morgan23

Sometimes it helps to take a look at a couple of companies in the same sector together. We’ll examine superstar retailers Crocs and Arhaus on some critical criteria for evaluating retail stocks: Growth Strategy, Management Team, Margins, Valuation, Weaknesses, and the Bear in the Closet.

Crocs, Inc. (NASDAQ:CROX) Crocs’ signature Clog, customized with small “Jibbitz.”

Crocs clogs with charms (Crocs )

Crocs Growth Strategy and Results

When it comes to expansion, Crocs has plenty of room thanks to being in the $380b TAM (total addressable market) footwear market, projected to grow to $440b by 2026. Currently, 71% of Crocs’ revenue comes from inside the United States, allowing space to expand overseas. It is also hard not to mention China, the second largest footwear market behind the United States. There are a lot of feet in China, and Crocs has less than 5% of its revenue currently coming from China (Crocs investor presentation). The company’s goal to double revenues in China looks realistic and could be an excellent opportunity. This piece of the growth plan is best summed up by CEO Andrew Rees in the Q2 22 investor call:

“Crocs has significant penetration opportunities in key international markets…our proven playbook is driving growth in South Korea, India, and Southeast Asia and we are very encouraged by the green shoots we are seeing in China.”

Crocs’ revenue growth print for Q2 was 56% on a constant currency basis.

However, a lot of that growth was from HEYDUDE. If we deduct $232m in HEYDUDE sales in the quarter from the total, we get a Crocs’ branded growth rate of 14.3%. Still good, but not crazy. That was despite a flat environment overall in the U.S., though, according to Crocs management on the Q2 call, which means that Crocs brand took share.

So now, the Crocs/HEYDUDE revenue split is around 75/25 with HEYDUDE growing gangbusters and Crocs doing mid-teens. This leads us to a pro-forma revenue growth estimate of around 20% for 2022. Growth for pretax income we put at a less impressive 12.5% due to the huge increase in interest expense from HEYDUDE acquisition debt and the lower margin HEYDUDE business.

Marketing, Branding and Advertising

To go along with this plan for global expansion, Crocs will need a strong marketing campaign to gain exposure, something management has plenty of experience doing in the past. Crocs’ inventive marketing campaigns are to credit for the company’s overall growth since 2017 and show no signs of slowing down. Past marketing strategies have included partnering with fashion brand Balenciaga, getting promotions from rappers such as Post Malone, putting Crocs in the extremely popular video game series NBA 2K, and even donating over 800,000 pairs of shoes to health care workers around the world during the Covid pandemic to increase global visibility. In order to further global exposure, Crocs is partnering with a diverse group of popular brands all over the globe, including designer “Salehe Bembury to Cinnamon Toast Crunch Cereal, to MCM in China and Lazy Oaf in Europe” (Q2 22 investor presentation).

With partnerships ranging from cereal to designer bags, Crocs really has set itself up for plenty of new customer exposure. It’s also important to note that Crocs plans to increase digital penetration to 50% by 2026. One notable strategy is from the Metaverse, a popular virtual reality world, where Crocs opened a virtual store with celebrity rapper Saweetie as a promoter.

Crocs Acquisition of HEYDUDE

HEYDUDE also brings the opportunity for a new marketing campaign, as Crocs has somewhat rebranded the shoe company to a more accessible product for the everyday individual. HEYDUDE was not a dud in the mud before the acquisition, bringing with it a reputation for robust sell-through at retail, significant free cash flow, rapid revenue growth, and 40% of sales from online sources. We think it was an excellent pickup (albeit expensive), and it fits very nicely with the Crocs brand.

I’ll say from experience that I love my HEYDUDE shoes. They are light and comfortable, are excellent for travel, and I can wear them to almost any function. Not having to tie my Dudes is an added bonus. I have a friend that sails who swears by them. And the guy pressure washed my house the other day had on a pair and told me he buys a new pair every other month. They are his throwaway shoe. I purchased mine on Amazon because I liked a particular style listed there that was unavailable on the HEYDUDE site. I have been hounded by HEYDUDE banner ads ever since and occasionally find my attention diverted to one or another of their new designs. I think this brand has legs.

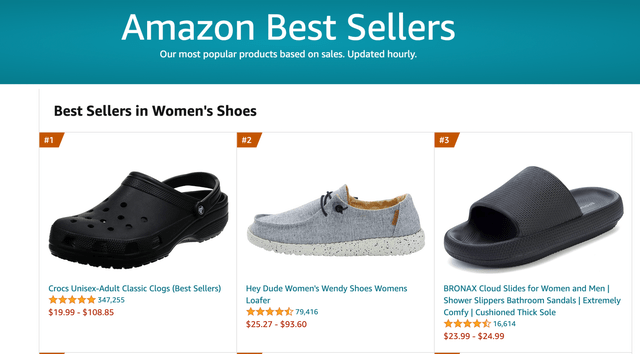

Crocs’ marketing team is insanely efficient at online marketing. Take a look at the best sellers list in footwear on Amazon and you’ll see that Crocs completely dominates the field. For both men and women, the Crocs’ clog is the number one best sold shoe. HEYDUDE, meanwhile has climbed to second for women and 4th for men. Additionally, Crocs/HEYDUDE has 7 more products in the top 20 for footwear, meaning that nearly half (9/20) of the most popular shoes sold on Amazon are owned by Crocs.

