monsitj

Investment Thesis

D.R. Horton (NYSE:DHI) saw increased cancellation rates last quarter, and it’s now evident that the rising mortgage rate is starting to cool down record-high housing demand. However, unlike previous cycles, the downside wouldn’t be that steep this time as housing inventory is way below its historical average. Moreover, D.R. Horton’s strategy to continue focusing on growing its market share would help top-line growth in the future. The dampening demand should normalize record high margins from early 2023 onwards. However, it should still remain at healthy levels. DHI is trading at the lower end of its historical P/TBV range, which I find attractive. Hence, I assign DHI a buy rating.

DHI Q3 Earnings

DHI reported mixed Q3 results with EPS beating consensus estimates while revenues missing the estimates. The third quarter EPS rose ~53% YoY to $4.69 vs the consensus estimates of $4.49. During the quarter the company recorded a 21% YoY rise in revenue which came in at $8.8bn against the consensus estimate of $8.99bn. On the margins front, the company performed very well with homebuilding gross margins improving by 120bps Y/Y to 30.1%, SG&A expense as a percentage of revenue decreasing by 50bps Y/Y, and pre-tax profit margins improving by 540bps Y/Y.

Demand to Cool Down but Undersupply of Homes Will Limit Downside

The recent DHI results show that the post-pandemic overheated housing market is beginning to cool off. During the third quarter, the company recorded 16,693 new orders which were down 8% YoY. The net new orders slumped due to a meaningful rise in cancellations which rose to 24% as the rapid rise in mortgage rates created a minor panic among homebuyers. However, the good news is that management has mentioned in the Q3 earnings call that the reselling demand is quite good, and the cancellations are being resold smoothly.

Looking forward, I expect demand to cool down given the high-interest rate environment. However, unlike previous recessions, I believe the low levels of available inventory should provide meaningful downside support. Currently, the housing inventory in the U.S. stands at 1.26mn homes which is much lower than the long-term historical average of 2.31mn homes. Since there is not much inventory out there or, in other words, the supply is tight, any demand dampening is unlikely to put much pressure on home prices. So, I am not expecting significant write-downs like we have seen in previous recessions. Also, the duration of this slowdown and the declining demand for new homes should be less than what we have seen previously.

