Olemedia/E+ via Getty Images

Cybersecurity firm CrowdStrike Holdings, Inc. (NASDAQ:CRWD) will continue to rapidly improve and could achieve $5.0B in revenues by 2025. The cloud-based cybersecurity technology company is building real momentum in ramping up its subscription business, and customers spend more money on the firm’s products and services. While shares of CrowdStrike are not cheap, I believe the SaaS business model has a lot of potential for the firm and shares have the potential to revalue higher!

CrowdStrike provides critical services in an evolving threat environment

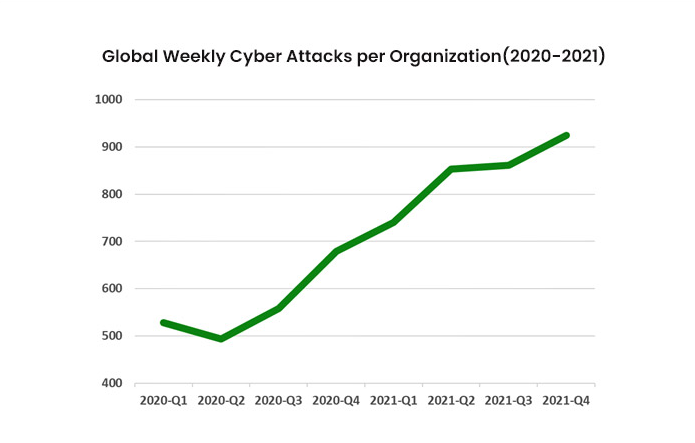

Cyberattacks are on the rise and pose serious challenges to companies and governments around the world. According to Check Point Research, cyberattacks on corporations increased 50% in 2021, compared to 2020, and hackers are getting more and more sophisticated. Hackers not only target customer information such as credit card data but also increasingly seek to gain control over information systems and blackmail companies into paying a ransom. A single attack on an IT system can cost companies millions of dollars, not considering immeasurable costs such as reputation damage and lost customer business.

Cyberattacks on companies surged during the pandemic.

Check Point Research

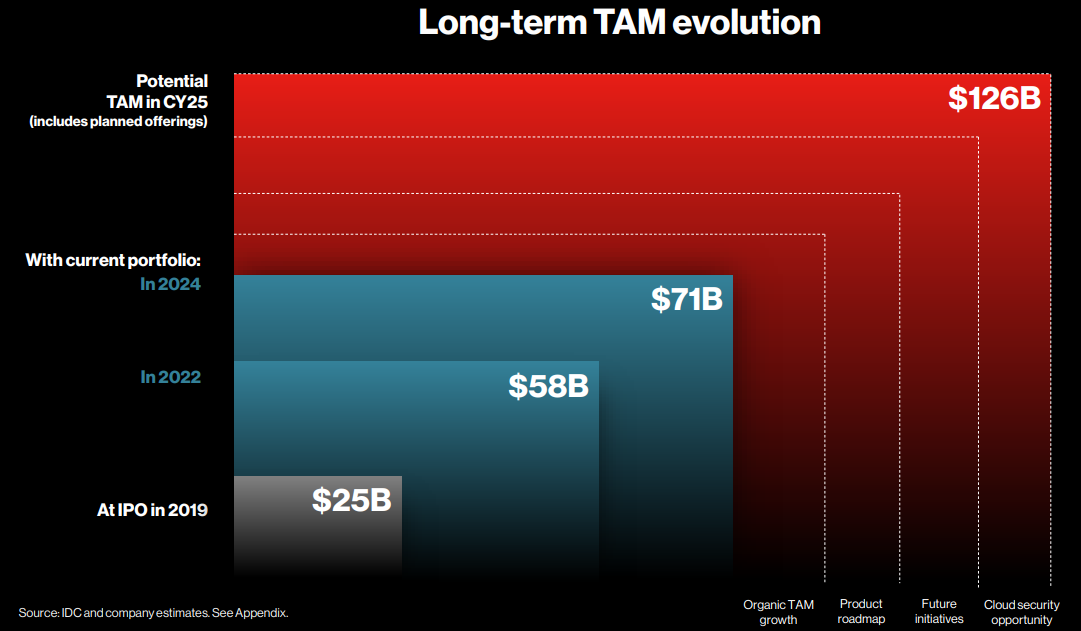

CrowdStrike addresses the threat posed by cyberattacks by providing cloud-based infrastructure that allows companies to shield critical information from hackers and other malicious actors. To accomplish this, CrowdStrike offers corporate endpoint security, threat intelligence, cloud security and identity protection, among other services. As cyberattacks happen more frequently and get more severe, however, the total addressable market for CrowdStrike is also growing rapidly.

