andresr

Investment Thesis

The Trade Desk (NASDAQ:TTD) is the largest demand side platform, serving as a critical intermediary for advertisers looking to optimize their ad spending. Through The Trade Desk, advertisers have access to the world’s most premium inventories and rich data insights.

The company had an excellent 2Q22 quarter as it was firing on all cylinders, as seen from its robust top-line growth. I also attempt to address investors’ concerns over why The Trade Desk’s high stock-based compensation (“SBC”) expense is not a concern. However, despite the great execution, the valuation is priced at a premium.

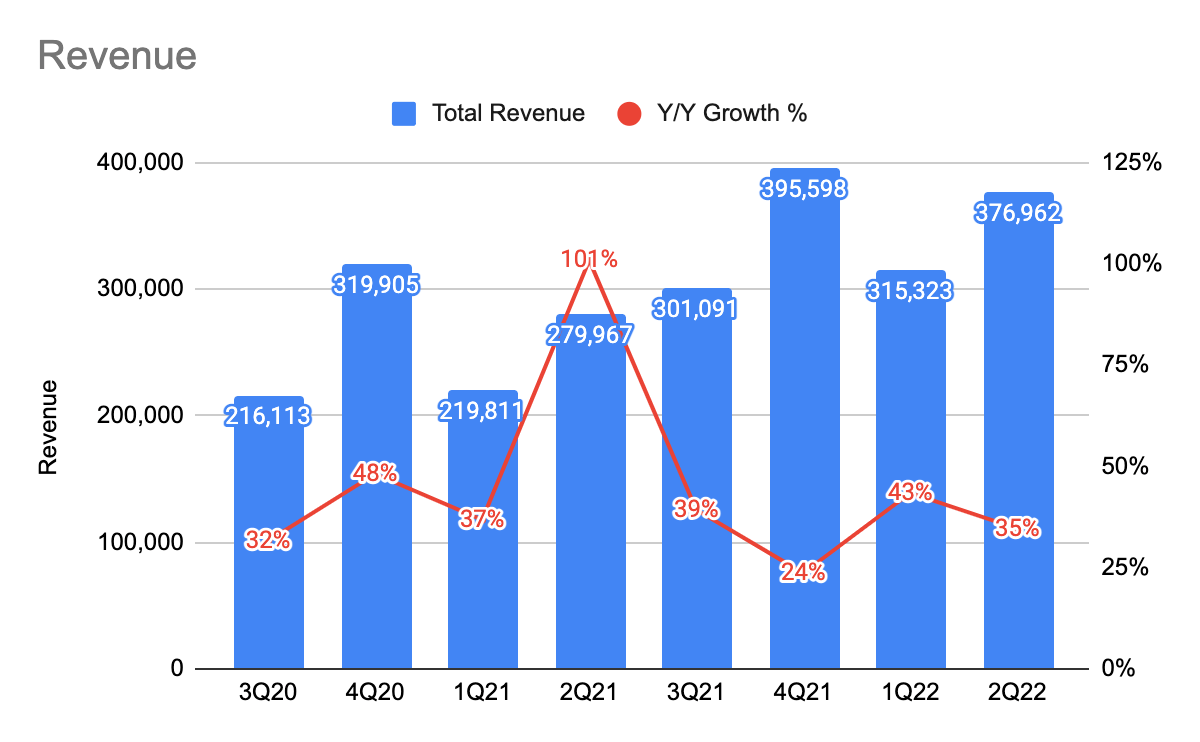

Robust Revenue Growth

TTD 10-Q

The company revenue grew 35% Y/Y, and this is driven by the (1) increasing shift to data-driven advertising, (2) the secular tailwind to advertising on Connected TV (“CTV”), and (3) advertisers who are seeking to optimize advertising dollars are shifting more budgets to The Trade Desk. Furthermore, the world’s leading brands have signed new or expanded long-term agreements (also known as joint partnership programs) with the company. This long-term commitment by brands further validates the value proposition of the platform.

This is in comparison with ad tech companies such as Snap Inc. (SNAP) which are impacted by lower discretionary spending. The Trade Desk serves as a critical intermediary for advertisers looking to get the best buck for their ad dollars, especially with the possibility of a recession looming. According to the management in the 2Q22 earnings call:

“Throughout the first half of 2022, and particularly in the second quarter…we have gained more market share or grabbed more land than at any period in our history…as marketers become more deliberate with their budgets, they are prioritizing, advertising that delivers the highest return and CTV has moved up the priority list…while we can’t control the macroeconomic environment, the pace at which we are signing new and expanded customer agreements indicates that we are becoming an indispensable partner in their business growth and we anticipate grabbing land regardless of the macroeconomic environment”

In addition, there is also a near-term tailwind related to upcoming political spending, and Netflix’s (NFLX) transition into an ad-based model is likely to benefit the platform in the future.