Amazon Bestsellers Screenshot (Amazon.com)

Management

While many questioned the purchase of HEYDUDE for $2.5b, Crocs’ management has shown how competent they are, and the share price has responded. CEO Rees took over as CEO in June 2017 and the stock is up 10X since then even after the pullback this year. Chief Marketing Officer Heidi Cooley has been there for nearly the same period, and Chief Digital Officer Adam Michaels has been there 9 years and leads a 200-person technology team. From what can be gathered from Crocs’ investor presentations, the management team is continuing to push growth in an innovative way, giving us confidence that with the acquisition of HEYDUDE and an ever-expanding global market, the management at Crocs will be able to continue to grow their product’s popularity and reach at an accelerated pace.

Early measuring of management’s acquisitions of HEYDUDE appears promising. The original goal of building HEYDUDE to a $1b brand by 2024 looks like it will be met immediately as revenue in Q2/2022 alone was $232m – almost double the previous year’s sales. HEYDUDE is a hot brand now in the U.S. and is taking share. This is a testament to management’s capital allocation success in our opinion. Being able to diversify away from the Crocs brand in case it cools, while using the same successful digital marketing strategies on the HEYDUDE brand look brilliant to us.

As mentioned above, we believe management has built an excellent marketing team.

Margins

Crocs has been able to maintain best in class 30% operating margins in an inflationary environment. They have proven their ability to push price when needed though we do think there is a near term limit to how far that can go. Margins on the Crocs branded product look much better than HEYDUDE at the moment and have been a major strength of the company. In Q2 2021, gross margins were a superb 62%, while in Q2 2022, they dropped to 52% when including the HEYDUDE acquisition. We believe management will be able to drive out some costs in the production of HEYDUDE shoes as they are clearly not as profitable as Crocs despite a much higher average price point.

Weaknesses and Concerns

- Crocs has significant challenges as a global retailer. Currency is a headwind, as is the war in Ukraine and China’s Covid-19 policy.

- The following comment by Andrew Rees in the Q2 earnings call shows some caution on the macro environment:

“With uncertainty around the future macroeconomic environment and consumer behavior, we are planning for lower growth in the Crocs Brand in the short-term. Our assumption is that consumer confidence in the U.S. and key European markets will continue to soften as the year progresses, as higher interest rates and high food and energy inflation slow consumption.”

- Next, it occurs to us that the same thing that assisted in driving crazy success in 2021 (liquidity dumped into the marketplace by the federal govt) will not only be absent, but liquidity will also be declining to some degree with quantitative tightening.

- There is a negative flip side to the HEYDUDE acquisition’s success: Debt. Interest expense rose dramatically to $33m in the latest quarter from $4.7m a year earlier. This caused income before tax to increase by only 12.4%. Company long-term debt is $2.7b, which is a chunk for a $4.8b market cap company. The additional debt will cause the share price to drop precipitously in the case of any margin problems or degradation of the growth picture.

- Like most companies, Crocs has been affected by supply chain issues. Crocs manufacture its shoes outside of the United States, with major production centers in China and Vietnam, two countries where production has been halted greatly by the Covid-19 pandemic. While Crocs has recently opened new factories in Indonesia and other nations, rising fuel prices and covid-19-related delays are still a great concern for the company.

The Bear in the Closet

I’m going to print the word that makes the Crocs team and fans of the shares shutter: Fad. CROX stock price hit $75 Nov. 1, 2007 after a 7-bagger run up from mid-2006. It can go really fast really big when it gets hot. And then it crashed 98% in 2008 to a buck and change (yes, you read that right, 98%!). So, we have to consider if the current demand is fad-driven and, if that’s the case, how bad will the next crash be? Some foresight into fashion trends is critical. Consumer confidence has recently hit lows not seen since the financial crisis. All this is to us what makes the HEYDUDE acquisition prescient. Growth in a hot new brand is likely to somewhat cushion a Crocs fad bust. But in general, a drop in popularity is what Crocs cannot afford.

Valuation

Management still targets $5b in Crocs brand sales by 2026 per the investor presentation.

