You’re going to name a recession after me? I wanted to be lionized for raising rates while the market handled inflation.

Drew Angerer

The Federal Reserve has chosen to emphasize a new goal, which is not one of their mandates.

During a recent presentation, Chairman Jerome Powell said:

… you want to be at a place where real rates are positive across the entire yield curve.

That’s a problem, because that’s absolutely not one of the mandates of the Federal Reserve. That’s not even relevant to their task. Let me be absolutely clear:

- The Federal Reserve’s role is not to create real positive yields.

They are tasked with maintaining price stability (which they can’t do here) and maximizing long-term employment (in the interest of improving real GDP growth rates). Neither of those goals says that real rates must be (or even “should be”) positive across the entire yield curve.

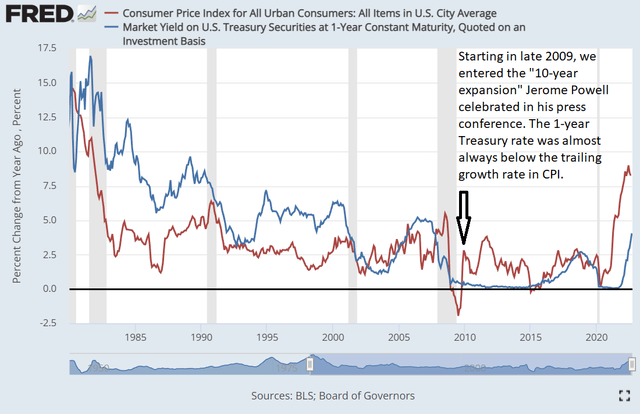

If we look at the last 43 years, we can see that the market yield on the 1-year Treasury was above inflation in the 80s and 90s, but after the great recession there has only been a few months where the 1-year Treasury yield was above the trailing CPI growth rate:

BLS, Board of Governors, Fred

Jerome Powell highlighted the 10-year expansion as a success of having low inflation:

… that’s not an accident so when inflation is low and stable, you can have these 9, 10, 11, 10 year, anyway, expansions…

It’s a quote. Don’t blame me for the phrasing. That comes from the official transcript.

Yet Chairman Powell ignored that the 10-year expansion happened with only a few months where 1-year Treasury yield was above the trailing change in CPI.

We could use forward changes in CPI (for precision), but the results would be so similar it would be a waste of time. It’s literally just shifting one line over a fraction of an inch. We don’t need time wasted. We need greater productivity.

It should concern investors when the chairman of the Federal Reserve is focusing on creating a metric (positive real yields across the entire yield curve) that’s not one of their responsibilities. It should concern them that this glorified metric is one which rarely occurred throughout the expansionary decade.

It should concern them, and yet many people identify with the premise that real yields “should be” positive. That modest real returns should be achieved even with zero risk. That’s making a qualitative decision, not an economic one.

Negative Real Rates

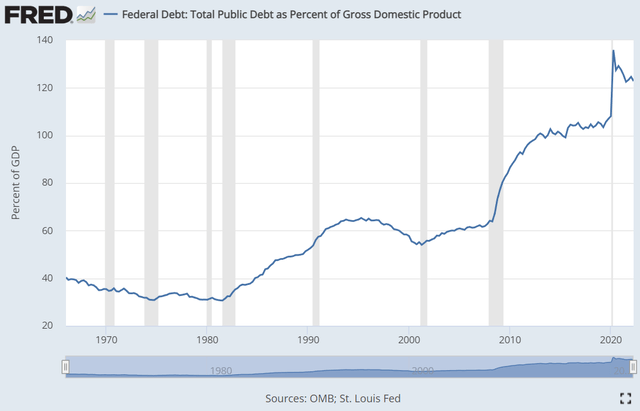

Total public debt as a percentage of GDP is running over 120%:

OMB, FRED

That’s not good. However, negative real rates can be very powerful.

If the inflation is 4% and GDP growth was 6%, then real GDP would grow by 2% (rounded). However, if the budget was balanced (income = expenses), the ratio of debt to GDP would fall materially. GDP would be up 6% while debt would be flat. To be clear, the national deficit hardly ever declines. It’s only happened a few years across several decades, and even then, it barely declined. Reductions in the chart above were driven by GDP growth exceeding deficit growth.

If the interest rate on rolling over debts climbs significantly, it becomes dramatically harder to reach that balanced budget. Higher rates create more mandatory spending because the interest must be paid.

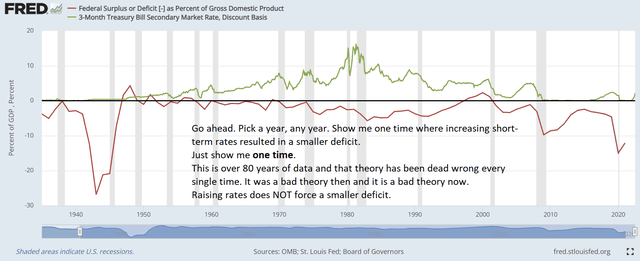

I know some people believe that raising rates will “force” the government to reduce deficit spending. Sounds good, right? They think we can just spank the government with higher rates and that will solve things. It has never worked. Never. In more than 80 years, raising rates has never reduced the deficit:

OMB, FRED

Higher Rates and Debt

At the end of 2021, federal debt held by the public was at $22.284 trillion. You can verify that using data from the CBO. Go to “Historical Budget Data” and pull the May 2022 document.