Profitability and Addressing The Stock-Based Compensation Expense

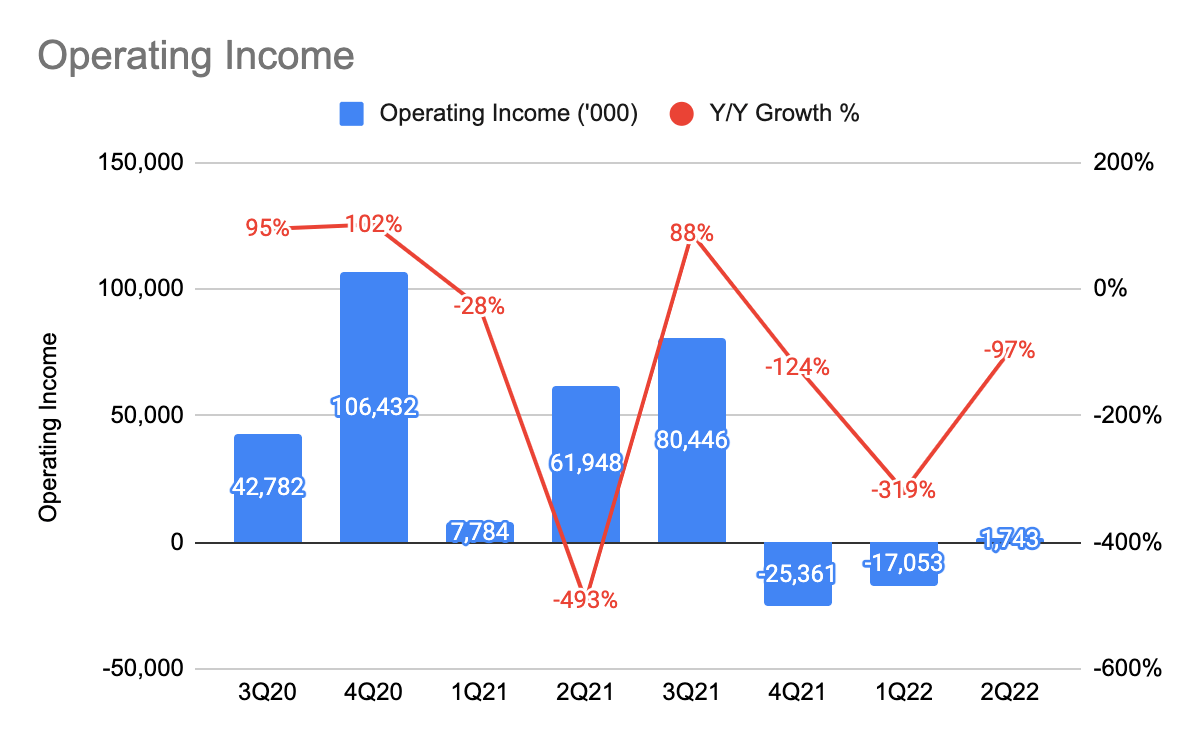

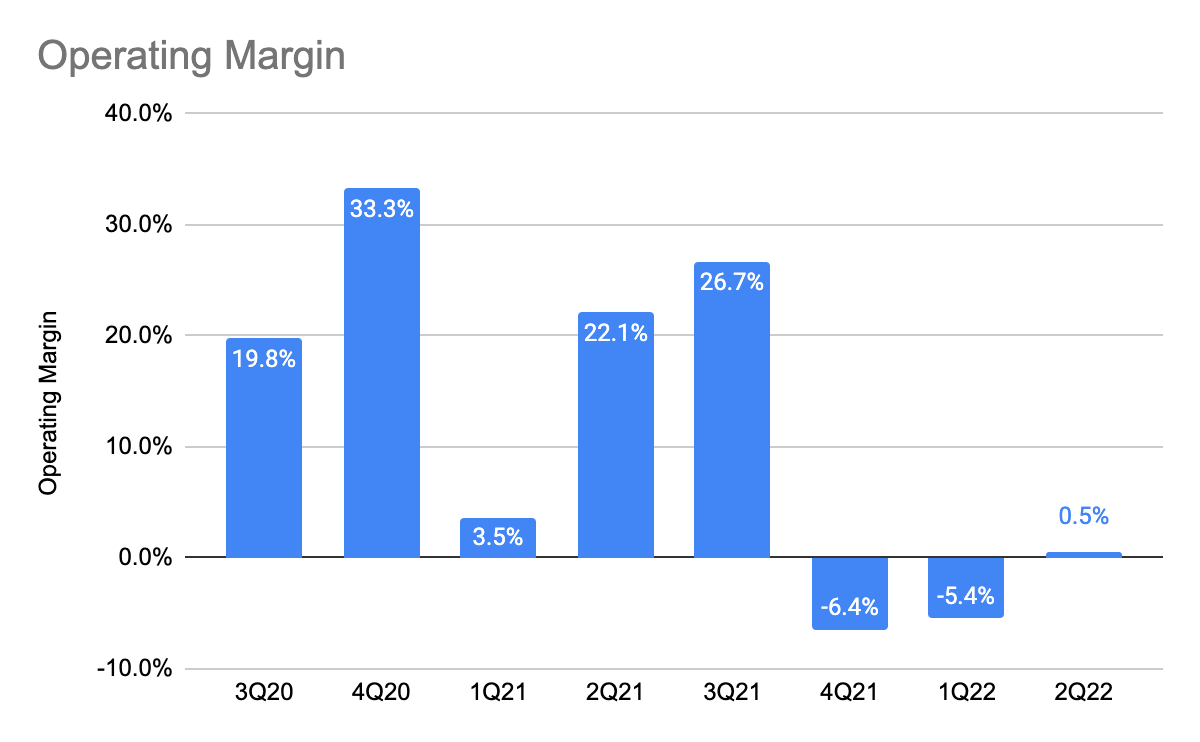

Profitability

TTD 10-Q TTD 10-Q

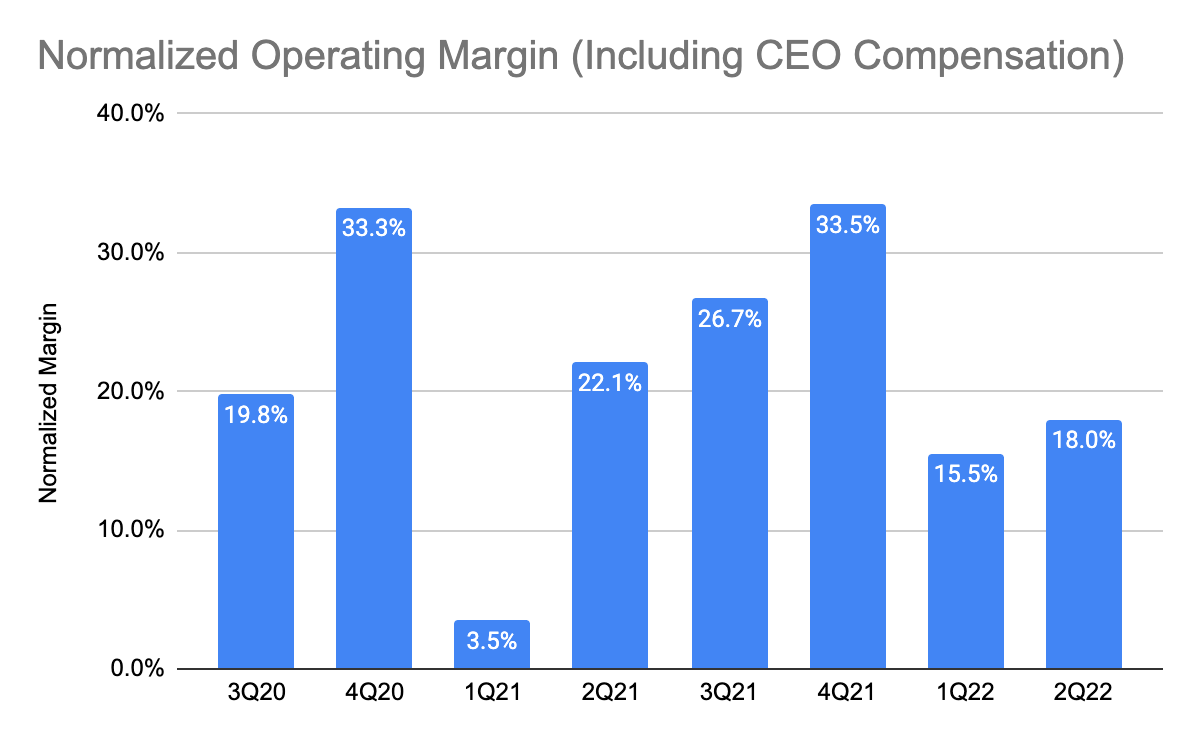

Historically, the company has always booked a net operating profit, but it was not until 4Q21 that its operating profit fell 124% Y/Y to a negative operating margin of 6.4%. And in 2Q22, its operating profit grew 97% Y/Y to 0.5% margin. So, what exactly happened?

