SimonSkafar/E+ via Getty Images

Investment Thesis

Alfen (OTCPK:ALFNF) is a Dutch company at the forefront of the energy transition for over 20 years. The company focuses on innovative products in the electrical energy sector, such as smart grids, EV charging stations, and energy storage systems. Revenue has increased fivefold since 2015, and very strong growth will likely continue for at least a few more years. If this happens, then the share is currently undervalued.

Note: the figures in this article are in Euro, and I recommend interested buyers to buy on the home exchange in Amsterdam, as the volume of ALFNF is extremely low.

Company Overview

The company divides its business into three main segments. Smart grid solutions, energy storage, and EV Charging Equipment

Smart grid solutions

This describes solutions for intelligent power grids that ensure the stability of the power grid. Due to renewable energies, many small decentralized plants feed into the power grid. But since electricity consumption also fluctuates greatly, attempts are being made to ensure the stability of the power grid using intelligent power grids. There’s a good overview here.

Energy Storage

The mobile application of Energy Storage Systems is often used where a temporary power supply is needed, for example, on construction sites. The company offers batteries in a 10-foot container, which can be expanded modularly.

Furthermore, these systems are suitable for temporarily storing energy from wind and solar parks. At peak times, these often generate more power than is currently needed in the grid and must either be sold very cheaply or discharged into the ground. This is a very unfavorable solution because later at night, the energy is needed again and must then be generated by other power plants.

EV Charging Equipment

This is about the sale of charging stations for electric vehicles (wall boxes), which can be used by private end customers, businesses, and even public stations. At the latter, the customer can pay for the charging process with his giro card. In addition, the company offers further services and maintenance.

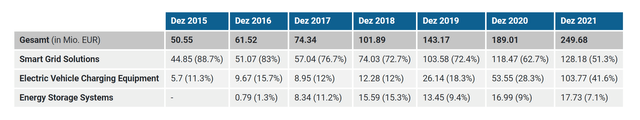

The company started manufacturing charging stations for electric vehicles as early as 2008. Therefore, the company was prepared to build many charging stations quickly as they had already done the necessary groundwork. Below we see the sales development of the three areas since 2015. The total sales from 2015 to 2021 have increased fivefold. Although all areas have grown, it was mainly the area of electric vehicle charging stations, which has grown exponentially in recent years.

Recent results & financials

In the latest Q3 results, we see that the EV charging equipment segment is now the strongest area and, in the third quarter alone, brought in €70M in revenue, so another solid increase. The chart above shows that the total sales in 2021 in this area were just €103M.

Alfen benefitted from higher EV adoption in its core markets leading to strong demand for EV charge points in all segments: at home, in semi-public places like offices, and in the public segment for on-street parking. Approximately 72% of revenues were generated from outside the Netherlands. In Q3 2022, Alfen produced approximately 63,500 charge points, a growth of 126% from Q3 2021 with approximately 28,000 charge points.

Source: Q3 results

However, the smart grid solutions business did less well with sales of €35.5M, which is still a 7% increase compared to the same quarter last year. According to the company, it is struggling with supply chain problems, which delay project completions. In the Energy storage systems segment, revenues were €17.1M (vs. €2.2M in Q3 2021). Thus, revenues in this segment were as strong in the last quarter as in the full year 2021.

Valuation

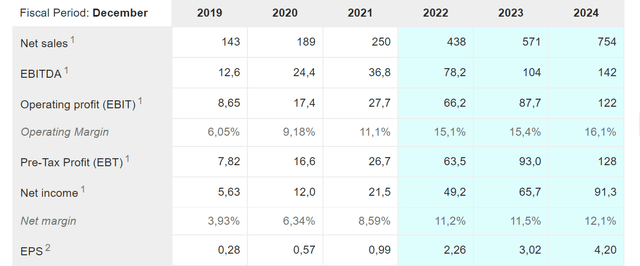

The company is currently valued at an enterprise value of €2.01B. The market cap is €2.06B, and the total debt is €6.9M. The share price in euros is currently €95, resulting in a 2022 P/E ratio of 42. If these estimates are correct, the P/E ratio would be 31 in 2023 and 23 in 2024.

According to Peter Lynch, a fairly valued company’s PEG ratio (P/E divided by growth) should be 1.0. When a company’s PEG ratio exceeds 1.0, it’s considered overvalued, and less than 1.0 is considered undervalued. Given the growth rates of 30 – 50% in recent years and considering that these are expected to continue until 2024, the share would have a PEG ratio of about 1, maybe even less. Depending on whether you take sales or earnings growth. But for example, revenue in Q3 2022 vs. Q3 2021 grew by 103%, so in this case, the PEG ratio would be well below 1

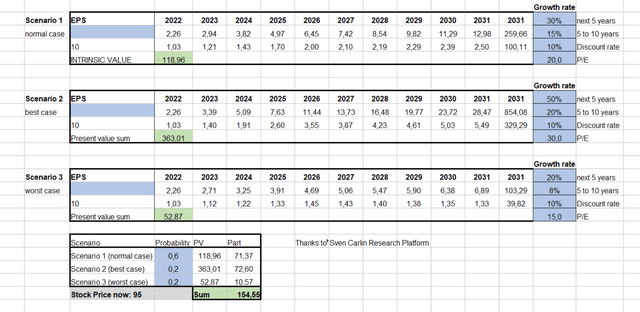

I have created a detailed analysis with three different scenarios to determine the current fair value with a discount cash flow model. The base scenario is indicated as the most probable variant. Of course, I have to estimate the growth figures roughly, and the calculation is not exact. Nevertheless, this approach is helpful because it allows us to get at least an idea of the fair value. In other words, it could be seen if a share was enormously overvalued or undervalued. According to this estimate, the fair value is currently €154.

