morgan23

Thesis

Crocs (NASDAQ:CROX) is a popular footwear brand among consumers globally. The company derives the majority of its revenue from the Americas region. However, it also has a strong base in the Asia Pacific and EMEA. Therefore, it’s exposed to globally diversified consumer trends and growth opportunities.

Furthermore, the company also has stepped up its game with its recent HEYDUDE acquisition to broaden its footprint in the consumer space. Notwithstanding, the company’s massive FY21 growth is expected to fall sharply. The company also highlighted that they continue to see near-term headwinds in their markets but remain confident in navigating these challenges.

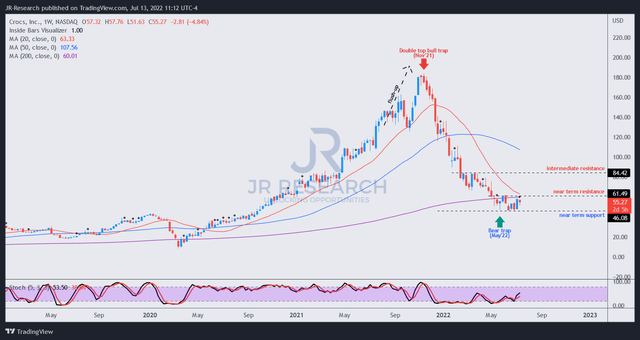

Our price action analysis indicates a recent bear trap (significant rejection of selling momentum) in May. As a result, we believe the market has been setting up a sustained base for accumulation.

Our valuation model suggests that CROX is likely undervalued. We believe the company could maintain a market-perform hurdle rate at the current levels.

Therefore, we rate CROX as a Buy, with a near-term price target of $70. It implies a potential upside of nearly 30%.

Crocs’ Massive Growth Phase Is Likely Over

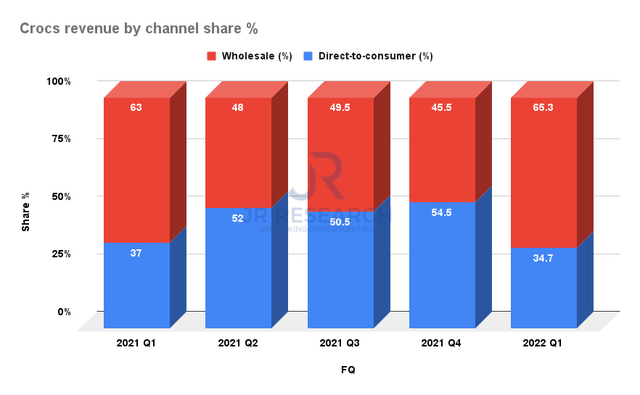

Crocs revenue by channel share % (Company filings)

Crocs’ operating model is driven primarily through its wholesale channel complemented by its DTC offerings. We expect that channel to continue as its main driver for its growth and profitability, as CEO Andrew Rees articulated in a June conference (edited):

We leverage wholesale and some direct-to-consumer retail, but it’s really digital- and wholesale-orientated. And that’s what’s driven the growth. And with that growth, we’ve gotten very significant improvements in profitability and operating leverage (Baird 2022 Global Consumer, Technology & Services Conference).

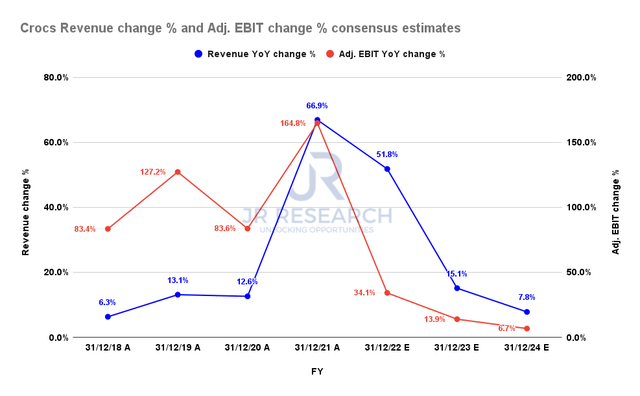

Crocs revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (generally bullish) suggest that Crocs’ tremendous surge in revenue growth has likely peaked in FY21. Furthermore, it’s expected to decelerate rapidly through FY24, reaching 7.8%.

Therefore, Crocs’ growth is expected to normalize toward its 10Y revenue CAGR of 8.7%. In addition, its adjusted EBIT growth also is projected to be impacted markedly with significantly slower revenue growth. As a result, we believe that the market has justifiably battered CROX since its November highs.