The cybersecurity technology company projects its total addressable market (“TAM”) growing to $126B by 2025. The estimated market size for CrowdStrike’s products and services in 2019 was just $25B. An evolving threat environment, meaning bad actors constantly innovate to find new ways to breach networks and steal protected data, also means that CrowdStrike’s TAM will keep growing.

CrowdStrike

Building a strong subscription business

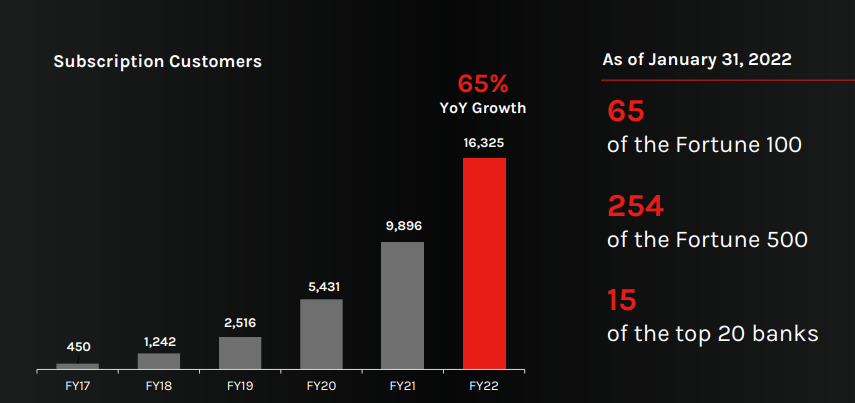

CrowdStrike monetizes its customers that want to protect themselves against cyberattacks through a SaaS model. Customers subscribe to CrowdStrike’s cloud-based security platform and pay the company a recurring fee. This business model has proven to be extremely successful for CrowdStrike, as companies constantly need the newest technology to protect themselves against the newest threats.

CrowdStrike’s subscription customers have surged in the last five years, and the firm achieved 65% customer growth just in the last year. In FY 2022, CrowdStrike added 6,429 new customers to its platform and continues to make inroads with the largest companies in the U.S.

