Cecilie_Arcurs/E+ via Getty Images

One thing that every company has in common is the need for certain workplace services in order to operate. These services can range from recruitment and assessment, to training and development, to outsourcing, and more. But at the end of the day, without these things, no business can truly function. Though there are many companies that are dedicated to providing these sorts of solutions, one that warrants special attention is ManpowerGroup (NYSE:MAN). Fundamentally, the business does generate attractive cash flows, but it has a history of volatility on both its top and bottom lines. All things considered though, shares of the company are trading at levels that should be considered fairly attractive. Relative to peers, I would make the case that the company is undervalued. When you consider the stagnation at its top and bottom lines, however, I would say that it is, at worst, fairly valued. Though at best, it might be marginally underpriced. Certainly, the risk to reward here is favorable for investors, but this is far from being a home run. Of course, this picture could always change in the future. And the best luck we are going to get at that possibility will be when management reports financial performance covering the first quarter of the company’s 2022 fiscal year. This is slated to take place on April 19th before the market opens.

ManpowerGroup – A play on workforce solutions

According to the management team at ManpowerGroup, the company is a global leader in providing workforce solutions and services. It accomplishes this through a network of over 2,200 offices spread across 75 countries and territories. These services are vast in nature, consisting of things like recruitment and assessment, where the company essentially engages in the talent acquisition process on behalf of its clients, training and development, where they provide training courses and other related features, and so much more. The company’s career management functions help individuals to manage their careers through outplacement services and targeted skills development programs. They also provide their clients with outsourcing services when it comes to human resources functions, and they provide workforce consulting, which essentially means the business helps its clients to create and implement a workforce strategy aimed at optimizing their organizational goals.

The business currently has a few key brands that it does all of this through. The first of these is called Manpower, and its focus is on providing contingent staffing and permanent recruitment services. The company does this by identifying high-quality talent and placing that talent with employers who are in need of these types of services. Another brand the company has is Experis. Through this, the company offers professional resourcing and project-based solutions across the globe. In fact, in 2021, this brand delivered 69 million hours of professional talent to its customers, with the company specializing in IT, engineering, and finance. It also offers workforce solutions as a recruitment process outsourcing firm through a brand called Talent Solutions.

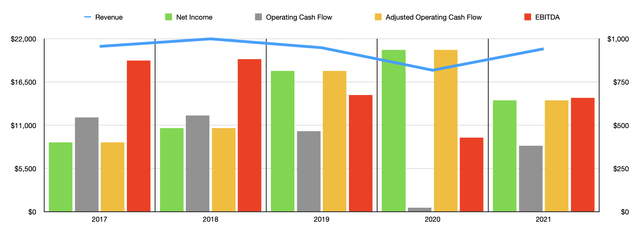

Over the past few years, ManpowerGroup has been rather volatile from a fundamental perspective. Revenue increased from $21.04 billion in 2017 to $21.99 billion in 2018. Sales then dropped to $20.86 billion in 2019 before plunging to $18 billion in 2020. The good news for investors is that the decline that was caused by the COVID-19 pandemic was short-lived. Revenue in 2021, as a result, rebounded to $20.72 billion. Management has not provided any guidance, unfortunately, when it comes to the entirety of the company’s 2022 fiscal year.

When it comes to profitability, the picture has been similarly volatile. In the three years ending in 2019, net income fluctuated between a low point of $465.7 million and a high point of $556.7 million. Then, in 2020, the company generated a profit of just $23.8 million. The good news for investors is that the company staged a partial recovery in 2021, with net income totaling $382.4 million for the year. Other profitability metrics have been similarly volatile in recent years. Between 2017 and 2020, operating cash flow with the company rose year after year, climbing from $400.9 million to $936.4 million. Then, in 2021, cash flow came in at $644.8 million. However, if you adjust for changes in working capital, the cash flow picture for the company looks much more similar to what we saw with net income. The high point was the $681.4 million achieved in 2018, while the low point was the $232.8 million the company generated two years later. Last year, this metric came in at $509.2 million. Also volatile has been EBITDA, fluctuating between $429.3 million and $882.5 million over the past five years. Last year, this metric totaled $658.8 million.

