lamyai

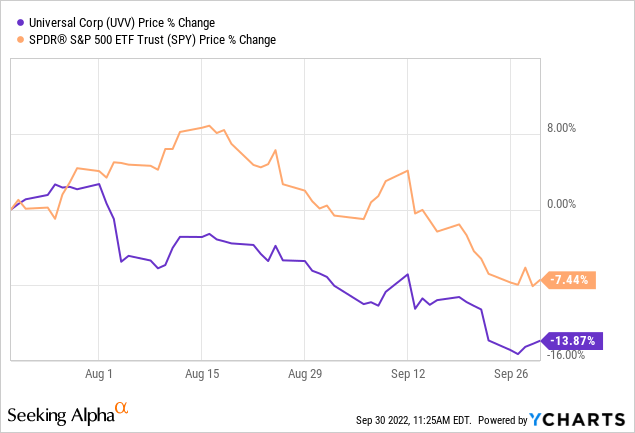

In July, 2022, we have published an article on Universal Corporation (NYSE:UVV), titled: “Universal Corp. could be an attractive buy for dividend investors.” In that article, we looked at several factors that indicated that the tobacco-supplier company’s stock could turn out to be a winner in the current macroeconomic environment. We concluded our analysis with a “buy” rating, because of the following reasons:

- The stock has performed historically well, during times of low consumer confidence

- The firm has a strong track record of paying a safe and sustainable quarterly dividend

- The company appeared to be fairly valued according to the Gordon Growth Model.

Since our last writing, UVV’s stock price has substantially fallen.

Today, we will provide an updated view on UVV, taking the latest earnings reports and macroeconomic developments into account.

Second quarter earnings results

The macroeconomic environment remains challenging, not only for UVV, but for most firms. Elevated raw material prices and freight costs combined with supply chain constraints are often the primary drivers of cost increases. UVV has not been an exception from this in the second quarter.

[…] we continued to effectively navigate increased costs, particularly rising prices for green leaf tobacco, and shipping constraints.

Despite these continuing challenges, the firm performed relatively well in the quarter.

Demand for leaf tobacco has stayed high, and flue-cured, burley, oriental, and wrapper tobacco have continued to be in an undersupply position during the second quarter.

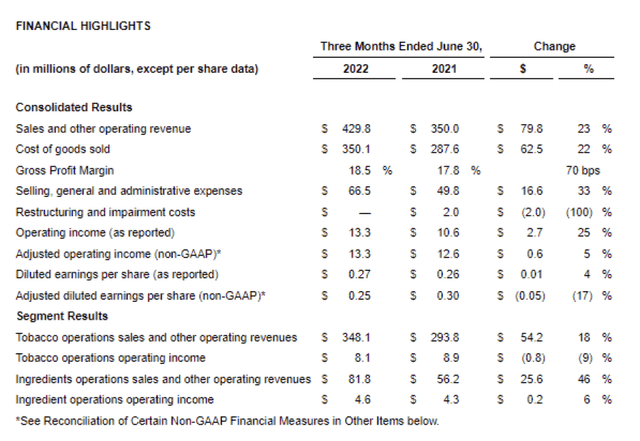

Consolidated revenues increased by $79.8 million to $429.8 million for the three months ended June 30, 2022, compared to the same period in fiscal year 2022, on higher carryover tobacco sales volumes and prices as well as the addition of Shank’s in October 2021 in the Ingredients Operations segment.

In the current market environment, we prefer to invest in companies that sell goods and services, which show demand inelasticity. UVV is one of these firms, as the demand for their products remains high despite the extremely low consumer confidence levels.

Further, the firm is anticipating that the market is likely to get even tighter for African burley tobacco, as severe weather conditions have significantly impacted the crop sizes in Africa during the year. The unfavorable FX environment, and the above-mentioned macroeconomic headwinds, however, have caused a slight decline in the tobacco operations segment’s operating income.

Tobacco Operations segment results were down largely on unfavorable foreign currency comparisons due to the strong U.S. dollar in the quarter ended June 30, 2022. […] Selling, general, and administrative expenses for the Tobacco Operations segment were higher in the quarter ended June 30, 2022, compared to June 30, 2021, primarily on unfavorable foreign currency comparisons.

In contrast, the ingredients operations segment has growth both across sales and operating income. This growth was primarily driven by the strong volumes for both human and pet food product categories.

Sales for all of our businesses in this segment were up in the quarter ended June 30, 2022, compared to the quarter ended June 30, 2021, with continued strong volumes for both human and pet food product categories. Selling, general, and administrative expenses for this segment increased in the quarter ended June 30, 2022, compared to the same quarter in the prior fiscal year, on the addition of Shank’s as well as higher labor costs. […] Revenues for the Ingredients Operations segment of $81.8 million for the quarter ended June 30, 2022, were up $25.6 million compared to the quarter ended June 30, 2021, largely on the addition of the revenues for Shank’s as well as higher sales volumes and prices.

The positive impacts were partially offset by rising raw material prices and higher freight costs. The firm, however, is making progress on capturing synergies across the plant-based ingredients platform, which could have a positive impact on the firm’s financial statements in the future.

Our businesses are working together on new product development and strategies to serve the platform’s diverse customers which utilize our portfolio of plant-based ingredients and botanical extracts and flavorings offerings.

We believe that the company remains attractive, as it delivered solid financial results in the second quarter, despite the macroeconomic challenges. However, in our opinion, the currency headwinds, elevated raw material prices, and increased freight costs are likely to keep negatively influencing the firm’s financial performance in the near future.

Based on fundamentals, we believe that the selloff since our last writing is not justified. In our opinion, the firm remains attractive and the current price levels could serve as an appealing entry point.

Dividend

In our previous article, we highlighted Universal Corporation’s safe and sustainable dividend payments as one of the main reasons for investing in UVV’s business.

The firm’s most recently announced a quarterly dividend of $0.79 per share, in-line with the previous quarterly payment. This translates to a yield of about 6.7% on an annual basis.

As the company keeps paying the quarterly dividends, despite the macroeconomic challenges and its investment in acquisitions, we believe the firm also remains attractive from a dividend investing point of view.

Key takeaways

Universal Corporation showed strong second quarter financial performance, fueled by strong demand and pricing.

However, macroeconomic headwinds, especially elevated raw material prices, high freight costs and the unfavorable FX environment, keep negatively impacting the firm’s financial performance.

The firm remains attractive from both a valuation and dividend point of view.

For these reasons we maintain our “buy” rating.

Be the first to comment