Jamie McCarthy/Getty Images Entertainment

Investment Thesis

Over the past year, Crocs (NASDAQ:CROX) shares have lost more than half of the market value, providing us a good buying opportunity. Over the past five years, the company’s revenue has grown by an average of 18.3% and is expected to continue growing. The new marketing strategy has made Crocs a household name, and the company has acquired significant pricing power that will allow it to maintain profitability even during price increases. Following the takeover of HEYDUDE and significant growth in financial leverage, the company has expectedly suspended buybacks. However, the practice will be resumed sooner rather than later, as Crocs generates solid cash flow, which allows the company to make a quick deleveraging. According to our valuation, CROX is trading well below its fair market value. We rate shares as a Strong Buy.

Company Profile

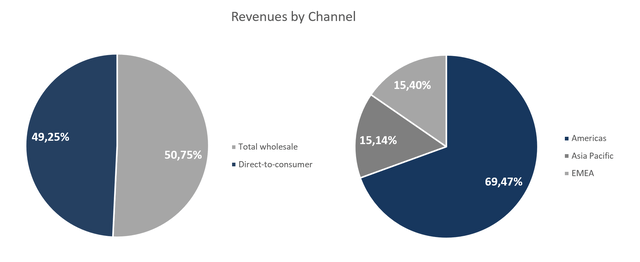

Crocs Inc. is specializing in design, production, distribution, and sale of casual footwear and accessories. Crocs became famous for its iconic clogs, which for a long time were the only product of the company. Following the takeover of HEYDUDE in December 2021, the firm expanded its product portfolio. Crocs markets its products in approximately 85 countries through two distribution channels: direct-to-consumer and wholesale. The revenue structure is shown below:

Created by the author, based on 10-K

The company was incorporated in 2005 and is headquartered in Broomfield, Colorado.

Positioning Is The Secret To Success

Initially positioning itself as a yachting shoe, Crocs has gone through a rocky path before becoming a recognizable and beloved brand by many. In the wake of the financial crisis in 2008, the company lost $185 million and cut two thousand jobs. The first attempts to break out of a niche segment into the mass market were met with the arrogant gaze of fashion influencers who described these foam clogs with one concise word “ugly”. Anything that doesn’t meet the generally accepted standards can be called ugly, but it can also be called unique and recognizable. What makes such companies as Converse, Dr. Martens, Hunter and Ugg so iconic? The unique and recognizable design of the main models has made these companies household names. Launched in 2018, the marketing strategy has given Crocs a cult following as well.

In recent years, Crocs have been seen on the legs of show business stars such as Kendall Jenner, Post Malone, Nicki Minaj, Justin Bieber and even Victoria Beckham. The collaboration with Balenciaga caught the attention of haute couture adepts, and now even the famous fashion magazine Vogue teaches its readers how to style the pair of Crocs.

According to Piper Sandler’s semi-annual Generation Z survey, Crocs was ranked at number 6 preferred footwear brand, up from number 8 a year ago. High brand awareness is Crocs’ most important competitive moat, as it provides the company with pricing power. In the first quarter, the Crocs brand average selling price rose 19.6%, well above the increase in the consumer price index.

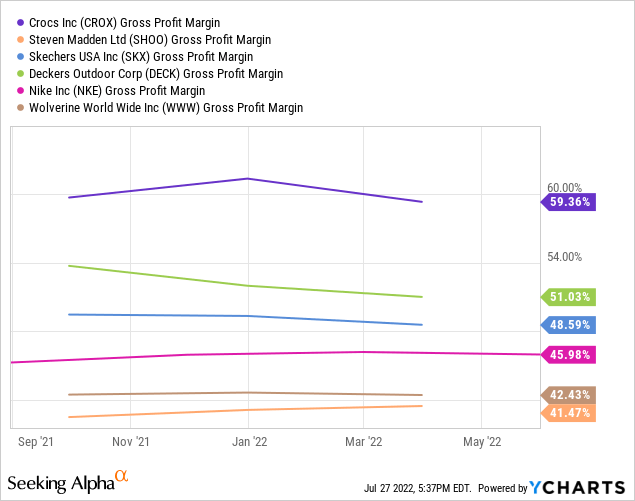

The clogs are a very simple product made from one single material – ethylene-vinyl acetate (EVA). High brand awareness allows the company to sell well above cost, making Crocs the highest gross margin in the footwear industry.

HEYDUDE has approximately 20 percent brand awareness among consumers in the Midwest, Florida and Texas, and less than 5 percent in the US coastal region. However, the brand also seems to have good potential. HEYDUDE spent incomparably less on marketing than Crocs. However, according to the same Piper Sandler’s survey, the brand was ranked at number 9 preferred footwear brand among US teenagers.

