Michael Vi/iStock Editorial via Getty Images

Investment Thesis

CrowdStrike Holdings, Inc. (NASDAQ:CRWD) is our preferred pure-play cloud-native endpoint security (EDR) company. The company has consistently ranked among the best EDR players in the industry. In addition, the most recent “Forrester Wave™: Endpoint Detection and Response Providers, Q2 2022” report reaffirmed our conviction that CRWD is the #1 EDR player in the market.

The company has also continued to gain market share rapidly as it competes aggressively against Microsoft (MSFT) and its pure-play peers. In addition, CrowdStrike’s highly scalable platform is validated again as it launched several cloud security initiatives to penetrate the space further. Consequently, the company has consistently expanded its TAM, coupled with the renewed focus on cloud security lately.

We also implored CRWD investors to add exposure during the recent February (Buy, up 45.7%) and March (Buy, up 19%) bottoms. We believe the significant upward momentum was linked to its robust FQ4’22 earnings card and its recent Investor Day presentation. CEO George Kurtz & Team demonstrated that the fear of competitive risks had been overstated as CrowdStrike continued to execute its “land and expand” motion confidently.

Nonetheless, we also think the stock looks fully valued now. There could still be potential upside moving forward, given its strong momentum. However, we struggle to find a reasonable margin of safety at the current levels.

Therefore, we revise our rating from Buy to Hold, given its substantial embedded growth premium.

Line Of Sight To CrowdStrike’s GAAP Profitability

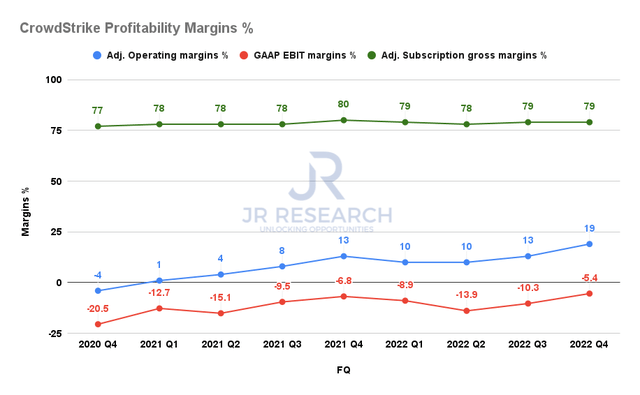

CrowdStrike profit margins % (Company filings)

The company reported a robust FQ4 card in March. Its revenue increased by 62.7% to $431M, while it also significantly improved its operating leverage. As a result, CrowdStrike’s adjusted operating margins improved to 19% in FQ4. However, investors need to note that CrowdStrike was still unprofitable in GAAP terms. Still, its GAAP EBIT margins have improved as it expanded its scale. In addition, the company clarified that it’s still in the early inning of its expanded FY26E TAM of $126B.

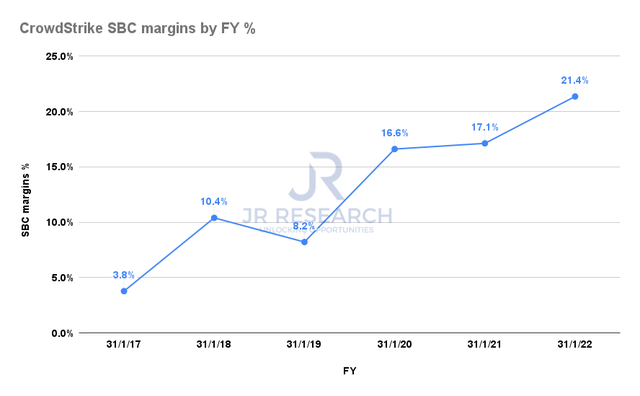

CrowdStrike SBC margins % (S&P Capital IQ)

The company’s stock-based compensation (SBC) margins markedly impact its GAAP EBIT margins. However, CrowdStrike also updated in its recent April Investor conference that it expects SBC to trend down and normalize from FY23 (CY22). It accentuated: “We expect stock compensation as a percent of revenue in FY23 to remain consistent with FY22 and then begin declining to mid-teens as we approach FY26.”