CrowdStrike

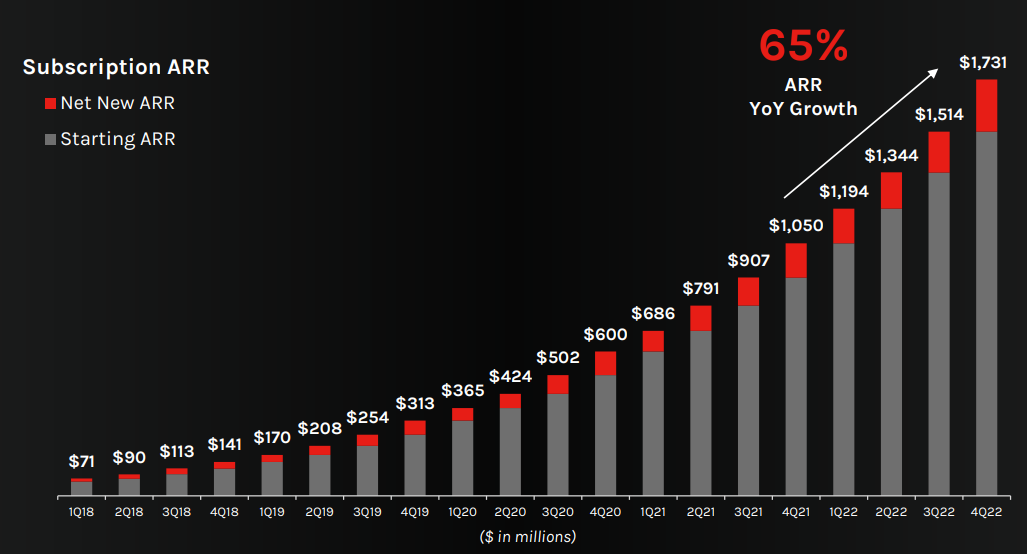

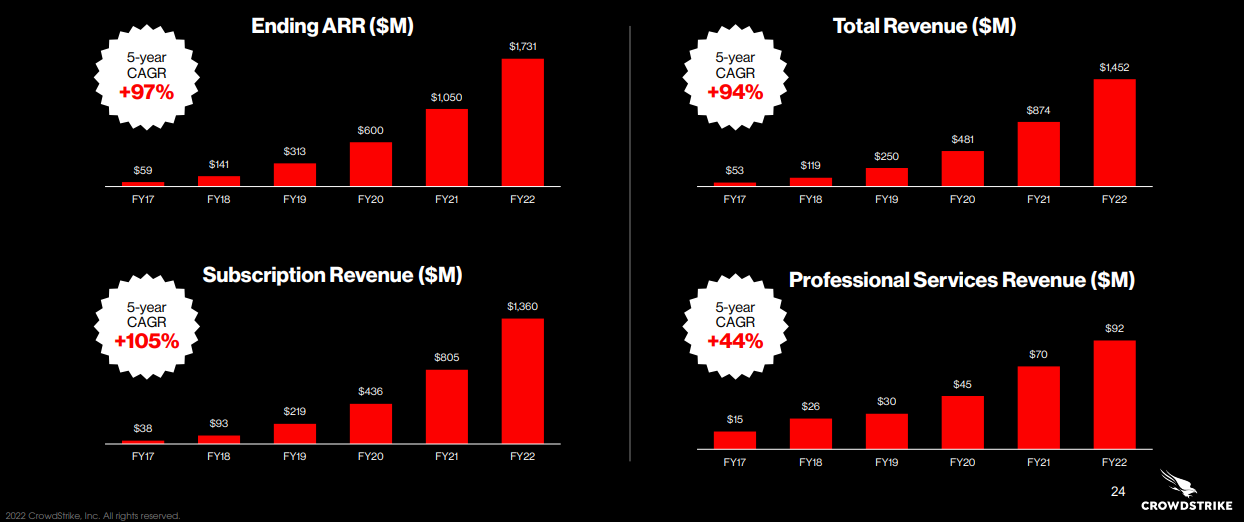

Because of CrowdStrike’s strong customer acquisition, especially during the pandemic, the firm saw super-strong revenue growth. The firm generated $1.7B in subscription ARR at the end of FY 2022, showing an increase of 65% year over year.

CrowdStrike

CrowdStrike’s subscription revenues, which represent 94% of total revenues, surged 69% year-over-year in FY 2022 to $1.36B.