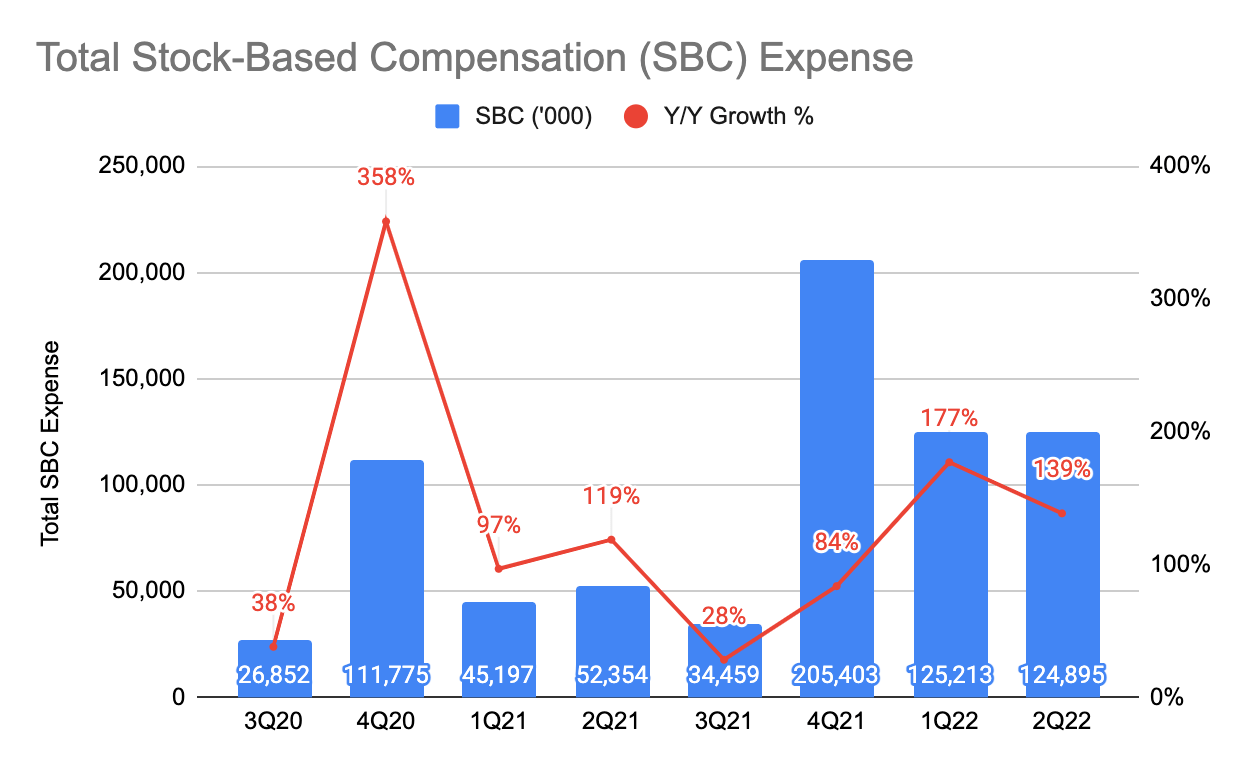

Stock-Based Compensation – To Worry, Or Not?

