MF3d

Earnings for Customers Bancorp, Inc. (NYSE:CUBI) will likely dip this year relative to last year because of above-average provisioning for expected loan losses. Economic headwinds will likely play a pivotal role in keeping provisioning above normal. On the other hand, strong loan growth and sequential margin expansion will likely support the bottom line. Overall, I’m expecting Customers Bancorp to report earnings of $7.71 per share for 2022, down 13% year-over-year. The year-end target price suggests a high upside from the current market price. Therefore, I’m adopting a buy rating on Customers Bancorp.

Loan Growth Likely to Decelerate after Second Quarter’s Phenomenal Performance

After declining in the first quarter of 2022, the loan portfolio turned around sharply during the second quarter of the year. As mentioned in the second quarter update, Customers Bancorp was able to add $1.5 billion worth of loans in the second quarter up to the middle of June. This growth was mostly attributable to specialty lending verticals.

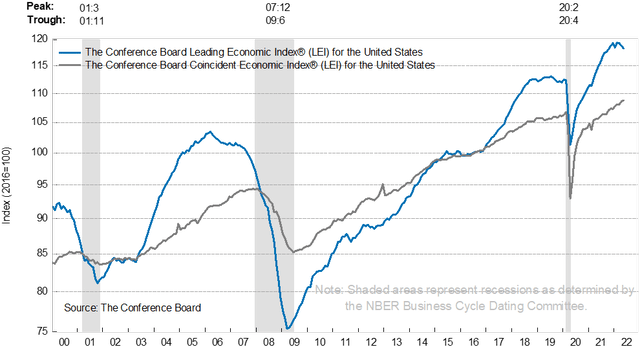

As such high loan growth is out of the ordinary and seems unsustainable, I’m expecting loan growth to decelerate in the latter part of 2022. Further, the surge in interest rates this year will dampen credit demand, especially for new home purchases. Moreover, the U.S. leading economic index has continued to fall over the last few months, which suggests that credit appetite may fall in the coming quarters.

Management mentioned in the conference call that it expects double-digit loan growth across all verticals, excluding mortgage banking. Considering these factors, I’m expecting the loan portfolio to increase by 10.8% by the end of December 2022 from the end of 2021.

Further, I’m expecting deposit growth to slightly outpace loan growth due to the newly launched blockchain-based business payment solution, called Customers Bank Instant Token or CBIT. This product has seen early success as Customers Bancorp was able to onboard more than 100 big clients by the end of March 2022, as mentioned in the conference call.

The following table shows my balance sheet estimates.

| FY17 | FY18 | FY19 | FY20 | FY21E | FY22E | ||

| Financial Position | |||||||

| Net Loans | 8,524 | 8,504 | 9,508 | 15,609 | 14,415 | 15,966 | |

| Growth of Net Loans | 3.5% | (0.2)% | 11.8% | 64.2% | (7.7)% | 10.8% | |

| Other Earning Assets | 743 | 711 | 1,262 | 1,905 | 4,316 | 3,886 | |

| Deposits | 6,800 | 7,142 | 8,649 | 11,310 | 16,778 | 18,787 | |

| Borrowings and Sub-Debt | 2,062 | 1,668 | 1,693 | 5,820 | 1,180 | 1,173 | |

| Common equity | 703 | 739 | 835 | 900 | 1,228 | 1,429 | |

| Book Value Per Share ($) | 21.6 | 22.9 | 26.4 | 28.4 | 36.5 | 41.6 | |

| Tangible BVPS ($) | 21.1 | 22.4 | 25.9 | 27.9 | 36.3 | 41.5 | |

|

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

Margin is Only Moderately Rate-Sensitive

Around 68% of interest-earning assets were market-sensitive at the end of March 2022, as mentioned in the earnings presentation. Therefore, the average yield will respond soon to interest rate hikes. Customers Bancorp has a large securities portfolio, which can create a lag in asset repricing. Fortunately, the effective duration of the securities portfolio is only 2.12 years, which is not too long.

Unfortunately, the liability side is also quite market-sensitive. Management estimates the current deposit beta to be around 45% to 55%, as mentioned in the presentation. In other words, it expects a 100 basis points hike in interest rates to boost the average deposit cost by around 45 to 55 basis points. On the plus side, around 28% of deposits were non-interest bearing at the end of March, which is not much but it’ll still provide some relief.

