photoman

Thesis

The metaverse, according to McKinsey is estimated to claim a market size of $5 trillion by 2030, and semiconductors are poised to play a key role in building the necessary infrastructure — be it for data communication, graphics or computation. In my opinion, there are two major semiconductor companies that lead innovation in this field: Qualcomm (NASDAQ:QCOM) and Nvidia (NASDAQ:NVDA).

Both NVDA and QCOM shares are down significantly YTD, almost 60% for NVDA versus about 40% for QCOM. Thus, it might be tempting to start considering buying the dip. But which one of the metaverse chipmakers should you pick?

In this article I will discuss whether an investment in Nvidia or Qualcomm is preferable, comparing the two firms with regards to (1) products and technology, (2) growth, (3) profitability and (4) valuation.

1. Technology & Products

Both Nvidia and Qualcomm have strong exposure to secular trends in connection to the next-generation internet, or in other words, the metaverse. But their associated technology differs somewhat.

Nvidia

To simplify, Nvidia is well positioned to grow alongside the metaverse-related gaming industry, or better the experience industry, by providing solutions for AI cloud-computing and 3D visualization technology. Notable highlights of Nvidia’s product portfolio include (not exhaustive): GeForce GPUs to power a cutting-edge gaming experience; GeForce NOW to support computing-power intensive game streaming services and related infrastructure; and GPU software to support cloud-based visual and virtual computing.

Moreover, one of NVIDIA’s most interesting ‘metaverse products’ is the company’s ‘Omniverse’ software, which is a cloud-based development framework for the creation of 3D immersive and virtual worlds. The ‘Omniverse’ platform allows for real-time photorealistic visualizations and incorporates AI for supporting lifelike simulations.

Qualcomm

Qualcomm, on the other hand, is focused on supporting the necessary infrastructure for wireless low latency data communication — which will be absolutely key for the metaverse experience. Notably, Qualcomm’s Snapdragon chipset currently powers most, if not all, AR/VR devices, including Meta’s (META) Oculus Quest and Lenovo’s Mirage Solo. In September 2022, the company has announced a strategic partnership with Meta Platforms to customize chipsets for VR/AR technologies. Mark Zuckerberg commented:

We’re working with Qualcomm Technologies on customized virtual reality chipsets — powered by Snapdragon XR platforms and technology — for our future roadmap of Quest products

Moreover, QUALCOMM has launched a $100 million investment fund dedicated to XR technologies, which aims to:

… accelerate the Metaverse content ecosystem and the next generation of spatial computing …

… for developer ecosystem funding in XR experiences such as gaming, health and wellness, media, entertainment, education, and enterprise.

Finally, Qualcomm also enjoys exposure to 5G, artificial intelligence, automotive, consumer, enterprise, cloud, and IoT — technologies that are likely going to have an indirect connection to the metaverse infrastructure and experience.

2. Growth

As a function of the product portfolio, it is arguably enormously difficult to derive a conclusion which company has a stronger growth outlook. And accordingly, readers should acknowledge this section with a healthy dose of skepticism and independent thinking.

Personally, I believe Qualcomm is in a better position to experience a near-term growth acceleration on the backdrop of the 5G rollout and higher VR technology adoption. Nvidia’s technology and value proposition, on the other hand, builds on the precondition that the infrastructure for 5G and low latency data communication has been broadly accepted. Accordingly, I believe that Nvidia’s growth might be a little bit more deferred and speculative.

Looking at the past 5 years, Qualcomm and Nvidia have grown at a similar rate. Nvidia has grown at an annual compounded growth rate of 25%, while Qualcomm has expanded revenues at a 22.5% CAGR.

According to analyst consensus estimates, which project revenues until 2025, expect that both companies will grow at an estimated 20% – 25% (Source Bloomberg). This expectation could be reasonable, in my opinion, if risk-taking (innovation and technology R&D) is accepted by the economy with a similar enthusiasm as it has been in the past decade, on the backdrop of low interest rates and strong valuation multiples for growth assets. But with rising real yields and falling asset prices, growth in the technology sector will likely be somewhat lower. So, in my opinion, investors are well advised to estimate a topline expansion for Nvidia and Qualcomm somewhere between 15% – 20%.

