Smile

The strength of the consumer balance sheet is commonly exhibited as a reason to expect corporate profits to remain strong and inflation to remain high. While consumer savings remain high, they are declining at a rapid pace and debt levels are rising. Consumers are spending beyond their means and at some point in the near future, spending will decline substantially. When this occurs, a negative feedback loop between consumer spending and employment is likely to occur. This situation will likely be exacerbated by the rapid rise in interest rates which has crashed asset prices.

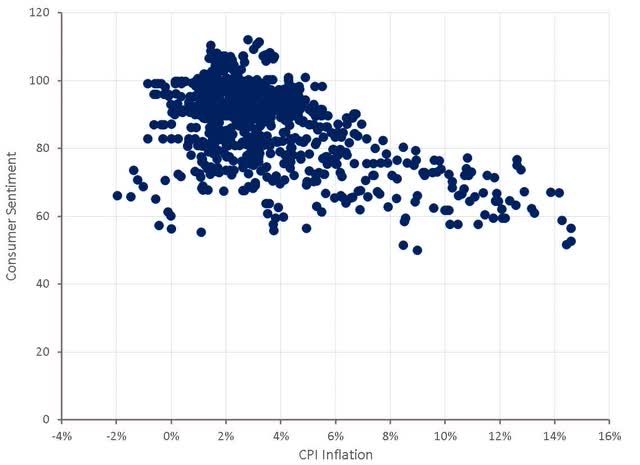

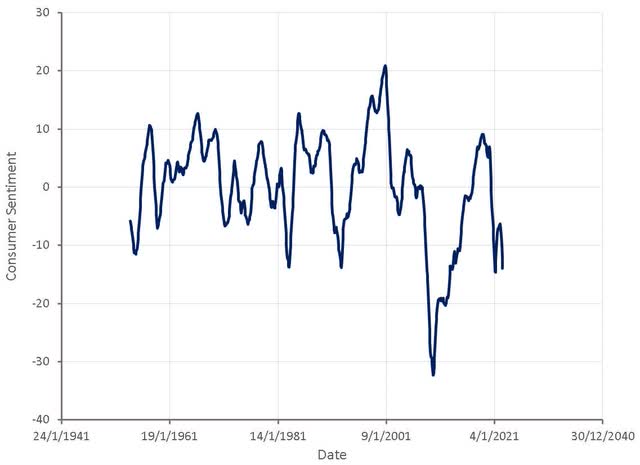

The post-pandemic economy has created an unusual situation, where despite a strong economy, consumer confidence is at extremely low levels. People are also becoming more pessimistic about conditions, with inflation a top concern, although younger generations are less concerned about inflation. Consumer confidence is generally highly correlated with inflation, but even when adjusting for the current level of inflation, consumer sentiment is at a level typically associated with recessions.

Figure 1: Impact of Inflation on Consumer Sentiment (source: Created by author using data from The Federal Reserve) Figure 2: Consumer Sentiment Adjusted for Inflation (source: Created by author using data from The Federal Reserve)

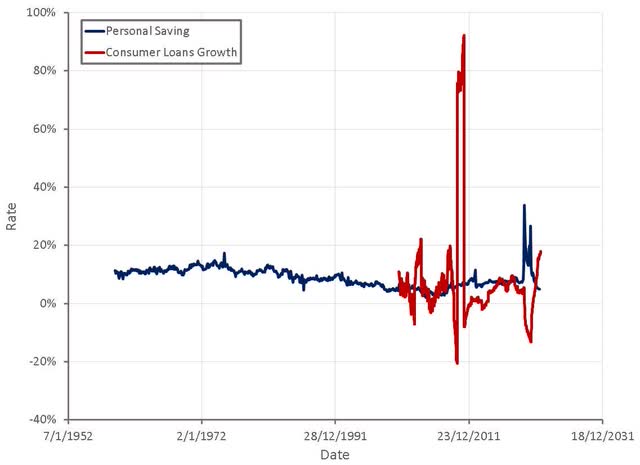

While the economy is currently strong and consumers have elevated savings, consumers are faced with declining asset prices and inflation that has outpaced wage growth. The consumer savings rate is now at extremely low levels and credit spending is rising rapidly. This situation is probably responsible for the extremely low levels of consumer confidence.

Figure 3: Personal Saving Rate and Consumer Loans Growth (source: Created by author using data from The Federal Reserve)

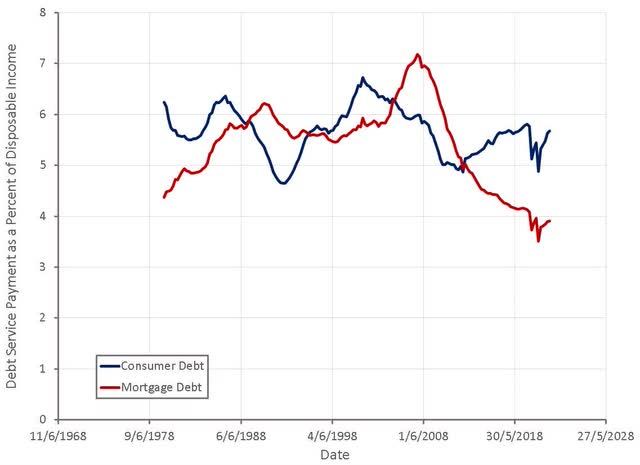

This is not currently a problem, as debt service burden levels remain relatively low, but consumer spending will decline at some point, and the longer the current situation continues, the worse condition consumers will be in when a recession occurs.

