Drew Angerer

Thesis

We highlighted in our pre-earnings article on NIO Inc. (NYSE:NIO) that there was too much pessimism in the market, even though NIO had already bottomed decisively in May.

NIO’s Q2 earnings release corroborated that the fear was misplaced, as it looks ready to ramp its production and delivery cadence through Q4. Therefore, we believe it demonstrates that the company’s execution remains solid, despite near-term supply chain disruptions and unpredictable COVID lockdowns impacting its capacity.

NIO is also continuing its expansion into Europe, likely pairing its ET5 with its ET7 flagship sedan. While BYD (OTCPK:BYDDF) is also charting its aggressive expansion, we believe NIO’s premium positioning has set itself apart from China’s leading NEV maker, differentiating itself effectively. In addition, NIO has also been making progress on the development of its mass-market models to expand its penetration in China.

Management also seems confident in its Q4 ramp, which could see NIO break new highs. Therefore, NIO’s production and deliveries cadence could be at a significant inflection point, lifting the market’s confidence in its breakeven profitability target exiting Q4’23.

Therefore, we believe the recent pullback over worries of heightened geopolitical tension and a weaker China economy offers another opportunity for investors to add more positions.

We reiterate our Speculative Buy rating on NIO but cut our medium-term price target to $23 (implying a potential upside of 25%). Our cut reflects near-term multiple compression and headwinds relating to execution risks on meeting its Q4 guidance. Also, the recent spike in lithium prices could impact its near-term gross margins recovery, which could also affect the recovery of its bullish bias.

NIO’s Q4 Ramp Could Be Massive

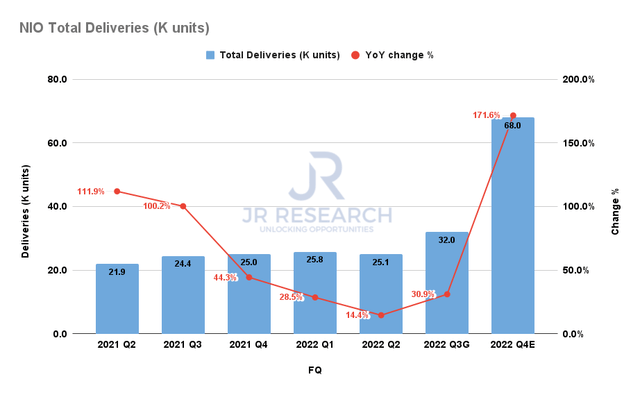

NIO deliveries (Company filings)

With Q2 done and dusted as it was affected by the COVID lockdowns, NIO looks ready to ramp in H2. Given the delivery updates for July and August provided before the earnings release, NIO is expected to deliver about 11.28K in vehicles in September, based on its Q3 guidance of 32K units (midpoint). It also represents an MoM increase of 5.7% from August’s 10.67K units, indicating that NIO’s new product line-ups are expected to support its ramp cadence.

Moreover, NIO’s Q3 guidance also represents a 30.9% YoY uptick and a 27.5% QoQ increase in deliveries. Hence, we postulate that Q2 is likely the nadir in its delivery growth.

Furthermore, NIO has not suggested otherwise that it would be unable to meet its 100K H2 deliveries target, which implies a record Q4, predicated on delivery estimates of 68K. Hence, it represents a massive 171.6% YoY uptick and a 113% QoQ increase. CEO William Li accentuated:

We will try our best to meet the delivery target for this year. We believe starting from the fourth quarter, we’re going to have the two factories running to make sure we can support the delivery demand. Actually, starting from the third quarter, we have already kicked off the tooling and the preparation for the mass production of ET5 at a large scale in factory 2 in the NeoPark. So we believe in the fourth quarter, we are going to break records every month. And we are confident [in achieving] the record-breaking target for the fourth quarter, and we have been making active preparations to meet this target as well. (NIO FQ2’22 earnings call)

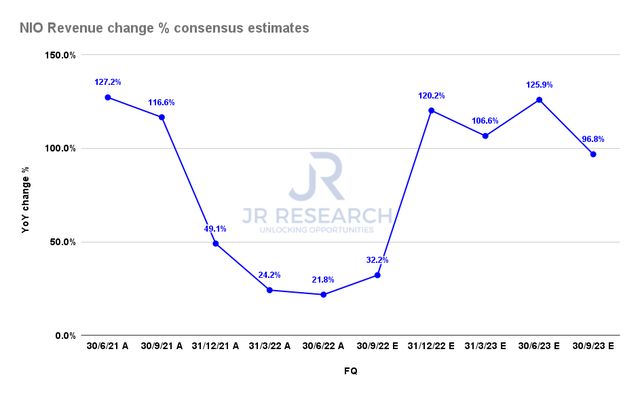

NIO Revenue change % consensus estimates (S&P Cap IQ)

Accordingly, the consensus estimates (bullish) are confident of its Q4 ramp, as the Street projects for NIO to post revenue growth of 120.2% in Q4. Also, its growth cadence is expected to follow through to FY23.

