With Jeff Warshaw’s opening bid, other potential buyers are now on the clock. avdyachenko/iStock via Getty Images

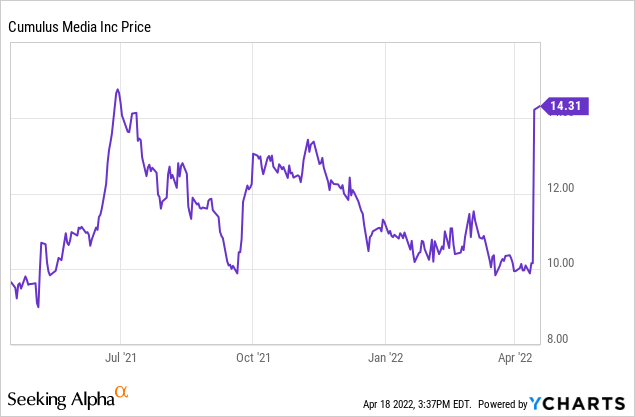

Over the last few weeks, we have been buyers of Cumulus Media (NASDAQ:CMLS) for client portfolios and personal portfolios as we recently had moved the name up to our top long-term play. Other names we were long had moved higher and realized what we perceived to be their fair value, and Cumulus kept getting cheaper even as the story, in our opinion, kept getting better. We were in the process of accumulating what we thought would be a healthy holding in the company, after which we were prepared to write a letter to management explaining how they needed to act sooner rather than later to enact shareholder-friendly proposals to help boost the stock price to keep private equity players and opportunists away. When a company only trades around 30,000 shares per day, on average, establishing positions in a way that does not move the market takes time and considerable patience. Unfortunately for us, we had plenty of patience and caution but not nearly enough time.

Such is life. When the trading did not feel right mid-week we became cautious and watched as the stock began to move higher and had relatively strong support…something that had been lacking previously as many times we found our low bids eventually getting hit in earlier trading days. We stuck to our guns, but found ourselves in the precarious position of being happy to have a 40%+ gain in short order but also disappointed that we did not get our entire desired position and that this bid was dramatically lower than our estimated full value for the company of $25-$30/share. We believed that Cumulus could reach that valuation in 12-24 months with continued debt repayments, disciplined acquisitions, a new dividend policy and a share buyback plan of at least $50 million.

We do think that this bid is highly opportunistic as it was leaked just as the company was once again trading near 52-week lows (about 10% above those lows). While the consortium, headed by Jeff Warshaw, has indicated that it would be willing to take the company private at $15-$17/share (but maybe more after doing some due diligence), it is our opinion that management should push for any negotiations to use $20/share as a starting point for them to engage.

Our Assumptions

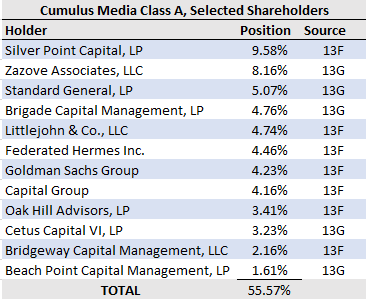

As it stands now, this Warshaw consortium probably is not working with any of the large holders of Cumulus. If they were, compliance with regulatory statutes would have kicked off and our guess is that we would have already seen a disclosure (and since we have not, our guess is that they are only working with a relatively small holder or they currently have only their own holding which is relatively small because again we have not seen any filings). Regardless, we find this offer a little suspect in that it is quite vague on who the players are behind the deal, offers very little insight into financing and is non-binding with very little (other than the big premium) to incentivize management to come to the table. Yes, the proposed premium looks strong compared to the recent stock price, but we believe that some of the current shareholders might be willing to pay more than the Warshaw consortium to take Cumulus private.

There are a lot of smart people already in this name and they currently control over 50% of the shares (please see table below). Standard General, the hedge fund run by Soohyung “Soo” Kim has a 5%+ holding, and we really thought that Cumulus might be his next takeover target as it did check many of the boxes for what he looks for in a potential deal. Silver Point Capital, Zazove Associates, Brigade Capital, Littlejohn & Co., etc. are all large holders and might be interested in a takeover, but certainly not a ‘takeunder’ (especially when Cumulus is arguably in the best shape among its peers).