Due to the combination of the asset and liability mixes, the balance sheet is moderately asset sensitive. Management’s interest-rate sensitivity analysis given in the 10-Q filing shows that a 200-basis points rate hike could boost the net interest income by 5.1% over twelve months. This analysis assumes a rate shock. In reality, the interest rate hike has been gradual, thus the impact will be lower than 5.1%. Overall, I’m expecting the net interest margin to increase by eight basis points in the last three quarters of 2022.

Despite the expansion, the margin for 2022 would be much below the margin for 2021 due to the tapering off of Paycheck Protection Program fees. Customers Bancorp’s topline benefited significantly from the program in the latter half of last year.

Provisioning Likely to Remain Above Normal

Customers Bancorp’s provisioning for expected loan losses was above normal during the first quarter of 2022. The provisioning will likely remain elevated because the heightened loan growth will require additional provisioning for expected loan losses. Moreover, high interest rates may push some borrowers into default, thereby, requiring Customers Bancorp to further build its loan loss reserves. The threats of a recession will provide more reason for caution.

Overall, I’m expecting the provisioning to remain at the first quarter’s level during the last two quarters of 2022. For the full year, I’m expecting the provision expense to make up 0.40% of total loans. In comparison, the net provision expense averaged 0.20% of total loans in the last five years.

Expecting Earnings to Dip by 13%

The higher-than-normal provisioning will likely be the biggest contributor to an earnings decline this year relative to last year. On the other hand, remarkable loan growth will likely support the bottom line. Overall, I’m expecting Customers Bancorp to report earnings of $7.71 per share for 2022, down 13% year-over-year. Despite the earnings dip relative to last year, earnings for 2022 will likely remain much higher than the pre-pandemic level. The following table shows my income statement estimates.

| FY17 | FY18 | FY19 | FY20 | FY21E | FY22E | ||

| Income Statement | |||||||

| Net interest income | 267 | 258 | 277 | 404 | 685 | 684 | |

| Provision for loan losses | 7 | 6 | 24 | 63 | 27 | 64 | |

| Non-interest income | 79 | 59 | 81 | 102 | 78 | 72 | |

| Non-interest expense | 216 | 220 | 232 | 267 | 294 | 342 | |

| Net income – Common Sh. | 64 | 57 | 65 | 119 | 300 | 265 | |

| EPS – Diluted ($) | 1.97 | 1.78 | 2.05 | 3.74 | 8.91 | 7.71 | |

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million, unless otherwise specified) |

|||||||

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, the threat of a recession can increase the provisioning for expected loan losses beyond my expectation.

High Price Upside Calls for a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Customers Bancorp. The stock has traded at an average P/TB ratio of 0.90 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 22.4 | 25.9 | 27.7 | 36.3 | ||

| Average Market Price ($) | 26.5 | 20.9 | 14.5 | 39.1 | ||

| Historical P/TB | 1.18x | 0.81x | 0.52x | 1.08x | 0.90x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $41.50 gives a target price of $37.20 for the end of 2022. This price target implies a 6.7% upside from the July 7 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.70x | 0.80x | 0.90x | 1.00x | 1.10x |

| TBVPS – Dec 2022 ($) | 41.5 | 41.5 | 41.5 | 41.5 | 41.5 |

| Target Price ($) | 28.9 | 33.1 | 37.2 | 41.4 | 45.5 |

| Market Price ($) | 34.9 | 34.9 | 34.9 | 34.9 | 34.9 |

| Upside/(Downside) | (17.1)% | (5.2)% | 6.7% | 18.6% | 30.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 8.3x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 1.78 | 2.05 | 3.74 | 8.91 | ||

| Average Market Price ($) | 26.5 | 20.9 | 14.5 | 39.1 | ||

| Historical P/E | 14.9x | 10.2x | 3.9x | 4.4x | 8.3x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $7.71 gives a target price of $64.30 for the end of 2022. This price target implies an 84.3% upside from the July 7 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 6.3x | 7.3x | 8.3x | 9.3x | 10.3x |

| EPS – 2022 ($) | 7.71 | 7.71 | 7.71 | 7.71 | 7.71 |

| Target Price ($) | 48.9 | 56.6 | 64.3 | 72.0 | 79.8 |

| Market Price ($) | 34.9 | 34.9 | 34.9 | 34.9 | 34.9 |

| Upside/(Downside) | 40.1% | 62.2% | 84.3% | 106.4% | 128.4% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $50.80, which implies a 45.5% upside from the current market price. Hence, I’m adopting a buy rating on Customers Bancorp.

Be the first to comment