imaginima/iStock via Getty Images

Kinder Morgan (NYSE:KMI) and Plains (NASDAQ:PAGP)(NASDAQ:PAA) are investment grade midstream businesses paying out safe, high, and growing dividends. PAGP is the 1099 issuing C-Corp economic equivalent of the K1 issuing MLP that is PAA. Investors pay a 4.3% premium for PAGP at present relative to PAA in exchange for the convenience of getting a 1099 tax form issued to them instead of a K1. This also makes it easier for investors who desire exposure to PAGP to hold it in their retirement accounts instead of risking dealing with UBTI if they elected to go with the cheaper PAA.

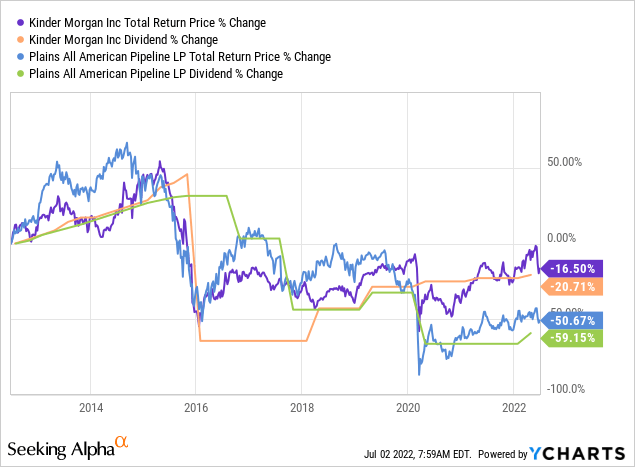

At the moment, KMI offers a 6.54% dividend yield while PAGP offers investors an 8.26% dividend yield. Meanwhile, PAA offers an 8.61% distribution yield. Both businesses have a spotty track record over the past decade that includes recent underperformance and some steep dividend/distribution cuts in the past:

However, both businesses have worked hard over in recent years to deleverage their balance sheets and get their dividend/distribution payouts back on the growth track while also simplifying and high-grading their asset portfolios. In this article we will compare KMI and PAGP/PAA side by side and discuss 3 reasons why we would rather buy PAGP/PAA than KMI today.

#1. Plains All American Pipeline Is Convincingly Cheaper Than Kinder Morgan

PAGP and PAA are convincingly cheaper than KMI:

| Metric | KMI | PAGP | PAA |

| EV/EBITDA | 9.74x | 9.06x | 8.93x |

| P/DCF | 7.86x | 5.06x | 4.86x |

| Dividend/Distribution Yield | 6.6% | 8.3% | 8.7% |

| Free Cash Flow Yield | 9.5% | 16.0% | 16.7% |

Despite trading at a premium to PAA, PAGP is still far cheaper by every other metric, particularly on the very important free cash flow yield and dividend yield metrics.

This deep value at PAA/PAGP is further evidenced by a very large insider purchase made recently by a Director on the company’s board Mr. Kevin McCarthy, who recently acquired 200,000 units at $9.81 per unit for a total amount of $1.96 million. When insiders put considerable skin in the game, it generally bodes very well for the prospects of the business.

#2. Plains Has Stronger Growth Potential

PAGP and PAA also have very strong growth potential thanks to the recovering demand picture in the Permian Basin. As a result – despite a tightened capital expenditure budget and aggressive recent asset sales – analysts expect PAA/PAGP to grow distributable cash flow per unit at a 7.2% CAGR through 2026 while also growing the distribution/dividend per share at a 4.5% CAGR and free cash flow at an 8.2% CAGR. When combined with the hefty dividend yield of 8.3% for PAGP and 8.7% distribution yield for PAA, this is extremely strong growth. Even better, it implies that PAA/PAGP could be in store for some significant multiple expansion, making the total return equation mouthwateringly appealing.

In contrast, KMI – which was not nearly as impacted during the COVID-19 energy market crash as PAA/PAGP was – is only expected to grow distributable cash flow per unit at a 4.6% CAGR through 2026, its dividend is only expected to grow at a 2.8% CAGR, and its free cash flow is only expected to increase at a 2.1% CAGR over that time span.

Essentially what this means is that PAA/PAGP are still recovering from the COVID-19 crash but are still being valued by Mr. Market like it is facing COVID-19 headwinds, whereas KMI does not really have any recovering to do and is being priced by Mr. Market as though it has no headwinds. The result is a meaningful forward growth potential gap on top of the already massive valuation gap.

#3. PAGP/PAA Is Better Positioned To Deleverage Further

Last, but not least, while KMI has a slightly better credit rating at BBB than PAA/PAGP’s BBB-, the fact of the matter is that PAA/PAGP is quickly catching up thanks to its very aggressive deleveraging program. The reason behind this is that PAA/PAGP has aggressively curtailed its growth CapEx, resulting in a massive free cash flow yield that is 650-720 basis points higher than KMI’s. All of this excess free cash flow is going in part towards higher investor capital returns, but the lion’s share of it is going towards paying down debt as fast as possible.

Management believes that the business’ strong cash flow generation and retention should enable it to reach its leverage target by the middle of next year, which would then free up space to meaningfully further increase capital returns to unitholders via buybacks and/or distribution increases. As management stated on the latest earnings call:

high levels of cash flow and strong distribution coverage position us to reach our leverage target in mid-2023 with meaningful capacity to further increase cash returns to equity holders and drive strong unitholder returns both near and longer term.

Investor Takeaway

While both Kinder Morgan and Plains are investment grade midstream businesses with spotty track records – but have high quality assets and stable cash flow profiles – we believe that the market is seriously mispricing the difference between these two businesses. Yes, KMI is more of a natural gas play whereas Plains is a Permian oil play and natural gas in general is viewed as having a brighter future.

However, Plains is actually the business with a brighter near to mid term growth profile thanks to the expected strong recovery in the Permian Basin in the coming years. On top of that, Plains is way cheaper than KMI and is also deleveraging far more rapidly, putting it in a position it will likely soon have a better balance sheet and will be able to accelerate its already superior investor capital returns.

While we like both businesses on the current pullback, KMI earns just a Buy rating from us while both PAA and PAGP earn a Strong Buy rating. If you don’t like dealing with K1s and/or want to invest in a retirement account, PAGP is the better option. Otherwise, PAA is cheaper and offers deferred taxation benefits if held in a taxable account, so we are partial to PAA.

Be the first to comment