Anna Richard/iStock via Getty Images

Introduction

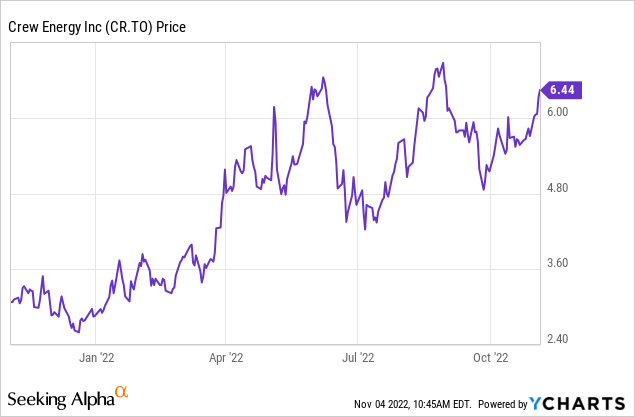

In an August article, I mentioned Crew Energy (OTCQB:CWEGF) (TSX:CR:CA) as an interesting vehicle to gain exposure to the natural gas price. Although Crew only has Canadian operations, it has secured access to several different key markets, which allowed it to outperform peers that only have access to AECO markets during the third quarter.

I was curious to see the Q3 cash flow in a lower natural gas price environment

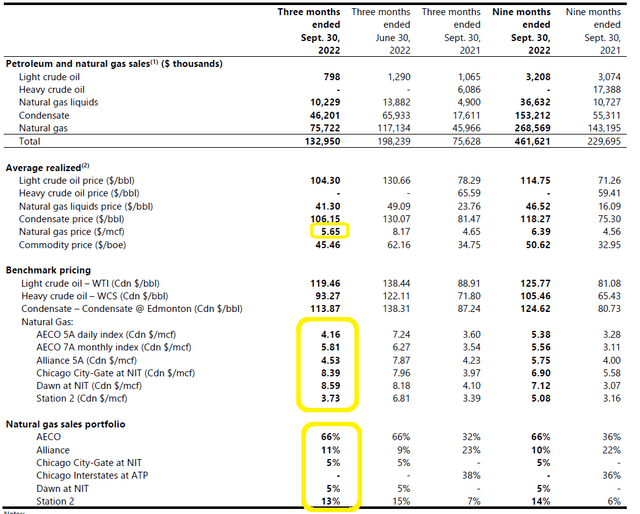

The average realized natural gas price during the third quarter was approximately C$5.65 per mcf. An excellent result considering the average AECO natural gas price was just C$4.16 based on the daily index. Thanks to Crew’s ability to serve other natural gas markets as well, the average realized price was boosted due to the higher natural gas prices in the US, resulting in an average realized price that’s almost 40% higher than the AECO daily index.

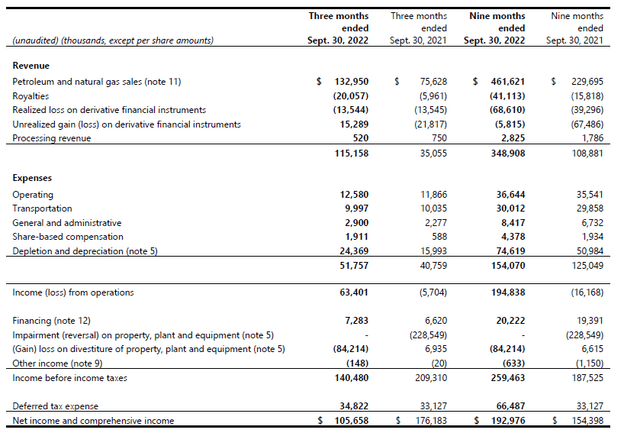

That’s an important competitive advantage versus a natural gas producer that does not have access to the US markets. And thanks to the total production rate of just under 32,000 boe/day (76% natural gas), the total reported revenue for the third quarter came in at C$133M. After deducting the royalty payments and adding back the net unrealized gain on hedging positions, the net reported revenue was C$115M.

Total operating expenses came in below C$52M, of which almost half were the non-cash depreciation and depletion expenses. Crew also recorded a C$84M gain on the sale of a property and this boosted the pre-tax income to C$141M and the net income to almost C$106M for an EPS of C$0.69. Great, but keep in mind that sale boosted the pre-tax income by approximately 150% so the underlying EPS would have been closer to C$0.28 per share.

This also is an excellent example to show why cash flow statements are important as well. The gain on the sale of the asset is a non-cash gain but this obviously has no impact on the operating cash flow and on the free cash flow excluding acquisitions and divestitures.

