Maki Nakamura/DigitalVision via Getty Images

Investment Thesis

After the Inflation Reduction Act was passed, the prices of all green energy sector representatives increased dramatically. Despite the resolution of legislative issues, the situation across the industry remains tense. Supply chains are still disrupted, manufacturing cost is still extremely high and large producers are often unable to quickly pass it on to the consumer. In our view, the market has overestimated the effect of the green energy subsidies to be extended. We give First Solar (NASDAQ:FSLR) SELL rating and do not recommend holding the company’s stock now, as it is too expensive.

The situation across the solar panel market

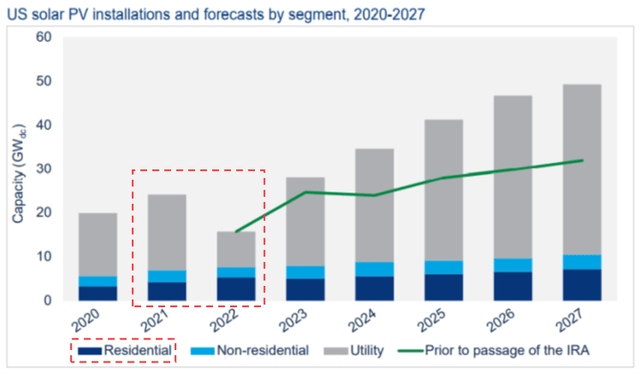

With the passage of the Inflation Reduction Act, the backlog of green energy sector challenges, related to uncertainties in the U.S. legislation, significantly decreased. This made investors very optimistic. The Act renews tax credits (both PTC and ITC), so it will drive up strong demand for solar panels and provide support for domestic manufacturers (in the form of tax deductions).

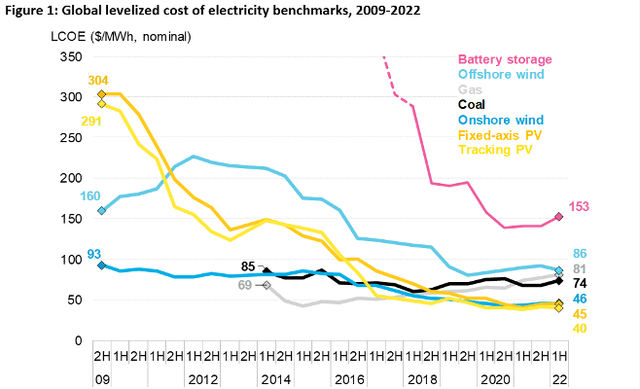

Under current conditions, the normalized cost per MWh generated by solar panels is significantly lower than by other sources, according to BloombergNEF, and tax credits make such projects doubly attractive. This is evident in the households use, as even in 1H 2022, when this market was in limbo, many retail customers continued to install solar panels at home, according to Wood Mackenzie.

Private customers are the target audience for First Solar, so the company has a huge number of orders for 2 years ahead. We do not expect problems with demand in future and are satisfied with the pace of shipments in Q2, given the improved logistics situation, the company’s revenue is starting to stabilize.

One more positive factor is the elimination of antidumping duties till 2024, with the adjustment that tax-exempt solar panels shall be put into use in the US within 180 days. The decision is unlikely to change the situation with competition in the domestic market, but it will support manufacturers which order components from Asian countries.

Although the uncertainty in legislation has been resolved positively for manufacturers, the supply chains are still unstable, and it seems to be a more significant factor for investment decisions.

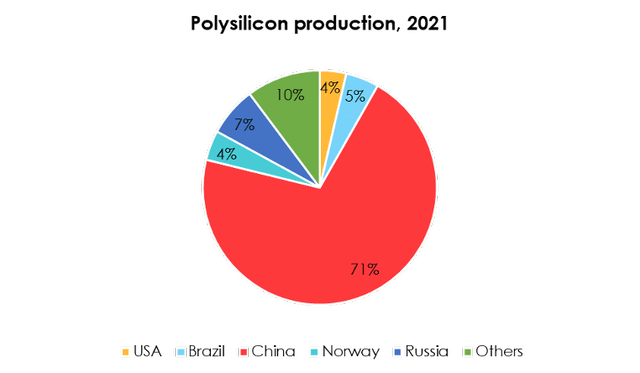

Polysilicon production is almost entirely concentrated in China, according to USGS, and this is the real challenge. With the current problems associated with lockdowns in China, the already severely limited supplies are declining even further.

