Jason Kempin

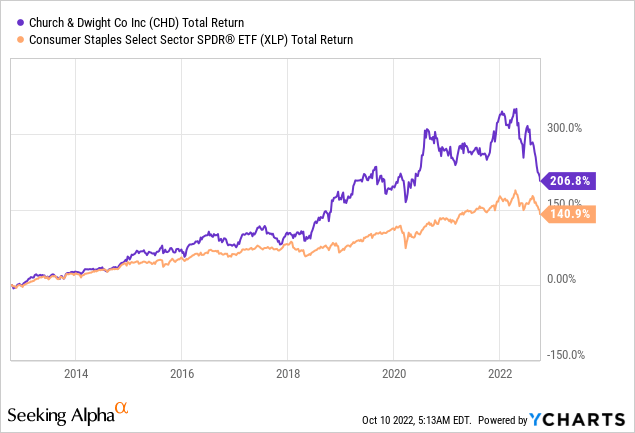

After a few years of strong performance Church & Dwight (NYSE:CHD) share price has been quickly closing the gap between the broader consumer staples sector.

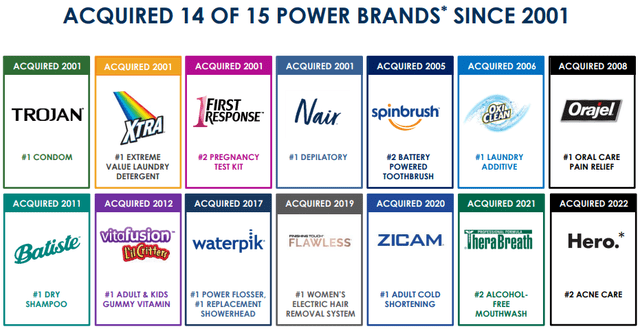

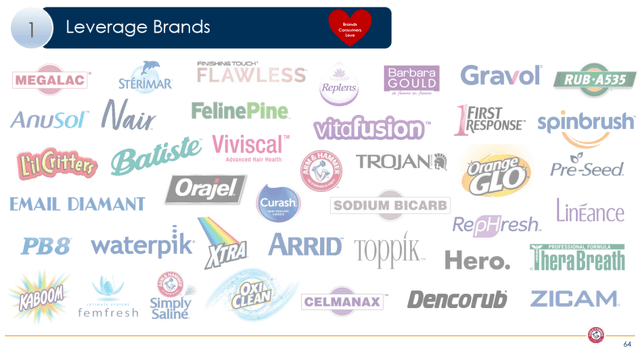

As the pandemic-induced demand is faltering, the company is once again facing the reality of its own strategy. For a relatively smaller player in the Home & Personal Care space that is also predominantly focused on the U.S. market, Church & Dwight relied heavily on outside deals for growing its business.

Church & Dwight Investor Presentation

Although very aggressive M&A strategies often lead to shareholder value destruction, oftentimes strategic bolt-on deals are necessary to complement a company’s organic sales growth. Moreover, large peers, such as Procter & Gamble (PG) and Unilever (UL), have both the scale necessary to quickly scale up globally their newly acquired brands.

In the case of CHD, however, this does not appear to be the case and even more importantly, the collection of these newly acquired brands do not seem to create a coherent brand portfolio.

Church & Dwight Investor Presentation

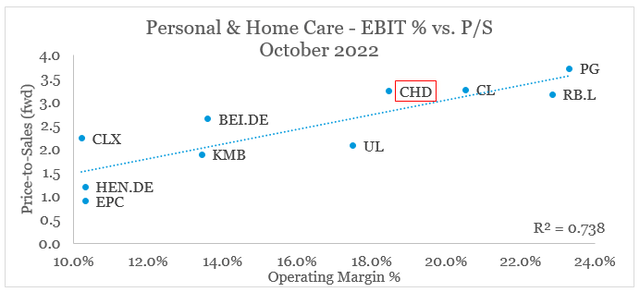

With that in mind, there are also some key financial aspects to keep an eye on as CHD seems to have taken a very different approach to its larger peers.