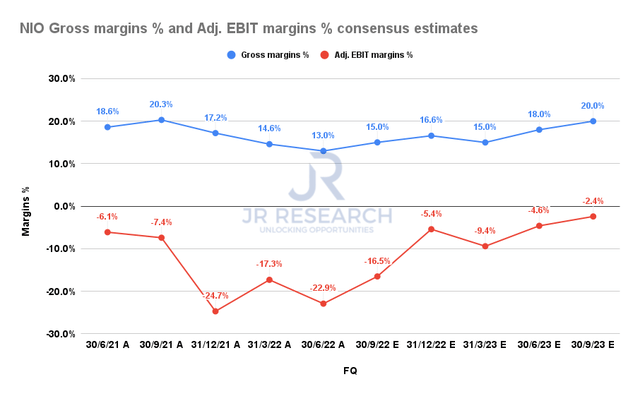

NIO Gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Therefore, it should be highly accretive to its operating leverage as NIO recovers its gross margins. Hence, NIO’s production and delivery ramp is predicated on its ability to navigate its supply chain adroitly, which remains the most critical risk for our thesis.

China’s adherence to its zero COVID restrictions could interfere markedly with NIO’s guidance, hobbling its supply chain visibility and production growth. We believe investors need to continue to bear this in mind.

Is NIO Stock A Buy, Sell, Or Hold?

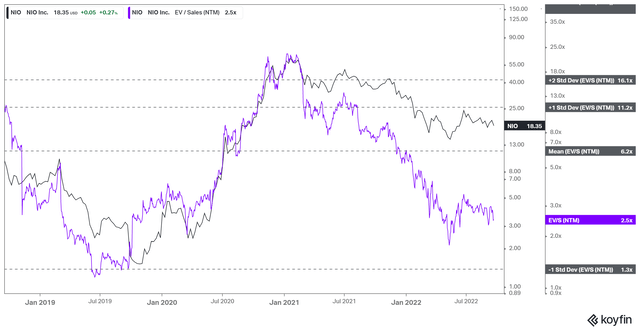

NIO NTM Revenue multiples valuation trend (koyfin)

NIO’s NTM revenue multiple of 2.5x remains well below its mean of 6.2x. Despite that, we believe the de-rating is justified, given the risks to its production and delivery visibility due to China’s unpredictable COVID lockdowns. Hence, we urge investors to apply a generous discount to its valuations and not chase momentum surges in NIO.

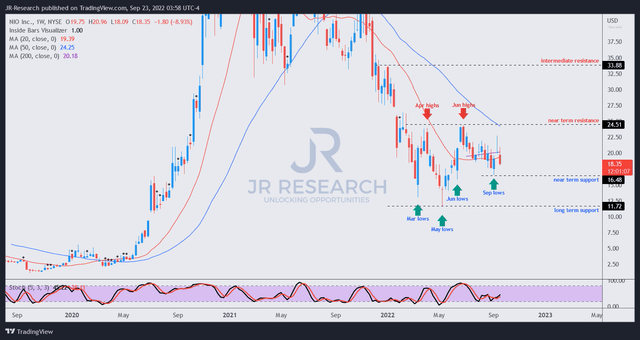

NIO price chart (weekly) (TradingView)

NIO has been moving within a consolidation range since its bottom in May 2022. However, we are confident that NIO’s price action suggests that it’s unlikely to fall back to its May lows if the company could keep up with its production and delivery cadence.

Notwithstanding, we gleaned that its near-term resistance ($24.50) has been a critical source of failure for its upward momentum. Therefore, NIO had met significant selling pressure over the past five months as it surged closer to that zone. Hence, we urge investors to avoid adding near that level and to avoid chasing momentum spikes. Investors should wait patiently for deep pullbacks before considering adding exposure.

Accordingly, NIO has fallen more than 20% from its post-earnings spike, closing in on its September lows. However, we believe NIO’s near-term support zone could proffer robust buying support, with July lows set up as a secondary level to add exposure if potential downside volatility causes a deeper pullback.

We reiterate our Speculative Buy rating on NIO, with a reduced medium-term PT of $23.

Be the first to comment