CrowdStrike

Revenue outlook: On a path to $5.0B in revenues by 2025

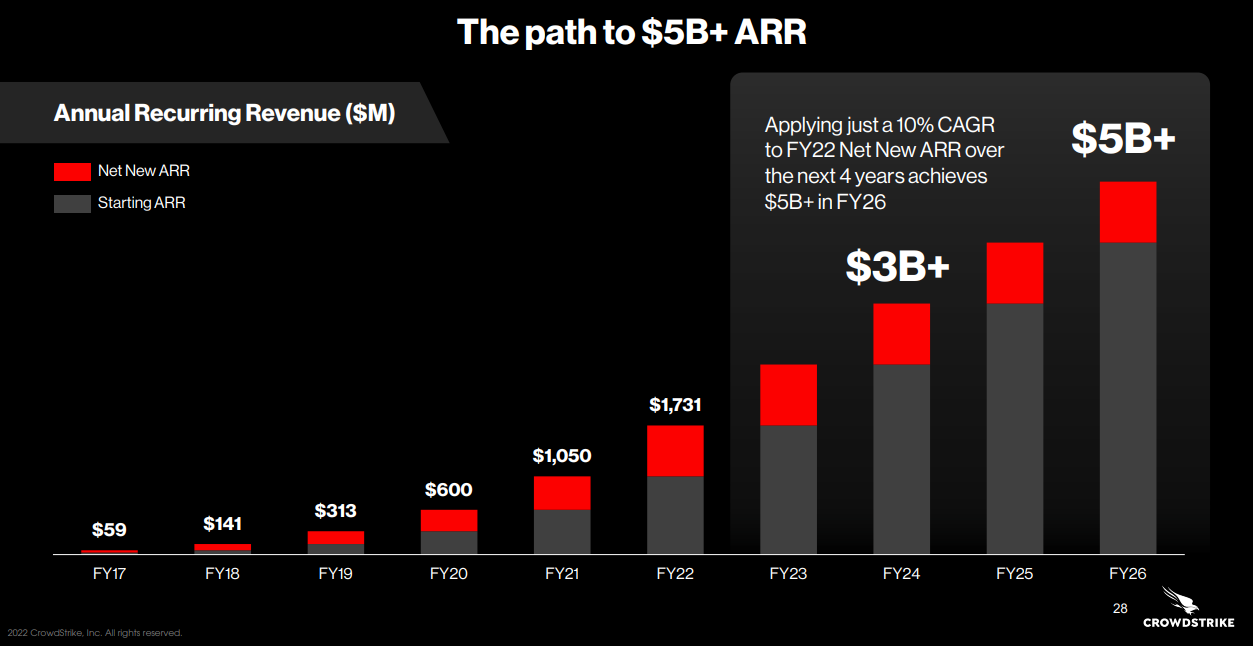

CrowdStrike strives to grow revenues (subscription and professional revenues) from $1.5B today to more than $5.0B in 2025, implying that revenues will increase by a factor of 3.3 X over the next four years. CrowdStrike projects to reach these goals through improving customer monetization and growing operating leverage.

CrowdStrike

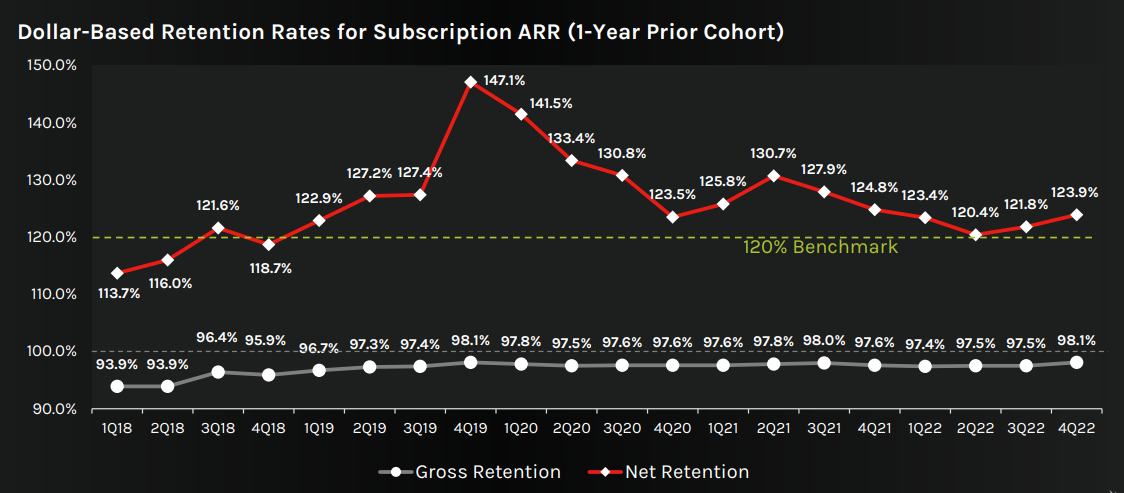

Strong customer monetization

Customers spend more money on CrowdStrike’s platform, and we can see this in a figure called dollar-based retention rate (“DBRR”). This figure expresses basically how well a company is monetizing its customers. Dollar-based retention rates measure by how much customers increase their product and service spend, from one reporting period to the other. For CrowdStrike, this figure was 123.9% in the last quarter, meaning the same group of customers increased its spending on the CrowdStrike platform by 23.9% compared to the same reporting period a year earlier. On another positive note, CrowdStrike’s DBRR increased sequentially in the last two quarters.