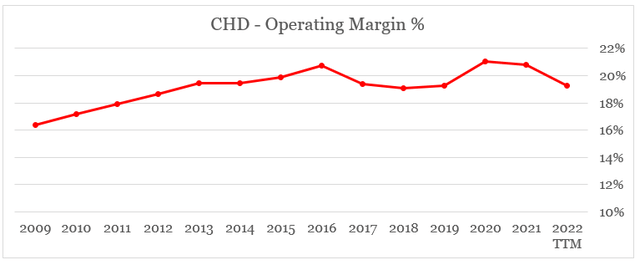

On the surface, the company’s current price-to-sales multiple is well-supported by its high operating margin. On a cross-sectional basis, both of these values are as expected, although CHD lies slightly above the trend line in the graph below.

prepared by the author, using data from Seeking Alpha

Financial Overview

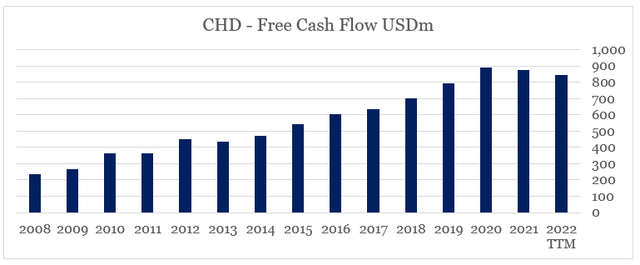

From a free cash flow point of view, CHD has been experiencing consistent growth over the years which was suddenly brought to an end as the pandemic-relate tailwinds dissipated.

prepared by the author, using data from Seeking Alpha

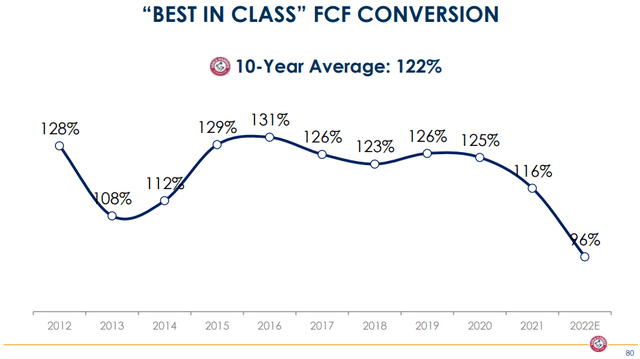

For a number of years, CHD’s management has emphasizing its strong free cash flow conversion rate, which a few years back was the highest in its peer group. Following the 2021 decline, however, FCF conversion has plunged during the first half of 2022 and is not expected to rebound anytime soon.

Church & Dwight Investor Presentation

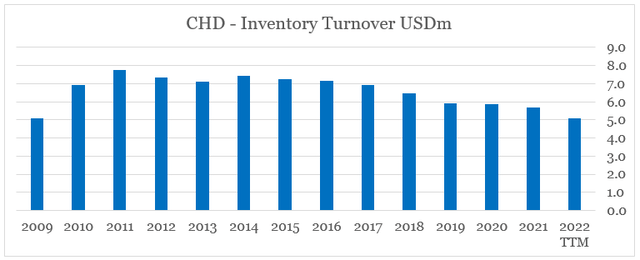

On one hand this has been caused by the recent margin pressures, which were also accompanied by a sustained decline in the company’s inventory turnover as CHD continues to expand its brand portfolio and rely on third-party manufacturers for some of its new products.

prepared by the author, using data from Seeking Alpha prepared by the author, using data from Seeking Alpha

It is worth mentioning that CHD has been utilizing certain more aggressive working capital practices, such as receivables factoring which I covered previously.

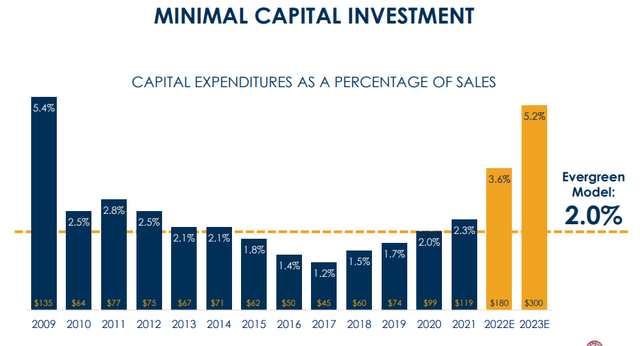

On the other hand, has been the need for much higher capital expenditure that I highlighted back in the beginning of 2020.

