krblokhin

Thesis

We updated in our post-earnings update in July that Altria Group, Inc. (NYSE:MO) stock’s July lows were well-supported, as we urge investors to add exposure. MO then joined the summer rally before its upward momentum was digested by the broad market pullback and its expected post-ex-dividend (September 14) sell-off last week.

Consequently, the market sent MO falling back toward the buy point highlighted in our previous article and just 3% above its July lows. As a result, we believe investors have been proffered another opportunity to add exposure if they missed July lows, as MO is now near-term oversold.

Notwithstanding, we deduce that the market has materially de-rated MO, given its fumbles with Juul. In early September, the company also concluded its legal settlement over Juul Labs’ marketing to underage users. However, we don’t expect that to lift buyers’ sentiments significantly as investors parse the company’s strategy over its long-term e-vapor future. Moreover, street analysts also highlighted that Philip Morris (PM) could end its agreement with Altria on IQOS when their agreement expires in 2024. As such, we believe a significant re-rating seems unlikely until MO can improve investors’ confidence in its long-term e-vapor strategy.

Notwithstanding, we are confident that the current levels have been adequately de-risked for income investors to consider adding more exposure. We are confident that its high-margin operating model should continue to support its robust dividend yields, helping to undergird its current valuations.

Hence, we reiterate our Buy rating on MO, with a medium-term price target (PT) of $50.

Altria Needs To Convince Investors Of Its Oral Tobacco Future

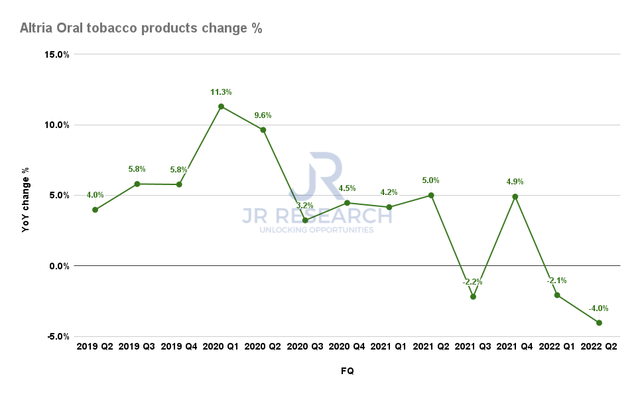

Altria Oral tobacco revenue change % (Company filings)

Juul Labs’ recent settlement over the marketing of its products to underage users did not impact buying sentiments materially. We believe that the market was unlikely to be concerned with Juul’s recent developments after the battering it received in June in reaction to the initial FDA ban.

Instead, we postulate that investors are still considering whether Altria has a viable strategy to lift the gloom over its oral tobacco sales. As seen above, the segment fell a further 4% in Q2, following Q1’s 2.1% decline. Hence, what was supposed to be the key pillar to future-proof Altria’s growth strategy hasn’t quite taken off.

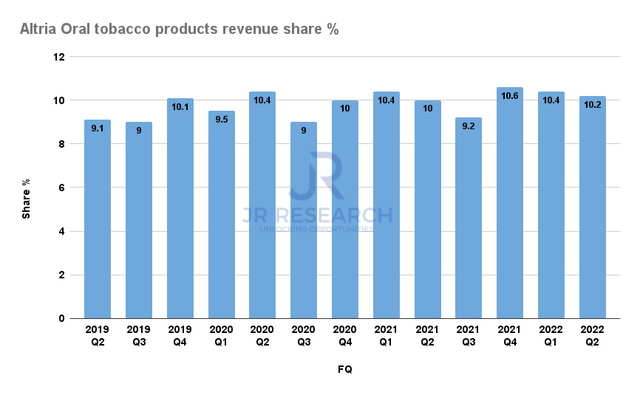

Altria Oral tobacco revenue share % (Company filings)

Therefore, Altria’s oral tobacco products have failed to gain significant traction, lifting investors’ confidence that it has a robust strategy. It accounted for just 10.2% of total revenue in Q2. Therefore, we believe Altria still has much to achieve to convince investors.

