hh5800

Thesis highlight

I recommend going long on D-Wave Quantum Inc. (NYSE:QBTS) ($8.18 as of this writing). It operates in an industry that has a huge total addressable market (“TAM”) and profit potential. If QBTS executes as it forecasts and adoption of quantum computing picks up, it could yield investors significant upside. At this valuation, if QBTS can hit management’s FY26 guidance and is valued at a mature growth multiple, it represents more than 100% upside.

Company overview

QBTS is a commercial quantum computing company that offers a full range of professional services as well as web-based access to its superconducting quantum computer systems and integrated software environment via its cloud service, Leap. D-business Wave’s model is primarily focused on generating revenue by providing customers with cloud access to our quantum computing systems in the form of QCaaS products, as well as by providing professional services in which QBTS assists customers in identifying and implementing quantum computing applications. (QBTS S-1)

Investments merits

Market opportunity is extremely huge

I would advise the readers that are interested in QBTS to do a quick read up on quantum computing so that it is easier to digest my thesis.

Although there have been great strides made in the field of traditional computing technology, it still has some important caveats. In classical computation, bits hold information and can only ever be in one of two states: 0 or 1. In order to execute traditional algorithms and perform computations, traditional processors must manipulate and transform binary data in specific ways. There is an endless need for quantum computing power because so many crucial and valuable problems have yet to be resolved. By leveraging the fact that quantum bits (qubits] in quantum mechanics can be both 0 and 1, QBTS’s quantum computing systems can provide computational resources that have never been available before, paving the way for the development of novel algorithms, applications, and solutions that were previously impossible.

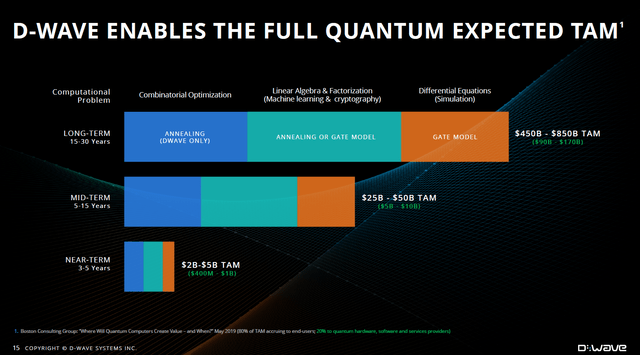

As you might imagine, quantum computing has had a far-reaching impact on society, paving the way for groundbreaking innovations in fields as diverse as drug discovery and climate prediction. As far as I’m aware, QBTS is the only firm developing both gate-model and commercial annealing quantum computing systems. This dual-system approach is critical for serving the entire quantum TAM because different types of systems benefit different types of applications. I am sure that as quantum computing becomes more common, new applications will be found that make the best use of either classical computing or quantum computing.

Given the fact that many potential applications have yet to be identified, it is currently very challenging and inaccurate to estimate the TAM. The Boston Consulting Group [BCG] predicts that the TAM for quantum computing will grow from an estimated $2.5-$5 billion in the near term to $450-$850 billion in the long term, with end users of quantum computing accounting for 80% of the TAM and quantum hardware, software, and service providers receiving 20%. BCG also estimates that combinatorial optimization problems, which are well-suited for annealing systems, will make up 24-26% of the TAM, or between $500 million and $1.2 billion in the near future and $112 billion and $212 billion in the long run. However, in the near term, where we have slightly more visibility, it is expected that there will be a window of opportunity for suppliers of quantum hardware, software, and services estimated to be worth between $100 million and $250 million.

Hence, with its full-stack cross-platform approach, I believe QBTS is well-positioned to seize a sizable share of the quantum TAM.

Only player in the industry with operational and commercial experience

QBTS is one of hundreds of quantum computing companies, but it has the most experience assisting customers in resolving practical optimization problems that are challenging for computers. They are the only company with operational and commercial experience managing a large-scale quantum computing business, and they are the only company that builds both annealing and gate-model quantum computers (recall the dual-system approach mentioned above) (QBTS S-1). QBTS takes a business-first approach, focusing on developing products and cloud services that can help companies tackle tough problems and see quick returns on their investments. This gives QBTS an edge over its competitors when it comes to anticipating and meeting customer needs.

The following are some of the key factors that I believe distinguish QBTS from its competitors.

- With QBTS’s full stack offering, businesses and developers can construct applications for a wide variety of production environments. QBTS cloud-delivered products and services are commercial annealing quantum systems that have proven to be valuable to businesses.

- QBTS’s platform-agnostic approach frees customers from having to choose between different quantum technology approaches and platforms in order to solve even the most complex business problems. QBTS gives customers open-source, cross-platform developer tools that can be used on a wide range of quantum systems, including both annealing and gate-model implementations. This means that customers only need to make a single investment in a single tool.

- QBTS is the only company in the world that develops and distributes annealing quantum computers, which are superior to classical computers at solving optimization problems (i.e., QBTS solutions address a significant portion of client pain points).

- The Leap quantum cloud service offered by QBTS meets a common need among large businesses: the ability to quickly and easily gain access to high-performance, scalable, production-grade annealing quantum computers.