As a matter of fact, capital spend fell below the sanitary minimum of the annual depreciation expense for two years, only to climb back to slightly above the annual depreciation expense in 2019. This consistent under-spending on fixed assets would most likely have a negative impact on CHD’s free cash flow growth going forward.

Source: Seeking Alpha

Church & Dwight Investor Presentation

This has caused the expectation for the company’s full year free cash flow to fall sharply from its 2021 levels.

We expect cash from operations for the full year to be approximately $900 million, down from $920 million, and our full year CapEx plan is now approximately $180 million as we continue to expand manufacturing capacity.

Source: CHD Q2 2022 Earnings Transcript

Even though the management has been guiding for a slight increase in capex to sales ratio to approximately 3.5%, the currently 2023 expected increase is far beyond this number as we saw in the graph above.

Our full year CapEx plan continues to be approximately $100 million as we began to expand manufacturing and distribution capacity, primarily focused on laundry, litter and vitamins. As I mentioned back at the Barclays conference in September, we do expect a step-up in CapEx over the next couple of years to approximately 3.5% of sales for these capacity-related investments.

(…)

Yeah. I said in my remarks is approximately 3.5%. So – and I said it for the first time at your conference, and I think I did say 3% or 4% then, but it’s about 3.5% for about two years, and it’s laundry, litter and vitamins, (…)

Rick Dierker – Chief Financial Officer

Source: CHD Q3 2020 Earnings Transcript

The Brand Strategy

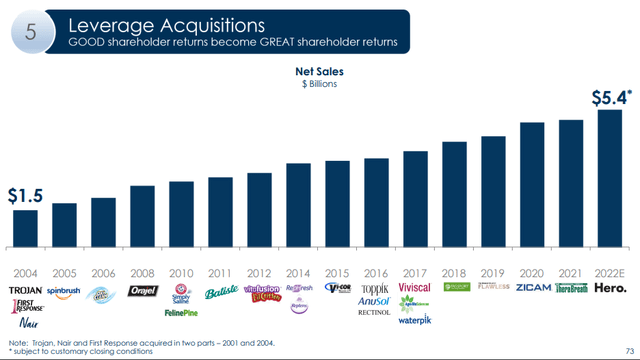

Similarly to praising its asset light model that now necessitates a sharp increase in capital expenditure, CHD’s management has also been praising its strategy focused around a very aggressive M&A approach.

Instead of focusing on its iconic brands, the management is focused on rapidly expanding its brand portfolio.

Church & Dwight Investor Presentation

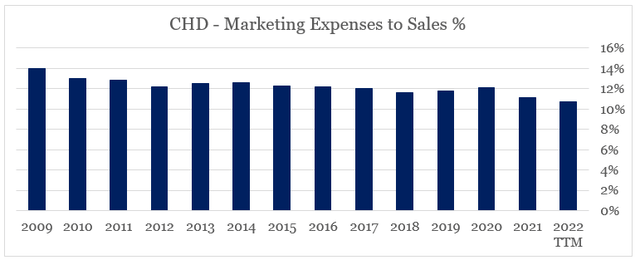

Such a strategy is not necessarily a bad approach, however, relying on too much outside deals to create a very diverse brand portfolio also requires higher spending on advertising and marketing in order to support these brands and create a coherent strategy around them.

Instead, CHD seems to be lowering its marketing expenses relative to sales, even as its expanding brand portfolio does not benefit from a master brand.