Cumulus has a number of hedge funds and “smart money” investors who own substantial holdings. (Bloomberg, SEC Filings)

We always thought that Cumulus should trade at a premium due precisely to what is playing out now right in front of our eyes. The scarcity phenomenon of media assets in certain areas of the market that are actually available to be purchased is a real issue. Look at the other radio broadcasters, or local television companies and how many of those companies are publicly traded and not controlled through super-voting shares? There are not a lot, and Mr. Kim’s Standard General just announced a deal to take Tegna (TGNA) private so there are now even fewer.

Why We Think A Higher Price Is Coming

We think that the Warshaw consortium could pay more…a lot more, to be honest. First, the headline number of $1.2 billion is extremely misleading and confusing. We will admit that this could be because investors have only seen reports, and not an actual offer, but what is being reported has raised a few questions. That includes a calculation that they say includes all of the company’s outstanding debt and the proposed high range of the offer at $17/share which comes out to a potential total transaction value of $1.2 billion. Investors really do not care about the debt as that is always assumed in a takeover of this type, but instead, care about what they are paid to walk away. With the Class A and Class B shares, you are looking at total consideration needed of about $350 million with an offer at $17/share. So add that $350 million with the total debt at 12/31/2021 of almost $806 million, and with rounding, you can arrive at $1.2 billion. However, it appears that maybe they are not backing out the cash on hand (which was over $175 million at 12/31/2021)? Again, we have not seen the particulars of the deal, but that math does not get us excited if we have read the proposed deal correctly.

We think that $20/share is the minimum price level for management to start negotiations if they believe that EBITDA for 2022 is going to come in at the lower range. This would require the buyers to issue new debt to take net leverage back up to 5.5x or more to fund the acquisition. One structure could be issuing debt of $350 million to get you to 5.5x leverage on $175 million of EBITDA and kicking in $60 million+ in cash to get the total price to $20/share. To pay for the whole deal at $20/share, with debt, the buyer would have to leverage the company up to 5.85x under this scenario – which is still doable.

If management believes that the upper range of their EBITDA guidance for 2022 (which was $200 million) is pretty achievable, then the price would need to be north of $20/share. While you can come up with some very aggressive prices under different scenarios, especially if preferred stock is utilized and no large dividends are extracted upfront, the big question is what rate you could finance the deal at. You can come up with scenarios of $23-$28/share with FY2022 EBITDA of around $200 million, but without knowing if there are any major players backing Mr. Warshaw, how the deal would be structured (merger with his company for instance), or which banks he may have already engaged, it is hard to tell exactly what the debt markets would be willing to float right now.

Our Game Plan Moving Forward

While we are pretty happy about our initial gain in such a short period of time, we are torn with the current state of events. We are not very confident that a deal gets done with this consortium at this price and think it is quite possible that no deal gets done between these parties. Taking a profit now off of our recently purchased shares would lock in a profit of $4/share. There are no options to trade on this stock, so we are left with pure equity exposure and the only way to hedge is essentially to sell shares. Because of this, we will be holding the position for the foreseeable future as we think that the news of the Warshaw consortium takeover interest might very well have put Cumulus Media into play. We see a lot of potential buyers, and many more potential parties if there was interest in breaking off pieces of the company among a group of buyers.

If Cumulus Media is now in play, we want to hang around and let other buyers emerge, because this is indeed one of the last gems in this industry available for buyers to realistically purchase and could fetch north of $20/share to the right buyer, or buyers. With interest having now emerged, we see less than $4 of downside if the deal falls apart (specifically we see around $2/share of downside) and only $2.70/share upside if the Warshaw Group is successful at $17. Yes, at $15 there is less than $1/share upside, but having said $17 was the max they would pay, it would be hard to walk that back to their lower end of the range. Enter a private equity fund, or major current shareholder, and we believe Cumulus can get a $20/share offer, and that is worth $5.75/share+ of upside from current levels. So, we do think that the risk of holding current positions through this process is worth it.

Be the first to comment