imaginima

Investment Thesis

CrowdStrike (NASDAQ:CRWD) is about to report fiscal Q3 2023 results in two weeks. And most importantly, it’s going to guide for fiscal Q4 2023. And I don’t believe CrowdStrike has had to navigate as an uncertain period as it now faces.

On the one hand, cyber threats and ransomware are real customer concerns that CrowdStrike is well equipped to prevent. On the other hand, the macro environment is rapidly deteriorating. And even the best SaaS companies are struggling for visibility.

Meanwhile, CrowdStrike’s valuation has already compressed. Investors love to buy high-quality compounders at a reasonable valuation. But you only get that criteria available, when the near-term outlook is grim. And that’s exactly what’s at play with CrowdStrike.

For my part, I remain bullish on CrowdStrike. I believe that in time, investors will recognize that this company is undervalued.

What’s Happening Right Now?

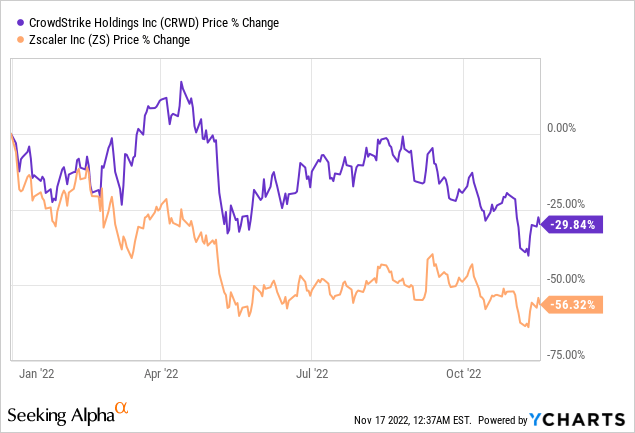

Earlier in 2022, cybersecurity stocks were managing to hold their ground as investors believed that the Russian invasion would lead to a rampant increase in cyber warfare, with companies being forced to invest in cyber security.

And this led to cybersecurity names performing strongly relative to other pockets of tech. Put another way, the macro environment was stimulating demand for cybersecurity names, even as many stocks in tech were falling hard.

However, as the months ensued, the macro environment moved beyond one of increased demand for cybersecurity solutions, to one of a slowing sales cycle. The demand for cybersecurity offerings is still here. Vendor consolidation is still a meaningful driver, particularly now, as companies are looking to cut back on their budgets.

Indeed, there’s still a secular growth story for cyber names. It’s just that enterprises are taking a more careful look to see how the economic environment is fairing as we enter 2023.

In many sectors, the impact of higher interest rates has been felt quite hard. And customers are cutting back on their IT spending, as well as cutting back on hiring, they are not looking to invest in the IT infrastructure. Or perhaps, better said, companies are looking to invest in cybersecurity, it’s just they don’t wish to do so right now.

And this leads me to discuss CrowdStrike’s Q3 2023 earnings coming in two weeks’ time.