Despite the massive amount of federal debt, the net interest expense was only $352.3 million. That suggests an average interest rate around 1.6%. The last time the implied rate (net interest expense divided by federal debt held by the public) was above 4% was in 2008.

Why 4%? Because the Federal Reserve thinks they should be going above 4%.

If the average rate on debt rose to 4% as expiring debts are rolled over, it would increase the net interest expense by about $539 billion per year.

We could go deeper into this topic, but I think it’s more important that investors firmly grip these core aspects.

Raising rates has the following impacts:

- The interest expense for decades is increased, raising future deficits.

- Investment in new capacity is discouraged. For instance, home buyers backing out of deals leading to less new housing.

- Currency is strengthened, making imports more competitive and exports less competitive. That’s a double-edged sword.

- The economy is weakened, driving up unemployment leading to less production and greater deficits (unemployment and other programs).

- There’s some reduction in demand, as the weaker economy reduces income. However, due to lower production, a smaller pie is being split.

Raising rates does not:

- Prevent new deficit spending. Not now. Not ever. It doesn’t work. Stop anyone who tries to claim it will work. They’ve been wrong for 80 years. Their credibility is trash.

Powell’s Dream

Chairman Powell’s dream of positive real rates across the yield curve is severely damaging the economy for years to come. These actions will add at least hundreds of billions, but trillions if the rates are maintained, to the federal debt over the coming decades. An extra $539 billion per year adds up pretty fast. The expense will show up in the field called “Net Interest Expense” and it’s just one of the lingering costs of Powell’s dream.

Since this recession is being strengthened by Powell’s dream, it only feels right to name it after him. This is Powell’s Recession.

Damage Achieved

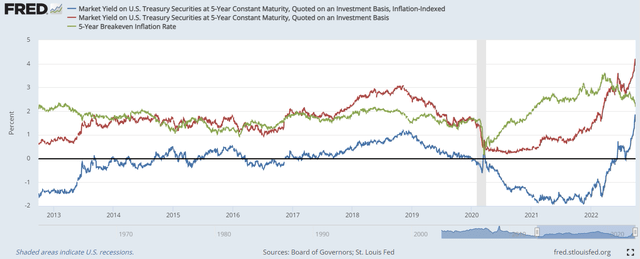

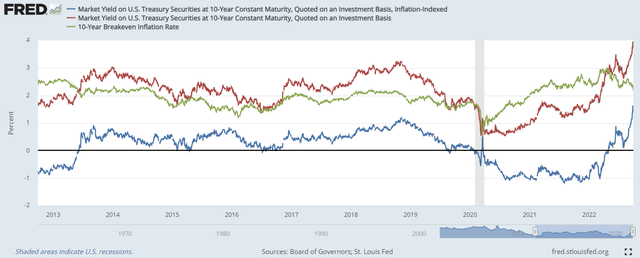

By hiking rates repeatedly, the Federal Reserve has convinced the market that it intends to create positive real rates. How can we tell? Because the yield on TIPS (Treasury Inflation Protected Securities) is right around the highest level seen in a decade for both 5-year and 10-year TIPS. The yield on 5-year TIPS is higher than any time in the last decade:

FRED

However, you can also see that the 5-year breakeven inflation rate is around 2.18%. The market prediction doesn’t call for inflation to be running particularly high. Certainly not compared to prior comments that a 3% average inflation rate might be acceptable when it was under 2% in some prior years.

The 10-year TIPS yield is also higher than at any prior point in the last decade.

FRED

Why Does Everyone Say Higher Are Good?

Do you get your macroeconomic view from Bank of America?

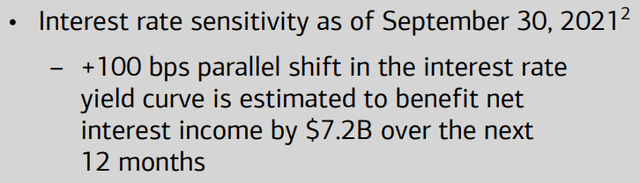

Here’s the reason they believed higher rates would be so great:

Bank of America Q3 2021 Investor Presentation

Changes things a little bit, doesn’t it? They had 7.2 billion reasons to convince Americans that higher rates would be great. Does it feel great right now?

Will Inflation Ever End

Yes. Primarily due to increases in supply. That’s usually how inflation is solved. However, by raising rates today (before the market solves inflation), Powell can claim credit for inflation ending and seek to cement a legacy as the genius that ended inflation. That sounds better than being the man who prolonged a recession and added trillions to the federal debt.

Be the first to comment