marekuliasz/iStock via Getty Images

Investment Thesis

Crescent Point Energy (NYSE:CPG) is well-positioned for a very strong oil market. Investors just need a little more patience. That’s the core takeaway here.

In a realistic world, CPG’s total yield is 14.5%. In a more bearish world, the total yield is around 8.0% or 9.0%.

No investment is a clear homerun. But given the available options in the market, CPG looks incredibly attractive.

What’s Happening Right Now?

Here’s a list of headwinds:

- Europe is probably in a recession already.

- The US is more likely than not going to enter one in 2023.

- What about China? Oh, please, I can’t even begin to describe how much we need China to get back to growth mode.

- But what about interest rates? Haven’t you heard? It’s all about crushing demand, and taming inflation!

- The Fed will not pivot.

In a matter of seconds, all the reasons for demand destruction become obvious.

There’s a whole list of events taking place that have the potential to be cataclysmic for the oil market. Have I highlighted anything that you didn’t already know? Nope.

You know this. I know this. Everyone knows this. These are known knows! It’s already in the WTI price.

And here’s the ultimate reality of the situation, despite all these events taking place, WTI prices have been largely range bound between approximately $75 and $95 WTI.

And if you think about it, that’s really not such a big range, when you consider everything that I mentioned above.

CPG Stock: Stubborn? Boring? Let’s Step Back

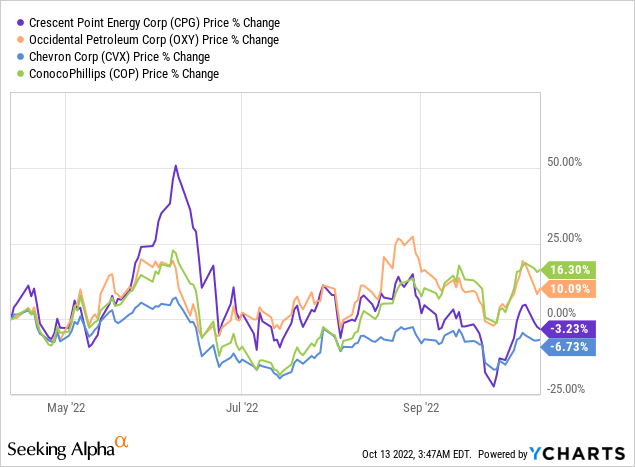

I find it fascinating to think that CPG’s share price has remained so stubborn. But then, I compare it to some of its peers.

For the past 6 months, these stocks have remained surprisingly boring and not moved up much.

But then, if you take a step back and look elsewhere in the market, and we see tech-carnage, all of a sudden being down 6% in the past 6-months is really nothing at all.

Is it such a bad thing to see your stock hold up, when the rest of the market is in turmoil? I don’t think that’s a huge problem at all.

Crescent Point Energy’s Capital Return Framework

I believe that the reason why CPG has held its ground is that the stock is mightily undervalued.

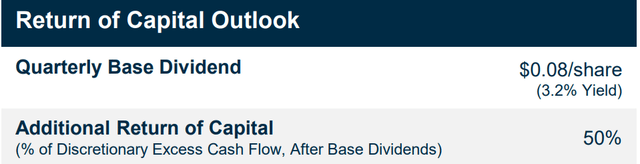

For its part, CPG has a very clear capital return framework.

CPG states that 50% of its excess cash flow, which CPG divines as free cash flow after dividends, will be returned to shareholders via share repurchases.

This capital return framework started now in Q3 2022. Hence, I believe that investors are now considering that since CPG is expecting around CAD$1.2 billion when WTI is around $85, that means that shareholders today will be getting close to an 11% annualized return starting Q3.

This 11% yield is on top of the 3.4% yield from CPG’s dividend.

What if Oil Turns Lower?

In the past, the problem with investing in oil companies is that they were often overleveraged. But that’s not the case today. If oil sticks around $80, maybe CPG’s free cash flow rate drops to $800 million.

I believe that is a fair assumption, given the amount of operating leverage the business model carries.

That would imply that investors would be getting very approximately $350 million back as share repurchases, plus around a 3.4% dividend yield. Thus, altogether the total yield would drop from close to 14.5% to approximately 8% or 9%. Clearly, there is a fair amount of divergence, but is that such a big problem?

How is it that a 9% yield in the current environment is something to be snooty about?

The Bottom Line

Any investor understands that the game is to buy low and sell high. Any investor can even rationalize that the best returns can be made from buying what is out of favor and waiting.

But those two elements feel so jarring. Buying out-of-favor stocks is something that we like to do occasionally when the market is ”behaving”. Little small and cute little dips, that get bought up and rallied strongly off the bottom. Enough to provide both the cortisol stress and the dopamine pleasure.

But when an investor is buying and buying and has little to show for it after several months, that second element, the waiting, becomes more than jarring. It becomes an irritation. It becomes paralyzing.

All those bullish adages of buying when others won’t and buying when there’s maximum pessimism, and all the rest of them, become simple platitudes that apply to other markets. But not this one. Alas, simple but not easy.

Be the first to comment