designer491

Do you own any preferred stocks? Certain preferreds have held up much better than the market so far in 2022. The Crestwood Equity Partners LP, 9.25% Preferred Partnership Units (NYSE:CEQP.PR) are one example of this.

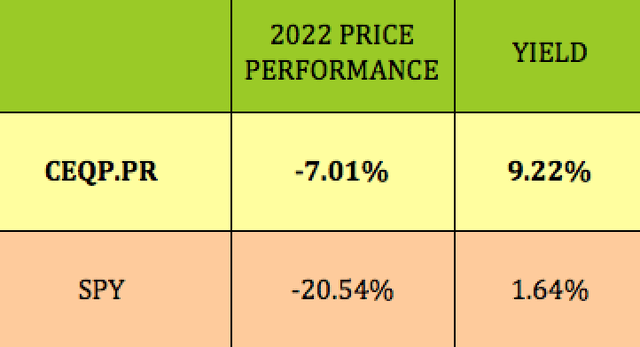

These preferred units are down -7% in 2022, vs. a -20.5% pullback for the S&P 500. In addition, when you consider their 9% yield, they’re nearly at breakeven, on a total return basis.

Profile:

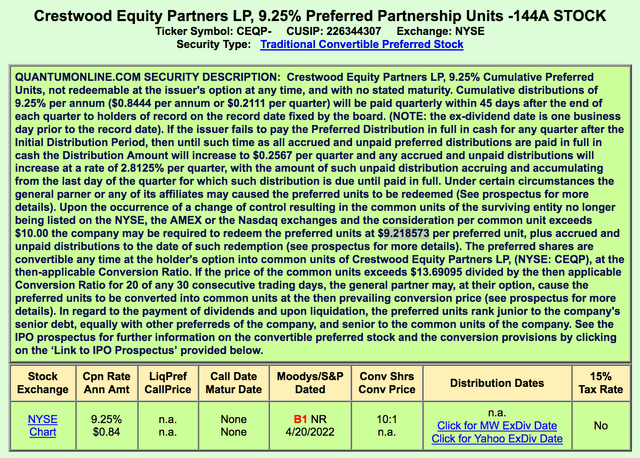

The CEQP.PR units have more investor protections than your average preferred shares, having been part of a Crestwood merger deal back in 2015. The preferred units are entitled to a cumulative distribution of $0.2111/quarter.

However, if Crestwood fails to pay the Preferred Distribution in full in cash, then until such time as all accrued and unpaid Preferred Distributions are paid in full in cash, the Distribution Amount will increase to $0.2567 per quarter; Crestwood won’t be permitted to declare or make any distributions in respect of any Junior Securities (including the common units) and; (B) subject to certain exceptions, certain preferred unitholders shall receive the board designation rights.

If a Change of Control (as defined in the Partnership Agreement Amendment) (other than a Cash COC Event) occurs, then each preferred unitholder shall, at its sole discretion:

(i) convert its preferred units into common units, at the then applicable Conversion Ratio, subject to the payment of any accrued but unpaid distributions to the date of conversion;

(iii) if (1) either (X) we are not the surviving entity or (Y) we are the surviving entity but the common units are no longer listed on the New York Stock Exchange or another national securities exchange and (2) the consideration per common unit exceeds $10.00, require us to use our best efforts to deliver to such preferred unitholders a mirror security to the preferred units in the surviving entity

(iii) if we are the surviving entity and the consideration per common unit exceeds $10.00, continue to hold its preferred units; or

(iv) require us to redeem its preferred units at a price of $9.218573 per preferred unit, plus accrued and unpaid distributions to the date of such redemption (which redemption may be paid, in the sole discretion of the general partner, in cash or in common units, in accordance with the terms of the Partnership Agreement Amendment). (prospectus)

There’s also a conversion feature, which allows preferred unitholders to convert all or any portion of their preferred units into common units, at the then applicable Conversion Ratio.

The preferred units have the same voting rights as the common units.

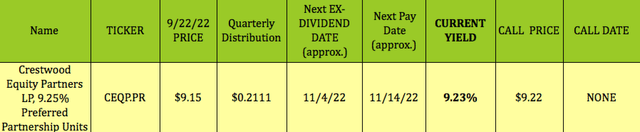

At its 9/22/22 intraday price of $9.15, CEQP.PR yields 9.23%.

They go ex-dividend and pay in a Feb/May/Aug/Nov. schedule, and should go ex-dividend next on ~11/4/22. Unlike most preferreds, there’s no call date for CEQP.PR.

