Nordroden/iStock via Getty Images

Dear readers/followers,

We’re going deeper into commodities and expanding the coverage here to include the largest metal service center operator in all of North America – Reliance Steel & Aluminum (NYSE:RS). The company has an 80+ year history, is headquartered in beautiful Arizona, and has seen and is expecting significant profit increases for the coming few years compared to current and historical levels.

In this article, I’ll share with you why I believe the company to be an investable prospect, and why I recently started a small position to complement my commodities portfolio.

Reliance Steel & Aluminum

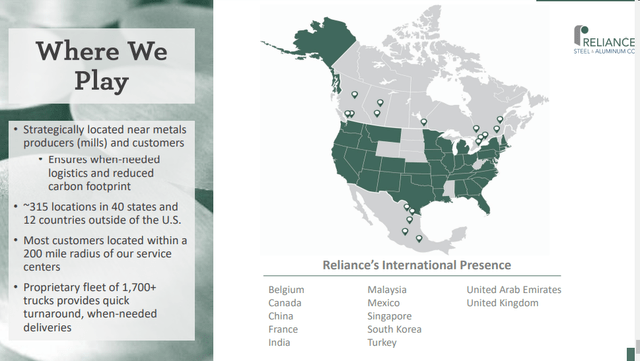

Founded in 1939 and headquartered in Scottsdale, AZ, the company works through about 315 locations, 40 states, and 12 countries on an international basis. RS provides customers with value-added metal processing services, distributing around 100,000 metal products to over 125,000 customers in a myriad of industries to all-size customers.

Where it differs from customers like Hydro is generally speaking individual scale. The average RS order is around $3,000, and around 50% of orders include some sort of value-added processing, most orders of which are processed and delivered within no slower than 24 hours. So while the company may work with a similar metal – aluminum – there’s still a difference here.

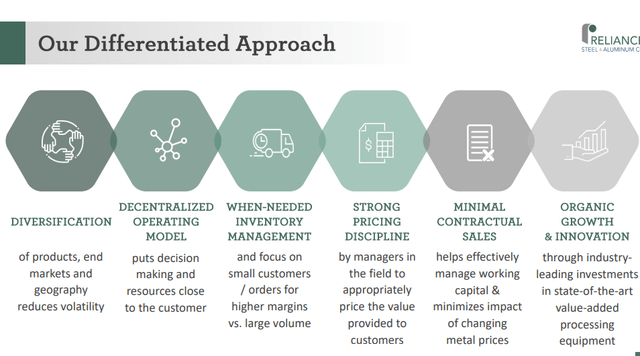

RS has plenty of positives to look at. The company combines a high pricing power (minimal contractual sales, quick ability to pass along price increases), good customer relationships, very disruption-proof (because few things can replace what the company offers), diversified, purchasing power due to size, and couples this with a solid balance sheet.

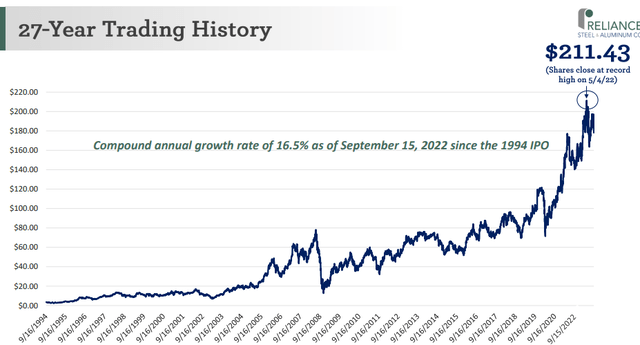

Reliance has been trading publicly for 27 years, and the returns in that time have been nothing short of staggering.

Reliance IR (Reliance IR)

RS is the sort of commodities play you want to invest in, and not “bet against” – because betting against this one usually turns out not so profitable. The company has outperformed the average industrial distributor returns, the S&P 500 as well as multiple other relevant indices outside of the US. Its resilience is documented.

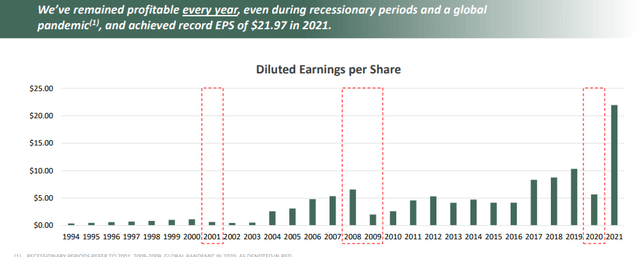

Reliance IR (Reliance IR)

The company has what is known as “countercyclical cash flows”, meaning cash flows from operations stay high in periods of economic uncertainty. At times, like in 2009, they even go up.

The reason for this company’s outperformance not only to peers and other mills but to the index as a whole comes from solid EBITDA margins and profitability, hailing from the foundational solidity I spoke of initially. It can be summarized in the following items here.