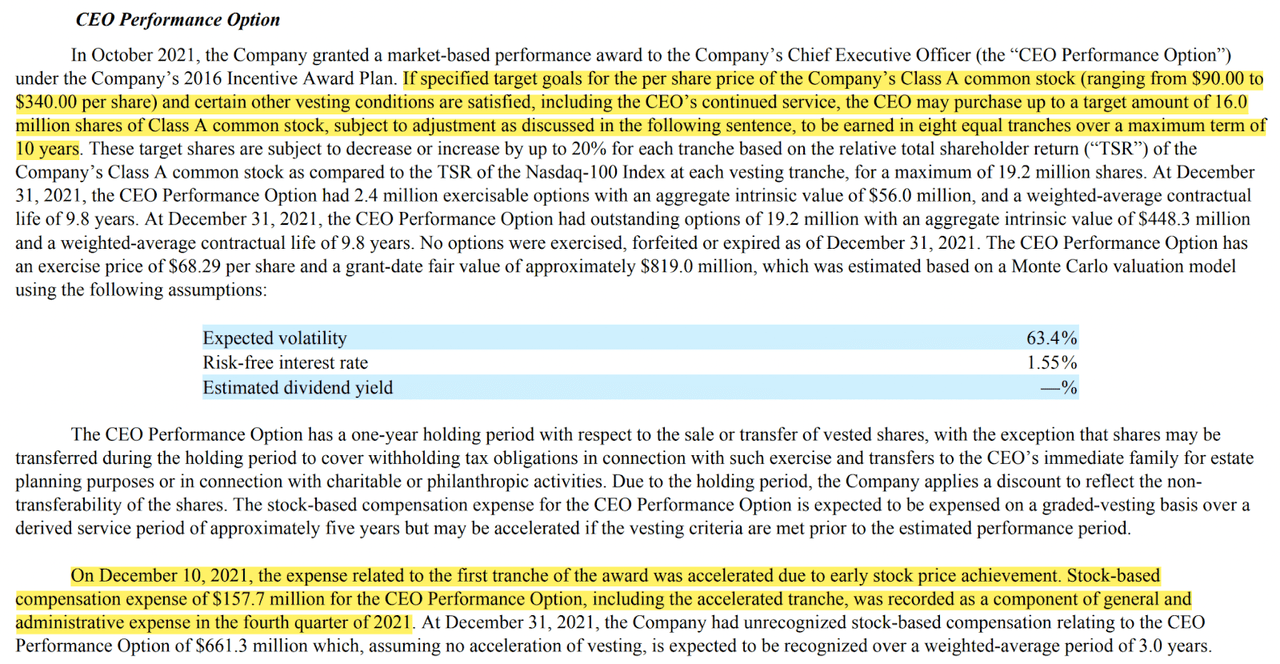

TTD 10-Q TTD 10-Q TTD FY21 10-K

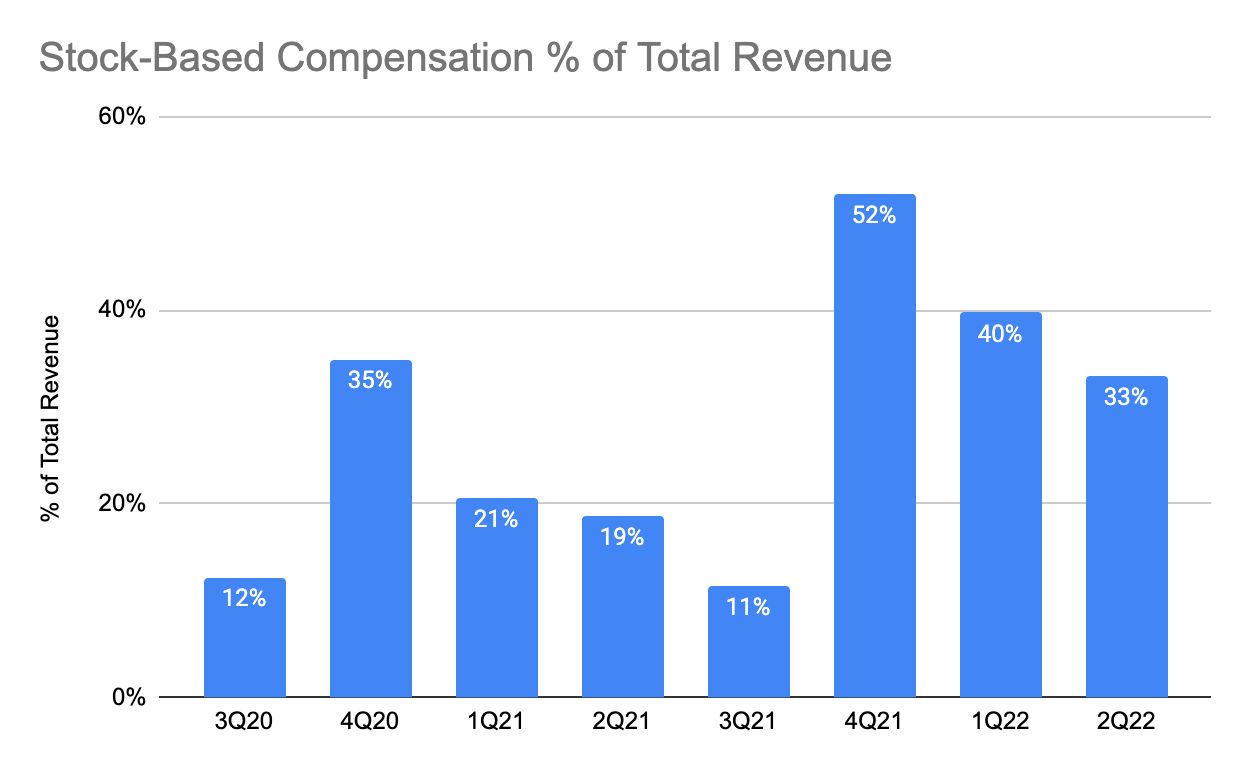

This was largely due to the increase in stock-based compensation (“SBC”) expense as its SBC expenses grew from a mere 11% in 3Q21, to 52% in 4Q21, which then slowly declined to 40% in 1Q22 and 33% in the most recent 2Q22 quarter. This increase is associated with the CEO compensation that was announced in October 2021 which CEO Jeff Green is awarded stock options based on the company’s performance. In 4Q21, SBC expense of $157.7 million was recorded as part of general and administrative (“G&A”) expenses, and $66 million of SBC expenses in 1Q22 and 2Q22, respectively. Therefore, we can see that this puts pressure on its near-term operating margin.

