gilaxia

Thesis

Live Nation Entertainment (NYSE:LYV) presents investors an opportunity to purchase stock in a company that is highly levered toward U.S. consumers. The company has posted excellent financial results, and has exceeded many metrics compared to the pre-pandemic times. Live Nation is a great company that will continue to expand its business as long as consumers remain strong and continue to spend. Even in the event of a cyclical downturn, Live Nation is financially healthy enough to withstand any macroeconomic shocks.

Company Overview

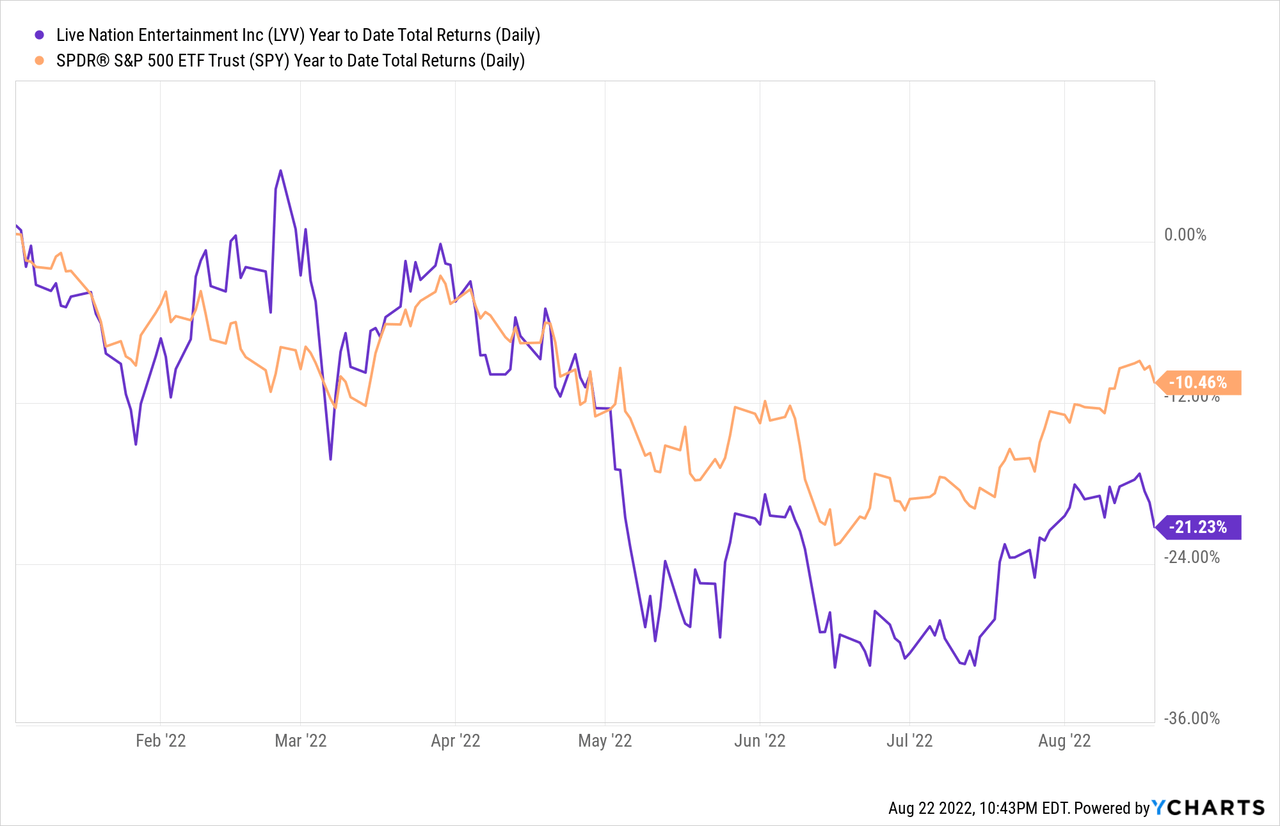

Live Nation is the leading operator of ticket sales for live entertainment in the United States and abroad. Live Nation operates numerous businesses, such as the operation of live music events through Live Nation, the ownership and management of venues, as well as the sale of tickets to live events through Ticket Master. Therefore, Live Nation has its feet in all areas of entertainment, and all parts of the entertainment food chain. In terms of its stock price, Live Nation has underperformed the S&P 500, declining ~20% YTD compared to the market’s decline of ~10%. The company’s stock price has seen some consolidation in the recent months.

Bounce Back Year

Live Nation has continued to be a great comeback story after the depths of the pandemic when live events were largely shuttered around the world. In Live Nation’s recent earnings report in early August, Live Nation has reported that compared to the same Q2 in 2019, the company saw 86% increase in Operating Income to $319 million and that concert bookings were up 30% for all venue types comparing the same time frame. The company’s outperformance compared to a pre-pandemic period shows the company’s financial health and resiliency, and shows that the market for live entertainment is stronger than ever and that its long-term prospects look bright. Live Nation also reports that the artist pipeline for 2023 is the largest ever, which should lend some confidence to investors who may fear that 2021 and 2022 outperformance are related to pent-up demand from the pandemic.

Sponsorship and Innovation

The live entertainment industry has seen the integration of different monetization strategies and technology that has increased the revenue potential of the business. For example, during the pandemic, Korean entertainment companies developed and created events surrounding VR concert experiences. Live Nation has also invested in technological improvements, especially with regards to its ticketing business through Ticketmaster. Earlier this year, Live Nation began to make strategic partnerships with big brands such as the NFL, to allow consumers to purchase digital tickets and provide solutions around it, such as creating a re-sale ticket marketplace and etc. The company has also forayed into the NFT market which is a good example of the company management’s willingness to continue to innovate and make sure that its business offerings are keeping up with developments in the modern times. In addition, Live Nation has seen substantial growth from the expansion of its sponsorship programs, which basically provide an opportunity for big corporations to market toward audiences through experiential advertisements. The company reports that 74% of its revenue growth has come from sponsorships, which shows the different monetization potential of live events.

