felixmizioznikov

As we approach the end of 2022, I have been reviewing my portfolio holdings and have made some moves to shrink the number of holdings in my portfolio. I have also made a couple additions, but I have been picky on that front. For the majority of my Roth IRA, I focus primarily on REITs due to the tax advantages and defensive nature of most REITs. Several sectors that have been the best performers in previous years have struggled mightily in 2022, and I have taken the opportunity to add the industrial REIT Terreno Realty (TRNO) and storage REIT National Storage Affiliates (NSA). When I was looking at NSA, I was also evaluating CubeSmart (NYSE:CUBE), and the recent 14% dividend hike convinced me to add the REIT as the newest position in my Roth IRA.

Investment Thesis

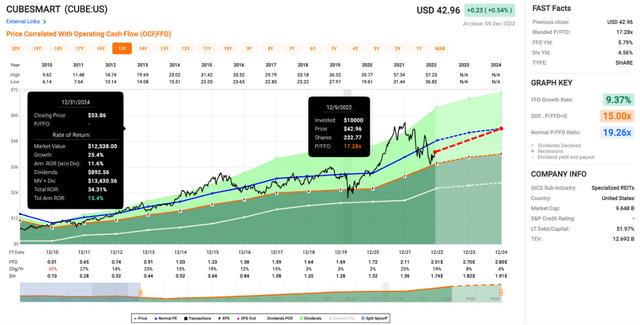

CubeSmart is a storage REIT with a market cap of $9.7B. Growth is expected to slow down a bit in coming years, but the company has consistently grown FFO/share and the dividend in the past decade. CubeSmart focuses on high density markets and the New York market makes up a large chunk of the portfolio. Shares have had a rough 2022 and are down over 20% YTD, providing a buying opportunity for long-term investors. Shares are trading at a price/FFO of 17.3x today, which is a couple turns below the average 19.3x multiple from the last decade. The yield today sits at 4.6%, and I think shares provide investors with a good shot at double-digit returns from a combination of income and share price appreciation.

Overview

Like other storage REITs, CubeSmart has experienced significant growth since 2010, going from 456 properties to 1,274 at the end of the most recent quarter. Like other real estate sectors, acquisitions have slowed down in 2022 as interest rates have risen. While the company was active in 2021 and added 66 properties compared to 5 dispositions, it has only added 3 properties to the portfolio in 2022. I’m curious to see how many acquisitions the company makes over the next couple years, but I think a cautious approach to growth is prudent.

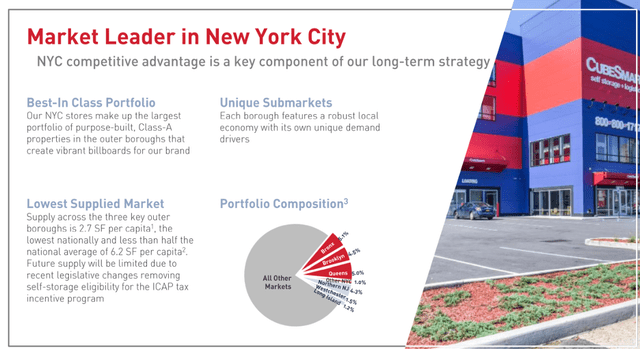

One of the things that sets CubeSmart apart from other storage REITs is the population density in the major markets. It has the highest population density of any publicly traded storage REIT within three miles. This is driven by the New York market, which makes up a large portion of the company’s portfolio.

New York Portfolio (cubesmart.com)

After skimming through the 10-Q, I found a lot to like especially with the financials. Revenue was up about 25% for the first nine months of the year, driven by organic growth as well as a large acquisition that closed in December 2021. The balance sheet is solid as well with a good debt ladder primarily made up of unsecured debt. The maturities range from 2025 to 2032 with interest rates ranging from 2% to 4.375%. The company also hasn’t been issuing a ton of equity in 2022, so dilution has been limited. The valuation is also cheaper than it has been in the last couple years.

Valuation

Shares spiked in 2021 as growth has been impressive for the last couple years, but shares have sold off in 2022. Shares are down just over 20% YTD, and I think it has created a good buying opportunity for long-term investors. Since 2010, shares have traded at an average price/FFO of 19.3x. Today, shares trade for a 17.3x multiple, a couple turns below the average.

If we do see a return to a multiple closer to 20x price/FFO, shares will be trading above $50 in a couple years and provide investors with double-digit returns. However, growth is projected to slow down over the next couple years. In the past, the company has routinely averaged double-digit FFO/share growth but estimates for 2023 and 2024 are for 8% and 4% growth, respectively. One of the things that impressed me about CubeSmart is the consistent dividend growth the company has provided for investors.

Dividend Growth

While I picked National Storage Affiliates as my first storage REIT due to its relatively cheap valuation and large 5.7% dividend, the recent dividend hike by CubeSmart convinced me to buy shares. The current yield sits at 4.6%. The dividend growth slowed down a bit from 2018 to 2021, but the last couple dividend hikes have been large ones. Last year’s hike was over 25%, from $0.34 to $0.43. This year, the company provided another large hike of 14% to a quarterly payout of $0.49. While I think the dividend growth could slow down in coming years as FFO/share growth is projected to slow a bit, I think CubeSmart will continue to provide dividend increases for years to come. With a payout ratio of 65%, it has room for further increases in the future.

Conclusion

I started buying REITs in my Roth IRA with well-known net lease REITs like Realty Income (O), STORE Capital (STOR), and Agree Realty (ADC) last year. I wanted to add other REIT sectors to the portfolio, and this year provided the buying opportunity I was looking for. The industrial sectors and storage sectors provided impressive growth in past years, but the valuations always looked expensive to me. Between National Storage Affiliates and CubeSmart, my Roth now has approximately a 15% position in the storage sector.

There is a lot to like about CubeSmart, from the consistent dividend growth to the attractive valuation today. With a portfolio located in the densest parts of the US, the company is well positioned moving forward. Shares aren’t dirt cheap today, but they are a bit cheaper at a price/FFO of 17.3x than the average multiple of 19.3x. Growth might slow down, but I’m expecting continued dividend growth on top of the 4.6% yield. I think shares have a good chance of providing double-digit returns moving forward and I think shares will eventually trade above $50 at some point in the next couple years.

Be the first to comment