paci77/iStock via Getty Images

Investment Thesis

Crescent Point Energy (NYSE:CPG) delivers a smashing Q3 result, with plenty of cash being returned to shareholders.

There’s really a lot to dig into here, but for me, management did a stellar job of putting out guidance for 2023. Even though the likelihood that oil goes to $75 WTI is improbable, at least it gets investors thinking. So, thank you management.

A lot of people like to overintellectualize where oil is going next year. That’s not my style. I prefer to be vaguely right than precisely wrong.

Despite acknowledging that nobody really knows where oil is headed next year, I remain positively compelled toward CPG.

Q3 Earnings, What You Need to Know

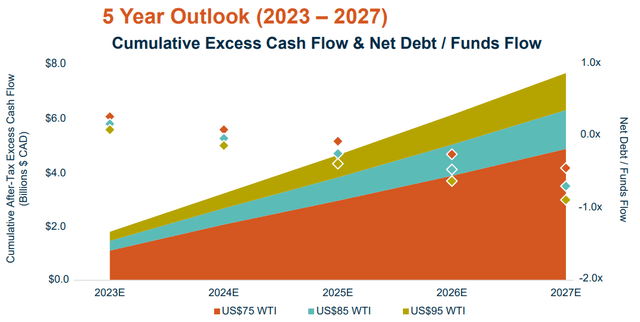

This is the core of the argument. CPG makes the case that if over the next several years, WTI stays around $75, its cumulative free cash flow after dividends will trickle higher.

Meanwhile, in Q3, CPG’s excess cash flow, that is free cash flows before dividends, was up 16% y/y to CAD$234 million.

Given everything that we’ve read in the past few weeks about inflation and oil field service rates going up, clearly, this increase in free cash flow is positive.

To illustrate my point, consider that CapEx for 2022 has now been upwards revised by 5% to CAD$995 million when just 90 days ago, the high end pointed to CAD$940 million.

On the hand, Q3 2022 saw its net debt come down by approximately CAD$1 billion, from CAD$2.1 billion last year to CAD$1.2 billion.

Capital Coming Back

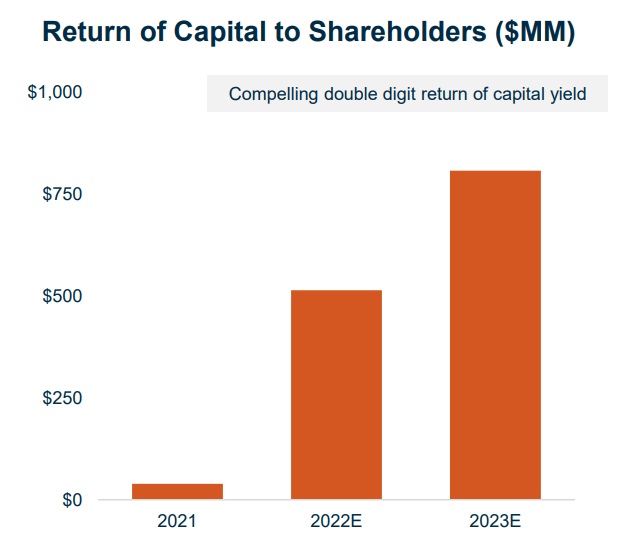

Moving on, in the month of October, to date, CPG repurchased 3 million shares. This compares with 8.2 million shares for Q3 as a whole. Put simply, CPG isn’t shying away from returning capital to shareholders.

CPG Q3 2022

Looking ahead to 2023, assuming that WTI stays around $75 to $85, then CPG is going to return approximately 15% of its market cap to shareholders.

Consider this, if WTI comes down slightly to about $80 WTI, investors will get a 15% total yield, from dividends and repurchases, see graph above.

Of course, most of the capital return comes from repurchases. Something that investors typically don’t value all that much.

But when despite little top-line growth, CPG’s adjusted funds flow per share, this is CPG’s free cash flow per share, increases by 52.3% y/y, all of a sudden, those buybacks start to look very attractive, I’m confident you’ll agree!

CPG Stock Valuation — 5x Next Year’s Free Cash Flow

If you are bullish on oil, you’d welcome CPG’s announcement that with WTI at $75 to $85, CPG is expected to make around $1.2 billion. I believe that if you strip out all the noise in the markets right now, I believe that this is a very fair and reasonable estimate.

Of course, many of us bulls are like ”no way Jose” is oil going to stay at $75. But as someone recently told me, I am not young enough to know everything.

There’s always the possibility that someway somehow oil gets back to $75.

The Bottom Line

The oil bull in me categorically can’t imagine that oil is going to stay at $75 in 2023. There’s just no way that’s going to happen, as too few companies are substantially ramping up production.

And while the spot market continues to entertain ”demand destruction” ideas, I believe that is wrong too.

Yet, you may contend, who am I to say that the spot market is wrong? Well, for one, just two years ago, WTI went negative on the spot market, so clearly, the spot market can get things wrong then.

So while risks always remain with oil stocks, I remain of the belief that paying 5x next year’s free cash flow is really cheap. Again, that’s CAD$1.2 billion of free cash flow if WTI hovers slightly lower from this point to around $80 WTI. Good luck.

Be the first to comment