Andrew Burton

As we move towards the next 1Q23 results for Alibaba Group Holding Limited (NYSE:BABA, OTCPK:BABAF), I think that the company is starting to see the light at the end of the tunnel. Here, I have summarized some of the key events and business updates since the last quarter and the progress the company has made since then.

Investment thesis

I have covered Alibaba extensively, and the articles can be found here. These articles address some of the regulatory concerns and risks that the company faces, as well as some deep dives into the company that I have done to support my investment thesis. My investment thesis remains intact and I still see a rather favorable risk/reward opportunity for Alibaba due to these reasons:

- China commerce: Alibaba has a large consumer base of more than 1 billion users and these users spend $1,300 each year, bringing opportunities for monetization, and this also helps its newer platforms to scale up in a more efficient manner.

- International commerce: the Lazada business continues to be a long-term growth driver for Alibaba due to the low penetration in the Southeast Asia region. Furthermore, with the success of Alibaba in China, Lazada could easily reap the benefits of Alibaba’s strong competitive advantages and moat in e-commerce and utilize the strong logistics capabilities that come with the Alibaba Group to compete with others in the region.

- Cloud: As the largest cloud player in the Asia-Pacific (“APAC”) region and the third largest in the world, Alibaba will likely maintain its leadership position in a cloud market that is still growing at a rapid pace. Furthermore, with international expansion opportunities and new capabilities rolling out like LingYang, I think we could see the next phase of growth emerging from these new areas.

- Investing for growth in the future: Alibaba continues to reinvest its incremental profit into businesses it views are strategic and this is necessary to continue to compete and win competitors in its space. Furthermore, with its cash-generative business, Alibaba can continue its mergers and acquisitions strategy to acquire new businesses to capture future opportunities or bring value to existing businesses.

China commerce

With regards to the recent 6.18 promotion event, there were more than 260,000 brands that participated, with about 300 brands that generated more than Rmb100 million of GMV and about 100 products with more than Rmb100 million in sales. In addition, new products launched were also gaining momentum in this year’s 6.18 promotions as the 45 million new products launched contributed to 30% of the transactions during the event. Furthermore, more than 100,000 SMEs saw their GMV grow more than 100% year on year.

In addition, the number of the Taobao shopping platform live streaming accounts increase 12% year-on-year, with 32 live streaming rooms having the ability to generate more than Rmb100 million in GMV. For Taobao deals, its MAU grew to 128 million, increasing 28% year-on-year and the total time spent was up 56% YOY to 9 billion minutes, with the average time spent per user at 70 mins, according to QuestMobile.

Local services and Cainiao

Alibaba’s Eleme online food delivery service launched a campaign to offer free orders to customers. These orders range from values of Rmb10 to Rmb100 and the experience was gamified through the use of puzzles and games. This campaign went viral on social media due to its interactive elements and I think it also demonstrates the strong competitive advantage in being able to engage with customers and should help to improve the company’s brand image.

In addition, logistics company Cainiao improved on its fulfilment efficiency during the 6.18 promotions, as the order volume increased 100% YOY and 70% of the orders arrived on the same day. I think that this is impressive, as Cainiao continues to improve efficiency and reduce delivery times, thereby bringing a flywheel effect to the entire Group.

International commerce to be a resilient driver of growth

Lazada announced on 12 May that, based on its survey of 766 online sellers in Southeast Asia, sellers in the region continue to have a confidence in the business outlook and continue to see growth in their business. In fact, according to the survey, 77% of online sellers surveyed said they expected an increase of 10% in sales for 2Q22. I think that this optimism comes from the demand improvement from the gradual easing of covid-19 restrictions that leads to improvement in business activities. In fact, the online sellers surveyed also surprisingly are rather optimistic about the economic situation, with 75% of them expecting an improved outlook moving into the second quarter of 2022.

Other findings which I find interesting are that 73% of consumers in the Southeast Asia region see e-commerce as an integral part of their day-to-day lives, and only 23% of those surveyed think that the higher costs as a result of inflation and supply chain disruptions will be a potential challenge. I think that this shows that e-commerce is here to stay in the region as it is globally, and not just a passing trend that will subside as pandemic restrictions ease. Furthermore, it is encouraging to see that online sellers are relatively optimistic about the economy and their business outlook with minimal concerns about the current inflationary environment and disruptions in supply chain.

Lazada also appointed a new CEO, Mr. James Dong, who will also serve as CEO for Indonesia. Mr. Dong is able to leverage on his experience as CEO of Lazada in Thailand and Vietnam. One of his priorities is to give a boost to the Lazada supply chain and consumer experience. This is the fourth CEO change for Lazada since 2018. When looking at how Alibaba’s China strategy was rolled out and how it relates to Lazada, I think that the new CEO who is appointed will have a larger focus on the strategy of localization.

Overall, I think that while Alibaba’s e-commerce ventures are still considered in the early stages of development, there are many opportunities for Lazada to innovate and bring new ways to shop online through shopping festivals and interactive experiences. In addition, Lazada is able to leverage on the expertise and resources of Alibaba, which is in its own right a successful e-commerce player in China, thus allowing Lazada to develop its own competitive advantage in the region.

