fotokostic/iStock via Getty Images

Investment Thesis

CVR Partners (NYSE:UAN) is well-positioned for the strong nitrogen pricing environment.

That said, so much has happened in the past month since my previous bullish analysis of CVR Partners.

Over the past month, investors have become concerned that there’s an oversupply of fertilizer, namely that fertilizer is being stocked up, and this has translated into CVR’s share price sliding by approximately 20%.

Yet, I don’t believe that this price weakness is justified on several fronts.

- In the first instance, the stock is very cheap already.

- Secondly, CVR Partners is well-positioned to benefit from a substantial input cost differential in the form of low energy costs relative to overseas, predominantly European peers.

- Thirdly, I estimate that CVR could have a cash distribution of $8.00 per unit, leading to a 7.5% yield for the quarter.

Hence, I rate the stock a buy.

CVR’s Near-Term Prospects Discussed

CVR Partners is a manufacturer of ammonia and urea ammonium nitrate (”UAN”) fertilizer products.

The bull and bear case can be summarized as such. On the one hand, there are farmers that are not looking to purchase ammonia and UAN fertilizer at elevated prices.

Farmers are clearly aware of the high fertilizer prices. This has led to farmers trying to defer applications into next year. And in turn, this has led to widely reported warehouse stocking of fertilizer. And this in turn has seen fertilizer share prices move lower.

On the other side of the equation, you have the dynamics that got us here in the first place. Specifically, Russia, Belarus, and Ukraine make up nearly 15% to 20% of the global fertilizer market; a lot of that fertilizer is now offline.

Essentially, the driver that got us here has not gone away.

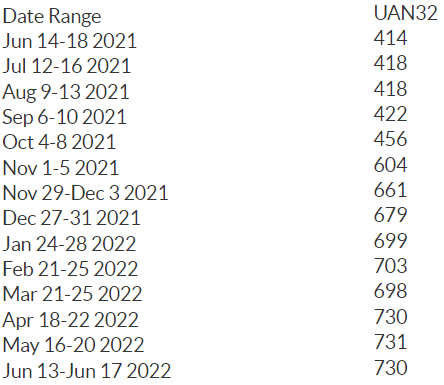

dtnpf.com

This is what you see above. These are retail prices. What CVR Partners sells are wholesale prices that will be at least 15% lower.

Still, even if we are no longer seeing UAN32 prices rapidly increasing, we are not seeing them fall either. At least not yet. What you see is a steady pricing environment.

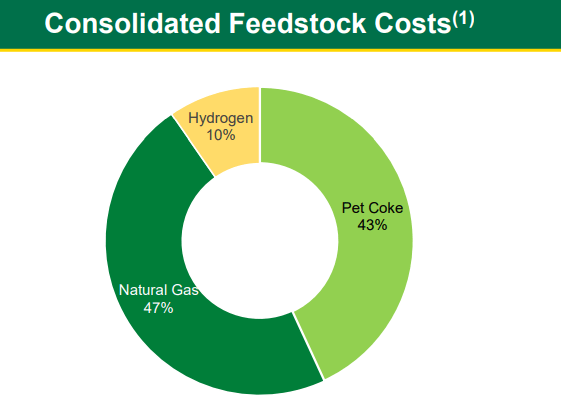

Meanwhile, on the other side of the equation, pet coke and natural gas feedstock input costs have a substantial impact on CVR’s profitability profile.

CVR investor presentation 2021

The graphic above is for last year’s Q1. It is not an updated figure, as I couldn’t find an updated figure. The point here is not to be precise but to directionally correct.

If natural gas prices come down, that is going to lead to CVR Partner’s free cash flow margins improving.

Trading Economics

As you can see above, in the past month natural gas prices have fallen by 35%. That will have a significant impact on improving CVR’s profitability profile.

The other feedstock, pet coke doesn’t appear to have moved up significantly in the past month.

Hence, altogether, I believe this lends itself towards CVR Partners having strong near-term profits.

CVR Partners’ Profitability Discussed

In Q1 2022, CVR Partners decided to hold back its cash distribution to improve its balance sheet. Indeed, recall that in Q1 2022, CVR Partners’ net debt position stood at $400 million.

Hence, by my estimates, I believe that when CVR Partner reports its Q2 earnings, its balance sheet will have moved closer to $250 million of net debt.

Accordingly, I believe that when CVR Partners reports its Q2 2022 results, we’ll see its net debt to EBITDA reaching somewhere near 0.7x on a trailing basis.

Simply put, with its debt now firmly under control, I believe that CVR Partners will now be in a better position to resume its strong cash distribution program.

UAN Stock Valuation – 3x EPS

For Q1 2022, CVR Partners‘ net income reached approximately $95 million. Given what we’ve discussed in terms of stable and high UAN32 prices, together with lower natural gas prices, I believe that we are going to see CVR reporting around $450 million in earnings this year.

This puts the stock priced at less than 3x EPS.

Furthermore, as you know, CVR is an LP. That means the business typically pays the majority of its income if it doesn’t use that cash to pay down.

What’s more, given what we’ve already discussed above in terms of its low net debt to EBITDA, this means that my estimate of CVR’s $120 to $150 million in earnings, most of it could return to shareholders.

Hence, to be conservative, it’s entirely possible that CVR’s cash distribution this quarter could be $8.00, or a 7.5% yield for the quarter.

The Bottom Line

CVR Partners is in a very strong position to return $8.00 per unit. This was the figure that CVR Partners was going to distribute last quarter when it opted to pay down its debt instead.

Consequently, given the high and stable nitrogen prices discussed, together with natural gas prices coming down at a rapid rate, I make the argument that CVR Partners could report $120 to $150 million in earnings in Q2 2022.

Consequently, paying less than 3x net income is a very cheap valuation for what’s on offer.

Be the first to comment