Effective go-to-market strategy

QBTS uses three go-to-market strategies: direct sales, partnerships, and developer strategy.

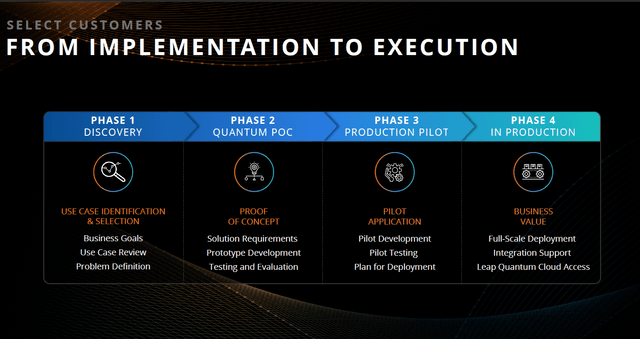

QBTS employs a four-phase customer engagement process for its DWave Launch direct sales strategy. It is especially important for QBTS to have a direct sales team because this is a large deployment that requires constant planning and communication between QBTS and the client.

- Phase 1 involves QBTS and the client working together to determine which, if any, of the client’s potential applications would benefit from being run on one of QBTS’s quantum hybrid solvers.

- The proof-of-concept stage occurs during phase 2. Where QBTS works together with the client to build an actual software implementation, and then begins testing said software on the Leap quantum cloud service.

- Third, during the pilot deployment phase, QBTS expands the implementation so that the application can be used on a commercial scale.

- QBTS’s quantum hybrid application is fully deployed in Stage 4. The customer has taken the problem in-house and is now fully connected to the Leap quantum cloud service.

As a means of scaling, QBTS partners with system integrators, independent software vendors, and cloud providers to resell its Leap quantum cloud service and access to its quantum processing units. The following are some illustrations of this in action:

- Extending its customer base by allowing D-Wave QPU access via third-party cloud services like AWS

- Creating new markets and enabling new use cases through system consultants like Accenture

- Establishing a network of worldwide distributors like NEC Corporation and local distributors like Strangeworks and Sigma-i.

Lastly, the QBTS developer strategy is carried out in an ingenious fashion. In order to achieve this goal, QBTS gives away free use of its Leap quantum cloud service platform to all of its customers. This platform provides users with “always on” access to resources like code samples, tutorials, an IDE, and a community forum. This strategy has three main advantages, in my opinion:

- Encouraging developer product usage,

- Fostering quantum application development and community engagement (from free to paid)

- Generating leads, or interacting with developers to identify potential new business clients.

Valuation

Price target

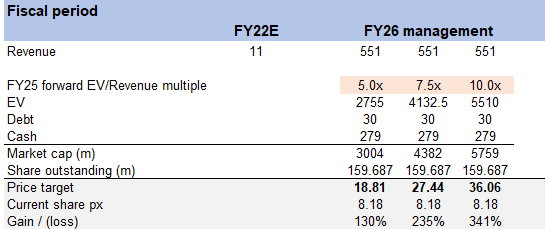

My model suggests a price target range from ~$19 to $36, suggesting an upside of 1.3x to 3.4x from today’s share price of $8.18. This is based on three different valuation multiple scenarios (5, 7.5, and 10x forward revenue multiple in FY25).

The reason for valuing this way is the extremely wide range of outcomes and TAM. As I mentioned above, the industry is extremely huge. Depending on the development of the industry by FY26, QBTS could be still growing at >100%, or it could have matured. My basis for using these multiple figures is based on the robotics automation process peers, Blue Prism and UiPath (PATH). Both of these companies operate in an industry that was considered “revolutionary” and experienced high growth, but growth has slowed down today. If QBTS is growing at:

- High pace in FY26, I would attach a higher revenue multiple (PRSM multiple when was still growing fast in 2018 and 2019).

- Slow pace in FY26, I would attach PATH current’s multiple.

Image created by author using data from QBTS’s filings and own estimates

Risks

Heavy competition

We are talking about a very large TAM here which means there would be a lot more upcoming competitors entering this space, simply because it is too lucrative. Given the quantum computing industry is still in its nascent stage, there is a high chance of new offerings that could be better than QBTS.

Possibility of raising equity or debt, thereby hurting equity value

QBTS generates meaningless revenue today. As such, there is a possibility that QBTS needs to raise additional capital in order to hit its milestone. Depending on the cause, the capital raise could have a huge detrimental impact on the stock price, especially if the cause is due to QBTS’s need to acquire a power competitor (like Adobe (ADBE) acquiring Figma).

QBTS is still in the growth stage

Buying QBTS is effectively a big bet on the future of quantum computing. Investors need to be comfortable that the bulk of value realization will be in the out years. This also makes it extremely tough to forecast QBTS. Hence, consensus figures might not be accurate at all.

Conclusion

To conclude, I believe the upside for QBTS is worth a lot more than it is today if it can hit management’s FY26, and even at a mid-single digit multiple that reflects slower growth moving forward, it still has more than 100% upside. Buying QBTS is a bet on quantum computing revolutionizing the computing space, and I believe it has what it takes to do so. Continuous execution success would be good for the stock because it would make it more likely that management’s predictions are accurate.

Be the first to comment