Andrey Maximenko/iStock via Getty Images

In its latest earnings report, Shoe Carnival (NASDAQ:SCVL) decided to compare its third fiscal quarter results with 2019 numbers, rather than 2021 numbers. In its Form 8-K the company said it did so because it believed the volatility associated with 2020 and 2021 would be more relevant because of it being ” prior to the onset of the COVID-19 pandemic and related government stimulus and supply chain disruption.”

Consequently, when a couple of questions were asked by analyst during the earnings call, the company confirmed the numbers of 2022 weren’t as good as they were in 2021.

Yet, when compared with 2019 it gave the appearance of a much stronger quarter than it really was when measured against last year.

Even so, the report was a mixed one, with some things to like, and others to dislike.

In this article we’ll look at some of the numbers from the earnings report and what the prospects for the company look going forward.

Latest earnings

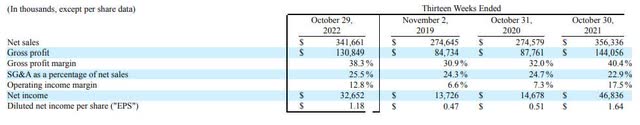

In this section I’m going to compare the results of the third quarter of 2022 as measured against 2019 and 2021, to give more perspective on SCVL’s performance. CEO Mark Worden said in its Form 8-K that 2021’s performance was influenced by stimulus, which is why the company chose pre-pandemic 2019 as its preferred quarter to prepare its 2022 fiscal third quarter performance against.

I think it would have been better for management to say the 2021 numbers were inflated by the stimulus checks in the earnings call, but still use that as the benchmark comparison for 2022’s numbers, rather than go back three years.

Revenue in the third quarter came in at $342 million, up $67 million from the $275 million in revenue generated in the third quarter of 2019, but down $14 million from the revenue generated in the third quarter of 2021.

Gross profit in the reporting period was $131 million, an increase of $46 million from the $275 million in gross profit from the same period in 2019, but down $13 million from the $144 million in gross profit generated in the same quarter of 2021.

Gross profit margin was 38.3 percent in Q3 2022, 30.9 percent in Q3 2019, and 40.4 percent in Q3 2021.

Operating income margin was $43.6 million, or $12.8 percent of sales in the quarter, 6.6 percent of sales in 2019 in the third quarter, and 17.5 of sales percent in the third quarter of 2021.

Company Form 8-K

Net income in the third quarter of 2022 was $33 million, in the third quarter of 2019 it was $14 million, and in the third quarter of 2021 it was $47 million.

Diluted EPS in Q3 2022 was $1.18, $0.47 for the third quarter of 2019, and $1.64 for the third quarter of 2021.

SG&A as a percentage of sales in the third quarter of 2022 was 25.5 percent, in the third quarter of 2019 it was 24.3 percent, and in the third quarter of 2021 it was 22.9 percent.

Full-year guidance for revenue was estimated to be in a range of $1.27 billion to $1.3 billion, below the $1.31 billion analysts are looking for. Management also lowered its EPS guidance from its former range of $3.85 to $4.15, to a new range of $3.95 to $4.10.

Cash and cash equivalents at the end of the quarter were $37.2 million, down significantly from the $173.4 million in cash and cash equivalents at the end of the third fiscal quarter of 2021.

Momentum could slow down

Even though SCVL’s numbers slowed down from 2021, it still had a good quarter, only lagging 2021 in its 44-year history. But what I want to look at in this section of the article is whether or not it’s going to be able to maintain its growth trajectory in the weakening economy. So far, its performance has been resilient, but I think the worst is yet to come in the next two to three quarters.

As for its share price, after dropping to a 5-year low of a little over $6.00 per share on March 16, 2020, it took off on a prolonged run, eventually reaching a 52-week high of 46.21 on November 15, 2021, before pulling back to close at $24.21 November 16,2022.

TradingView

The company has had seven consecutive quarters of double-digit operating profits, and EPS for the first nine months of its fiscal year has doubled from all other years in its history, with the exception of one year. With guidance moderated in the quarter, it appears to me there are concerns about momentum continuing in the short term based upon the impact of disposable income on its customers.

That of course will be determined by how inflation reacts to the Federal Reserve continuing to raise interest rates over the next several months, and at what pace. If interest rates approach 5 percent, I think we’re close to the top of what the Fed can do before drastically impacting the amount of money the U.S. government will have to pay for its $31 trillion in debt obligation.

The other factor is the recession, which will probably deepen in the early half of 2023, but beyond that it isn’t clear concerning the potential length of it.

All of this will affect, to one degree or another, the spending habits of consumers. As it relates to SCVL, it could change the sales mix from higher prices to lower prices, and/or consumers could put off spending on new footwear altogether if things get worse before they get better, which is a very strong possibility.

With that in mind, I lean toward the company struggling to maintain its momentum in the next two to three quarters, but further out, with its plans to add more stores over the next few years, it should be able to maintain, at least, an incremental growth trajectory, and possibly better if consumers decide to spend more on footwear after inflationary and recession effects start to wane.

An important stat to watch will be how it’s able to grow its loyalty members after a surge in new loyalty members bringing the total to a record of over 31.5 million in the third quarter.

Concerning adding stores, SCVL has plans to of its Shoe Station stores from 21 to 30 by the end of fiscal 2023, and to add over 70 more in the time period of 2026 to 2028.

For its Shoe Carnival footprint, is will have over 400 stores operating in fiscal 2023 and will add another 100-plus stores in the time period of 2026 to 2028.

Conclusion

I think SCVL is going to come under some pressure through the first half of calendar 2023, with the result being a slowdown in its growth momentum, which has been impressive recently.

Unless it surprises to the upside in the months ahead, I think its share price is going to rangebound $20.00 to $25.00 range, and if economic pressures tighten up consumer spending, it could drop below that if results are lower than anticipated.

In the long term, I think Shoe Carnival is going to continue to enjoy growth momentum, although it will need to spend more to achieve that, and with lower cash on hand, it’ll get more expensive to do so, which means adding debt, which would put pressure on margins and earnings if interest rates remain high over the next several years during its building program.

Because of uncertain economic times, it’s hard to know whether or not SCTV is at a good entry point now, and whether or not results and expectations are already priced in.

I think its share price could go either way, so waiting for a drop in price would probably be the best way to take a position, and from there dollar-cost average over the next couple of quarters in order to get a reasonable cost basis in the company.

Be the first to comment