Market Share Growth Prospects

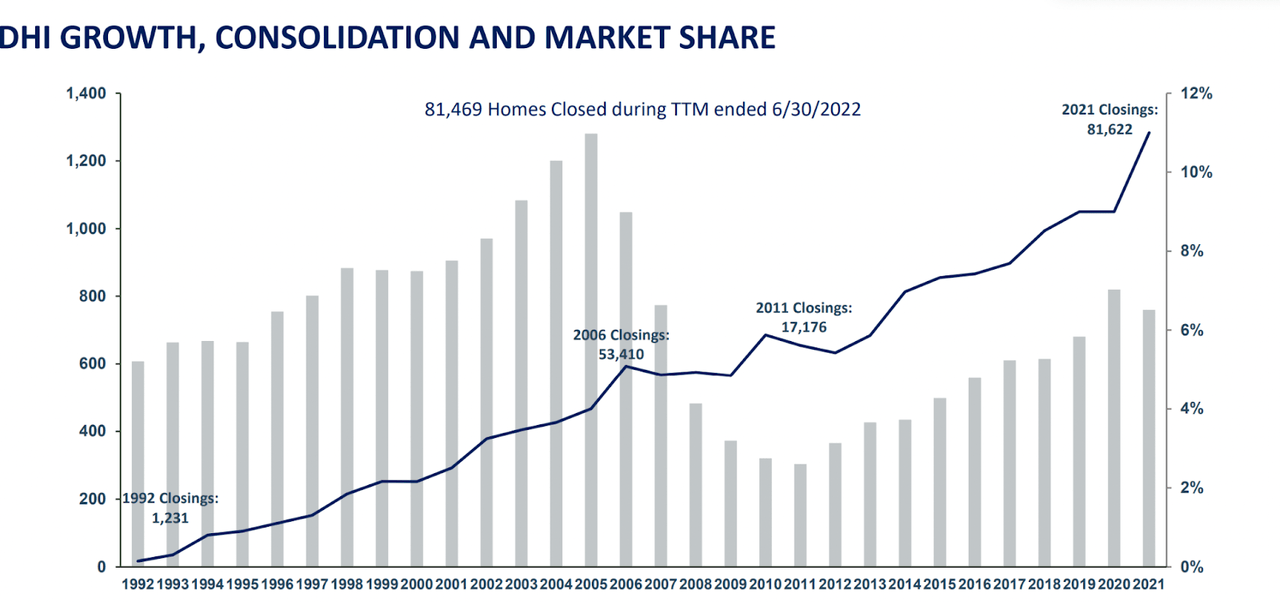

DHI primarily targets a large section of home buyers who buy affordable homes. Nearly 54% of the home sold last quarter were priced below $350k which is ~$100k lesser than the average selling price (‘ASP’) of other major homebuilders. The strategy of targeting entry-level buyers has helped DHI to increase its market share from 5% in 2009 to 11% by 2021 end.

DHI Share Growth (Investor Presentation)

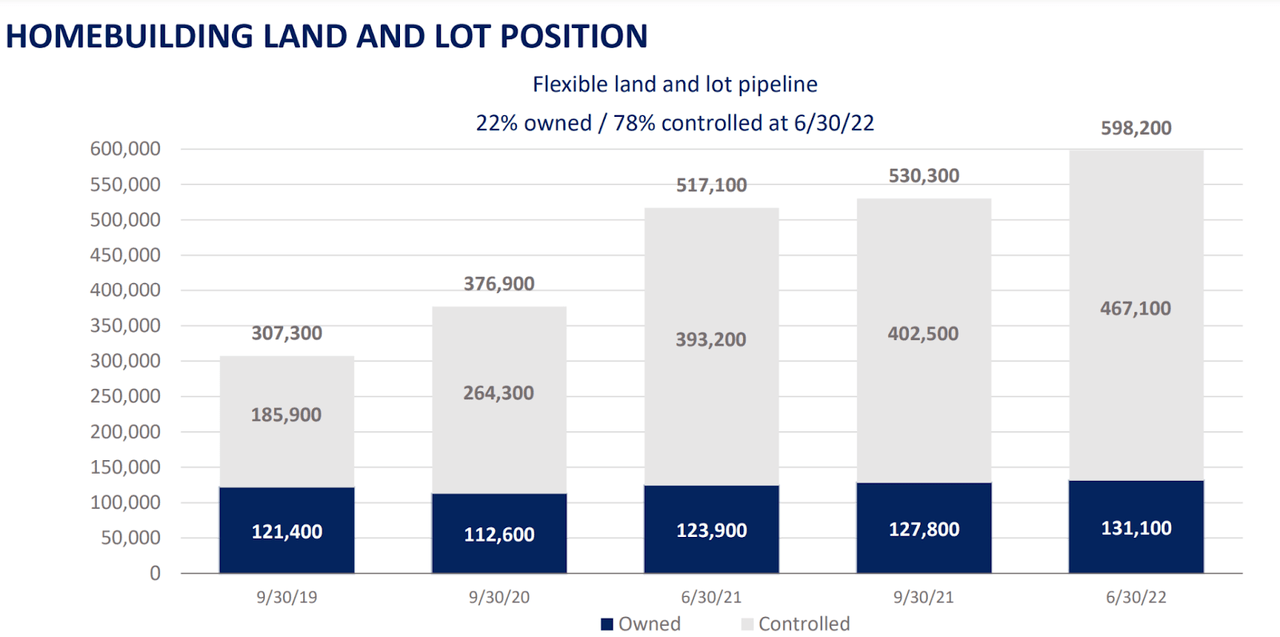

To further increase market share and fuel its growth, the company has been aggressively investing in land in recent years. The company has increased its lot count from 307,300 in 2019 to 598,200 currently. The company’s land asset stands equal to 7.3 years of land lot supply on last year’s closing. This is among the highest lot supply in terms of years among major homebuilders.

DHI Homebuilding Land and Lot Position (Investor Presentation)

One can argue that higher land holding will lead to higher capital requirements and thus will adversely affect the ROIC of a company. But that’s not the case with DHI. DHI has a ~28% ROIC which is among the highest in the homebuilding industry. This is possible due to the company’s land light investment model in which D.R. Horton holds buying rights for land (or options land) without actually owning it until the company needs it. The company has 78% of its land holding optioned as of the last quarter which is an increase versus 60% in 2019. Looking forward, we expect the company to continue opening new communities and gaining market share which should offset some of the macro slowdown.