Cloud computing

Alibaba’s cloud business continues to rank among the largest in the world. Based on the latest Gartner report on the market share for Infrastructure as a Service providers, (“IaaS”), AliCloud is the 3rd largest IaaS provider for fourth consecutive year. It has a global market share of 9.55% and APAC market share of 25.5%. AliCloud has entered 27 regions and continued to move into a broad range of verticals. Alibaba is also expanding its data centers across the APAC region, with operations in Indonesia, Philippines, South Korea and Thailand and also increasing its footprint internationally with a third data center in Germany.

On May 17, Alibaba Cloud also launched its third data center in Germany, as well as 2 new data centers in Saudi Arabia. These international expansion opportunities for Alibaba show the company’s strength in its cloud computing capabilities and execution abilities and bring further opportunities to grow its international market share.

Alibaba also announced Lingyang, which is a new brand that positions itself as a data intelligence as a service provider (“DaaS”) and this opens up a new data intelligence capability to customers. It includes products like analytical cloud, marketing cloud, among others. Lingyang will provide services to help its customers meet their digitalisation needs. Specifically, I think Lingyang will target customers with large amount of data that relies on these data as a growth driver, as well as companies that need to go through digital transformation. LingYang served internal units like Taobao and Tmall, and currently has large brands as its external customers, like LVMH (OTCPK:LVMHF), McDonald’s (MCD) and XPeng (XPEV), among others.

All in all, I think that by presenting itself as a DaaS provider, the company is able to position itself as a company with a wide range of solutions and comprehensive range of products and services for its customers.

In addition, Alibaba showcased a new cloud infrastructure system called Cloud Infrastructure Processing Unit (“CIPU”) that is meant to power data centers. This new system is said to be able to bring improvements in performance across networking, storage, security and computing power. Ultimately, the new system is meant to address the increasing demand for higher data volume at lower latency. This means that Alibaba’s new system can then service more intensive use cases for big data and artificial intelligence.

Valuation

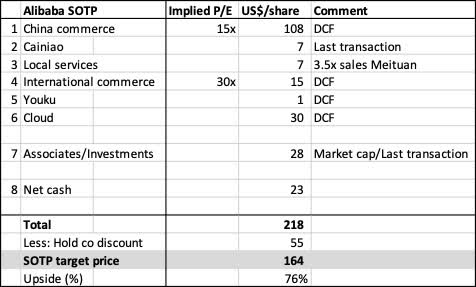

I derived a target price for Alibaba based on a SOTP valuation. For China commerce and international commerce, I use a DCF model for these with an implied P/E of 15x and 30x respectively. I think that this is reasonable given the faster growth profile of the international commerce segment. For Cainiao’s valuation, this was based on the last transaction available and for local services, I used a multiple of 3.5x sales that is similar to Meituan (OTCPK:MPNGF). Lastly, I applied a holding company discount of 25% to derive a SOTP valuation target price of $164, representing 50% upside from current levels.

SOTP valuation for Alibaba (Author generated)

Risks

Regulations and political pressure

With the recent news about Alibaba and other technology giants in China being fined for anti-monopolistic behavior and not disclosing M&A transactions, the whispers of the past haunt Alibaba investors who still can easily recall the saga with Jack Ma and the CCP, as well as the halt in the Ant Financial IPO. However, I think we have seen the worst of the crackdown and companies like Alibaba now know to prioritize its alignment with national policies and the government. As such, along with the recent news about the breakup of Alibaba and Ant Financial is a positive one that aligns the company with the CCP. I think that the second half will see less turbulent times for Alibaba, as most of the regulatory pressures should ease.

Competitive pressures

With any company in the leadership position in any market, there comes the risk that their competitive advantage diminishes. Alibaba may be the largest e-commerce and cloud player in China, but there are competitors that may outperform it through a variety of strategies. Competitors in China like JD.com (JD) and Pinduoduo (PDD) can gain market share locally and threaten the company’s dominant e-commerce position. In the international scene, there are pressures from international players like Amazon (AMZN) and Sea Limited’s (SE) Shopee. Competition in these markets could slow GMV and user growth for Alibaba compared to expectations.

Cloud risks

Alibaba’s cloud revenue growth could risk slowing down due to intensifying competition from Huawei, Tencent and China Telecom. If Alibaba is unable to maintain market leadership in cloud, this could affect economies of scale effects that it currently enjoys.

Conclusion

I think that we are seeing the light at the end of the tunnel for Alibaba. As we move into the second half of 2022, regulatory pressures should start to ease as the company prioritizes the alignment to the Chinese policies. Furthermore, China commerce is looking great based on the 6.18 sales as it continues to grow and stay resilient during uncertain covid-19 times for China. Furthermore, there is a huge upside from international commerce, as Lazada is likely to be key driver in the long term for its e-commerce ambitions. AliCloud continues to dominate and, with continued innovation, it is likely to remain a leader globally and in APAC. My target price for Alibaba based on SOTP valuation is $164, representing 50% upside from current levels.

Be the first to comment