MadamLead

After a stellar first half in 2022, the energy sector stumbled, inspiring some analysts to forecast that the bull run was over. But that view is looking premature as Big Oil shares rally anew.

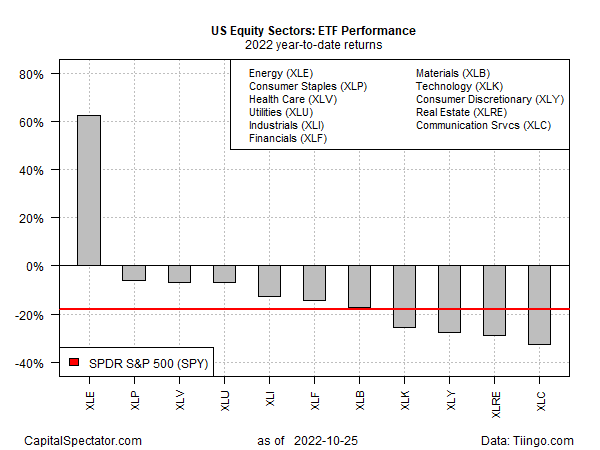

Year to date, energy stocks remain the clear performance leader for US equity sectors, based on a set of ETFs. As a result, there’s a decent chance that investment portfolios that have delivered relatively strong results this year can be traced to overweights in conventional energy shares.

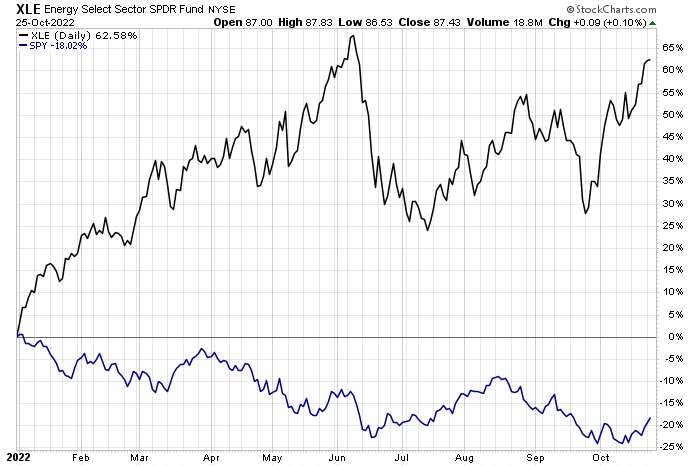

The outperformance of Energy Select Sector (XLE) certainly tells a compelling story. Compared with the broad market (SPY), the performance difference could hardly be more stark. XLE, which is dominated by the likes of Exxon Mobil (XOM) and Chevron (CVX), is up a sizzling 62.6% year to date. The ETF’s current rally has lifted the price to within shouting distance of the previous high in early June.

Notably, no other sector even comes close to XLE’s performance run. That’s true for the year-to-date window as well as the trailing one-, three- and six-month periods.

Explaining the energy’s sector ongoing leadership tends to converge on the narrative that a perfect storm of bullish conditions has been unfolding, including Russia’s invasion of Ukraine, which has triggered a global energy crisis, and underinvestment in developing new conventional energy supplies in recent years.

“Some investments are suitable for the fearful, others for the greedy. US energy stocks may be a rare fit for both,” advise the executive chairman of Strive Asset Management and the Chairman and CEO of Teton Capital. “The sector is an inflation hedge and also has home-run growth potential if liberated from shareholder-imposed mandates to abide by environmental, social and governance constraints. Energy stocks should continue to outperform as capital rotates from technology to energy,” they predict.

The latest trigger to fire up the energy sector is the decision by OPEC+ to cut oil output earlier this month. Rising recession risk for the global economy lurks as a bearish factor for the energy-price outlook, but to some extent, that may be offset if China eases or ends its zero-tolerance Covid policy. The lockdowns have suppressed the country’s consumption of energy and so a policy shift would reverse the trend and boost demand for oil and gas.

Perhaps the key question for the near-term energy outlook: Will President Xi Jinping, now that he’s secured his third term as general secretary of the Communist Party, ease the lockdown in China that has stifled energy consumption?

Only Xi knows for sure, but even without that policy change, the energy bulls remain optimistic. The main risk factor: recession. Europe is probably already in recession and the US may soon follow.

Yet energy stocks have rallied sharply, again, in recent weeks, but it’s not obvious that XLE can easily surpass its June peak without policy shift in China.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment