Sundry Photography

Investment Thesis

Broadcom (NASDAQ:AVGO) is a developer and supplier of semiconductor and related software products. Despite already being regarded as a giant, revenue is expected to be stable. Additionally, there is more room for expansion; 80% of customers use at least 5 other Broadcom solutions, which allows for a theoretical $100 billion total addressable market. This market expansion has allowed Broadcom to grow its dividend by a 43% CAGR over the last 5 years.

Organic revenue growth remains high at over 5% pre-VMware acquisition, with operating margin remaining at 70%.

Broadcom also frequently engages in attempts to purchase other companies to expand its market, most recently, VMware. Despite the large VMware acquisition Broadcom expects to maintain its 50% free cash dividend payout and continue its remaining $3 billion in share buybacks through 2023. Broadcom expects to reduce its debt-to-EBITDA to 2.5x by 2 years post-acquisition without impacting dividends.

Estimated Fair Value (EFV) = PE of 14 times E23 EPS of $40 = 14 X 40 = $560

|

Broadcom |

E2022 |

E2023 |

E2024 |

|

Price-to-Sales |

6.19 |

5.85 |

5.69 |

|

Price-to-Earnings |

13.61 |

12.46 |

11.83 |

|

Projected Yield |

3.3% |

3.9% |

4.1% |

Divisions

Broadcom operates 22 category-leading semiconductor and software products, with over 19,000 patents in its portfolio as of FY2021. These divisions are broken into 2 major segments for reporting simplicity: semiconductor solutions and infrastructure software.

Semiconductor solutions include data center solutions, telecommunications-related products, radio frequency devices (including cellular), and touch controllers for mobile devices.

Infrastructure software is Broadcom’s portfolio of software which includes security, automation, cloud networking, and development environments.

Semiconductor Solutions

Semiconductor solutions make up most of Broadcom’s revenue, including enterprise storage, broadband, industrial solutions, networking, and wireless communication.

Broadcom estimates that 99.9% of all internet traffic crosses at least one Broadcom chip at one point or another, with 80% of modern Wi-Fi architecture running on Broadcom systems. This enables over $50 billion per year in the systems market.

Broadcom Company Presentation |

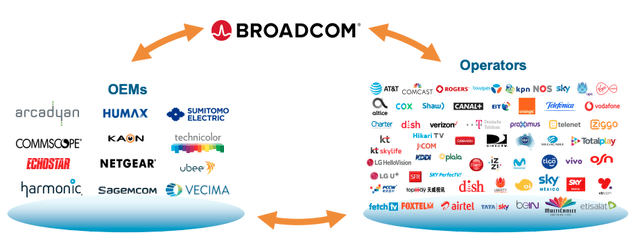

Broadcom is one of the most trusted names in end-to-end semiconductors, with 20 years of built-up relationships with OEMs and operators.

In storage, over 70% of enterprise servers deemed “mission-critical” use Broadcom’s line of server storage systems, with all of the top 10 providers for enterprise and cloud customers being represented.

Between 2016 and 2021 alone, the amount of data that exists on the internet has increased exponentially, estimated to have reached 19.5 Zettabytes per year transferred by the end of 2021.

Infrastructure Software

773 of the top global 2000 companies, leverage Broadcom’s software solutions, including all of the top 18 banks, all of the top 10 telecoms companies, and all of the top 10 automakers.

Cloud technology expansion has accelerated rapidly since COVID-19 began, spurred on by the “work-from-anywhere” revolution. To fill the gaps and save resources, firms have been moving away from strictly hosting on-premises servers except for mission-critical workloads and migrated to a mix of public cloud resources and private clouds. Since 2020, the amount of on-premises hosting has only increased by a 3-year-CAGR of 7%, while public-cloud services like AWS have seen a 19% 3-year-CAGR. While public-cloud technology gives up some security and control, it is often magnitudes cheaper to maintain and provides agility as the infrastructure is on-demand and can be scaled up quickly without a lot of Capex.

Since the acquisition of Symantec, the annual recurring revenue has increased to $5.1 billion (total backlog of $14.4 billion) with over 1,000 new agreements averaging 2.3 years in length being entered since 4Q2020.

Many of the top users of the private cloud see the benefit in this and want to lean into agility and cost reduction without giving up control over security and reliability. This is where the VMware acquisition comes in. Leveraging existing software offerings and the expertise of VMware, Broadcom hopes to create a hybrid approach to enterprise cloud – allowing firms to achieve both security and flexibility. In addition, Broadcom hopes to shift its mix toward subscription fees rather than maintenance and support of existing technology which is in line with VMware’s existing strategic shift.

Acquisitions

The two largest and most recent acquisitions were of Symantec in 2020 and VMware, which has not yet closed but was announced on May 26. While both are massive transactions with tens of billions of dollars exchanged, Broadcom has a history of delivering after large acquisitions. It has not broken the 4.5x debt-to-EBITDA level in its history.

The acquisition of Symantec was to expand cybersecurity offerings, retooling Symantec’s expertise to better serve Broadcom’s large enterprise client base. Symantec excelled in turnkey regulatory compliance, work from anywhere security, and tackling the ever-advancing threats to cyber security.

VMware is an established name in the virtualization market, a critical component of the work-from-home shift. With a broad base of top-tier solutions and customers, Broadcom will rename its infrastructure software division to VMware, and target $8.5 billion in additional EBITDA per year. Additionally, 5,000 patents will be acquired from VMware, allowing Broadcom to boost itself to the top of the private cloud market.

Risks

Broadcom has been the center of an antitrust probe by the FTC, which alleges that the company used its massive position in the market to retaliate against “disloyal” customers with overly harsh contract terms. While the final closure of the VMware acquisition is expected to complete in FY2023, the acquisition does run the chance of being halted by authorities if they deem that Broadcom is attempting to monopolize the market through acquisitions.

With over 99.9% of internet traffic estimated to flow through Broadcom products at one point or another, it could be disastrous should a major security flaw be revealed.

Both the semiconductor and software industries are fiercely competitive, and though Broadcom boasts a diverse client base, should they be priced or innovated out of the market, it would negatively impact the financials of the company.

Conclusion

Despite being out of the explosive growth phase of a tech company, Broadcom is a recognizable name in a hyper-competitive industry. Enhanced by a long series of acquisitions, Broadcom has the know-how to integrate VMware while enriching its customers and itself.

With exponential growth in IoT, it is likely that Broadcom has the potential for further capital appreciation as its products come more and more into demand, despite already 99.9% of internet traffic estimated to move through a Broadcom product at one point in the flow.

Be the first to comment