Finding Out The Normalized Operating Profit

Author’s Estimates Author’s Estimates

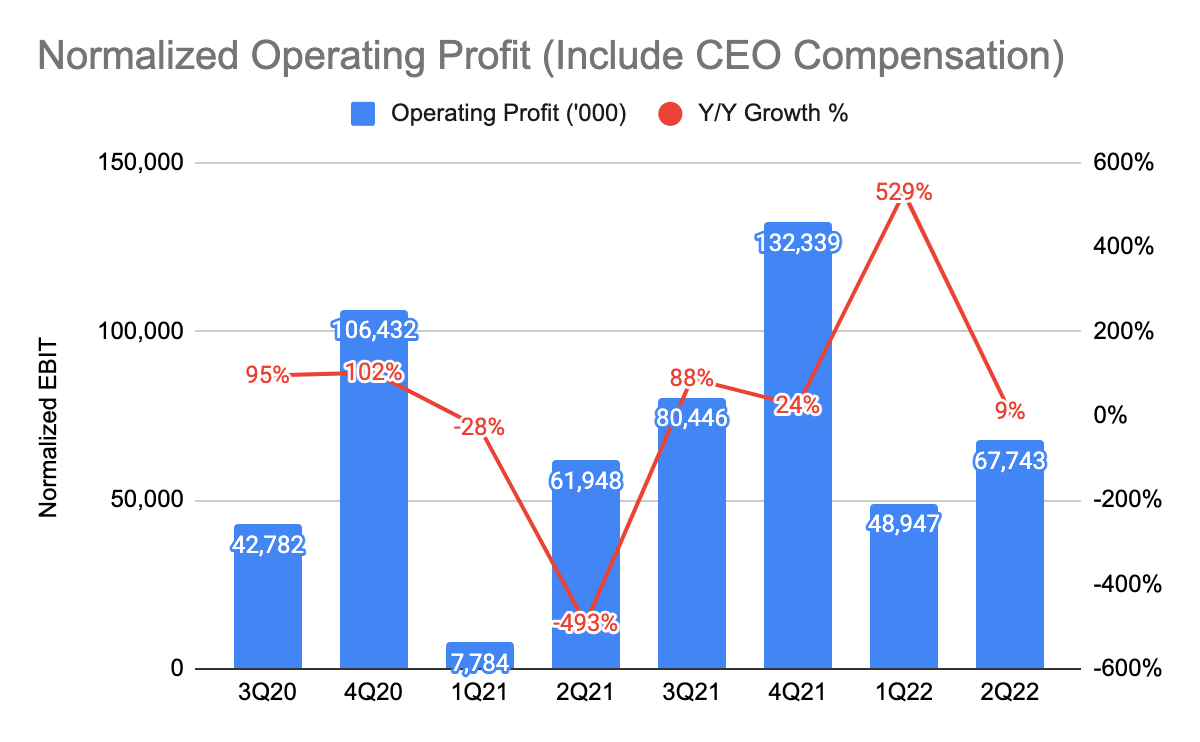

However, since this is a non-recurring CEO compensation, we can attempt to find the normalized operating profit by adding the SBC expenses to its existing operating profit. This will give us a positive operating margin of 18% for the current 2Q22 quarter.

Reinvesting In the Business

TTD 10-Q

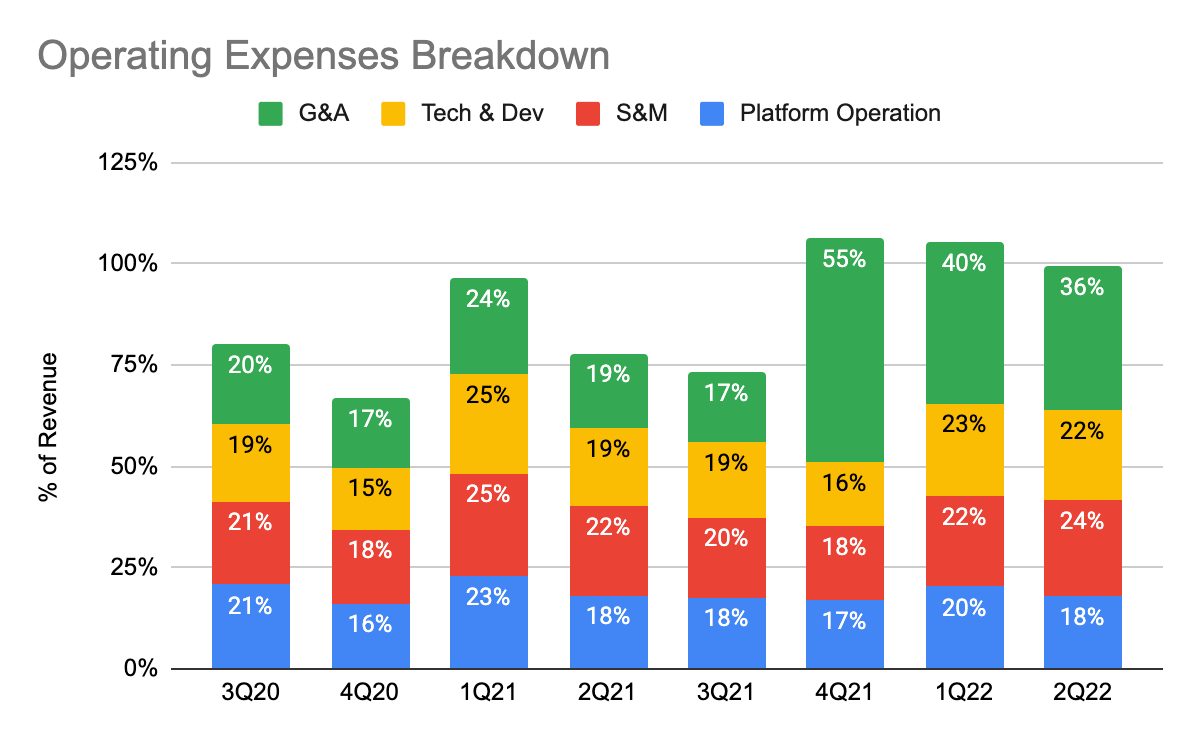

The reason for the lower margin as compared to a year ago is its reinvestments, which were addressed by the management back in the 4Q21 earnings call:

“…we see significant opportunities to invest in our business with a massive available market in front of us that can generate long term growth, such as the generational shift to connected TV, the expanding retail data opportunity and the expectation that our international operations will grow faster than North America over the long-term…expect to increase our rate of hiring over pandemic affected periods and will do so in a competitive hiring market…return-to-work expenses will begin to revert to pre-pandemic levels…expect the operating expense structure of the company to be better than it was prior to the pandemic, and over the long term expect Sales & Marketing and Technology & Development areas to represent a larger share of our investment.”

