Cate Gillon

Introduction

Crocs (NASDAQ:CROX) is cheaply priced, just see the below articles which do a great job in articulating this. This article looks to provide a different point of view from the figures and the DCFs.

Crocs: The Shoes Are Plastic, But The Price Is Gold

Despite The Macroeconomic Headwinds, We Maintain Our Buy Rating On Crocs

Investment Thesis

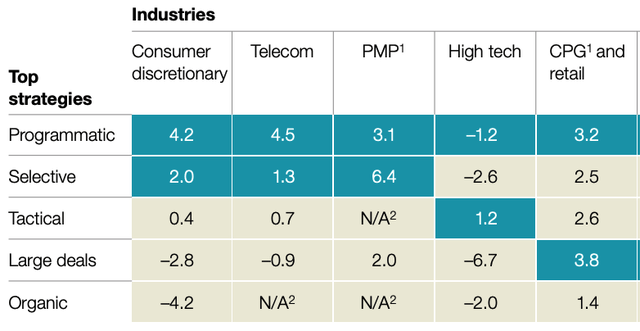

Due to the acquisition of ‘Hey Dude’, and the size of the transaction (30% of Crocs’ market cap at the time of announcement, $2.5 Billion), Crocs’ stock price has dropped by 75%. A statistical analysis completed on two decades of M&A by McKinsey, examined median excess returns to shareholders using different M&A strategies and their effect on their respective industries. Large transactions, defined as “30% or more of the market cap”, were found to produce the largest excess returns in the ‘CPG and Retail’ industry creating excess returns of 3.8% on average. The empirical evidence further suggests that ‘faster growing’ industries, have a -12% excess return for the 5 years post a large transaction, while companies in “slower-growing, mature industries” exhibit 4% excess returns on average. Within industries that showed these characteristics (mature industries), this was effectively the most efficient way to consolidate and grow. Intuitively, as a result of the high concentration of ‘high growth sectors’ within the overall market’s indices (who historically don’t find success through large M&A deals), large transactions are unilaterally considered value destroying by the market regardless of their characteristics. Aswath Damodaran, the ‘Dean of valuation’, is quoted commenting on acquisitions stating, “just say no”.

Additionally, the acquisition will allow Crocs to leverage their supply chain and apply their successful marketing strategy towards Hey Dude, resulting in synergies that unlock free cash flow. Given that a material amount of Hey Dude’s revenue is attributed to the US, specifically Texas and the surrounding states, management sees the opportunity to explore shelf space on the East and West coasts as enough to facilitate double-digit growth in the medium term, while international adoption will facilitate growth in the long term.

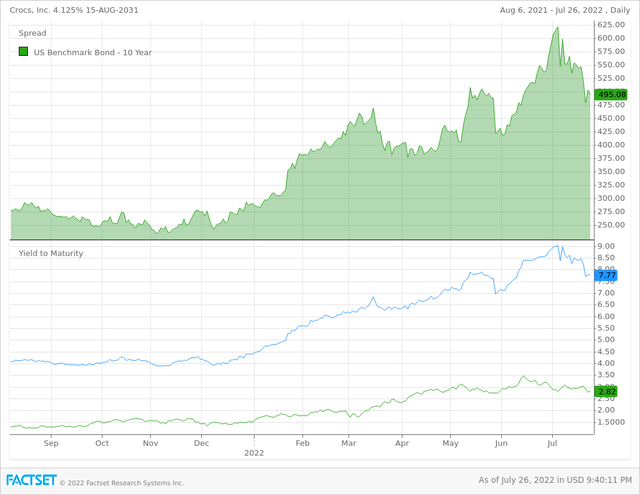

The bond market is currently pricing in a significant slowdown in the company’s growth prospects. The ‘On The Run’ 10-year 4.125% bond, issued on the 10th of August 2021, is priced at 76.63, down 26.12% YTD (which I believe to also be a relatively cheap security). There has also been a material increase in the OAS, shifting up 250 bps to 484 bps through HY1 2022 indicating a significant increase in risk premiums.

