raisbeckfoto

Thesis

At an EV/EBIT of about x10, I like the risk reward of investing in Cisco Systems, Inc. (NASDAQ:CSCO) stock. The company is likely to maintain a leading competitive position in the market for networking services, while business model innovation and new software products are on track to drive topline expansion. Moreover, the fact that Cisco has consistently beaten earnings estimates for the past few quarters indicates that analysts’ expectations are still lagging the company’s performance. I value Cisco stock with a residual earnings model, anchored on analyst EPS consensus estimates and see almost 50% upside. My target price is $71.58/share.

Cisco has underperformed the market YTD, being down approximately 23% versus a loss of 12% for the S&P 500. Accordingly, investors might regard Cisco’s current trading price as an attractive entry point.

About Cisco

Cisco Systems, Inc. is a leading information technology and networking services conglomerate. The company offers a diversified portfolio of network infrastructure products and services, enterprise network security, software development, data collaboration and cloud computing, amongst others. As of mid-2022, Cisco operates 6 key segments: Secure and Agile Networks with about 46%of sales, Hybrid Work with 9%, Security with approximately 7%, Internet of the Future with nearly 9%, Application Experiences with slightly more than 1%, and General Services with about 28%. Cisco is primarily focused on customers located in the United States.

Investment Opportunity

For fiscal 2023, which for Cisco started with the September quarter, Cisco is likely on track to deliver a 5-6% topline expansion, reaching an estimated $54 of total revenues. Notably, this is about 3 percentage points higher than what has been estimated by analyst consensus, highlighting that sell-side IB’s are still lagging the company’s performance. Resilient sales growth is likely supported by strong enterprise IT investments, as modernizing network systems and accelerating digitalization efforts remains a key priority for U.S.’ companies. At the same time, I believe Cisco will likely transition more and more towards a higher-margin SaaS (software as a service) portfolio based on modular software services. For reference, software now accounts for more than 30% of the company’s revenues, of which 80% are accountable to recurring subscription services.

Strong Financials

Despite the very challenging macro-economic backdrop, that needs not further explanation to Seeking Alpha readers, Cisco has performed very well. For the trailing twelve months, Cisco grew revenues at 3.5% to $51.6 billion, which reflects a stronger growth rate than nominal GDP. Even more notable is the company’s profitability. Despite inflationary pressures, Cisco defended a 62.6% gross profit margin and a 23% net-income margin, generating $32.3 billion of gross profit and $11.9 billion of net-income respectively ($2.84 per share). Cash from operations was $13.2 billion (TTM reference).

Cisco ended the June quarter with $19.3 billion of cash and cash equivalents, including short term investments and $9.5 billion of total debt. Accordingly, Cisco’s implied 3% dividend yield should be more than sustainable, and the company’s net cash position should support considerable M&A opportunity. If an investor estimates x5 gross leverage as acceptable, Cisco could claim a M&A war chest of greater than $55 billion.

Residual Earnings Valuation

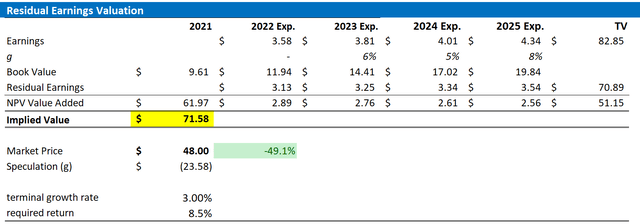

Let us now look at the valuation. What could be a fair per-share value for Cisco’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on the consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise.

- To estimate the capital charge, I anchor on Cisco’s cost of equity at 8.5%.

- To derive Cisco’s tax rate, I extrapolate the 3-year average effective tax rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3.0%, which I argue is in line with nominal GDP growth expectations, but below CSCO historical growth track record as I like to be conservative in my assumptions.

Based on the above assumptions, my calculation returns a base-case target price for Cisco of $71.58/share, implying that CSCO could be almost 50% undervalued.

Analyst Consensus EPS; Author’s Calculation

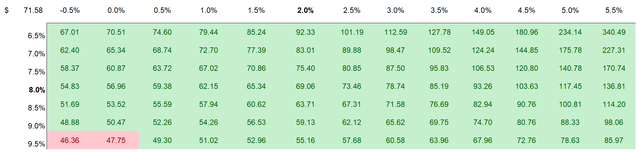

I understand that investors might have different assumptions with regards to Cisco’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks

Cisco is arguably relatively low risk given the company’s valuation discount paired with non-cyclical exposure to IT infrastructure and enterprise digitalization. Moreover, the company has proven earnings resiliency even in challenging macro-environments, which is anchored strong profitability metrics and a competitive moat.

That said, short-term downside risks could be general volatility in the financial markets and the prospect of a sharp recession. As potentially long-term risks I have identified non-strategic/non-economic M&A activity and structurally changing market trends–such as IT innovation.

Conclusion

In my opinion, Cisco’s valuation is lagging the company’s transformation towards a more-subscription-based technology company. Notably, the company’s x10 P/E implies a discount of more than 30% to the sector median, which is not justified in my opinion. Accordingly, I see an attractive risk/reward opportunity and I personally calculate nearly 50% upside based on a residual earnings valuation model.

Be the first to comment