NiseriN

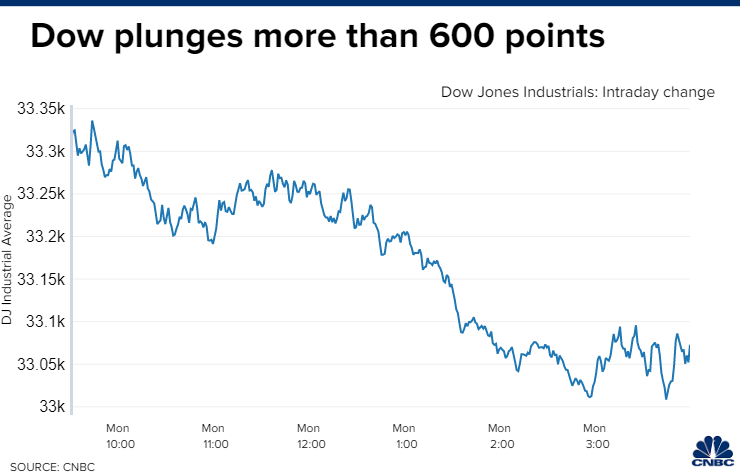

As though hibernating for the winter, the bears were sound asleep over the past four weeks. Alas, they have awakened over the past two days after the S&P 500 gave back a whopping 4% of its 17% rally off the June low. Evidently, the sky is now falling. They argue that yesterday’s plunge in stock prices is the market’s way of telling investors that the Fed must be far more aggressive in tightening monetary policy to slow the economy and topple inflation. I argue that the major market indexes simply hit technical resistance levels after a huge run up over a short period of time and needed to take a breather.

Finviz

Granted, investors are concerned about how hawkish Chairman Powell might be when he speaks on Friday, which is a great excuse for short-term oriented investors and traders to take profits after this huge run. If the market is telling us anything, it is that investors need to check their speculative investment activities at the door and temper their enthusiasm for risk assets. If not, the Fed will be more aggressive in tightening policy. Fed officials are investors too, as we have learned over the past two years, and they don’t want the stock market to crash. To the contrary, they want to see price appreciation, but only to the extent that it doesn’t fuel a surge in demand for goods and services at a time when they are trying to contain inflation.

CNBC

This is a delicate balancing act, but what is different today from where we stood two months ago is that the rate of inflation has clearly peaked and is starting to decline. At the same time, the economy is not falling apart. Consumer spending is growing very modestly on an inflation-adjusted basis. The Fed can’t ask for much more.