NFL / Ticketmaster Partnership

Return to Value

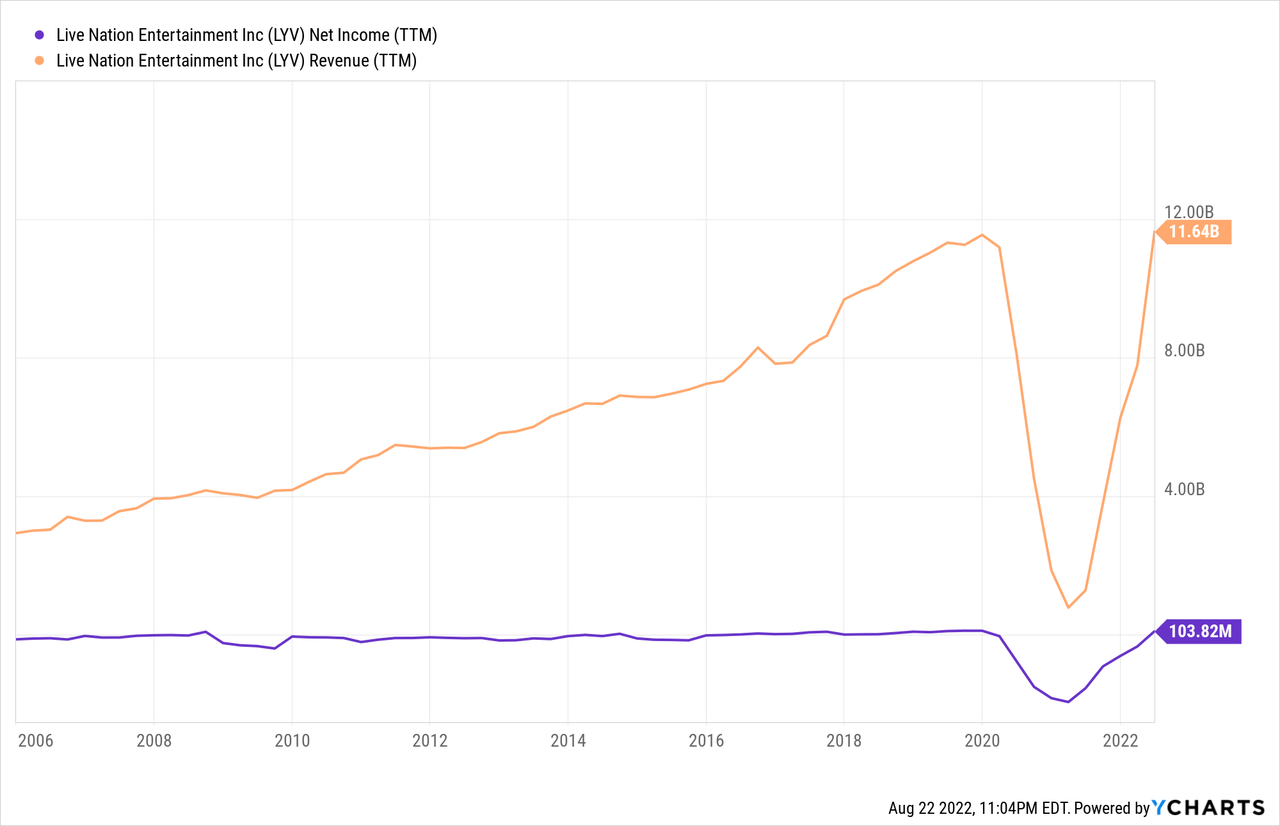

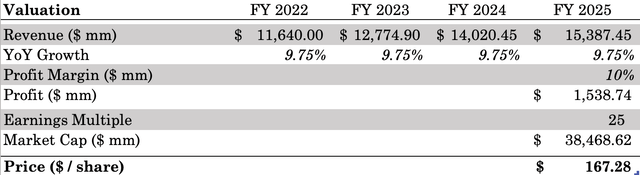

As seen in the chart below, Live Nation has seen a huge decline in revenue and earnings during the pandemic, and the company has come back with stronger results than the pre-pandemic highs on both fronts. The return to profitability and revenue should provide a clear indication that Live Nation has endured the worst possible scenario for a live entertainment business, and that the prospects are much brighter for the company on the heels of technology-driven growth in the industry. From 2015 to 2019, Live Nation has seen its top line grow by 9.75% a year on average, and we believe that Live Nation will be able to replicate this growth for the next five years based on continued innovation by the company and new monetization opportunities through partnerships and sponsorships. By 2025, we believe that the company can be fairly valued at $167.28 per share at a ~25x P/E which we believe is a reasonable multiple for a company that will still be growing and increasing profit margins over time. That’s roughly an 83% capital appreciation potential from current levels.

Sweet Minute Capital Valuation Model

Conclusion

Live Nation Entertainment is a great company that has remained resilient during the pandemic and currently provides growth at a reasonable price to investors. We believe that the company’s outperformance compared to the pre-pandemic times demonstrates that the company is back on the right track, and we believe the stock has potential for major price appreciation as the company continues to grow its profits and improve margins. We also like seeing the various partnerships that Live Nation has been able to make, as well as seeing growth in different monetization areas, such as sponsorships. We believe that these moves will reward shareholders in the long-run, and gives us a good reason to believe that the management will exceed our own expectations.

Be the first to comment