Long-Term Prospects

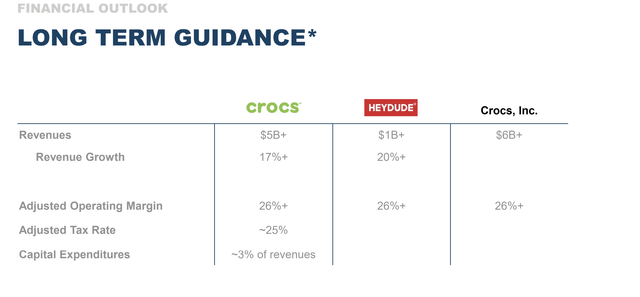

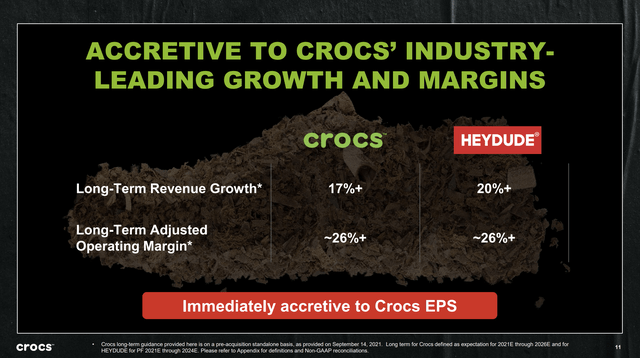

Crocs is expected to end 2022 with $3.5 billion in revenue. According to long-term guidance, the company’s consolidated sales will be $6B+ with an operating margin of 26%+. Long term for Crocs and Crocs, Inc. defined as 2026E and for HEYDUDE defined as 2024E.

Assuming that the Crocs segment can reach $5B by 2026 driven by strong expansion in the highly fragmented sandal market and growth in international sales, the long-term consolidated revenue forecast looks conservative as it does not account for HEYDUDE growth beyond 2024. However, the Italian footwear company acquired in December 2021 may surprise the Street.

According to marketing agency WanderLuxe World, HEYDUDE saw a 15x increase in sales between 2017-2019, and in the last quarter, management raised its annual revenue expectations by 20% to $750-800 million, which projects a 31.6-40.4% YoY growth. The long term guidance implies that HEYDUDE sales will grow at a CAGR of less than 14% through 2024, well below current momentum and past expectations.

Notably, according to CFO Anne Mehlman, HEYDUDE spent almost no money on marketing before the takeover:

“…the difference there is our investment in SG&A, in order, in marketing, because they haven’t spent much in marketing at all. So we intend to invest in marketing, in people and the infrastructure to build a stable brand going forward.”

Management expects HEYDUDE’s operating margin to decline from 40% to 26%, which implies an increase in operating expenses of $105-112 million, the lion’s share of which will be for marketing, which will also support strong sales growth.

Although the company’s margins came under pressure in the last reporting period due to rising raw material costs, freight headwinds and interest costs, in the medium/long term, CROX has the potential for profitability growth as:

- Over the past 10 years, the company has reduced COGS by an average of 0.6 percentage points per year due to economies of scale. The company’s growth is expected to continue in the coming years.

- As noted earlier, the company has significant pricing power in the market, which means it can pass the costs on to consumers.

- Crocs increases share of higher margin DTC and online sales.

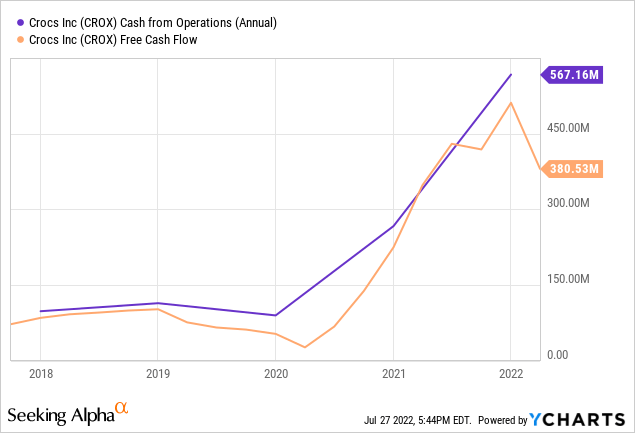

One of Crocs’ growth drivers has always been the massive buybacks enabled by the solid cash flow the company generates. So, at the end of 2021, cash from operations amounted to $567.2 million, and free cash flow – $380.5 million.

Following the takeover of HEYDUDE and a significant increase in financial leverage, the company has expectedly suspended buybacks. However, the practice will be resumed sooner rather than later, as one annual free cash flow directed to repay the debt will be enough to return to normal financial leverage.