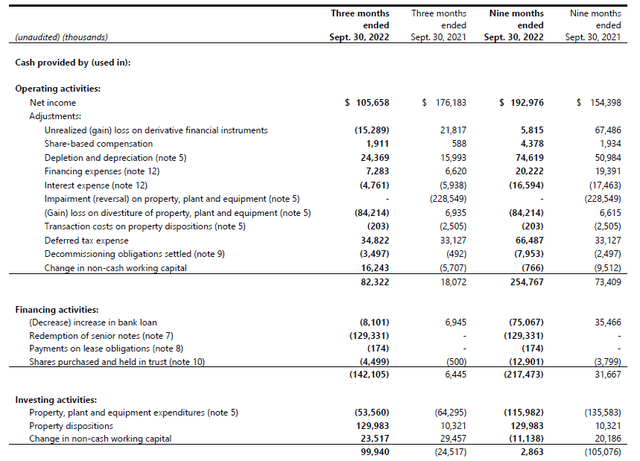

As you can see below, the C$84M book gain gets deducted again and the adjusted operating cash flow was C$82M and after deducting the C$16M in working capital changes, the normalized operating cash flow was approximately C$66M. The total capex was C$54M, resulting in a normalized cash flow of approximately C$12M (and this includes a C$13.5M realized loss on derivatives). Note how the property disposition was completed for almost C$130M, but I am keeping this out of the equation as it clearly is a non-recurring item.

We shouldn’t be alarmed by the high capex, as the third quarter’s capex was actually disproportionally high. As you can see, about 46% of the 9M 2022 capex was spent in just 33% of the time. The original full-year capex was anticipated to be C$130-140M, which means Crew has spent in excess of 40% of the full-year capex in just one quarter.

That capex guidance has now been increased to C$175-185M indicating Crew plans to spend C$60-70M on capital expenditures in the current quarter. This should be sufficient to drill 12 wells and boost the exit production rate and the production rate going into 2023. As Crew tends to have a capex-heavy second semester, we should see the capex drop down to just C$45-55M in the first semester of 2023, and Crew now anticipates to end Q2 2023 with a net debt of less than C$100M.

The balance sheet is still improving

Thanks to the strong production results and decent natural gas prices, Crew’s free cash flow on a YTD basis comes in at approximately C$140M (again excluding non-recurring items). Throw in the C$130M in cash it received for selling the Attachie and Portage assets, and Crew generated about C$270M in incoming cash flow in the first nine months of the year.

That cash was well-spent: C$130M was used to redeem senior notes (which have a 6.5% coupon, so the buyback will save about C$8.5M in interest expenses per year going forward) while Crew also fully repaid its bank loan. Meanwhile, the cash position was increased from zero as of the end of 2021 to in excess of C$40M at the end of September. The net debt position decreased from C$372M as of the end of 2021 to just C$131M as of the end of September. Throwing in the working capital deficit of C$49M net of cash, and the total net debt and working capital deficit was just C$180M and this makes Crew’s target of reaching a sub-C$100M net debt by the end of Q2 2023 relatively conservative. Odds are Crew will likely reach that level sooner.

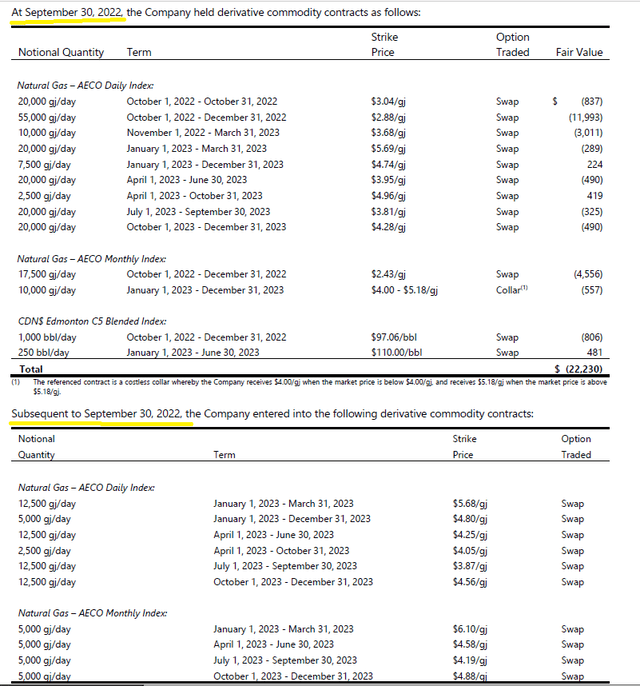

A portion of the production remains hedged and this will continue to have an impact on the reported results but I am pleased to see Crew entered into additional hedges at higher prices, which I think is the right approach.

Investment thesis

Crew Energy’s enterprise value is currently approximately C$1.1B and that doesn’t appear to be outrageously expensive give the current oil and gas price environment. I appreciate Crew adding additional hedges (if the company was okay to hedge gas at C$2.88 per giga-joule, it only makes sense to add more hedges at a price of C$4+ to reduce the volatility and increase the visibility on future cash flows).

I still don’t have a position in Crew Energy, but I am following its performance closely.

Be the first to comment