Spencer Platt/Getty Images News

CSX Corporation (NASDAQ:CSX) is about to report earnings, so I thought it’d be worthwhile to determine whether or not it makes sense to buy prior to earnings yet again. I did this previously, and it worked out very well, so I thought I’d see if I could have a repeat performance. I’m going to try to forecast the upcoming earnings by looking at the traffic figures to date, the elevated cost of rail transportation, and reviewing those against the performance in 2021. I’m going to take this forecast and then try to determine whether or not the share price is compelling.

We’re all pressed for time. I’m sure you’ve got to get back to trying to crack frictionless travel or cold fusion or similar. I’ve been working on a particular Sudoku that’s classified as “Medium”, but all signs are that it’s really “Hard.” Either way, we all have things to do, so I understand why you may not want to spend excess time wading through yet another one of my screeds. For that reason, I’m offering you the “gist” of my thinking in this handy single paragraph. You’re welcome. Traffic is down very slightly in 2022 relative to the same period in 2021, but the cost of rail transportation has increased dramatically. Although I forecast net income to be down relative to last year, most of this underperformance relates to last year’s asset disposition sale. Most importantly, in my view, the shares are now attractively priced. In my view, any risk of disappointing fuel surcharges and the like are more than compensated for by the decent price here. There you have it. Now that you have the highlights of my article, any nausea or involuntary eye rolling is entirely on you. Since I’ve given you the “gist” of my thinking in this “thesis statement”, I don’t want to read any moaning about my not-so-subtle bragging, or the fact that I spell words properly.

Predicting is Hard, Especially About the Future

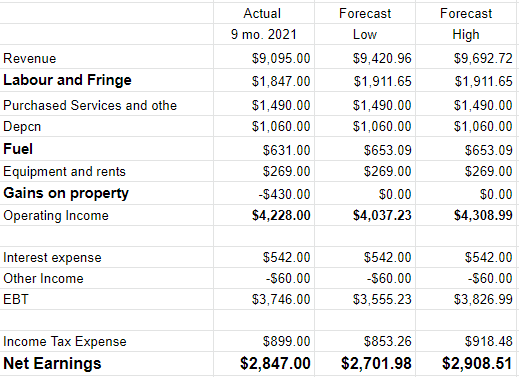

The following is a nominal (i.e. not inflation adjusted) forecast of what I think CSX’s upcoming revenue and net income will be. I’m going to offer my low and high range for these figures. I’m going to use two data sources to come up with my rough and ready prediction of revenue. The first will be a comparison of traffic figures between week 39 of 2021 and week 39 of 2022. The second will be a review of the recent financial history here, combined with an acknowledgement of the increased cost of freight transportation. I’ll use some simple math to more fully describe my thinking in case it’s not clear. Let’s pretend that the company generated revenue of $1 per carload over the 39 weeks of 2021, and they moved 100 carloads during that time, meaning that for the first 39 weeks of the year, they generated $100 in revenue. Things are a bit softer in 2022 as I’ve written about previously, so let’s pretend that they only moved 95 carloads in 2022. Inflation picked up, though, and the railroads are able to charge $1.10 per carload in 2022, per the following from the St. Louis Fed. In this new scenario, the company generates revenue of 95 * $1.10= $104.50. I understand that inflation hasn’t “stepped up” in one jump, so applying the inflation rate to all of 2022 would be too aggressive. Rather than run the risk of so-called “analysis paralysis”, I’m just going to assume 40% of the total inflation number for my low estimate, and 70% of the total inflation number for my high estimate. Some of this increase comes from fuel surcharges that the company frequently passes along to customers on a lag. Also, I’m going to assume that the company generates identical revenue from hauling a carload of lumber, for example, as they do from hauling a carload of waste and non-ferrous scrap. I know that that’s an enormous simplifying assumption, but I’m comfortable with that. My back of the envelope analysis should be used as only a starting off point for those individuals who want to try to slice the data even finer. If anyone has a problem with any of the above methodology, I’m assuming that they’ll offer their feedback in the calm, sane manner that has come to be the hallmark of discussions on the internet.

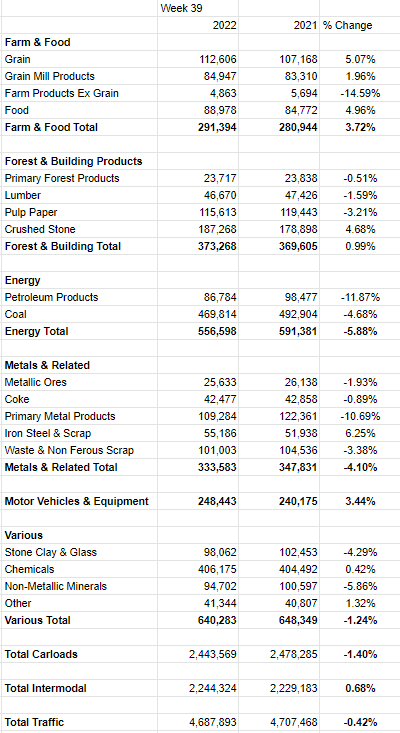

First, the traffic figures. The following is a comparison of the traffic between 2021 and 2022, covering approximately the same time periods as the financial periods for the year. We see from the following that traffic figures are down a very slight .42% in 2022 as compared to the same period in 2021. Interestingly (to me, at least) is the fact that intermodal really pulled it out of the fire for the firm this year. Absent the growth in intermodal, traffic would have been down about 1.4% over last year.