Street analysts raised concerns recently that PM may consider ending its IQOS agreement with Altria, even though sales have been paused due to a patent dispute. However, with Philip Morris intending to reintroduce the product in 2023, Cowen & Co. articulated that PM and MO “don’t see eye to eye on whether or not Altria hit key performance indicators.” It added:

That means when their current agreement expires in April 2024, [we] expects Philip Morris will work to end the relationship with Altria, and vertically integrate IQOS. – Barron’s

MO’s Dividends Look Secure For Now

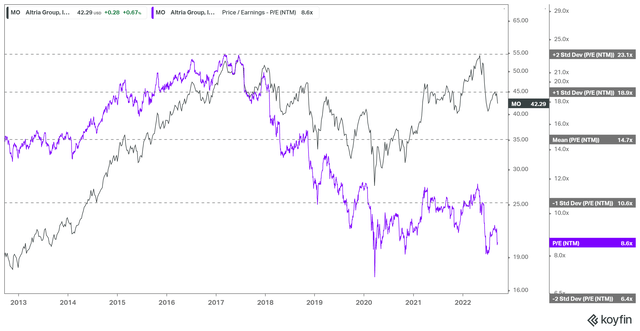

MO NTM normalized P/E valuation trend (koyfin)

MO last traded below the one standard deviation zone below its 10Y mean at an NTM normalized P/E of 8.6x. However, we noted that the market had not re-rated MO materially, suggesting that investors have remained tentative over the long-term prospects of its oral tobacco future.

As a result, we believe it’s essential for investors to assign a generous discount from its 10Y mean before considering adding exposure. Therefore, we believe the current levels are appropriate.

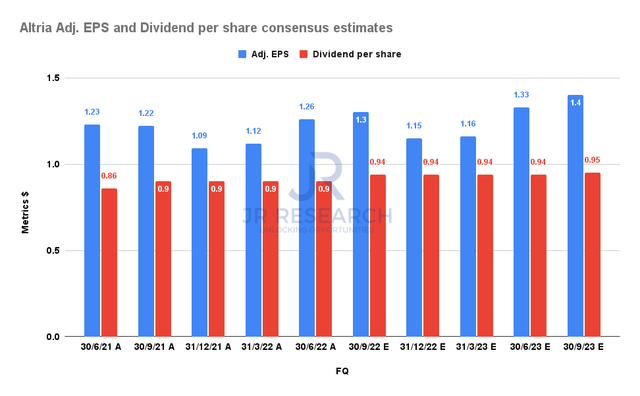

MO Adjusted EPS and Dividend per share consensus estimates (S&P Cap IQ)

Altria raised its dividend per share (DPS) for its recent distribution (ex-dividend: September 14) to $0.94. Moreover, we are confident its upgraded distribution is prudent, with a payout ratio well-covered by its earnings.

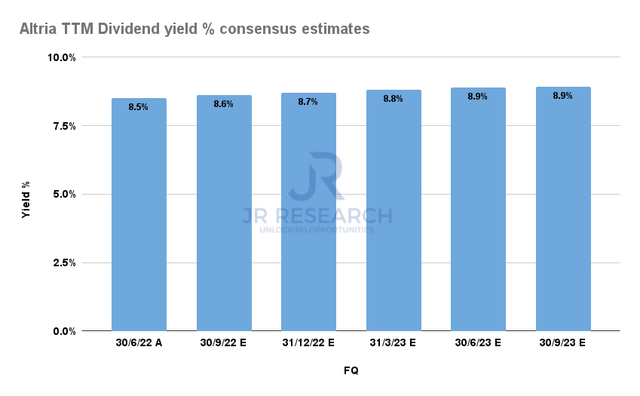

MO TTM Dividend yield % consensus estimates (S&P Cap IQ)

As a result, we believe its TTM dividend yield, close to 9%, should help undergird its battered valuations. While we believe that a medium-term re-rating remains tentative, given its structural headwinds, we deduce that downside volatility should be limited from here.

Is MO Stock A Buy, Sell, Or Hold?

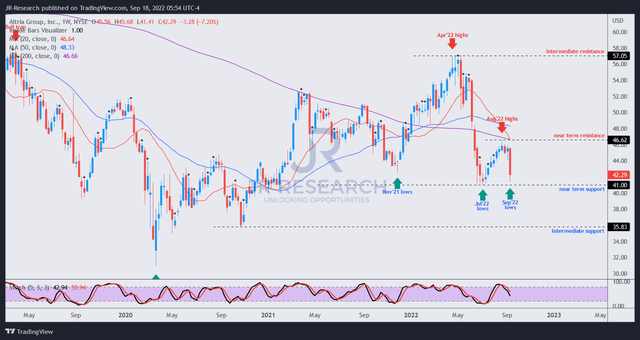

MO price chart (weekly) (TradingView)

MO fell markedly last week, exacerbated by its post-ex-dividend sell-off. As a result, it last traded close to its near-term support ($41), which has supported MO since January 2021. Therefore, we expect robust buying momentum at the current levels, supported by reasonable valuations, and strong forward dividend yields.

Therefore, we reiterate our Buy rating on MO stock.

Be the first to comment