Revenue Growth Rates Are Still Strong

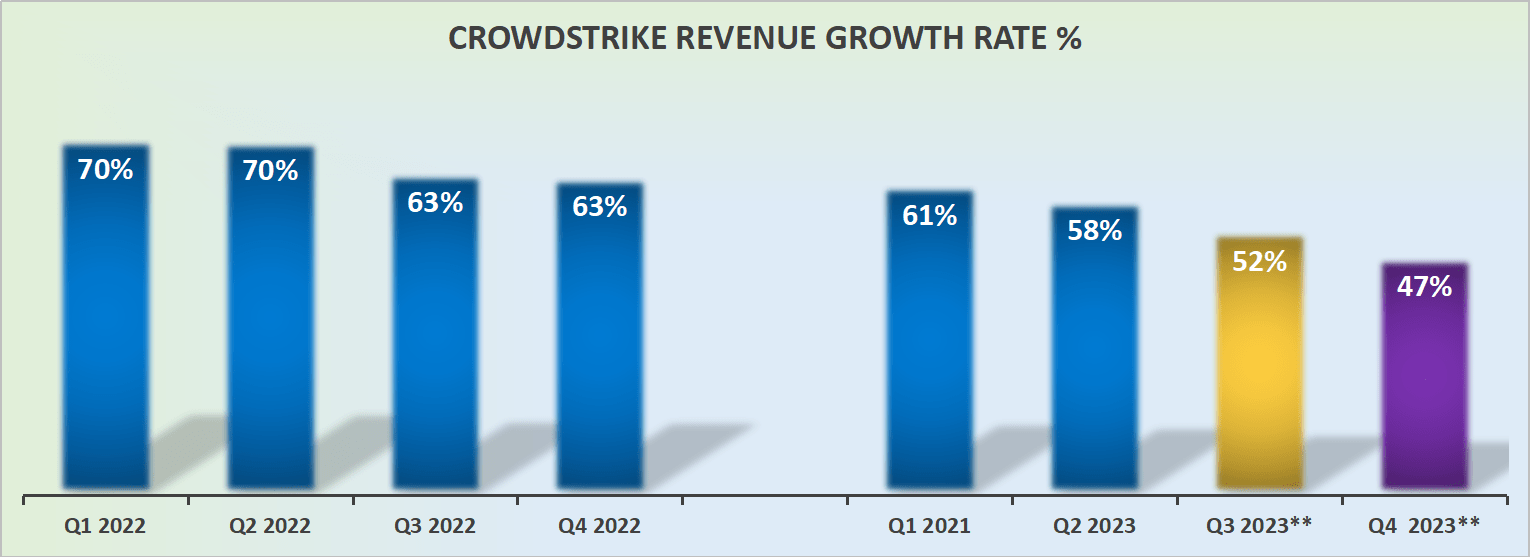

CRWD revenue growth rates

The big question that investors are attempting to grapple with is this, did CrowdStrike benefit from a pull forward in demand from the digital transformation post-Covid? And if so, by how much?

And then, as a corollary to that question, does this mean that there’s going to be a lull in fiscal H2 2023?

And then, further complicating matters, is it a case like what Fortinet (FTNT), Microsoft (MSFT), and to some extent Amazon’s AWS (AMZN) have seen will be reflected in CrowdStrike’s near-term prospects?

That’s a really difficult question. But just how important is the very near term for CrowdStrike?

Profitability Profile, Mind the GAAP?

CrowdStrike, like nearly all fast-growing tech companies, has a gap of approximately 25,000 basis points between its GAAP and non-GAAP earnings.

On the one hand, the stock is fairly non-GAAP profitable. In fact, I suspect that CrowdStrike’s non-GAAP operating margins will be in the high teens. On the other hand, on a GAAP basis, its operating margins will probably be negative high single digits.

How much of a concern is it that there’s such a wide gap due to stock-based compensation?

For investors, it’s bad enough that the macro environment is challenging. But when you combine that with investors actively looking under the hood and questioning a company’s stock-based compensation, investors are left with a sour taste in their mouth.

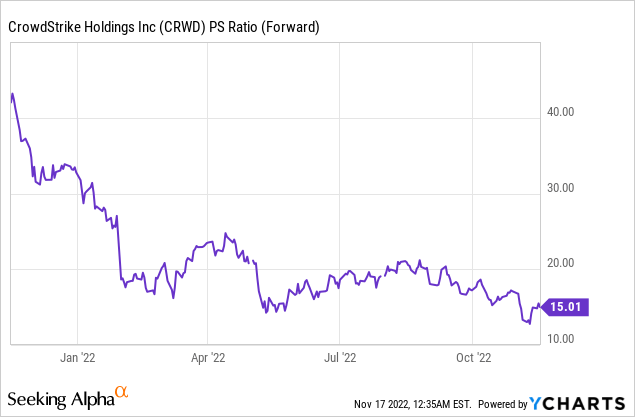

CRWD Stock Valuation — One Must Look Out

The graphic above is a reminder of how much CrowdStrike’s multiple has been compressed. It’s incredible how far the multiple has compressed.

However, the way I would look at an investment in CrowdStrike is that if I look out over 3 or 4 years, this stock is going to be priced at 30x non-GAAP EPS. I’ll have to wait a few years for CrowdStrike to reach approximately $5.00 of GAAP EPS, but that time will come.

And again, as I’ve stated already, cybersecurity is a secular growth sector. The only question that we are struggling to fundamentally answer is what does the very near-term look like?

In other words, in the long-term most would agree that CrowdStrike will be just fine. It’s just that the very near-term outlook is slightly unclear.

The Bottom Line

CrowdStike has always been a crowd favorite amongst investors. Investors have given CrowdStrike plenty of room to continue investing for growth, without asking difficult questions. Why? Because investors didn’t have to.

But now, as investors are about to wrap up 2022, and investors are looking to prune their portfolio to start 2023 with a ”fresh” portfolio, and put in the rearview mirror investments that went sour, will CrowdStrike remain a crowd favorite?

Having been through a few stock market cycles myself now, I’m increasingly confident to say that value investing does work, and buying high-quality businesses does make sense. It’s just that you may not get rewarded for a really long time.

And it’s easy to say that one is a buy-and-hold investor when stocks are going up. But when crunch time comes and crunch times sticks around for a really long time, that’s when the real crunch test emerges.

For my part, I believe that CrowdStrike’s risk-reward is positively skewed. It’s just that investors have patience when it’s not needed. And no patience when it’s needed.

Be the first to comment