However, management remains confident in navigating the recent macro headwinds due to its global footprint. Rees accentuated (edited):

So we’re a global company, so we’re not just driven by what is happening here in the United States. There is a lot of uncertainty in the world today. And as we think about kind of managing our company and as our brand, we want to remain really agile and nimble and read the consumer in the moments that they are and manage accordingly. If we think about the COVID period over the last two years, we’ve demonstrated a tremendous amount of agility that has been very successful for the company and for shareholders. (Baird conference)

And, Profitability Is Expected To Remain Robust

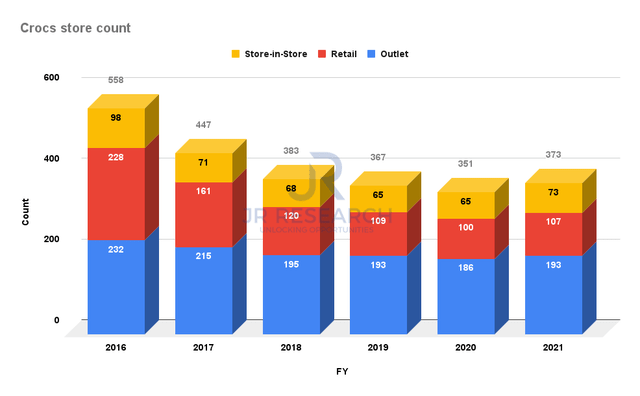

Crocs store count (Company filings)

The company’s solid execution of improving its profitability has been remarkable. That also included streamlining its store footprint over time and optimizing its SG&A exposure. As a result, Crocs store count fell from 558 in 2016 to 373 in 2021 (down by 33%). Accordingly, it has allowed the company to redeploy its spending toward marketing, as management highlighted (edited):

When you think about SG&A back kind of pre this cycle, it was really tied up in retail and fixed SG&A, which we actually cut all that back. So we cut the retail base from like roughly 600 stores to a little over 300, and we reinvested that back into flexible marketing. So the P&L, it’s completely different in the way that it’s structured, which gives it a lot more resiliency. (Baird conference)

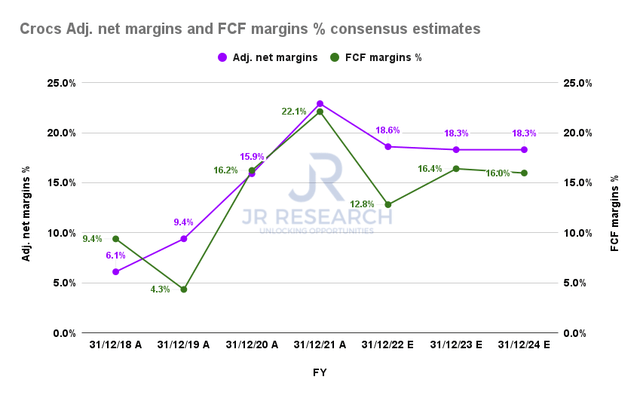

Crocs adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Therefore, Crocs’ profitability is expected to remain robust, as seen above. Notably, the flow-through to its free cash flow margins also are remarkable, helping to undergird CROX’s valuation.

Our reverse cash flow valuation model also indicates that CROX seems undervalued now. We applied a market-perform hurdle rate of 12% (well below CROX 5Y total return CAGR of 48.22%), with a steep FCF yield of 15% in FY26.

Assuming a TTM FCF margin of 14.5% in FY26 (below the consensus estimates), we need Crocs to post a TTM revenue of $5.67B by CQ4’26. Accordingly, we think the revenue target is achievable based on the revised consensus estimates and our prudent assumptions.

CROX Bear Trap In May Held Resiliently

CROX price chart (TradingView)

CROX formed a bear trap in May, which has held robustly. Therefore, we believe it’s likely an accumulation phase as the market “quietly” layered in. However, more prudent investors are encouraged to add closer to its near-term support ($46) as we expect some selling pressure at its near-term resistance ($61).

Notwithstanding, we’re confident that the bear trap could subsequently help stanch and reverse its bearish bias.

Is CROX A Buy, Sell, Or Hold?

We rate CROX as a Buy, with a near-term PT of $70 (30% potential upside).

The market has correctly de-rated and hammered CROX as its growth is projected to slow markedly.

However, Crocs’ profitability is expected to remain robust. Also, its valuation seems undervalued according to our model.

Its price action is also constructive, with its bear trap in May resolutely holding its current consolidation zone.

Be the first to comment