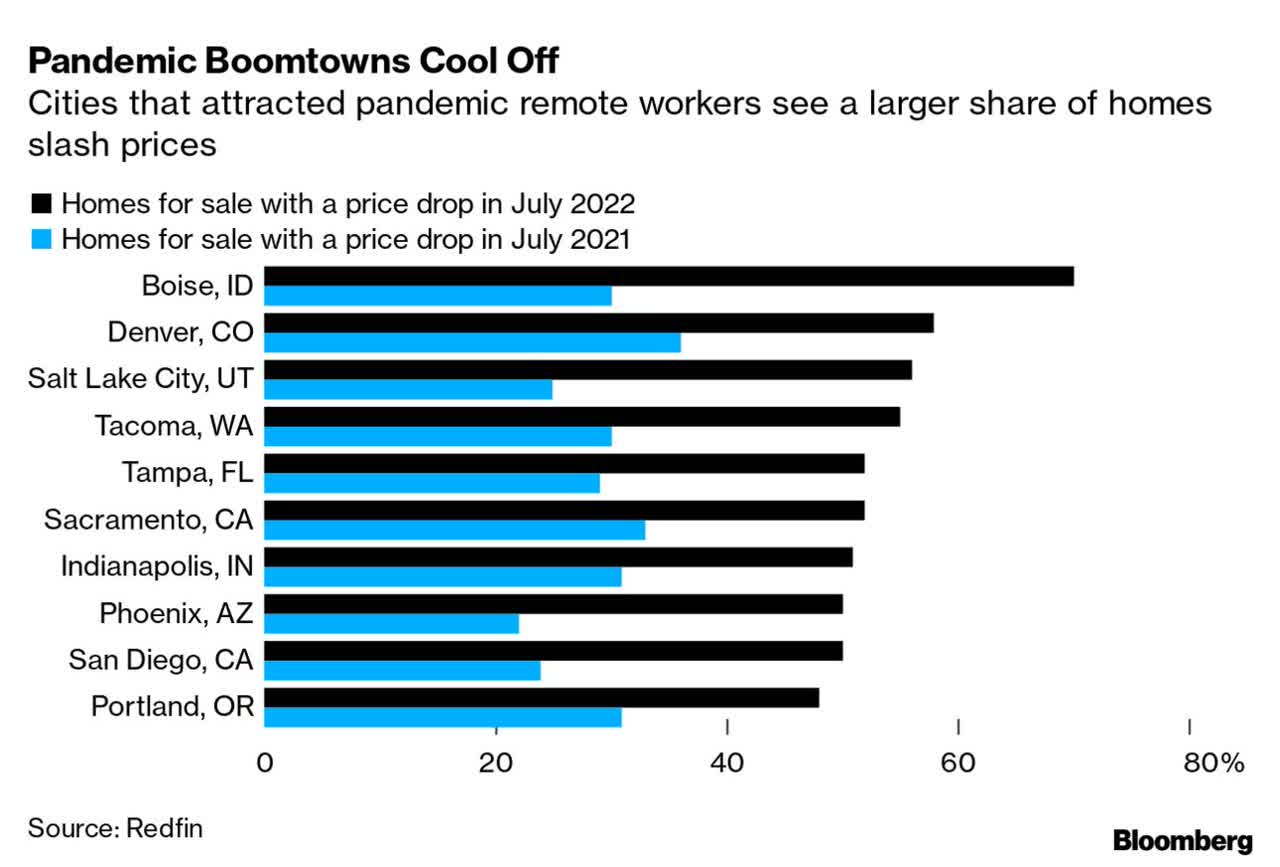

I see further improvement on the inflation front later this year coming from a category that has been of the greatest concern—housing. Home prices are now falling, which is the precursor to rents no longer increasing and eventually falling as well. Outside of food and energy, this has had the greatest impact on increasing the rate of inflation. I have read numerous stories about the coming collapse in housing, but that is nothing more than bears grasping for straws. The supply and demand dynamics of the housing industry are such that I think it is very difficult to see a nationwide collapse in home prices. We simply do not have enough supply.

Bloomberg

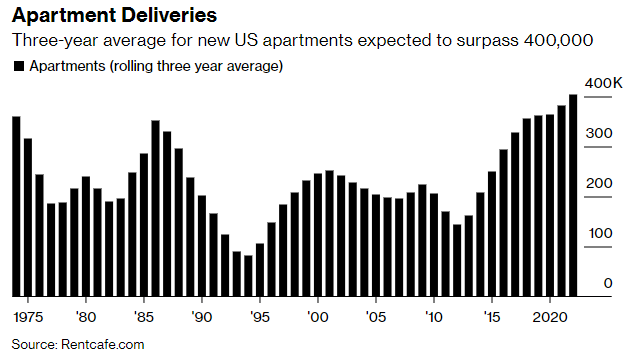

Yet even supply is starting to improve, as apartment construction is expected to increase to a 50-year high of 420,000 units nationwide, according to RentCafe. This is demand meeting supply, which should bring down prices, but it takes time. With home values leveling off and potentially falling modestly, as the supply of apartments increases, the rate of increase in rents should do the same in the coming 12-18 months. It will not happen today, but the most important thing is that it is happening and will result in a much lower inflation rate when it does. The Fed is aware of this, and it should temper rate hike expectations later this year.

