NicoElNino

Investors looking for safe harbors this year have found little refuge in small-caps. The Russell 2000 ETF (IWM) is down 27% YTD, even worse than the S&P 500 (SPY). Today, I would like to present a unique investment idea which benefits from recessionary pressures, though liquidity constraints likely reduce actionability to smaller accounts and patient investors.

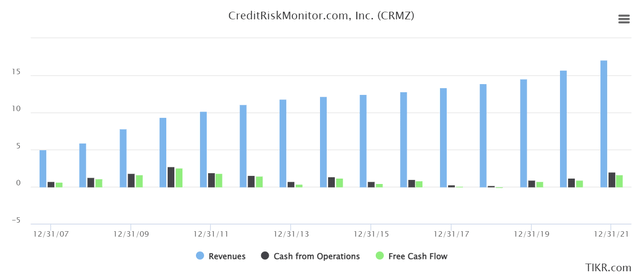

CreditRiskMonitor (OTCQX:CRMZ) sells B2B credit reports primarily through fixed annual subscriptions. The company states over 35% of Fortune 1000 companies already subscribe to their services, validating their product in the marketplace. CRMZ also boasts impressive growth over the past 15 years, increasing revenue every year since 2007 with only one year of negative free cash flow:

As you can see, CRMZ nearly doubled their revenues in the years following the Great Financial Crisis, as businesses renewed their focus on counterparty risks. Some resurgence has already begun post-Covid, but the stock appears to have mostly missed the memo.

Trailing earnings of $3.2m should be adjusted for the $1.5M PPP loan forgiveness in Dec-21, and backing out non-cash items leaves us with $2m of TTM free cash flow. It should be noted that results include development costs for their recently launched SupplyChainMonitor tool, and the associated revenues have yet to materialize.

A good business overview was posted earlier this year by Eskimo Research, which is worth reviewing for more background. The author notes that recent outsourced sales efforts have helped drive growth, which also helps explain the recent surge in revenues.

Competition

Dun & Bradstreet (DNB) services a large portion of the market via their Paydex score. Most CRMZ customers also subscribe to DNB but use their CRMZ subscription to reduce their DNB expenses, which often charges per use and not just the flat rate.

The clearest recent benchmark is Moody’s (MCO) takeout of competitor Cortera for $135m in FY21 ($139m adjusted for $4m cash balance), which Crunchbase reports earned $35m of FY19 revenue (2.4x CRMZ’s 2019 revenue). Using this to value CRMZ would arrive at 135/2.4/10.7m shares = $5.26/share, before making any adjustments for the $1.18/share of cash at CRMZ.

Cortera had received over $500m of VC funding before the takeout, and peer RapidRatings just got a $200m equity infusion. An older Moody’s purchase, BvD, was bought in 2017 for more than 20x EBITDA.

Valuation

At $2/share, CRMZ trades at a $21.4m market cap, with $12.6m cash on their balance sheet. The resulting $8.8m EV is only 4.4x TTM FCF (23% yield) for a growing subscription revenue business, recently burdened with costs for a new stream of revenues that have yet to hit the financials. This seems very undemanding, and suggests CRMZ could be trading at a negative enterprise value in less than 5 years without growth.

I believe the business shouldn’t trade below a 10% FCF yield given the business tailwinds, growth opportunities, and steady operating history. $20m for the FCF plus $12.6m for the cash arrives at a $32.6m market capitalization, or $3.05/share (50% upside). This value can be enhanced through continued cash generation at the business, growing their bottom line, and share repurchases below $3/share.

I also am not attributing any value to CRMZ’s vast database on public and private companies, data which has significant value and helps explain the premium paid for peer Cortera. CRMZ collects in excess of $2.5 trillion in annual trade receivable transaction data as part of their Trade Contributor Program.

Additionally, I expect a significant amount of expense would be removed by a strategic acquirer buying CRMZ, which could consolidate sales efforts and eliminate duplicative corporate and public company expenses. With $8.4m of TTM SG&A, even a 25% reduction for synergies would imply CRMZ is trading ~2x EV/FCF (50% yield) for an acquirer.

Risks

Ownership is controlled by Flum Partners, whose GP is CEO Jerry Flum. The controlled nature of the company doesn’t appear too concerning as Jerry has previously returned significant capital to shareholders, paying over $6.5m of dividends between 2009 and 2019, before suspending payments during Covid, and recently authorizing a $1m repurchase plan. It seems likely no capital return will be implemented until 12 months post PPP forgiveness (2 months remaining).

Prior 5% holder Tabatabai was selling down a position last year, depressing the share price. Limited volume can result in outsized moves when buyers enter or exit.

Capital return and acceleration of revenues from the new SupplyChainMonitor tool would be catalysts for shareholders. Absent these catalysts, CRMZ is a low-float, low-volume stock which could drift sideways or down for an extended period of time.

Conclusion

CreditRiskMonitor is in the business of helping businesses manage risk, and such services have been brought into sharp focus with recent turmoil in the markets and supply chains. Trading at a 23% yield on EV with catalysts for re-rating, I expect CRMZ to outperform the market over the coming years. In the event the business is sold, there appears to be evidence they could command a sale price significantly above the current trading range.

Be the first to comment