Why Its High Stock-Based Compensation Is Not A Concern

TTD 10-Q TTD 10-Q

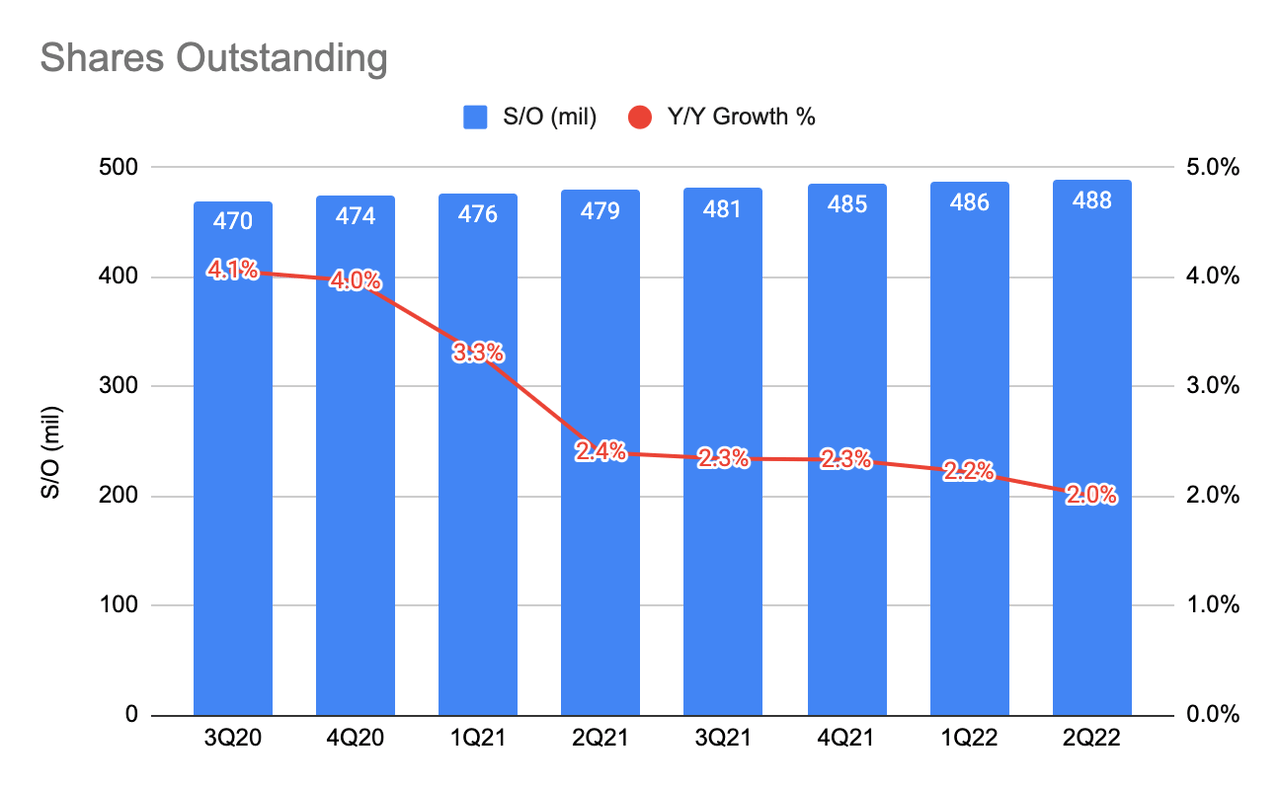

I like to go a step further to address investors’ concerns over the company’s high SBC expense. SBC generally can be dangerous as it dilutes shareholders by increasing the number of outstanding shares. However, that is not true in the case of The Trade Desk, in my opinion.