Adjusted diluted EPS is projected by the CFO at $9.50 to $10.30. This would suggest an approximate 8X P/E at the midpoint despite a 98% rise in the share price from June 2022 lows. GAAP earnings appear to echo that P/E after Q2s $160m in after-tax income. Of course, there is no tangible book value after the HEYDUDE acquisition. Price/Sales ratio is a very reasonable 1.26X.

Given our conservative forward estimated GAAP diluted earnings growth rate of 12.5% vs. an 8X P/E multiple, we would assign a buy rating on the stock if evaluating strictly on valuation.

Summary Crocs

Crocs is a riskier yet better diversified company with the acquisition of HEYDUDE. We like management and believe in their abilities, especially their marketing expertise. The valuation is excellent on a present and go forward basis. Growth opportunities for international expansion and HEYDUDE are significant. There are opportunities with synergies and increased margins at HEYDUDE. Yet, the drawbacks are significant. Those profits could disappear quickly with a drop in popularity. Looking at what happened to the company and share price going into the great recession is not comforting. Some of our hesitance with this stock rests with the belief that we are not over this current/future recession. “Don’t fight the Fed,” is one phrase that lingers in our minds. Does the market being down a mere 10% from its peak make sense in the face of: 1) a prior bubble in valuation; 2) the end and reversal of decade long quantitative easing; 3) higher and rising interest rates; and 4) high oil prices and inflation, not to mention supply chain issues and wars.

Given all of that, we like adding shares in small increments at lower prices as long as the fundamental picture holds. Any negative changes in popularity, particularly in the U.S. are a clear sign to dump the stock.

Arhaus, Inc. (NASDAQ:ARHS)

Founded in Ohio in 1986, Arhaus is a retailer focused on providing upscale quality furniture for middle to upper-class families. Since its first store in Cleveland, the furniture retailer has steadily expanded, boasting 80 stores and two massive distribution centers across the United States. Similar to Crocs, Arhaus got new management in 2017 in the form of CEO John Reed, a co-founder of the company who has since facilitated the expansion of the company. That includes this past November when Arhaus went public to raise money with a company valuation of 1.75 billion and an initial stock price of around $13. Arhaus shares were down dramatically to between $6 and $8 before popping by around 50% since posting Q2 results that blew out estimates. The end of the 2nd quarter marked the end of the companies third as a public company.

Arhaus.com |

Growth Strategy and Results

While the furniture market is massive as a whole in the U.S. ($340 billion), it is much smaller for the fragmented upscale furniture that Arhaus sells ($60 billion).

In Q2, 2022 Arhaus showed dynamic growth, exceeding GAAP EPS estimates by .18 in delivering .27. Top line growth was 66% YoY. Adjusted EBITDA increased 76%. That delivery was on top of really strong numbers in Q2 of 2021

The company was successful in resolving many of its supply chain headaches in the past two quarters. CEO John Reed commented on this in their Q1 report, stating that “Net revenue and comparable growth were driven by the investments we are making to ensure faster and more efficient delivery of the product to our clients and our improving supply chain.” The company distribution center in North Carolina had an opening that was “better than expected,” and made a part of this contribution.

Arhaus CEO Reed has had a focus on expansion since taking over in 2017. He has planned on opening 5-7 new showrooms each year, a promise he kept the past two years and appears to be in motion for years to come. To aid these new locations and to help the company expand in the western part of the country, he is building a third distribution center in Texas, which will be 800,000 sq. ft. in size and allow a seamless expansion for the company.

The company’s offerings are clearly resonating with consumers and the new fall collection Arhaus Home hits soon:

“From the beauty of our materials to the handcrafted artisan designed with our furniture and décor, we believe our product is truly special within the market, and clients seem to be agreeing. Our Style issue catalog will arrive in our clients’ home and our new products will be in the showrooms by the end of August.” CEO Reed.

Revenue guidance was increased to 45% growth for the year in the Q2 report.

One competitive advantage barely mentioned is the fact that half of the company’s product is produced in the U.S. This from the CEO:

“But again, half of our product also is made in United States. So again, that (high transport costs) hasn’t hit us as much as a lot of our competitors who had had to raise prices more because most of their things are imported. And so they may have taken more as a percent than we have, but we haven’t needed to because half of our products are here in the U.S.”

Lastly, the company will open 10 to 14 new stores cumulatively in 2022 and 2023 or an increase of 15% total or 7.5% annualized.

Image of a new Arhaus showroom (Arhaus.com)

Management Team

CEO Reed has lots of experience with the company as a co-founder in 1986. This stint as CEO started in 2017. The CFO since 2019, Dawn Philipson seems sharp to us. Overall, the management team appears competent with seven important leadership positions.

In May several top officers purchased shares from $5.50 to $6.20. They included CEO John Reed, CFO Dawn Philipson, Chief Merchandising Officer

Margins

Margins appear surprisingly healthy with gross margins rising slightly to 43% in Q2. Operating margins are a bit slim at 16.3% but should continue to improve as the company grows and improves its cost structure. Notably, that 16.3% ops margin compares with 4.6% in the year earlier period – quite an improvement.