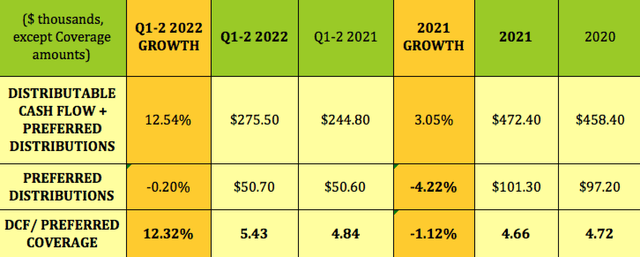

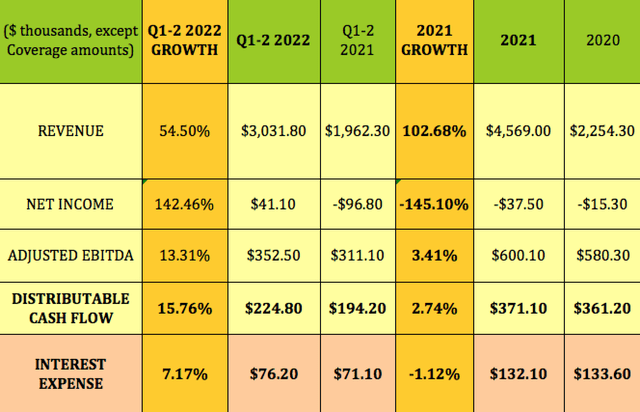

The coverage for these preferred distributions was in a 4.66X to 4.72X range for 2020 and 2021, and increased by ~12% in Q1-2 ’22, to a strong 5.43X figure:

Taxes:

Unitholders receive a K-1 report at tax time.

Company Profile:

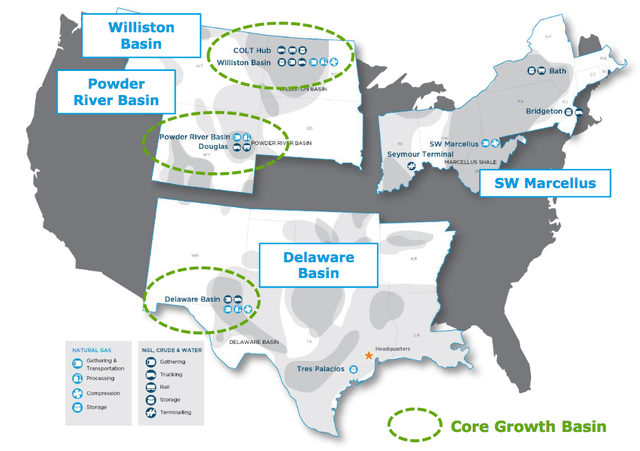

Crestwood Equity Partners LP (CEQP) is a publicly-traded master limited partnership that owns and operates midstream assets located primarily in the Williston Basin, Delaware Basin, Powder River Basin and Marcellus Shale.

Its operations and financial results are divided into three segments that include Gathering & Processing North, Gathering & Processing South and Storage & Logistics. Across its three segments, CEQP is engaged in the gathering, processing, treating, compression, storage and transportation of natural gas; storage, transportation, terminalling and marketing of NGLs; gathering, storage, transportation, terminalling and marketing of crude oil; and gathering and disposal of produced water. (CEQP site)

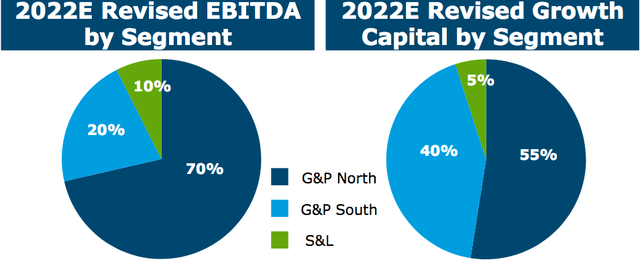

The Gathering & Processing North segment is by far the largest, with 70% of estimated 2022 EBITDA, with the G&P South segment at 20%, and the Storage & Logistics segment at 10%.

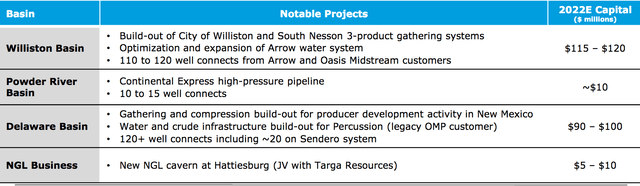

Management is allocating 55% capex to G&P North, 40% to G&P South, and 5% to the S&L segment. Much of CEQP’s 2022 capital program is centered around integrating Crestwood’s legacy systems with many of its newly acquired assets.