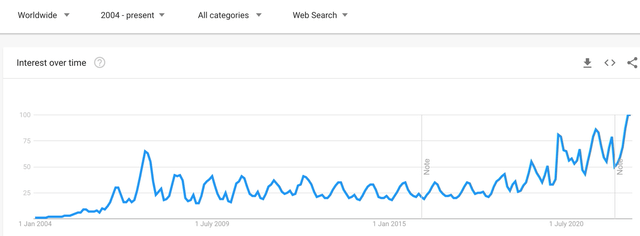

This shift within the fixed income market is further highlighted in the equity market as it currently interpolates Crocs’ growth to slow significantly in the near term, with a justified growth rate of (-)7.26% priced in (based on a forward PE of 5.07 and a Cost of Equity of 11.95%). This growth rate is contradictory to what the data indicates, as Google trends for both, Crocs and Hey Dude, indicate that awareness is at an all-time high. In addition, this contradicts management’s guidance for revenue to exhibit a 23% CAGR into 2026. I view management’s guidance to be conservative due to their historical track record. The last time management missed guidance or issued a revised downward guidance, was in February 2020, during the onslaught of the pandemic. Other than this black swan event, management has beaten guidance by an average of 10% for revenue and 30% for operating profit. Given this track record over the past 5 years, management’s ability to predict earnings in a conservative manner allows for use of provided estimates with a certain deal of confidence. Crocs has been raising prices since 2021 (Crocs, Inc. (CROX) CEO Andrew Rees on Q1 2021 Results – Earnings Call Transcript) to pass through inflation, coupling this with the trend growth, it is evident that customers are sticky and exhibit low price elasticity which allows for sustainable growth in margins.

The comfortable footwear (CF) industry is fragmented and is characterized by low entry barriers, low switching costs, and easy access to inputs. Brand and scale economics dominate the footwear industry.

Based on its product offerings, Crocs’ is most comparable to Deckers and Skechers within the CF industry. The recent trends in overall consumer behavior have shifted towards customization, which has seen Crocs’ sales of the personalized accessory, Jibbitz, skyrocket. Compared to all the offerings of their competitors, Crocs offers the largest flexibility for customization, feeding into consumer trends.

Crocs Website

Crocs, Deckers and Skechers’ current market prices indicate a justified growth rate of -7.26%, 2.46% and 1.23%, respectively. While factoring in the deteriorating economy during the first half of 2022, the company was able to raise guidance and realize synergies faster than initially anticipated for Hey Dude. As more synergies are realized, and consumer demand for the brand is at its highest levels in history, management forecast double-digit growth next fiscal year – a clear disconnect from market expectations.

So just to reiterate our guidance, we’re very confident in our full year guidance, which is both the 20% plus in Crocs brand and the upward revision of the Hey Dude brand, which carries best-in-class operating margins for the combination.

Crocs, Inc. (CROX) CEO Andrew Rees on Q1 2022 Results – Earnings Call Transcript

Crocs have the highest profit margins within their peer group, and this can be attributable to the scale economics that is present within the business model. The bear case for the fiscal year 2022/23 is that consumer confidence, that has significantly deteriorated, will destroy demand for the product. While the degree of deterioration is unknown, demand slowing from an overall macro perspective is to be expected.

Research released by Deloitte, in studying consumer behavior during past recessions, found that due to the lack of growth in discretionary income, customers flock to “retailers with a stronger value-based proposition… and discount retailers at this time benefited from consumers flocking to lower-priced and off-price offerings”. Any recession will affect consumer spending, but the case remains, the company’s offerings will be resilient due to their high-quality-low-price equilibrium that is sought out by price-sensitive consumers during recessions.

Management And Capital Allocation

Andrew Rees was appointed CEO in June 2017 and was instrumental in the transformation of the company between 2014-2017 in which he served as President.

He joined Crocs, Inc. from L.E.K. Consulting, where he served as Managing Director for the past 14 years. Rees has extensive experience within the footwear industry, serving as Vice President of Strategic Planning at Rebook International and is responsible for their retail channel’s growth and profitability. His responsibilities included strategic planning for Reebok Worldwide where Mr. Rees led the US Retail and Consumer Products Practice. Through his consulting experience, he has also built substantial knowledge on operating and strategic strategies with leading world-wide consumer brands. Management has a track record of disciplined capital allocation. The acquisition of Hey Dude is the first major acquisition since 2008. They have been able to revive the company and have returned capital to shareholders efficiently within the last decade. The company has effectively returned capital to shareholders through buybacks with the 10-year CAGR of diluted shares reduced by 26.1%. This on average has attributed to 4.1% annual return for shareholders.