MAN stock – Taking a look at analysts’ expectations

As I mentioned already, management is due to report financial performance covering the first quarter of the company’s 2022 fiscal year before the market opens on April 19th. As we near that date, we should pay attention to what analysts are anticipating. For the quarter, the current expectation is for revenue of $5.08 billion. To put this in perspective, that would represent a year-over-year increase of 3.2% compared to the $4.92 billion generated in the first quarter of 2021. Management has recently said that the outlook for its services in the IT, finance, and manufacturing markets should be rather appealing. This is because, in the most recent survey the company looked at, it concluded that employers in 36 out of 40 countries surveyed report stronger hiring activities than what they experienced one year earlier. It wouldn’t be shocking if management does outperform on the revenue side as a result of this. But only time will tell.

When it comes to the company’s bottom line, analysts currently anticipate earnings per share of $1.53. However, management’s current guidance for the quarter is for earnings per share of between $1.56 and $1.64. At the midpoint, that comes out to $1.60. The company’s own guidance excludes certain costs, such as integration expenses of between $4 million and $6 million, as well as an $8 million loss on the sale of its Russian operations. To be fair, on an adjusted basis, analysts are anticipating earnings per share of $1.59. But at the end of the day, I would venture to say that management would be more accurate. If the company can deliver on this in a positive way, then it could serve as a catalyst to push shares higher in the near term.

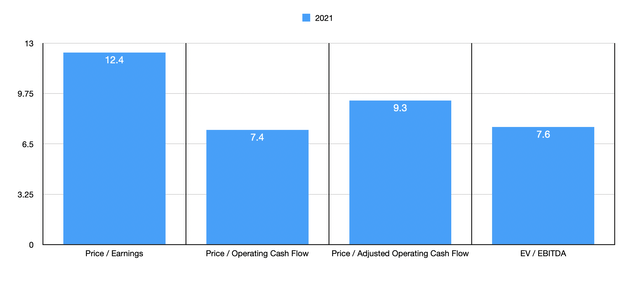

When it comes to valuing the company, the picture is fairly straightforward. Using the firm’s 2021 results, it is trading at a price to earnings multiple of 12.4. The price to operating cash flow multiple is 7.4, while the price to adjusted operating cash flow multiple is slightly higher at 9.3. Meanwhile, the EV to EBITDA multiple of the company should be 7.6. To put this in perspective, I decided to price the company against five similar firms. On a price-to-earnings basis, these companies ranged from a low of 11.9 to a high of 41.5. On a price to operating cash flow basis, the range was from 8.4 to 32. And on an EV to EBITDA basis, the ranges from 6.1 to 30.9. In all three cases, only one of the five firms was cheaper than ManpowerGroup.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ManpowerGroup | 12.4 | 7.4 | 7.6 |

| 51job, Inc (JOBS) | 41.5 | N/A | 30.9 |

| Insperity (NSP) | 31.6 | 15.1 | 16.9 |

| Korn Ferry (KFY) | 11.9 | 8.4 | 6.1 |

| ASGN Incorporated (ASGN) | 15.1 | 32.0 | 14.5 |

| TriNet Group (TNET) | 18.9 | 29.5 | 10.9 |

Takeaway

Based on all the data provided, shares of ManpowerGroup do you look cheap and the near-term outlook for the company is likely favorable. I am slightly disappointed in its historical volatility, especially when this existed even prior to the pandemic. I generally prefer companies with consistently growing revenue and cash flows. But at the end of the day, the stock is priced low enough that it could still offer some nice upside. I don’t see this as a home run opportunity by any means. But it could still make for a solid prospect for someone interested in this space.

Be the first to comment