Carload Comparisons for Week 39 2022, 2021 (CSX Investor relations)

My Forecast for CSX Corporation

I know that the more variables I tweak, the less accurate will be my prediction, but I can’t help it. I just love to tweak. Anyway, the three variables that jump off the page that seem to scream “tweak me” are “Labour and fringe” (spelled in the financial statements the improper American way), “Fuel”, and “Gains on Property.” I think labour expenses are set to rise, and I’m going to assume that they’re up by 3.5% in each of my scenarios. I’m going to assume the same for fuel expenses. Finally, operating income was goosed by a $430 million gain on property in 2021, and I’m assuming no such gain in 2022.

Given these assumptions, I’m forecasting net earnings to be off by 5% in the most pessimistic scenario, and up by about 2.2% in the most optimistic scenario. According to my forecasts, this year’s income will be most heavily impacted by the elimination of gains on property, labour increases, and fuel increases, in that order.

CSX Revenue and Net Income Forecast (CSX Investor relations, Author calculations)

The impact on the stock is uncertain at this point. Sometimes the market is in a very forgiving mood about the elimination of one-off events, and sometimes the market is in a mood to punish. Given this, I think it makes sense to only consider buying at prices that are attractive. Let’s try to work out whether or not the shares are attractively priced, shall we?

CSX Stock

My regulars know that I consider the business and the stock to be distinctly different things. This is because the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long term expectations about the business. Given that the financial statement valuation of the business is “backward looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results.

I hate to remind you about it, but playing this expectations game is what allowed me to buy CSX at $29.72 and then sell at $33.41 before the stock dropped precipitously in price. Although I am boastful, I don’t want to imply that I did anything special here, or that I had a special “system.” I didn’t do anything special in this circumstance. I took advantage of the market when the crowd was too pessimistic by buying, and took advantage of the market again when the crowd became too optimistic.

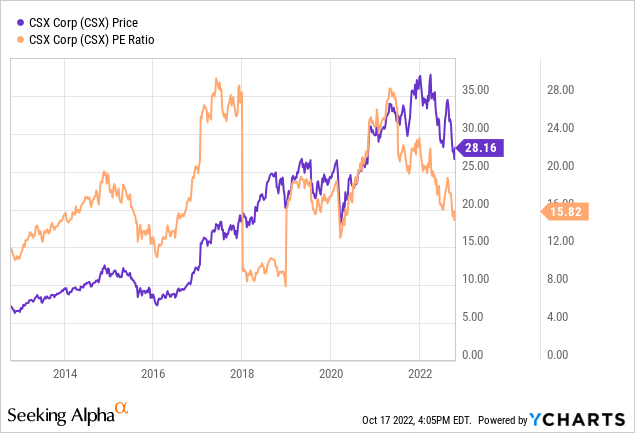

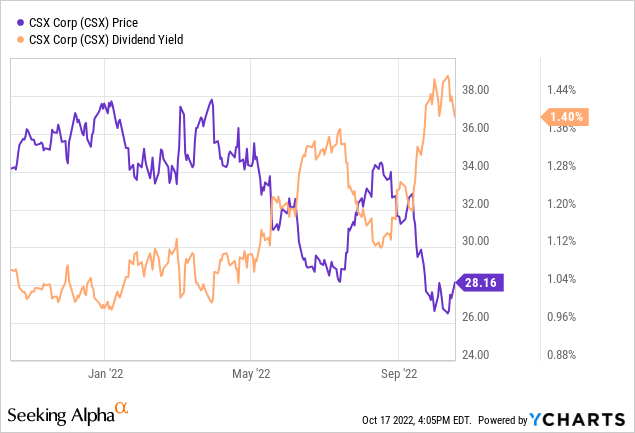

In case you’ve forgotten, I got excited about CSX Corporation prior to earnings last quarter when the stock was trading at a valuation of ~PE 16.54 while sporting a dividend yield of about 1.3%. Fast forward to the present and we see that the shares are actually slightly cheaper, and the dividend yield is slightly richer than when I last bought in.

I think there’s a decent chance that earnings will disappoint. I think some analysts are being excessively optimistic with their fuel surcharge forecasts, but I frequently think analysts are excessively optimistic. This doesn’t mean that I want to be on the opposite side of the trade from them, though. I think CSX remains a very compelling franchise, with an enormous “moat”, and I think the upcoming earnings will be compelling enough to compensate investors for the risks of lower earnings. Given what’s happened to the cost of freight over the past year, I think it’s fairly inevitable that nominal revenue will increase. Even if net income falters relative to this time last year, this is still a good investment in my view. This is because the valuation of this unassailable moat is quite compelling yet again. I’m going to buy shares at the next available opportunity.

Be the first to comment