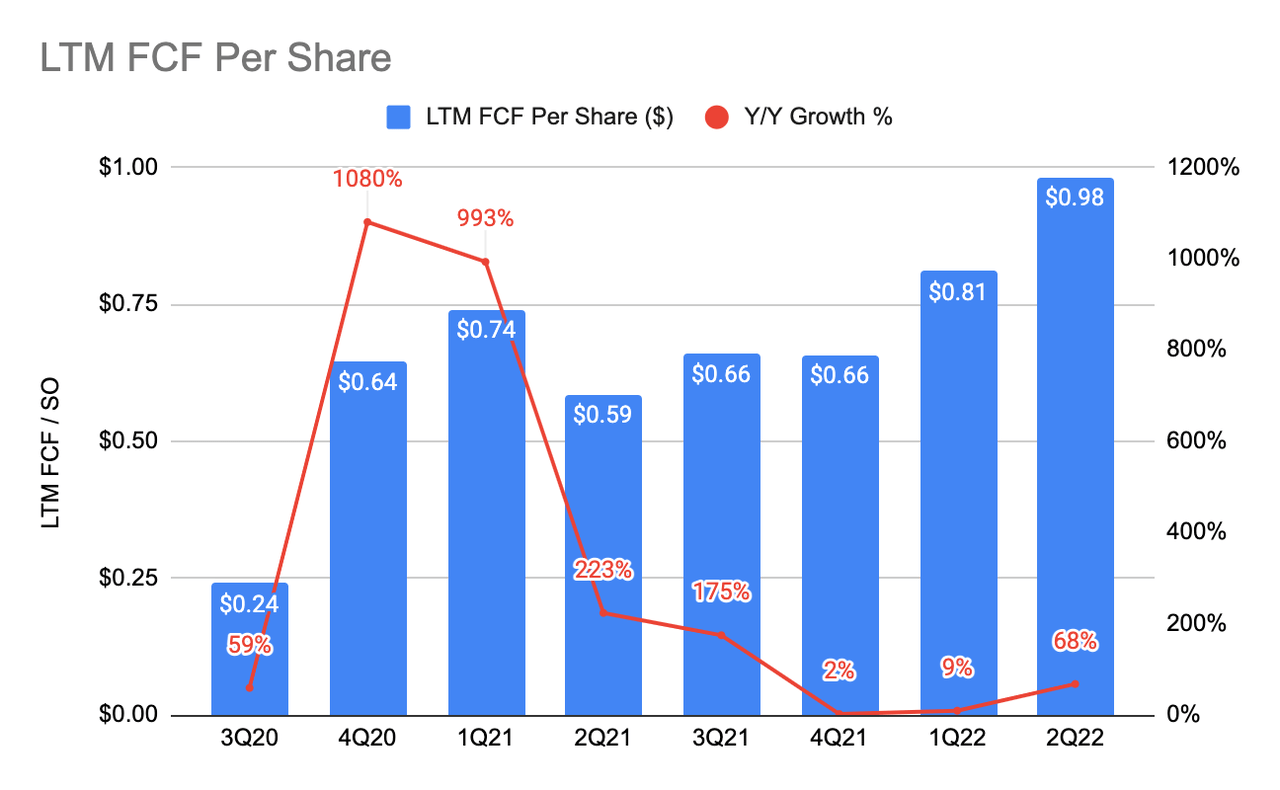

Its last 12 months (“LTM”) free cash flow (“FCF”) per share growth has been growing much faster than the rate of its share dilution. Moreover, a 2% dilution is negligible as well. Note that in June 2021, the company announced a 10-for-1 stock split, thus, I multiplied the shares outstanding for all of the quarters before 2Q21 by 10.

Valuation

Author’s Estimates

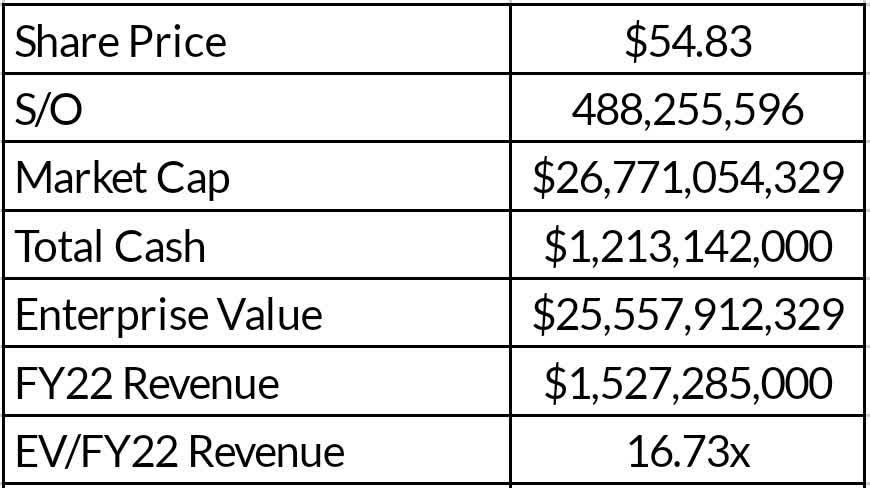

While the company is executing remarkably, the issue that I have is the seemingly high multiple The Trade Desk is trading at. I’m estimating that FY22 revenue will be $1.58 billion, and this gives me an EV/FY22 revenue of 16.73x. If we assume that its FCF margin is 26%, this gives us an EV/FCF of roughly 64x. Without doing a discounted cash flow valuation, it’s clear that the market is attaching a premium to its valuation.

I believe this is so for various reasons – (1) The Trade Desk is far more resilient than other ad-tech players, (2) highly profitable, (3) no debt, and (4) generating strong FCF. But despite these factors, I am personally uncomfortable with the valuation.

Conclusion

All in all, this was an extremely strong quarter as The Trade Desk remains a go-to platform for advertisers seeking to optimize their ad spending. I also attempt to find out the normalized operating margin by excluding the non-recurring compensation expense, which gives us a lower operating margin than a year ago. This is given the sheer number of opportunities available and the management continues to reinvest in the business to grab market share. I’ve also touched on how the high SBC expense is not a concern as the LTM FCF per share is still growing much faster than share dilution, and moreover, the share dilution on a Y/Y basis is negligible as well. But despite the great performance, I am personally uncomfortable with the multiple the company is trading at.

Let me know your thoughts in the comments section below.

Be the first to comment