Weaknesses

- The company is clicking on all cylinders operationally. A recession would put a dent in demand though the company has invested in and grown through past recessions. With no long-term debt and lots of cash, there is little existential threat from a recession.

- Higher and rising mortgage rates could tamp demand as less people purchase homes.

- One major concern of Arhaus is its poor reliability and customer service and associated online reviews. Our experience ordering product a couple years was not satisfactory. The furniture had to be shipped back and replaced twice due to damage before it even arrived. Although the table was in perfect condition the third time and it has been great for the past two years, it was a major hassle getting it. From reading reviews online, we are not alone as many have faced furniture both damaged and missing pieces. Though most reviews are happy with the eventual quality of their furniture, the consensus seems to be that Arhaus has subpar and unknowledgeable customer service. Not only does this lead to customers not re-ordering from the company due to the hassle, but also high operation costs with the constant wasted products and transportation. Maybe the company has addressed most of these issues recently and that’s one reason for the increase in sales as inventory and labor catches up, post pandemic.

The Bear in the Closet

We’ve had an incredible housing boom since covid-19. Is it a bubble? Real estate values in certain parts of the country certainly feel like it. Higher mortgage rates combined with quantitative tightening could further cool the housing market and cause a decline in prices. We can’t envision a positive scenario for a furniture company if home prices decline and we think there is a real possibility of it. After all, if quantitative easing is responsible for huge asset price increases, wouldn’t quantitative tightening cause an inverse reaction?

Valuation

Guidance was updated and increased during the latest Q2 earnings report to include earnings estimates of $95m for the year. At today’s market cap of $1.24b that puts this year’s P/E at 13X. Full year analyst estimates for 2023 are .78 vs. 2022’s .68. With Q2 EPS of .26 analysts are either skeptical or have not yet caught up with the latest earnings print. We don’t see anything in the report that would suggest they company could not earn $1 in EPS this year. That puts the P/E at today’s 9.26 at 9X. And we should increase that estimate to $1.2 for next year based on the new Dallas distribution center and new store openings. That’s an extremely attractive forward P/E of 7.7X.

It’s worth mentioning positive tangible book value of $123m with $144m of cash with no long-term debt.

Summary/Other Considerations – Arhaus

As a couple of analysts on the Q2 call pointed out, Arhaus, “somewhat bucked the trend,” in sales and earnings results in Q2. How did they do it? What’s the secret sauce? The housing market cooled for sure. Other retailers struggled. Some of the increase could have been supply constrained catchup. Maybe it’s the trades program paying dividends, designers and real estate professionals referring business? We did a word search for “secret,” on the Q2 earnings transcript and found the following paragraph from Jennifer Porter, Chief Marketing Officer:

“I think we are seeing our product content and storytelling really engaged a lot of the AI-assisted merchandising capabilities and the ability to share specific content with clients has been working really well. I’m not going to get into too many more specifics there, because I don’t want to give away all of our secrets.”

I think the marketing strategy is part of it. We also believe there is a niche Arhaus is filling, premium quality but not outrageously expensive. With half the product made in the U.S. there is a shipping/supply advantage here. I visited a store in Atlanta and the service was spot on. The design consultant I spoke with knew his stuff, and explained that employees of Arhaus are not just minimum wage sales clerks, the more they sell the more they make. The showroom looked great and held a prime spot at Phipps Plaza mall. The other store in Atlanta is at the extremely hot Avalon outdoor mall in Alpharetta, so that leads me to echo one of the comments John Reed made, that the company is really focusing on locations and either renovating or moving stores that are not up to standard.

Conclusion, Crocs vs. Arhaus

Crocs and Arhaus are two promising retail stocks that can currently be purchased at low P/E ratios. But are earnings unrealistically elevated? Both companies have competitive strengths. Crocs has its HEYDUDE brand acquisition growth trajectory and stellar online marketing expertise. Arhaus has a combination of online/web site marketing, showroom location selection, increasing distribution capability, consultant compensation structure, and quality/value proposition niche.

Both companies have plenty of room to grow in their respective markets.

Given the current economic environment mentioned several times in this piece, we put a hold rating on both stocks. Alternatively, accumulate a small position over time. In either case, be ready to pounce on both equities if current fundamentals prevail and there is a recessionary down market. Both have high quality prospects.

If someone put a gun to my head and said, which would you choose to purchase now. First, I would say, “get that gun away from my head!” Then I would say Arhaus, due to what I feel will be better performance in and around a potential recession due to having no debt and plenty of cash, and having invested for growth through previous recessions. I also believe the company is earlier in its growth path. In our opinion, the possible end of the current fad in Crocs and the company’s high debt are potential share-value destroyers here.

Be the first to comment