The acquisition is an exemplary instance of strategic capital allocation in which they were able to capitalize on ultra-loose monetary policy, which was used to secure the funding of $2 billion for the acquisition. This was financed by a Senior Term Loan Credit Agreement (rate set at SOFR +3.50%) obtained from Citi.

Management have indicated that the main allocation of capital for fiscal year 2023 will be reducing the leverage ratio to below 2.0. Which I forecast Crocs will do by midyear 2023, through paying down $600-800 Million of the loan facility.

Misconception #1: They paid too much for the acquisition

There are many inherent similarities between Crocs and Hey dude. Both companies cater to cult-like fan bases, provide extreme comfort at the expense of ‘good looks’, and have a company structure that is critical to their success. As a result of the popularity of these two brands as measured by retail surveys, they will be able to navigate supply chain headwinds and achieve these synergies that are present within FY 2023.It has become evident, given the guidance and disclosures that have been made public due to the merger, why Crocs have levered up to historically high levels. Company disclosures and retail surveys indicate that Hey Dude is un-proportionally much more popular within the ‘middle’ of the US. Several times, management has alluded to synergies of expanding the offering to the national retailers on the East and West coast, see below Andrew Rees’ exert from a recent investor event.

I think the best way to think about HEYDUDE’s distribution is kind of down the middle of the country… That’s where the brand has about 20% awareness. If you look on the coasts, both East and West Coast, the brand has a less than 5% awareness… What we’re primarily looking to do in the short-term… is broaden distribution with national retail chains. And I think that will be a very achievable task. And then beyond that, we’ll then look at international growth first predominantly in Europe, and then we’ll also look at Asia subsequently.”

Misconception 2#: Crocs is a lockdown beneficiary

An analysis of the worldwide Google trends indicates that the interest for the product is the highest it has ever been in July 2022. Which tops the two peaks previously held which coincide with the two peak waves of COVID outbreak. This growth could also allude to the ability of the company to continue to grow in high inflation/low consumer demand environments which is made evident by the recent resurgence in interest. Customers are looking at relatively cheap but high-quality name brands that will provide them with products that will last. Within the two Crocs segments, the large shift to wholesale revenues along with growth in digital sales, has created a structural shift in the operating margins of the business. The lowest profit segment historically has been ‘direct to consumer’, excluding digital, through brick-and-mortar stores. The change in the structure of the margins towards wholesale and digital are the reason that the business can maintain these high margins relative to the 10-year average. The Hey Dude acquisition was initially guided to produce $700 million in revenues for FY 2022 and within the first 6 weeks of operations, synergies and strong demand from within the Crocs supply chain has enabled management to revise guidance upward to $840-890 million – a 23.5% increase in 6 weeks. It should be noted that this occurred during a quarter that has been overshadowed by war, multidecade low consumer confidence, high inflation, and extreme supply shocks. In a recent earnings call, Anne Mehlman [CFO] explained the sticky nature of margins. Despite our belief that these high margins are not sustainable, we are more likely to believe that Crocs will remain relatively close to the recent highs than the 2018 levels.

The easiest way to think about that is our classic clog in the US has moved from $35… to $50 now… and we haven’t seen any pushback, obviously, because we’ve had a big unit growth since that time… Jibbitz are a big piece of that margin reconstruction because… they’re really profitable… Product mix is also a big component of that because clogs have a really high profit margin and, over time, we have shrunk the other kind of less – undifferentiated products”

Conclusion

I forecast that the bond and stock market participants are both grossly under-pricing Crocs’ future earnings and management’s ability to deliver. This is further highlighted by the deep discounting of an already synergy-providing acquisition throughout HY1 2022, Hey Dude.

The risks are inherent; consumer confidence, inflation, supply shocks, war, and the list may go on. These risks however are likely to affect stock prices in the short term, but in the long term, strong fundamentals, backed by strong management and a solid brand, coupled with a vision for growth, will always prevail – especially when you pay 50c for a Dollar.

Be the first to comment