RS IR (RS IR)

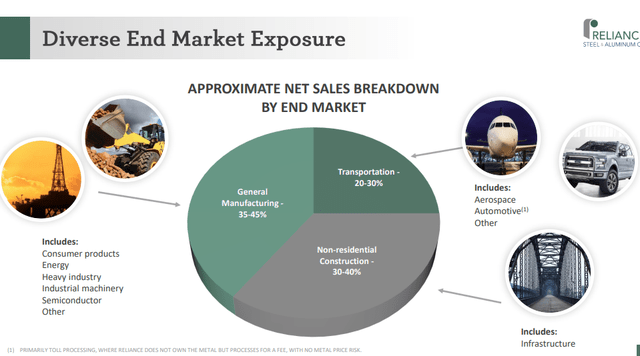

Unlike Hydro, the company isn’t exposed to any one particular metal except steel. The highest exposure comes from Carbon Steel, at around 50%+, but the company is diversified beyond this, coming in at 17% stainless, 15% aluminum, and 4% alloy. Product diversification is even better, with the top focus being Carbon steel tubing, giving the company a 12% exposure to the product. Geographically, we have the highest exposure to the mid-west, and end markets have surprisingly low exposure to things like Aerospace/automotive and transportation.

RS IR (RS IR)

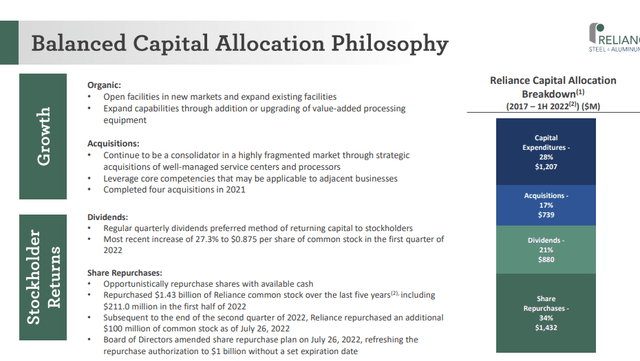

This is all before we even go into some of the more quality-indicative metrics. 97% of the customers are repeat-based, which is amazing given what the company does. The average order size may seem low initially, but this is just that. An average, and it quickly adds up. The company is also one to heavily invest in its own processes and assets, as well as M&A’ing necessary investments, such as a $1.21B CapEx on a 5-year basis , and 50% of the annual CapEx business not spent into recurring costs, but growth. The company has invested over $730M into M&A over the past 5 years and has acquired 71 companies since 1994.

And, all of this leads to superb margins, seeing ranges of 25-30% on a gross basis, which for this sort of company is excellent.

The only problem is really that the company isn’t that great of a dividend payor. Oh, it has tradition – 63 consecutive payments with 29 increases since IPO and a 15,650% increase in dividends since the start. But the yield is below 2%. The company favors common share repurchases above dividend distributions, usually speaking. Take a look at the capital allocation stack.

RS IR (RS IR)

The company’s recent financial performance is very good. 2021 was a record year for Reliance steel, seeing net sales upwards of $14B with record margins of 32% gross, and EBITDA that’s more than double the results of COVID-impacted 2020. EPS came in over $22/share.

Recent 2Q22 results saw further sales increases, margins at 32% if you go by non-GAAP FIFO numbers, and EBIT that’s rising both YoY and sequentially. In short, things are still trending up despite everything.

Reliance steel is an industry leader in a highly fragmented market of metal wholesaling. Despite the company’s size, they only have 5.8% of the total market, but it’s also the only industry leader with any scale.

The next-largest 3 comps have a combined percentage of 4.2% of the market, and the remaining 90% is fragmented among the remainder. There are 9,300 metal wholesale locations, in turn, operated by 6,900 companies, with Reliance as the only one to have a 5%+ market share.

That is worth something.

RS IR (RS IR)

In the end, the bullish thesis for Reliance is based on continual market dominance, positive trends, revenue growth rates likely to stay positive, improved CapEx resulting in solid, 28-30% margins, diversification and a very strong history. The company is also BBB-rated.

There is a bearish thesis worth at least looking at here. However, the usual primary argument that’s fielded by RS bears is that the company is a cyclical that may well be at the top of an ongoing cycle. First off, the latest article claiming this was in December, and the company RoR since that time outperforms the S&P 500 by almost 40%.

Secondly, this somewhat disregards that while there is some cyclicality to the company’s earnings, the much stronger historical trend is the upward trajectory that has been unfailing – and based on all of the positives we’ve been mentioning for the company here. I view this perspective as far too simplistic, and disregarding the company’s market position, pricing power, and ability to pivot from its current to virtually any market situation it seems bound to encounter.

We’ve seen a yield decline due to valuation, and the conclusion from bearish analysts is that this makes a market-beating annualized RoR difficult. I take another view – and I’ll share that with you here.

