pixelfit/E+ via Getty Images

There are many words to describe the stock market, but the word “rational” is hardly one of them. That’s because stocks can swing from relative overvaluation to undervaluation in a short period of time. As such, I largely stayed away from buying apartment REITs in the first several months of the year, as this sector was rather expensive.

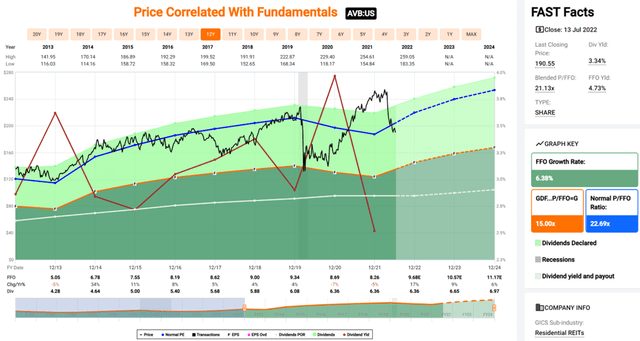

Recent events, however, have made this segment far more attractive. This brings me to AvalonBay Communities (NYSE:AVB), which has become far more attractive after the recent sell-off. As shown below, AVB is now trading well off its 52-week high of $259 achieved as recently as April. In this article, I highlight why AVB is now in my buy range, so let’s get started.

Why AVB?

AvalonBay Communities is one of the largest Apartment REITs in the U.S., with an ownership interest in 296 apartment communities, consisting of nearly 88K housing units. Its portfolio is diversified across major metropolitan markets 12 states from coast to coast and the District of Columbia.

AvalonBay has significant economy of scale advantages over smaller peers as the 2nd largest Apartment REIT by gross assets. That’s because it’s able to spread corporate overhead costs over a wider asset base, resulting in more favorable margins. The higher margins result in better cash flow conversion to the bottom line, and the low-cost structure makes for better resiliency during a downturn. This is reflected by AVB’s 60.4% operating margin (with depreciation addback) over the trailing twelve months, comparing favorably to the 56.6% of smaller peer, Mid-America Apartment Communities (MAA).

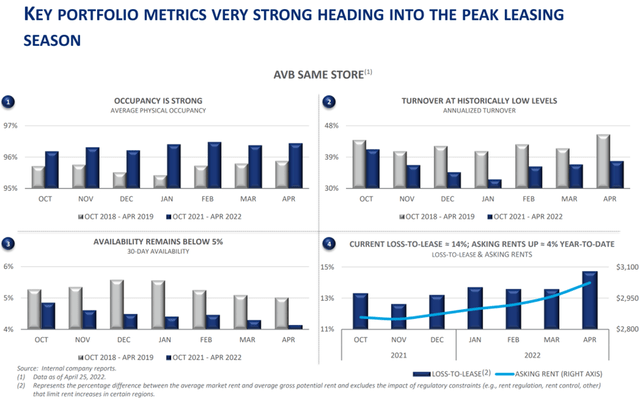

AVB has largely benefitted from an inflationary environment, as it’s been able to raise rents rather in a robust manner. This is reflected by the 9.9% YoY (1.7% QoQ) increase in cash basis rents during the first quarter, and core FFO per share grew by a faster rate, at 15.9% YoY. This was driven by strong performance in all regions. As shown below, AVB’s occupancy has remained above 96% in the six months leading up to April, and this is above the same period prior to the pandemic, and lease turnover sits at historical lows.

AVB Portfolio Metrics (Investor Presentation)

Looking forward to Q2 results and beyond, AVB should see accretive growth as it begins leasing out housing units in its two recently completed developments in Owings Mills, Maryland, and Woburn, Massachusetts, comprising of 787 apartment homes with a total aggregate cost of $218 million. Management projects an initial stabilized yield of 6.9%. This compares favorably to AVB’s weighted average cost of capital of 3.8% on recent capital raised, resulting in a healthy 3.1% investment spread.

Factors that could drive the share price down include rising interest rates, which could raise AVB’s cost of debt and thereby lessen investment spreads. In addition, general macroeconomic weakness could pressure rent growth, at least in the near term, and management has already guided that it no longer expects to be a net buyer of properties this year. However, it still has a rather large development pipeline to lean on, as noted during the recent conference call:

We continue to lean into our development platform with lease-ups outperforming and generating meaningful earnings growth and value creation. We are also building our development rights pipeline now up to $4 billion, providing options on future value creation including significant investment in our established regions at accretive returns as well as a continued focus on optimizing the portfolio by growing in our expansion markets.

And finally, we continue to look to tap our Company’s strengths with our structured investment program being our latest offering by tapping into our development, construction and financial know-how to grow earnings and create value.

Meanwhile, AVB sports a strong A- rated balance sheet, and is one of just a handful of REITs to achieve this distinction. This lends support to its 3.4% dividend yield, which comes with a safe 79% payout ratio. Notably, dividend growth has been muted since 2020, but I would expect for growth to resume as development projects come online.

Lastly, while AVG doesn’t scream cheap at the current price of $189, it’s not expensive either. It currently carries a forward P/FFO of 19.6, which sits below its normal P/FFO of 22.7 over the past decade. Moreover, sell-side analysts forecast double-digit FFO/share growth in the 14-20% range over the next 4 quarters, and have a consensus Buy rating with an average price target of $231.57. This implies a potential one-year 26% total return including dividends.

Investor Takeaway

AvalonBay Communities is a high-quality apartment REIT that’s now trading well below its recent highs. It has a robust development portfolio, a safe dividend yield, and trades at what I believe is a reasonable forward valuation. This enables a REIT investor to be a virtual landlord of a high-quality portfolio without all the hassles. As such, I think it makes for an attractive long-term holding at the current price level.

Be the first to comment