Moreover, about half of China’s silicon is mined in Xinjiang. Profitable import to the U.S. from this region is not possible. Moreover, there is a strong demand for solar panels in Europe and less restrictions on cooperation with China.

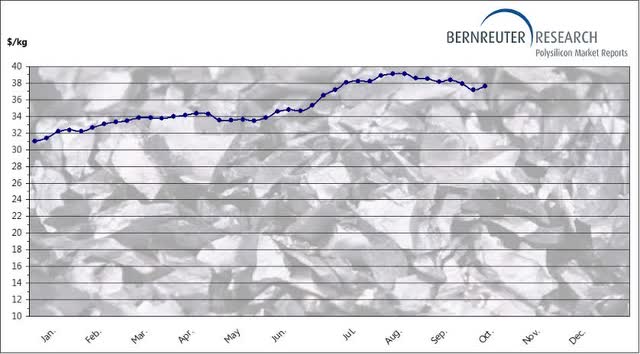

Silicon prices continue to increase steadily, even amid correction in the prices for other resources, according to Bernreuter. Due to high concentration and limited supply, we do not expect a strong trend reversal in the near term.

Cost inflation for panel manufacturers far exceeds headline inflation within the economy or PPI in other sectors and we believe that the renewal of tax deductions is not enough to make loud statements about the investment attractiveness of the sector.

A detailed view on First Solar – future perspectives and valuation issues

First Solar business is largely focused on retail, but the company also sells project assets for commercial use (e.g., sale of line in Japan in Q2 and upcoming line sale in Chile).

Series 6 is the core product line of FSLR, but the company is now making a big bet on the next generation of panels, Series 7 / 7+. The key difference is the lack of traditional frame, new mounting design and larger panel area. The system is more efficient in terms of power generation, cost-effective in terms of installation (the BOS cost). The company also claims higher durability of the new modules.

Nevertheless, we believe that transition to the new generation will take a long time. The new panels will be produced primarily at new factories in Ohio and India, and while the latter will begin to operate next year, the Ohio factory is not scheduled to be commissioned until 2024.

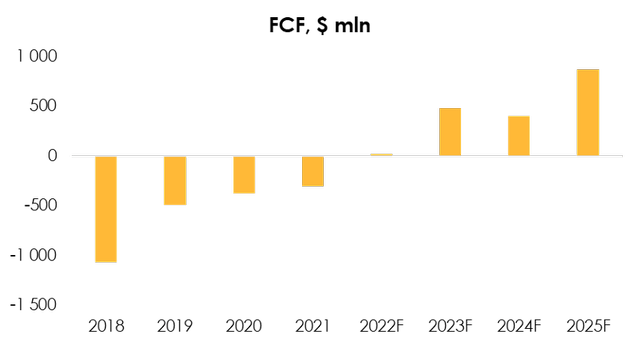

We expect the gradual transition to Series 7 not only to create a new competitive product, but also to improve the company’s profit margin. Now the management is using mostly freight adjusters in module supply contracts but is starting to switch to technology and steel adjusters in future contracts. In addition, First Solar is forced to close commitments under agreements signed more than a year ago due to long production cycles and disruption of supply chains, resulting in low 2022 margin.

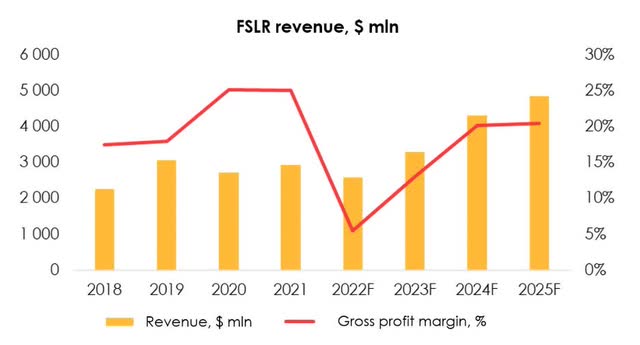

As per our forecast the revenue of First Solar will increase at an average annual growth rate of 13.47% to $4 846 mln in 2025, driven by opening of new facilities and accelerated production rate. At the same time, by including adjustment clause in the contacts and price updates, First Solar will be able to increase its gross margin to 20.40% by 2025, even with continued high silicon prices.