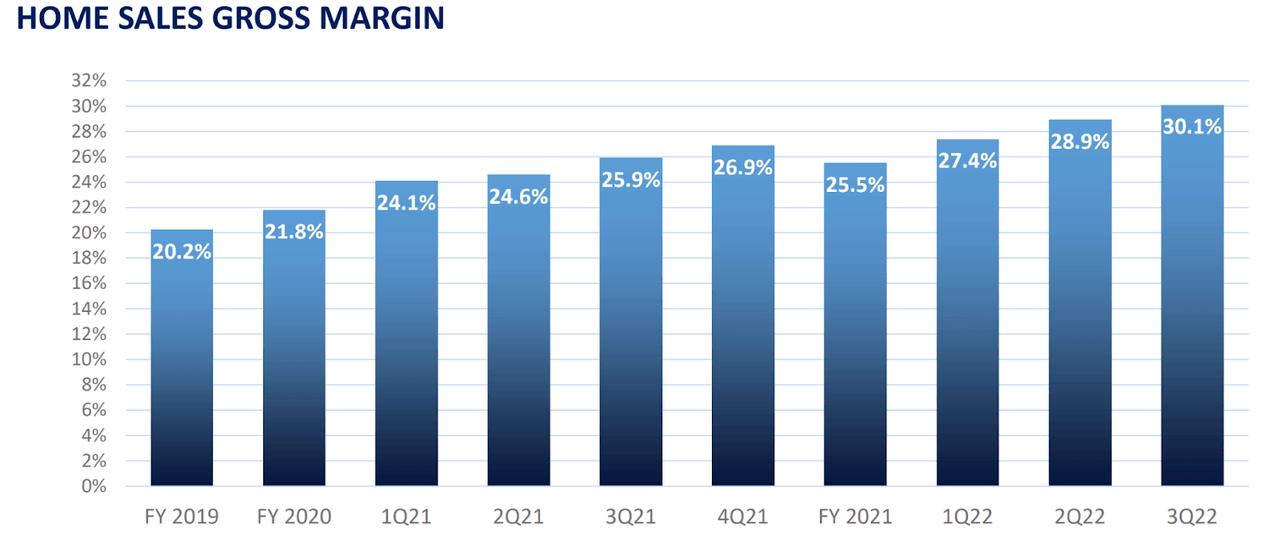

Margins to Normalize

Just before the pandemic, in 2019, DHI had a gross margin of ~20%. With the abrupt rise in demand for homes and the supply-demand mismatch, homebuilders were in a good position to push prices. Also, since a good deal of communities which they were building were on land acquired pre-covid at lower prices, their margins increased significantly. D.R. Horton’s home building gross margins expanded from 22% in Q1 2020 to 30% in Q3 2022. Apart from rising gross margins, SG&A as a % of revenue also contracted to a record low of 6.6% as homebuilders were getting orders without offering many sales incentives.

DHI Home Sales Gross Margin (Investor Presentation)

Due to the surge in mortgage rates, we expect demand to pull back a little, which should put pressure on the ASP of homes. Further, gross margins of homes built on land acquired post covid at higher prices should be lower. This can cause record-high gross margins for D.R. Horton to cool off from the next year onwards. Moreover, SG&A as a % of revenue should also rise as DHI should start offering sales incentives again to push sales due to lesser demand. So, I expect DHI’s gross margins to go back to the low 20s over the next few years. However, I am not too worried about it as this fact is well understood by the market and is already getting priced in at the current levels.

Valuations

If we exclude the covid-related panic crash (i.e., March, April 2020), over the last 5 years, D.R. Horton has traded at P/TBV per share of between ~1.4x on the lower end and ~2.9x on the higher end.

DHI Price/Tangible Book Value Per Share (Seeking Alpha)

Currently, DHI has been trading near the lower end of this range. The company has ~$11.9 bn worth of home orders in backlog which should result in good revenues and earnings in the coming quarters. According to the consensus estimates, DHI is likely to post an EPS of $5.26 in Q4 of the current fiscal year and $14.03 next year. That means by the end of FY2023, the company’s TBV could rise to ~$71. Even if we assume the stock will continue to trade near the lower end of this range, it implies a meaningful upside for the stock price. I find risk-reward favorable and have a buy rating on the stock.

Be the first to comment