CROX Stock Valuation

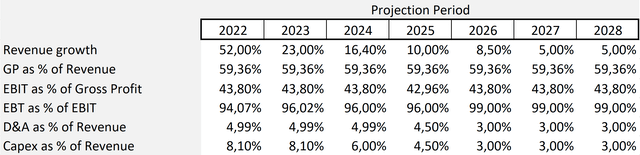

Our DCF model is built on several assumptions. We expect revenue to grow in line with management’s expectations and reach $6 billion in 2026. Although Crocs’ operating margin has grown steadily in recent years and stood at 29.5% in 2021, we assume that the figure will be at 26% until the end of the forecast period. Over the past five years, D&A expenses have averaged 5% of revenue, and we expect the figure to remain at that level. Crocs is expected to have capital expenditures of $200M for the year, representing 8.1% of revenue, which we expect to fall to 3% of revenue, which is also in line with the long term guidance. The assumptions are presented below:

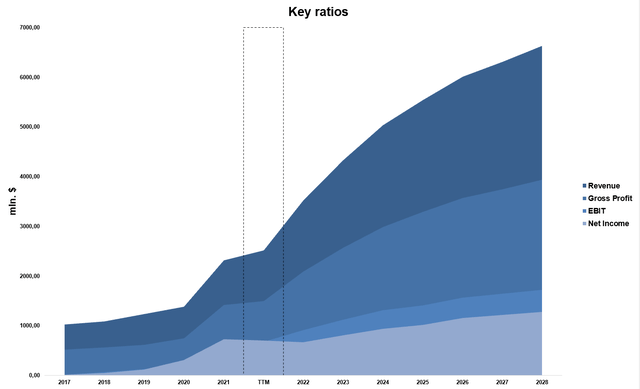

Based on the assumptions, the expected dynamics of key financial indicators are presented below:

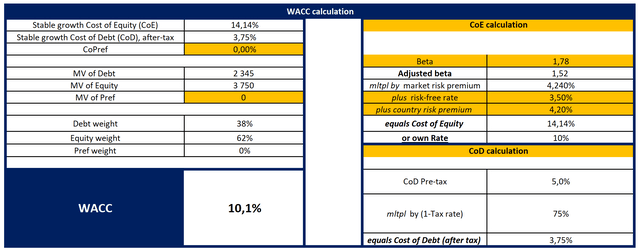

With the cost of equity equal to 14.14%, the Weighted Average Cost of Capital [WACC] is 10.1%.

With a Terminal EV/EBITDA of 6.2x, the model projects a fair market value of $8.4 billion, or $136 per share, above the Wall Street consensus estimate of $100.6, but well below the Williams Trading’s target price of $200. The upside potential we see is about 123%.

You can see the model here.

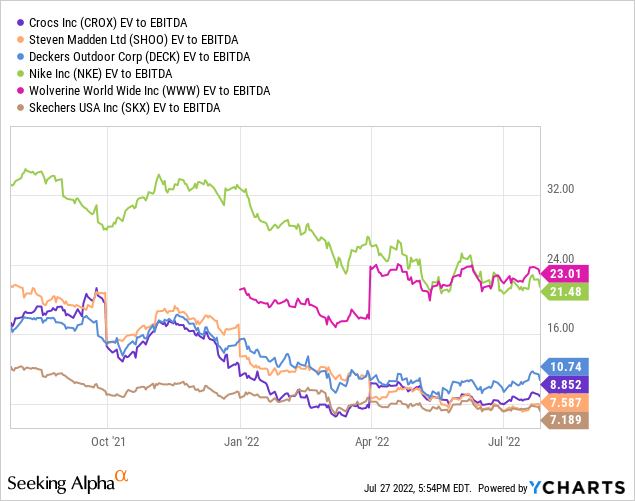

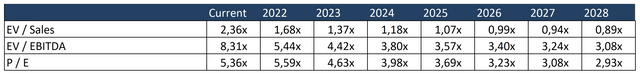

Despite double-digit growth, strong profitability and solid cash flow, Crocs trades at a significant discount to peers.

By forward multiples, CROX looks extremely cheap.

Key Risks

- All HEYDUDE shoes are made in China. Although management emphasizes that the situation is under control, zero-Covid policy and supply chain issues could have a significant impact on segment results.

- Consumer Discretionary companies are cyclical businesses. If there’s a sharp decline in consumer spending, Crocs’ sales and the share price may suffer significantly more than the market as a whole.

- 42% of Crocs’ revenue comes from overseas. Excessive strengthening of the US dollar is one of the main risks for the company’s financial performance.

Conclusion

Crocs is one of those cases where the stock price doesn’t reflect the business’ fundamentals. The company has a competitive moat, double-digit growth, strong margins, solid cash flow, and trades at a significant discount to the market, Wall Street consensus and our estimate of fair market value. We are bullish on CROX.

Be the first to comment