Figure 4: Debt Service Payments Relative to Disposable Income (source: Created by author using data from The Federal Reserve)

While savings remain high, they are declining rapidly and are not evenly distributed across the population. The vast majority of the increase in savings came from higher income groups, who also have a lower propensity to consume. With many in lower income groups likely having already spent their excess savings, consumer spending will come under pressure in coming months. Real credit and debit spending is up 9% in the past 12 months for high income households, 2% for middle income households and down 2% for low income households.

According to a McKinsey survey two thirds of consumers are actively managing their balance sheets, taking actions like reducing savings (44%), increasing debt (18%), skipping bills (18%) and taking on another job or more hours (13%). Three quarters of consumers are changing their shopping behavior, taking actions like adjusting quantity / pack size (60%), delaying purchases (44%), changing retailers (37%), changing brands (26%) and utilizing BNPL programs (21%).

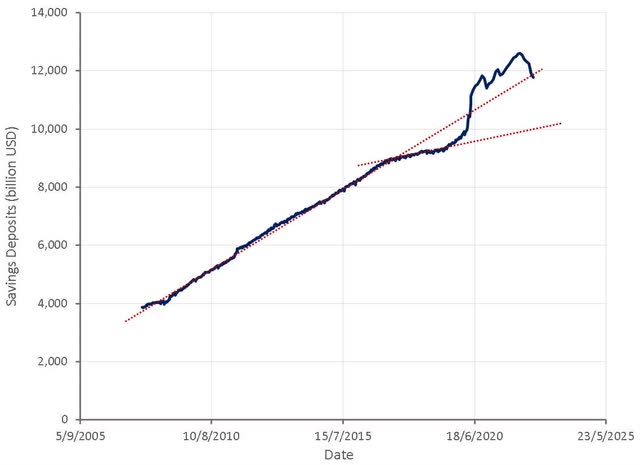

Figure 5: Savings Deposits (source: Created by author using data from The Federal Reserve)

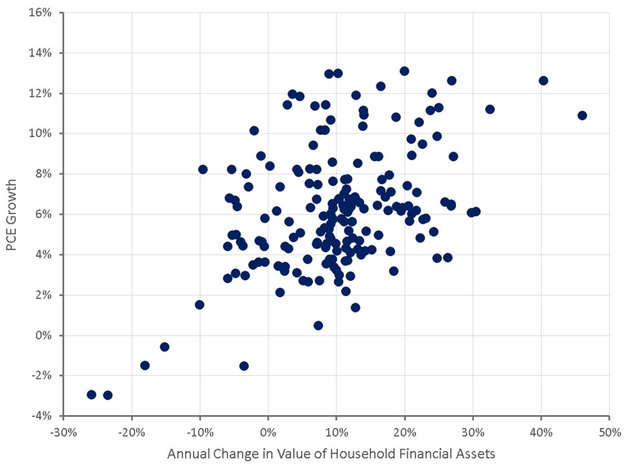

Amongst higher income households, the rapid drop in asset prices is likely to begin effecting spending at some point. The rapid rise in interest rates is negatively impacting most asset classes, with a large impact on wealth for most individuals, depending on how their wealth is invested across asset classes. So far, this is largely a return to pre-COVID asset prices and as such the impact may be somewhat muted. The longer this situation continues though, and the further asset prices drop, the more likely it is the consumer spending will decline.

Figure 6: Wealth Effect on Personal Consumption Expenditure (source: Created by author using data from The Federal Reserve)

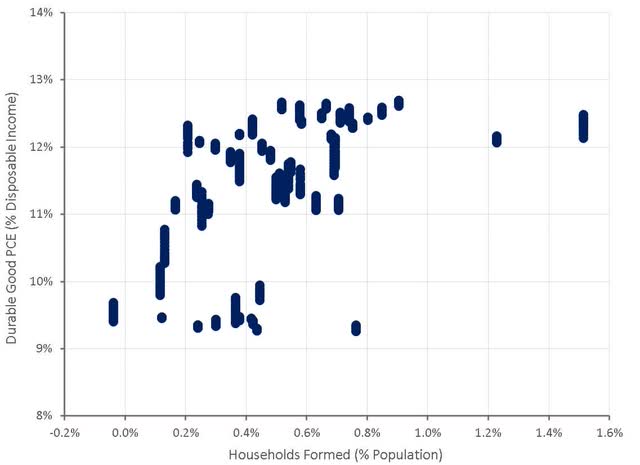

The current situation is particularly concerning, as a large decline in consumer spending and subsequently employment levels may be difficult to reverse. COVID caused an acceleration of household formation which is likely to take time to digest, and household formation typically results in spending on durable goods like furniture, electronics and whitegoods. This type of spending is unlikely to repeated in the short-term, even with a large amount of monetary and fiscal stimulus.

Figure 7: Durable Goods Personal Consumption Expenditure and Growth in Households (source: Created by author using data from The Federal Reserve)

Conclusion

COVID caused a positive feedback loop between strong consumer spending and employment. Consumers are currently spending beyond their means, and at some point in the future, spending will fall. When this occurs, there will be a negative feedback loop between consumer spending and employment. This dynamic looks set to be compounded by the large drop in the value of financial assets caused by higher interest rates. It may not be easy for the Fed to stimulate the economy in the event of a recession because a large amount of demand has been pulled forward (furniture, whitegoods, electronics, etc.). This situation will likely be negative for equities, particularly those that have benefited from elevated consumer spending in recent years. This is also likely to result in a rapid decline in interest rates, dependent on supply constraints in commodity markets.

Be the first to comment