How big is the market?

It doesn’t take a prophet to realize that the market for charging stations and intermediate power storage solutions is only just beginning and still has a lot of potential. But how much exactly? The company itself writes in its half-year report:

The European market for EV charge points has a long-term growth trend with a CAGR of>30% in the period 2020-2030 (source: Guidehouse). This long-term growth trend is also reflected in the first half-year of 2022 with growing EV adoption in European markets. 32% more battery EVs were sold than in the same period last year (source: ACEA).

Source: Semi-annual report

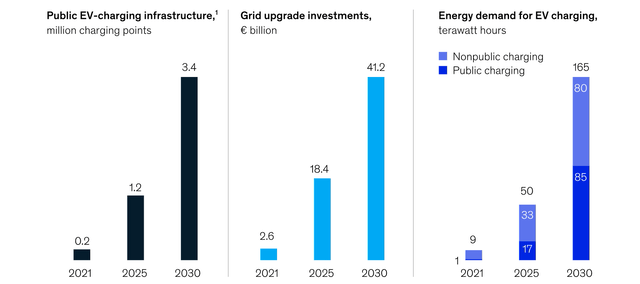

According to McKinsey, 3.4M charging stations are needed in the European Union by 2030. In 2021 there were only 0.2M. By mid-2022, there were about 330k.

In Q3 2022, Alfen produced approximately 63k charge points. This is the number from the Q3 report. If I understand correctly, these units are produced and ready for delivery and installation but do not correspond to what has been installed. But if you look at the overall number of needed charging stations, it’s clear that there is still a lot of potential here for years to come.

And that is only one segment of the company. There is also the energy storage area. Of course, we can only use rough estimates here, but if we consider the most significant disadvantage of wind and solar, it becomes clear that there must be solutions to store excess energy to use it later. There are also natural solutions, such as pumping water up reservoirs, but these are very limited.

The Europe energy storage market is expected to grow at a CAGR of approximately 16.3%, reaching 5.2 GW of installed capacity in 2027 from 1.6 GW in 2020. Factors such as the declining prices of lithium-ion batteries with increased application range and increased demand for uninterrupted power supply are expected to drive the European energy storage market.

Source: Mordor intelligence

Risks

Of course, there are also several risks. As far as I can tell, the company does not produce anything unique and therefore always has competition in all areas. So how much of the total pie the company will get is not clear. Customers may prefer cheaper charging systems from Asia. Also possible is that a competitor finds other battery systems that are better or cheaper. A few days ago, I wrote an article about sodium instead of lithium batteries.

Another risk for the share price is if the results are unexpectedly disappointing. The current P/E of 42 is not cheap, which means growth expectation is priced in. If this growth does not come, the share price could plummet.

At least the area for charging station equipment is dependent on electric cars becoming established. If there are problems in the long term or other technologies such as hydrogen, the demand and all the stations may not be as great as currently expected.

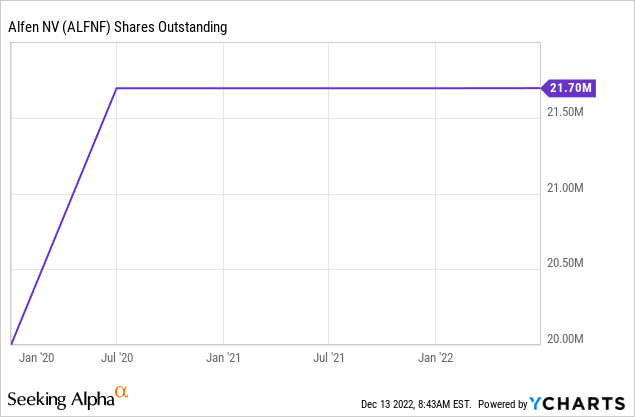

Share dilution and insider selling

I always want to look at stock dilution and whether there is insider selling. There have been a little bit of both, but nothing spectacular. The total amount of insider sales this year is less than €1M.

Conclusion

From my point of view, there are not many interesting European companies at the moment, but Alfen is one of them. What the company produces is and remains in great demand, and accordingly, the revenue numbers and earnings per share are exploding since the margin has also been improving for some years.

The share has lost 20% this year since its all-time high, and even if it is not a cheap valuation, the growth figures and prospects are very positive. Moreover, the company has no debt. Therefore, the company is, for me, a much better buy than some highly valued American startups that are often still cash flow negative. Whoever wants to diversify his portfolio in this direction has an attractive opportunity here.

Be the first to comment