prepared by the author, using data from Seeking Alpha

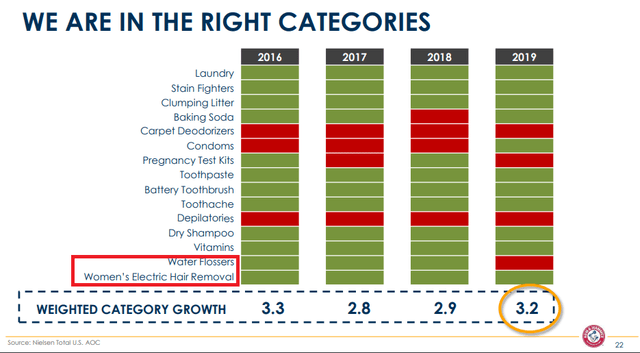

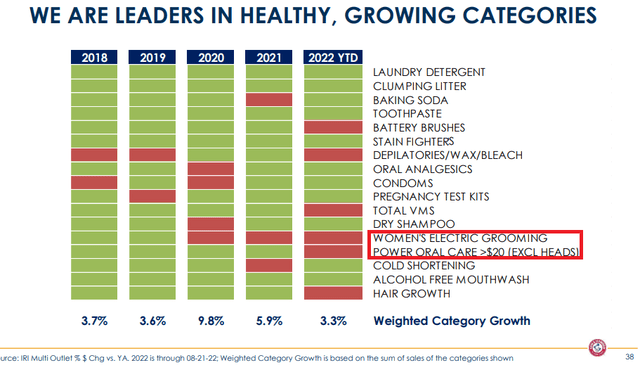

By acquiring companies that are currently experiencing a high-growth period, CHD creates a short to medium term tailwind for its topline results. For example, at the time when I first covered the company, CHD had just acquired Waterpik and Flawless – an oral irrigators and pulsating shower heads brand and a hair removal brand.

Back then, the categories where both of these companies are operating were experiencing a growth period.

Church & Dwight Investor Presentation

Simply relying on these industry trends and its predominantly U.S. based distribution network, CHD was supposedly making a very good long-term deal.

Just two years later, however, these categories do not seem to be doing as well as they did back in 2020 (note the category description change).

Church & Dwight Investor Presentation

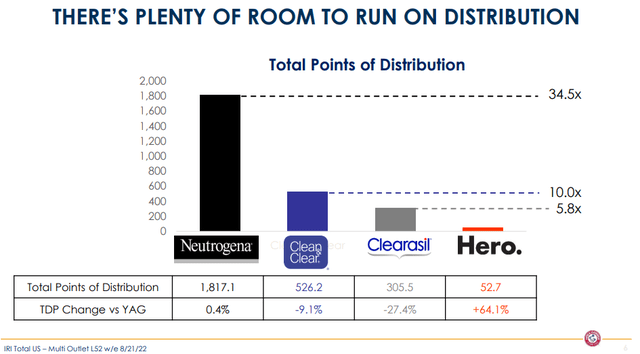

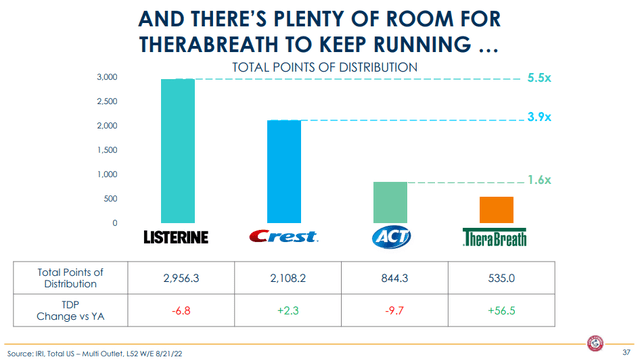

Moreover, the focus has now shifted to new categories, such as cold shortening, alcohol free mouthwash and acne patches. All categories where CHD’s latest M&A deals are expected to create shareholder value.

Church & Dwight Investor Presentation Church & Dwight Investor Presentation

Although these newly acquired brands could perform much better, CHD’s strategy is becoming too stretched across many different product categories, while at the same time the company lacks the resources that brand owners of Listerine, Crest, Neutrogena and Clean & Clear have. Those are the likes of Johnson & Johnson (JNJ), Procter & Gamble (P&G) and Reckitt Benckiser Group (OTCPK:RBGLY).

Conclusion

Church & Dwight’s recent poor performance comes as a result of both outside and internal problems. As inflationary pressures persist, the company has suddenly made a 180 degree turn on its asset light strategy. Capital expenditures are increasing rapidly at a time when margin pressures also intensifying. In the meantime, the management continues to stretch the company’s brand portfolio in a very wide spectrum of product categories where competition is fierce. All that creates significant risks going forward.

Be the first to comment