Reliance Steel & Aluminum Valuation

As mentioned, the people who have bet against RS since early 2021 have mostly seen their theses not materialize, as this company has held against the tides of the market extremely well. It’s also likely that these bouts of outperformance are likely to continue.

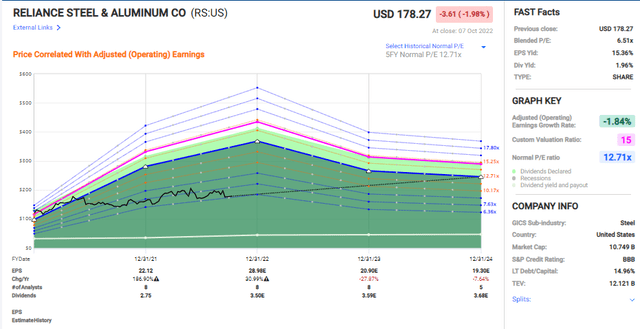

Current quarterly results do quite a bit in terms of justifying the 2022E forecasts on an adjusted EPS basis. It is also wrong to discount analyst accuracy when it comes to Reliance Steel.

RS Valuation (F.A.S.T Graphs)

Because even if we assume that we’re currently in an upcycle sort of position – which by the way is an entirely valid point of view – this in itself does not dictate that valuations are on their way down. Quite the opposite. Reliance has an at least 20-30% historical trend of beating estimates, both prior to 2014 and after. It currently trades at no higher than 6.5x P/E, cheap for these sorts of cash flows, even estimated at a 10-12x P/E, the returns you can garner from investing here are between 6-18% annually. I won’t go below 10x P/E here, because I believe the company in the long term is worth a lot more.

So a 17% annualized RoR is my “baseline” expectation here, and I do consider Reliance Steel & Aluminum to be a worthy “BUY”, provided you understand what you’re buying. This unfortunately isn’t a high-income or high-yielding company. At 1.96%, it doesn’t even clear treasury returns. But it has outperformed over time, and I see very few reasons why it should not continue to do so going forward.

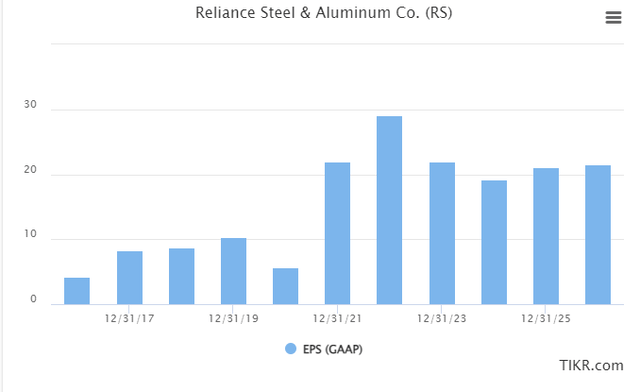

Other forecasts are equally positive. S&P Global expects Reliance to post records in 2022, yes. But even beyond that, results aren’t set to drop far below 2021 to any one particular year, compared to pre-2021 periods. We’re looking at a potential new base earnings level for the company.

RS GAAP EPS Forecasts (TIKR.com/S&P Global)

In a similar way to how biopharma companies received influxes of cash during COVID-19, I believe that the same sort of inflow given the current macro will result for RS for several years, allowing the company to invest, improve operations, and execute on appealing M&A’s, which will cement the appealing level of earnings we see here.

9 S&P global analysts follow the company, averaging a share price target of $220/share, which give us a 23.5% upside here. This comes from a range of $201 to $241, where even the lowest target is significantly above the current share price. Out of those 9 analysts, 8 have a “BUY” or equivalent rating. No S&P Global analysts currently have a “SELL” rating on the business.

All of this creates a situation where perhaps I don’t want to invest tens of thousands of dollars into the company straight away – but where I slowly want to start putting money to work. It’s not a “cheapest-ever” sort of business or situation, but it’s appealing enough that I want to put my money to work in a great company.

So that is what I’m doing.

I’m cutting the S&P Average target somewhat to a normalized 10.5x P/E and coming up with a conservative $210/share PT. But note that even at $180/share, the company trades at essentially 1.0x to a conservative NAV – so it’s not even at 1x NAV yet. This should give you some idea of where the company, in my view, “should” be trading.

So, this is my current thesis on the company.

Thesis

Here is my thesis on Reliance Steel & Aluminum

- The company is a strong player in commodities, specifically metals trading. Combining pricing power with market share (the only on the market above 5%), good history, superb management, and excellent diversification, we have a very appealing investment at the right price.

- While there is some cyclicality to results, I would argue that it’s not as some seem to think, and I give the company a conservative PT of a normalized 10.5x P/E.

- This comes to $210/share, and I go in with a “BUY” here.

Remember, I’m all about:

Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1. If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment