Jirsak

Nu Holdings Ltd. (NYSE:NU), or “Nubank,” is the largest Fintech bank in Latin America and has a mission to “bank the unbanked” in the region. The company was founded in 2013 and backed by a range of best-in-class investment firms from Sequoia Capital to Tiger Management and even Chinese Tech giant Tencent (OTCPK:TCEHY)(OTCPK:TCTZF).

Latin America is fertile ground for huge fintech disruption. The continent has a large unbanked population, high mobile interest usage, and favorable government regulation. Therefore, Nu Holdings is poised to continually benefit from these tailwinds as well as those offered by cryptocurrency, which is a service the company provides (more on this later).

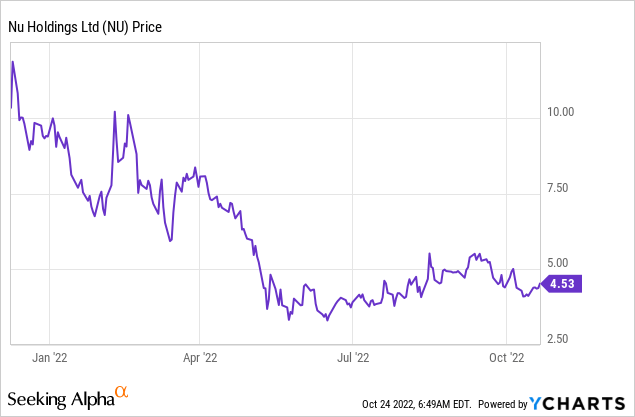

In addition, Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) sold stakes in payment giants Visa (V) and Mastercard (MA) in the first and second quarters of 2022 and loaded up on $1 billion worth of shares of the Brazilian Fintech bank. Berkshire Hathaway purchased 107 million shares at an average price of ~$9.38 per share. At the time of writing, Nu Holdings is trading at ~$4.53 per share and it now is significantly cheaper than the level Berkshire invested. Thus, in this post, I’m going to break down the company’s business model, financials, and valuation. Let’s dive in.

Fintech Business Model

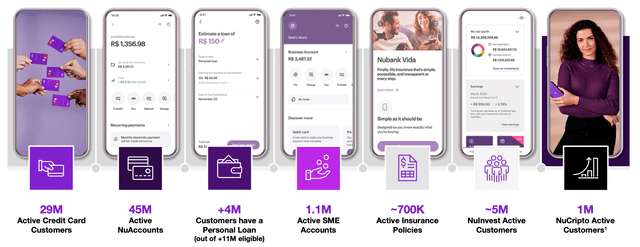

Nu Holdings was founded in 2013, as a single-solution fintech application that enabled a Mastercard credit card to be managed through a mobile application. After the success of this, the company launched a loyalty card program, loans, and then of course crypto. At the time of writing, the business has 29 million Active Credit Card customers, 45 million Active Accounts, and over 4 million customers have personal loans through the business. Nubank also caters well to Small and Medium-sized Enterprises and has 1.1 million of these users on its platform.

NuBank Product (Investor Presentation)

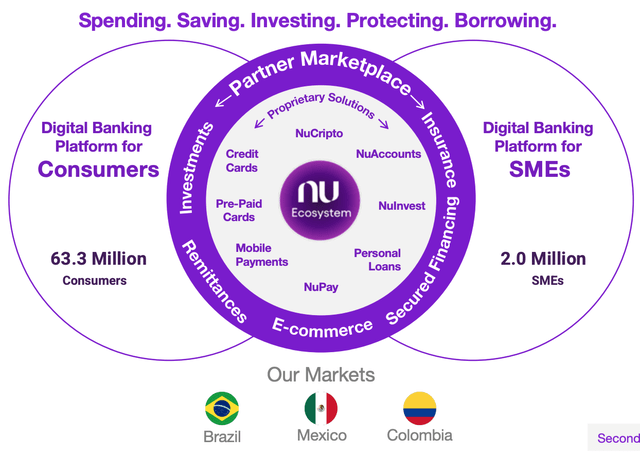

The platform is really like the European fintech App Revolut, but on steroids. It enables consumers to Spend, Save, Invest, Protect and Borrow. The company is the number one issuer of new payment cards across its three main markets Brazil, Mexico and Columbia.

NuBank Platform (investor presentation)

In late October 2022, Nubank announced its plans to launch its own custom cryptocurrency on the Polygon/Ethereum Blockchain. The plan is to launch these crypto tokens to 2,000 users initially for testing as part of a larger rewards program in Brazil. This could be a real game-changer, as it can offer another revenue stream for the business, while also leveraging the popularity of crypto, but with its own solution.

Growing Financials

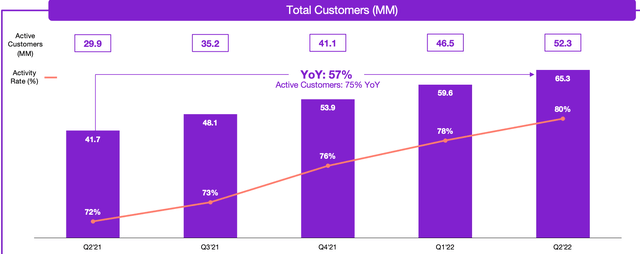

Nu Holdings generated solid business results in the second quarter of 2022. Its number of customers was 65.3 million, which reached a record high for both retail and SME customers. This was mainly driven by strong user growth in the company’s main market Brazil. Users in this region increased by a rapid 51% year-over-year, to 62.3 million, and its activity rate hit a record high of 80%. Nu customers now represent a staggering 36% of Brazil’s adult population.

The platform is also the primary bank for over 55% of the monthly active customers. This is a major endorsement of trust for the business, as it means users don’t need to have a legacy bank, which unshackles the potential for Nubank. In Mexico, the customer base of the business increased by a rapid 6 times to 2.7 million. In Colombia, the company also grew its users to 314,000. Tracking the “Activity Rate” is key to the success of the platform, as, if users are using the platform more regularly, they are likely to be completing more transactions. In this case, we see the business has increased its Activity rate from 72% in Q2,21 to 80% in Q2,22, which is positive.

Total Customers (Q2 Earnings Report)

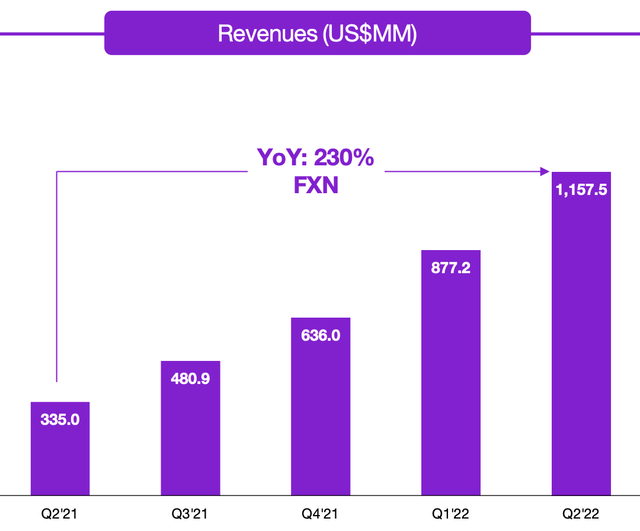

Nubank generated record revenue in Q2,22 of $1.2 billion, which increased by a blistering 244% year over year. The company also generated strong Gross Profit $363.5 million which increased by 118% year over year. Its gross profit margin did get squeezed from 50% in Q2,21 to just 31% in Q2,22. This was mainly driven by increasing interesting interest expenses. As the company’s loan portfolio matures and interest rates begin to stabilize, I forecast its gross margins to recover, which is aligned with management’s predictions.

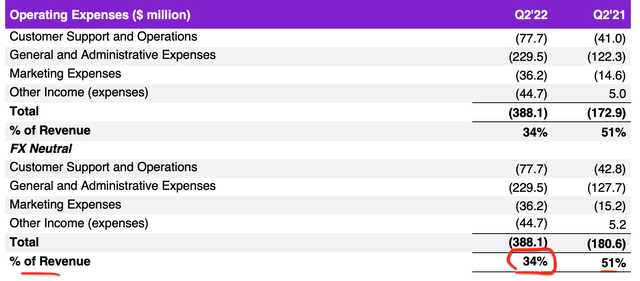

Nubank generated solid Operating Expenses of $388.1 million, which increased by a rapid 124% year over year. This increase in expenses was driven by growth in customer support expenses and marketing. General and Administrative expenses increased by an eye-watering 88% year-over-year, which was mainly driven by an increase in headcount and stock-based compensation. Although an increase in expenses may look bad at first glance, as a percentage of total revenue, expenses have declined from 51% in Q2 2021 to just 34% by Q2 2022. Therefore, the business is demonstrating increased operating leverage, which is a positive sign moving forward and means its top-line revenue is growing faster than its bottom-line costs. Its credit portfolio particularly benefits from a greater scale as its low-cost deposit base can help expand its net interest margin.

The company reported a net loss of $29.9 million in Q2 2022 which is worse than the $15.2 million produced in the Q1 2022. This was driven by stock-based compensation and the aforementioned factors. Analyzing the balance sheet of Nu Holdings is fairly challenging as, like any bank, capital requirements can skew financial statements. However, at first glance, it looks as though the business has $3.7 billion in cash and cash equivalents. In addition to total debt of debt $617 million, this means the company is in a solid liquidity position overall.

Advanced Valuation Of Nubank

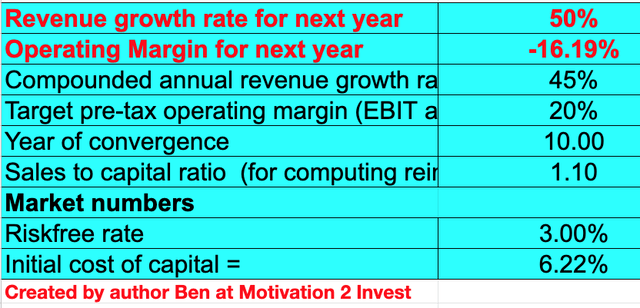

In order to value Nubank, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted a steady 50% revenue growth for next year and 45% per year over the next 2 to 5 years. This is much less than the prior growth rate of 244%. Therefore, I believe this revenue growth to be relatively conservative and achievable, given the huge number of platform tailwinds and upsell opportunities.

Nubank stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the company to grow its operating margin from -16.19% to 20% over the next 10 years. I forecast this to be driven by the increasing operating leverage identified previously and further platform efficiencies.

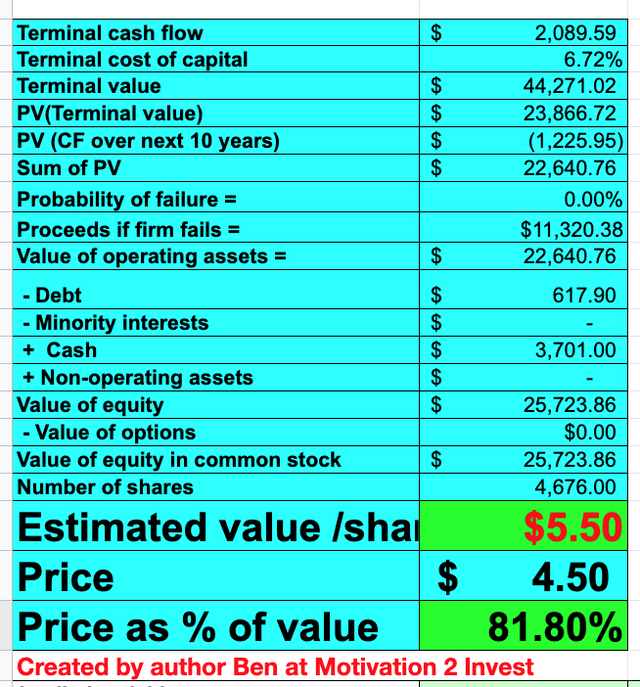

Nubank stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors, I get a fair value of $5.50 per share. The stock is trading at $4.50 at the time of writing, and thus it is at least 18% undervalued. As an extra data point, the stock is trading at a Price to Sales ratio = 4.88 which is cheaper than historic levels.

Risks

Recession/Payments slowdown

Brazil has a fairly high inflation rate of 7.17%, and the central bank has raised interest rates 12 times to combat this. Therefore, analysts are forecasting stagnant growth and slowing exports within the next year at least. A slowdown in economic activity is not a good sign for any fintech or payments company, as they tend to collect revenue from payment volume. In addition, higher input costs for the consumer could lead to higher default rates for loans. The good news is inflation has started to fall in Brazil, but is still higher than the pre-pandemic levels of ~4%.

Final Thoughts

Nu Holdings is a dominant fintech company that has truly disrupted the traditional banking system in Brazil and Latin America as a whole. The company will face competition from the “Amazon of Latin America” MecardoLibre (MELI) which is offering loans and Fintech payments. However, Nu Holdings is a pure fintech play that has a multi-platform solution that is used by a large percentage of people for their traditional bank. The stock is undervalued at the time of writing and thus looks to be a great long-term investment.

Be the first to comment