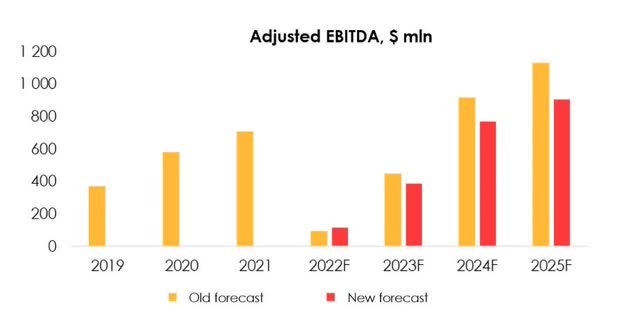

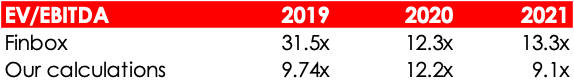

It is noteworthy that First Solar accounting policy is quite specific. In the Income Statement, the Q2 gross margin total -3.74%, but in fact ~$58 mln loss is the revaluation of the Chile plant to be sold, which is not actually a cash cost item and should not be included in the EBITDA calculation. First Solar strategy was largely focused on developing project assets for subsequent sale, but due to high uncertainty in the price of future deals and volatility of such profit, we decided not to assume sale income and revised First Solar historical and projected EBITDA.

The EBITDA revision significantly reduced the volatility of historical multiples and the number of fragile assumptions we use in forecasting future financial results.

Outstanding financial position and a path to strengthen it even more

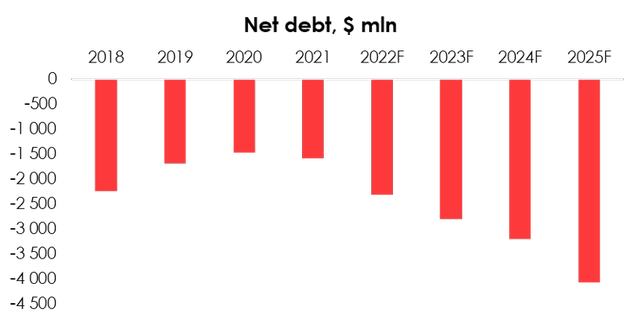

As of the end of 1H 2022 First Solar had negative debt of $1 670 mln, while the remaining $175 mln of debt on the company’s balance sheet is attributable to the project asset in Chile to be sold soon. Technically, First Solar has no debt obligations. The company is fully financed at the expense of its own funds. Despite relatively high CAPEX program ($640 mln in 2023 and $880 mln in 2024 as per our forecast), First Solar will not have to raise additional funding at all.

We expect the company’s net debt to decline to $4 068 mln by 2025, supported by income from sold plants, accelerated production cycle (and subsequent inventory retirement), and tax incentives for US-based panel manufacturers.

Since taxes and income from the sale of assets are not included in the adjusted EBITDA calculation, we assume these factors in the net debt forecast.

Valuation

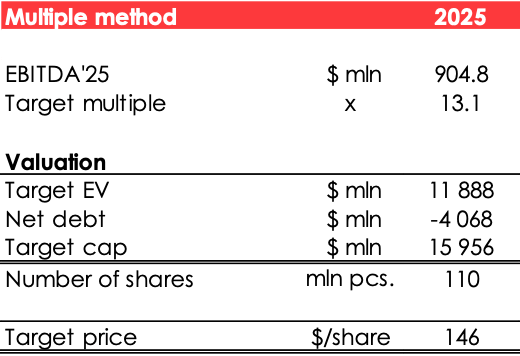

We have revised our stock target price upwards from $101 to $107 due to the following:

- Changes in EBITDA calculation and forecast for 2022-2025.

- Inclusion of the net debt forecast in the valuation.

- Valuation horizon shift (the company’s valuation is based on 2025 financial results discounted at 13% DR).

Based on the new assumptions, we have revised the stock status to SELL. Downside -24%. It is worth mentioning that fair value price of stock ($107 per share) was get by discounting price of the stock in 2025 ($146 per share) at 13% annual rate.

Despite the overall positivity, we believe that the market has overestimated the effect of the green energy subsidies to be extended. Due to problems with supply chains and limited production capacity, First Solar is starting to look overvalued.

Invest Heroes

Source: calculations by Invest Heroes

Conclusion

The strong hike in solar panel makers’ share price after the passage of the Inflation Reduction Act and extension of green economy subsidies seems to be excessively optimistic market reaction. First Solar has a good fundamental position, but now the company seems to be overvalued. We do not recommend buying the stock at current prices and expect a decline on the one-year horizon.

To manage the position, we recommend keeping an eye on financial statements of First Solar and industry research (Wood Mackenzie, EIA, PV-Magazine , etc.)

Be the first to comment