Bloomberg

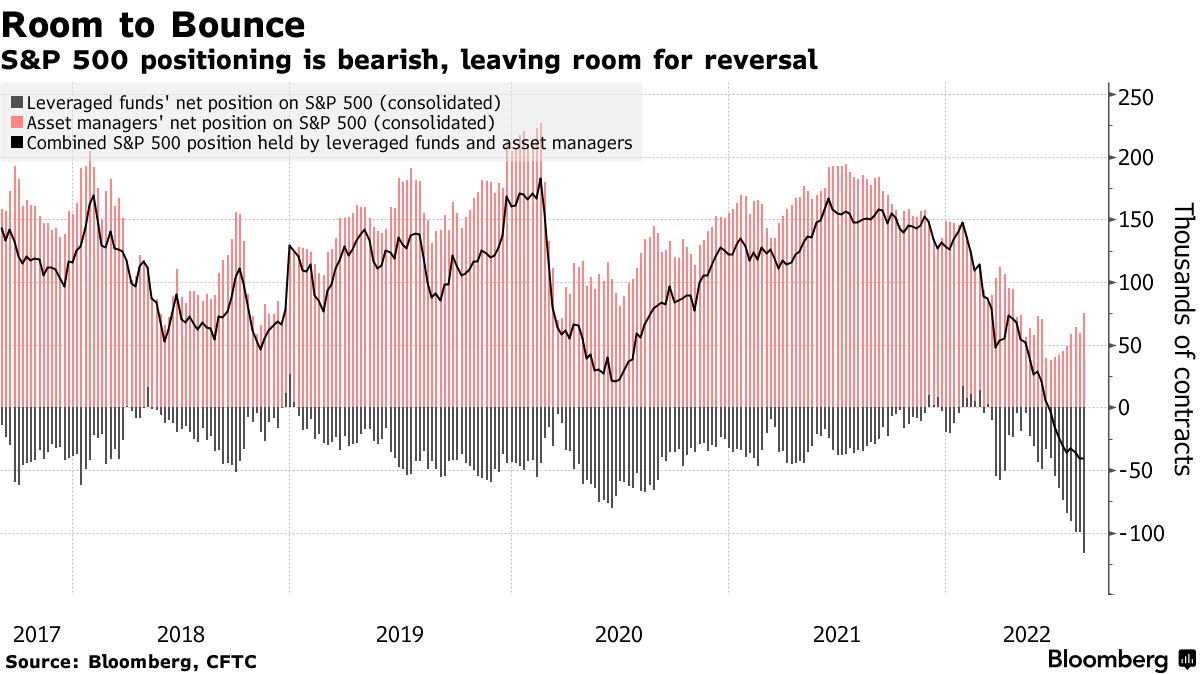

If markets remain volatile and the averages sink further between now and Friday to the near-term support levels I have discussed, I can see Chairman Powell disappoint those who are looking for a more hawkish tilt. He is very adept at talking out of both sides of his mouth, leaving something for both bulls and bears to grasp onto, which is his goal. I don’t think he wants new all-time highs until the Fed is closer to taming inflation, but he certainly doesn’t want new lows that would undermine the expansion. Investors are positioning for a worse-case scenario, which tells me that it will not happen.

Bloomberg

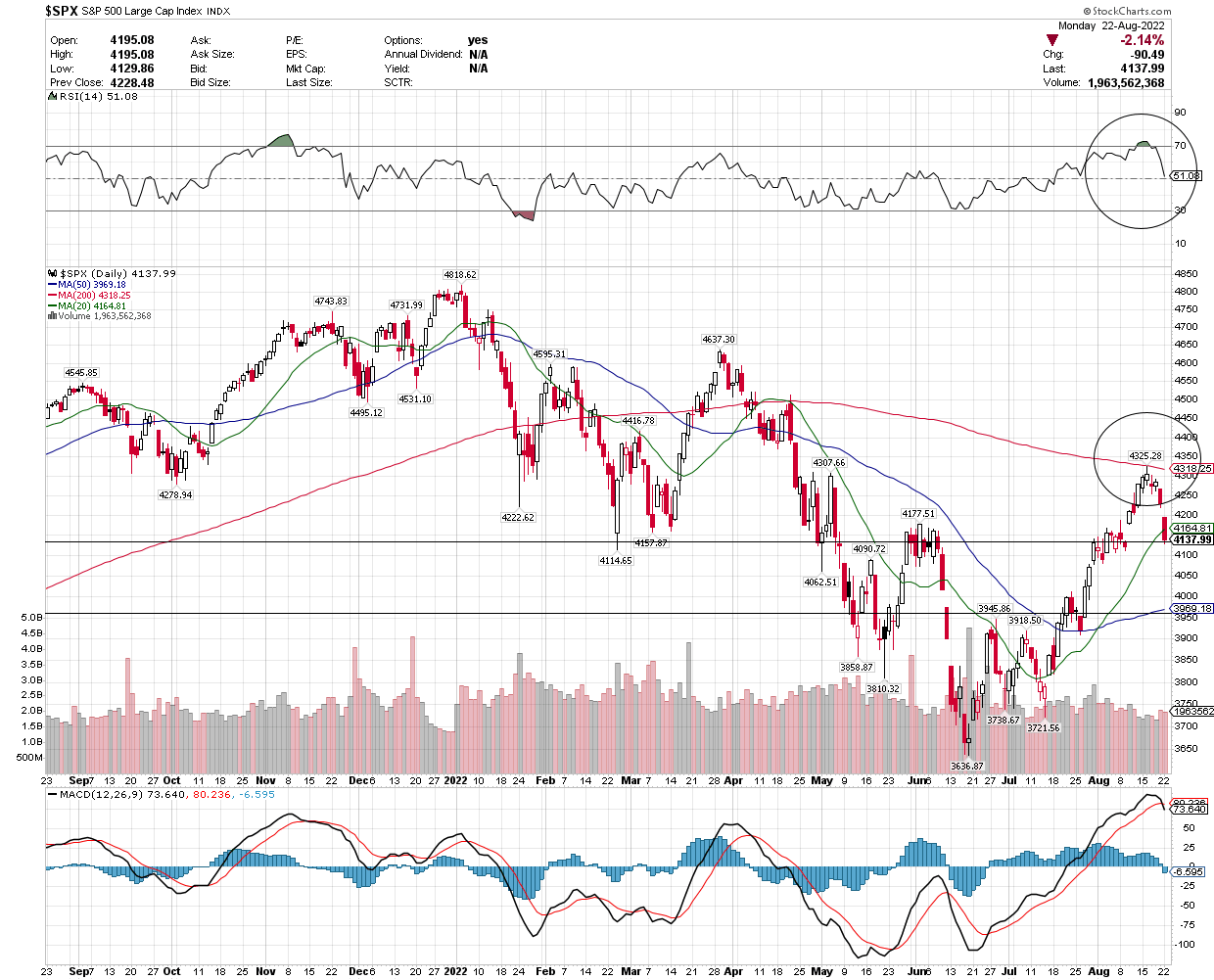

The Technical Picture

This pullback has been very orderly so far, with the S&P 500 falling below the 20-day moving average yesterday at 4,164 and likely testing the 50-day moving average at 3,970, which is rising. We have largely resolved the overbought condition in the market and may approach an oversold one if we fall to the 50-day. I think that level will attract buyers.

Stockcharts

Be the first to comment