CrowdStrike

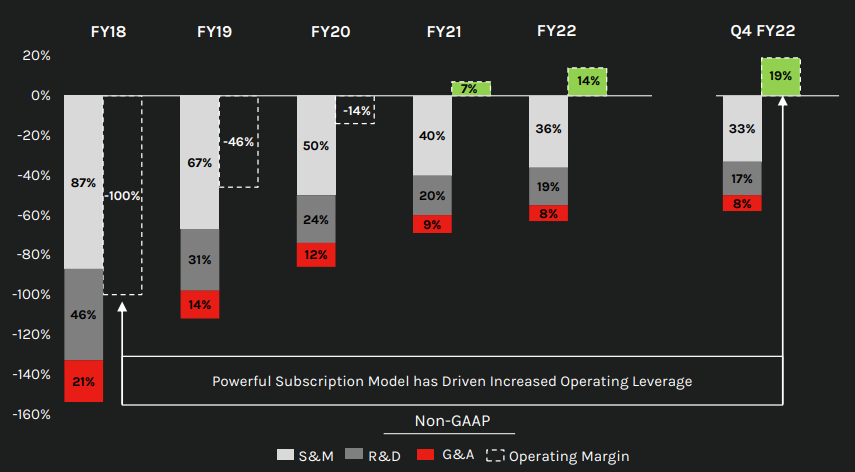

Operating leverage

CrowdStrike’s business model works with scale. The more customers the firm signs on to its platform, the better the unit economics work. While CrowdStrike has lost a lot of money in the past – chiefly because it scaled its platform and developed new products – the firm has significant operating leverage. As the subscription business grows, the need to spend heavily on marketing decreases, which improves CrowdStrike’s margins. In the fourth quarter of FY 2022, CrowdStrike reported a 19% operating margin. In FY 2021, this margin was just 7%, and it was negative in the year before that.

CrowdStrike

CrowdStrike’s growth is worth the price

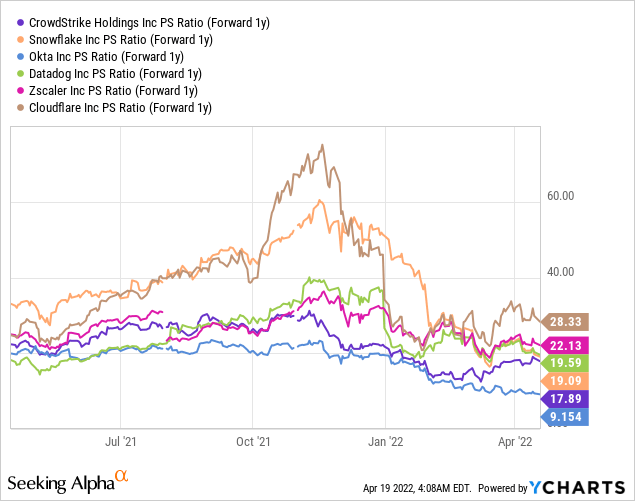

CrowdStrike is not a cheap stock… and that’s because the company has serious momentum in customer acquisition and a strong subscription business. The massive increase in revenues to $5.0B until 2025 also plays a role in creating a premium valuation for CrowdStrike. However, I believe CrowdStrike’s TAM expansion as well as robust DBRR justify the price. CrowdStrike has a P-S ratio of 17.9 X which makes it one of the cheapest cloud-security stocks in the market.

Risks with CrowdStrike

For CrowdStrike I see more risks on the valuation side than on the commercial side. CrowdStrike is growing its subscription base extremely quickly, and the company provides critical infrastructure to support the growth of other companies.

However, CrowdStrike is not exactly a stock you would describe as cheap. The reason why CrowdStrike has such a high sales valuation factor is because of the firm’s revenue growth prospects. A lot of this growth is already priced into shares of CrowdStrike, and if the cloud-based technology firm were to disappoint investors with the expansion of its subscription business, the stock may get punished with a lower sales valuation factor. What would change my mind about CrowdStrike is if customer acquisition slowed down or the dollar-based net retention rate declined materially.

Final thoughts

I believe the SaaS business model has a lot of potential for CrowdStrike in an evolving threat environment. CrowdStrike targets $5.0B in annual recurring revenue by 2025 and the addressable market keeps expanding. Improving customer monetization paired with strong customer acquisition justifies a premium valuation for CrowdStrike!

Be the first to comment