Consequently, we should expect CrowdStrike to continue gaining leverage as it accelerates its land and expand motion in its cloud security modules moving forward. The company was also confident of its operating efficiency, as CFO Burt Podbere emphasized (edited):

We are operating very efficiently as a company and achieving a high ROI on our investments. We believe our business model is capable of delivering our target models operating income in the near term, but we do not think that would be the best course of action given the massive market opportunity we see at hand and our strategic position within the ecosystem.

Looking beyond FY23, we plan to deliver incremental leverage each year as we work towards consistently delivering operating margin on our target model of 20% to 22% starting in Q1 of FY25. Additionally, longer term, we see room to exceed these targets beyond FY25. (CrowdStrike Investor Briefing)

Clearing The Path to $5B ARR By FY26

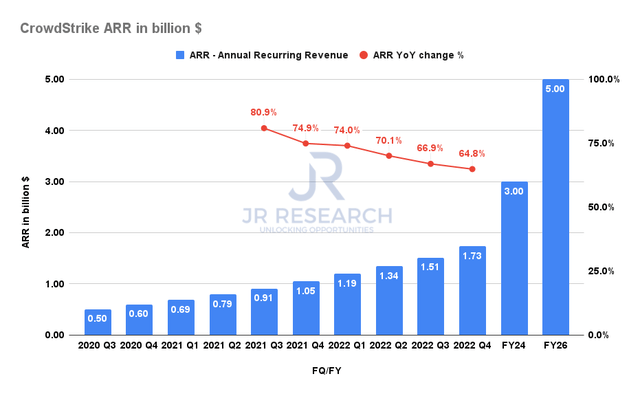

CrowdStrike ARR (Company filings)

Notably, the company revised its ARR model significantly as it communicated $5B in annualized recurring revenue (ARR) by FY25 (CY25). However, the company was careful to underscore that it didn’t constitute “guidance.” Instead, investors should consider it as a framework to think about the company’s opportunities.

Still, we consider the revised framework significant. The previous model suggested an ARR of $3B by FY26. Therefore, we believe that the company continues to expect significant growth cadence moving ahead, even as it gets closer to GAAP profitability. Based on the updated framework, investors can expect CrowdStrike’s ARR to increase at a CAGR of 30.1% through FY26.

Nevertheless, it represents a marked slowdown from the ARR growth (YoY change) from previous years as CrowdStrike scales higher. But, we think a 30+% CAGR for a company operating near $2B ARR is notable, and therefore we are pretty pleased with the update.

Is CRWD Stock A Buy, Sell, Or Hold?

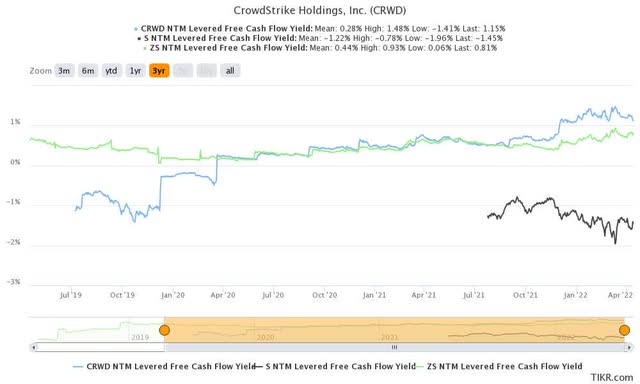

CRWD stock consensus price targets Vs. stock performance (TIKR) CRWD stock NTM FCF yields % (TIKR)

We revise our rating on CRWD stock from Buy to Hold. It has recovered remarkably from its recent bottom and it last traded at a markedly higher premium.

Nonetheless, investors should consider that CRWD stock has consistently traded at a high multiple, and its FCF yields are much better than its peers listed above. However, despite its solid execution cadence, we would be remiss in adding exposure to CRWD stock at the current levels. Moreover, it has also moved well ahead of its most conservative price targets.

Therefore, we believe investors should wait patiently for meaningful retracement if they would like a reasonable margin of safety.

Be the first to comment