yuelan

Since our no-go rating on Credit Suisse (NYSE:CS), the bank announced two additional profit warnings and another change at the top. As already mentioned, the new CEO is coming from the bank’s asset management segment and is a clear message to understand where Credit Suisse is heading in the short and medium long-term horizon. Following a piece of news from Reuters, the Swiss bank is considering cutting around 5,000 jobs or 10% of its total workforce. This potential restructuring process underscores Credit Suisse’s ongoing challenges that the new CEO Ulrich Koerner is facing as he is trying to get the bank back on track after a series of scandals.

Ongoing Restructuring? We don’t think so.

The bank did not comment on the Reuters news but reiterated that it would provide an update on the corporate strategy along with the third-quarter results, branding any news on the matter as “speculative“. As defined by the bank, “2022 was a year of transition“, which has made a change in management, a restructuring to reduce risk-taking in investment banking, and a strengthening of the bank’s wealth management division. The market is now waiting for the Q3 performance to understand the CS’s financial conditions given the fact that the bank is rejecting any M&A hypothesis.

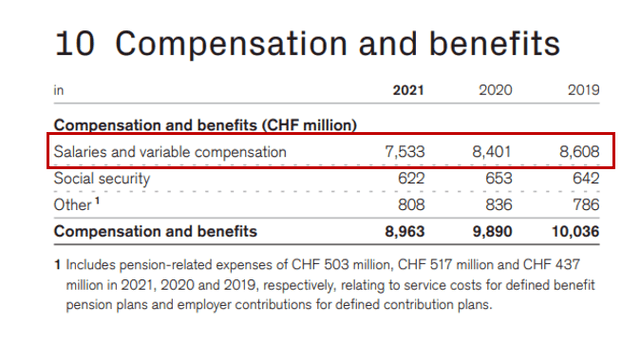

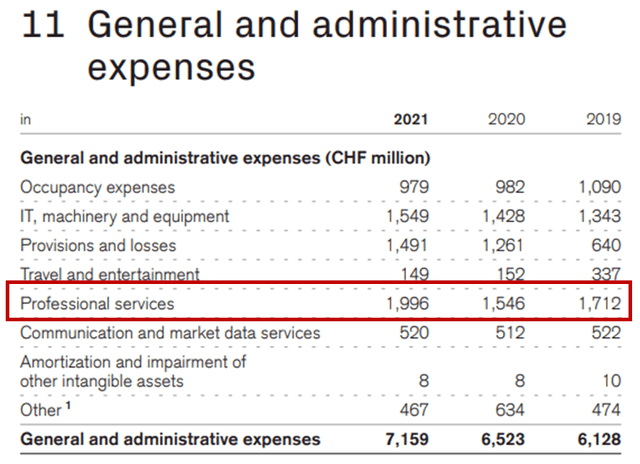

Moreover, Credit Suisse has anticipated its plans to cut costs to below CHF 15.5 billion over the medium term versus the CHF 16.8 billion annually expected this year. If we are looking at the P&L performance over the last three years, the picture is not positive. On one hand, at first glance, the Swiss bank seems to be in line to reduce salaries & comps package, whereas, on the other hand, SG&A expenses continue to increase. Why? Credit Suisse is officially reducing its workforce (and the total expenditure), but in the meantime is increasing the number of its external contractor’s employees (with higher SG&A expense due to an increase in professional services).

Credit Suisse total salaries Credit Suisse SG&A expense

China Opportunity

One of the first CEO decisions was to move forward with the Chinese wealth management division. In an interview with Reuters, “despite all the rumors, China is a long-term goal for us” assured Benjamin Cavalli who leads CS’s wealth management business in the Asia-Pacific region. He explained that the debut in China will take place as soon as the group has obtained full ownership of the Chinese JV Credit Suisse Securities, which is expected by the first quarter of 2023. The group has already made 50 ad hoc hires. The executive of the Swiss bank stressed the enormous potential of the wealth management sector represented by the world’s second-largest economy. Indeed, according to official estimates from last June, the Chinese wealth management market is worth 29 trillion yuan, or 4.2 trillion dollars and is currently dominated by Chinese banks.

Conclusion and Valuation

Aside from the China show-me story, the reality is that the bank’s net revenue lines were flat in the period between 2019 and 2021 while total operating expenses increased to CHF 19 billion from CHF 17.4 billion. With this current inflation and future expectation, our internal team finds it hard to believe that Credit Suisse will manage to reduce its internal costs in such a short period of time. In Q2, we reported that: “CS’s cost base should be reduced to less than CHF 15.5 billion over the medium term from the CHF 16.5-17.0 previously, but it is unclear how this will be done”. We cannot foresee a major restructuring plan but this will probably happen. No title was less effective than this one: Valuation Is Less Important Than Earnings. We continue to favor other names in the sector: ISP and Credit Agricole in particular.

Be the first to comment