Management has made several recent acquisitions in order to ramp up its assets, including Oasis for $1.8B, Sendero for $600M, and FirstReserve’s interest in a Crestwood JV:

CEQP site

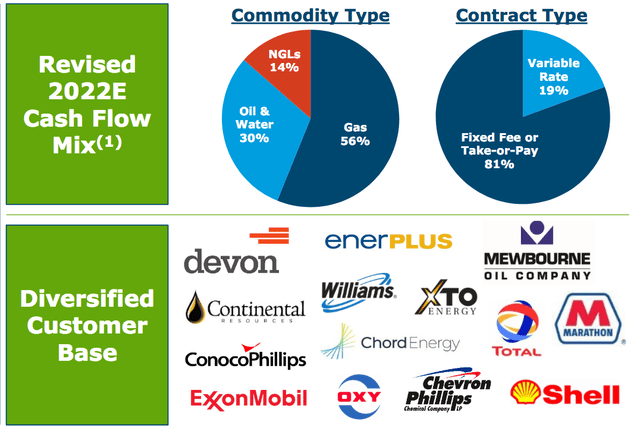

56% of Crestwood’s cash flow is generated by gas, with oil and water producing 30%, and NGLs kicking in 14%. There’s resilience vs. roiling commodity markets, in that 81% of cash flow is covered by fixed fee/take or pay contracts with several well-known oil majors:

Earnings:

CEQP has had major revenue growth in 2021 and so far in 2022, due to its acquisitions and organic expansion projects being put into service. Net income, which includes several non-cash expenses, the major one being depreciation and amortization, is often very lumpy for midstream firms.

Instead, investors look at EBITDA, which is up over 13% so far in 2022, and distributable cash flow, DCF, which is up 15.76%. Interest expense is up ~7%, due to more assets to finance.

Growth Projects:

Management has several more growth projects in the works for 2022 in each of its segments, with the Williston Basin getting ~$115M in capex, and the Delaware Basin getting $90M; while the Powder River and NGL assets are getting ~$5 to $10M:

Guidance:

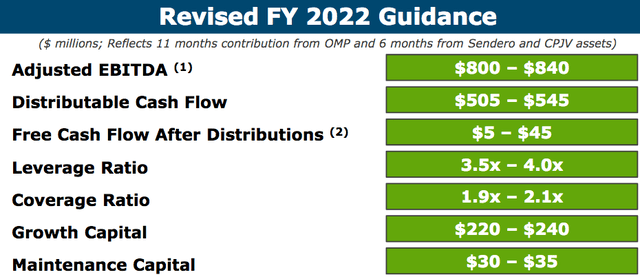

Management raised its 2022 guidance, based upon the favorable impacts of the acquisitions. EBITDA is now expected to be from $800 to $840M, with the midpoint $820M representing a ~37% increase over 2021’s $600M figure.

DCF is expected to be from $505 to $545M, with the midpoint $525M figure representing a ~41% increase over 2021’s ~$371M figure.

Debt:

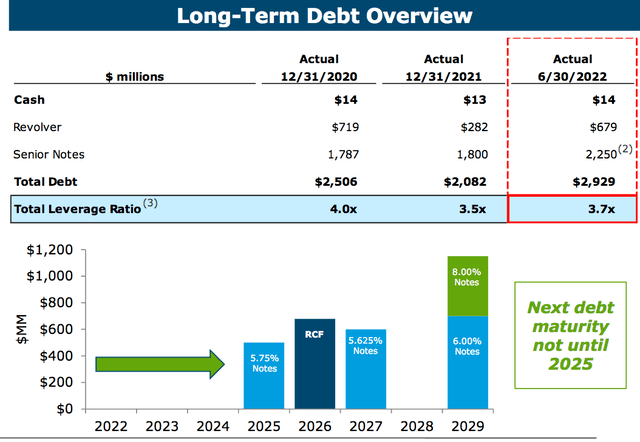

Management has been working on decreasing CEQP’s debt leverage over the last two years and has made some inroads, with its figures showing a decline from 4X at 12/31/20, to 3.7X as of 6/30/22.

CEQP has no debt maturities until 2025, when its 5.75% Notes come due.

Profitability and Leverage:

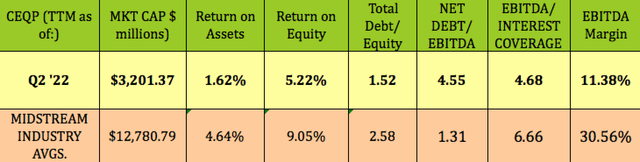

We show a higher net debt/EBITDA figure of 4,55X, but that’s based upon trailing figures. Using an annualized Q2 ’22 EBITDA figure shows a net debt/EBITDA figure of 4.05X. Thar figure should improve a bit, with EBITDA expected to rise in the 2nd half of 2022.

While CEQP’s ROA, ROE, and margin figures are all lower than midstream industry averages, its Debt/Equity leverage is much lower:

Parting Thoughts:

If you’re looking for a relatively conservative high-yield income vehicle, take a closer look at CEQP.PR. We rate it a long-term buy based upon its strong preferred distribution coverage and CEQP’s continuing growth.

All tables by Hidden Dividend Stocks Plus, except where noted.

Be the first to comment