tremendous pricing power in a high-inflationary environment.

Adding to that, the outlook was good, which is important as the economy is everything except strong right now.

Needless to say, investors (in general) liked the company’s results. The stock added more than 9% as the company is one of the best buys on weakness, in my opinion.

While its dividend yield is low, the company has all characteristics to deliver high long-term total returns for investors looking to add an emphasis on capital gains to their long-term portfolios.

(Dis)agree? Let me know in the comments!

Be the first to comment