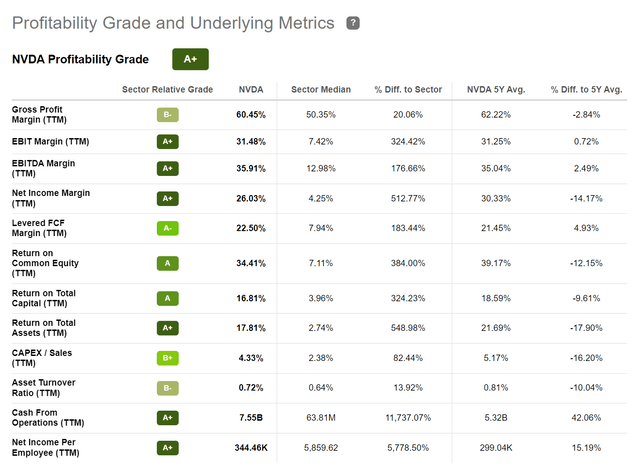

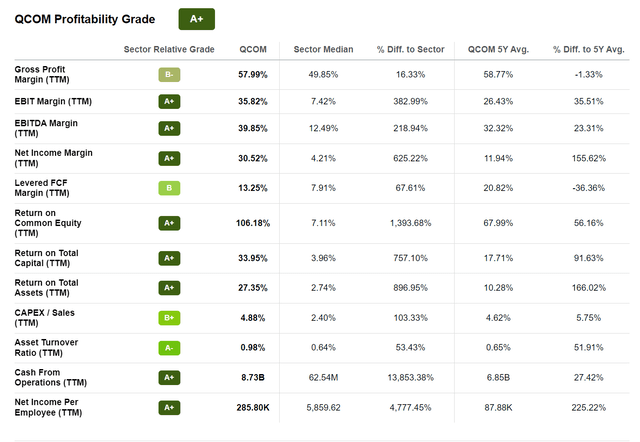

3. Profitability

Nvidia and Qualcomm are both highly profitable and claim margins that rival the profitability of the leading FAANG tech companies. But in context of a head-to-head relative comparison between Nvidia and Qualcomm, I am struggling to derive an insightful takeaway. This comparison is perfectly balanced, in my opinion.

For the trailing twelve months, Nvidia has managed to claim a gross profit margin of 60%, which is 20% higher than what is the median for the technology sector. Qualcomm’s gross margin was 58% respectively, which is about 16% above the sector median. However, operating income margin (EBIT, TTM reference) is 35.8% for Qualcomm and thus higher than the respective 31.5% for Nvidia.

There is also no clear takeaway which company operates more capital efficient. It is true that Qualcomm enjoys a return on total assets (TTM reference) of about 27.4%, as compared to 17.8% for Nvidia. But Nvidia generates $344,460 of net income per employee versus $285,800 for Qualcomm.

Nvidia

Qualcomm

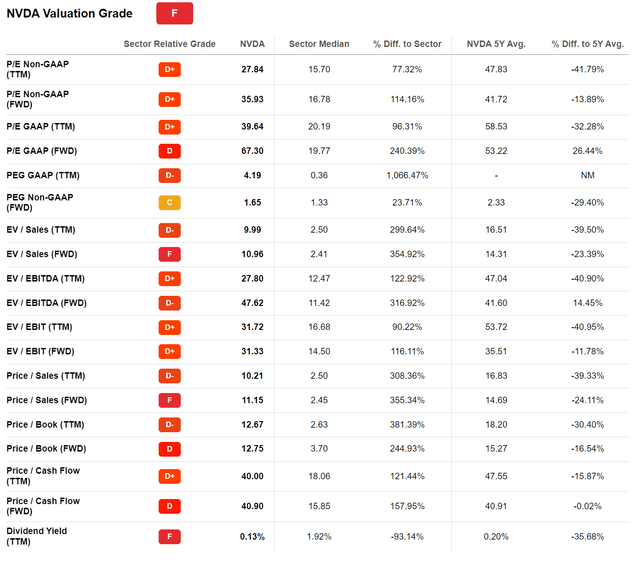

4. Valuation

Given that both Qualcomm and Nvidia post competitive size, growth and profitability, an investor would expect that the two companies trade at a similar valuation. But this is very far from the reality. Nvidia trades much more expensive.

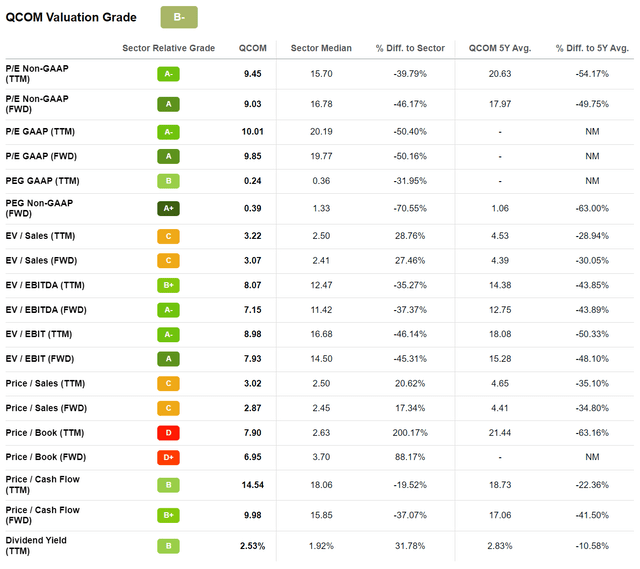

According to data compiled by Seeking Alpha, Qualcomm is valued at a one-year forward P/E of x9, while Nvidia’s one-year forward P/E is x36. Consequently, the P/E multiple implies a 40% sector valuation discount for Qualcomm, versus a 114% respective premium for Nvidia.

The argument of a valuation dispersion can be made for all relevant multiples, including P/S and P/B. Enclosed is some more data.

Nvidia

Qualcomm

Conclusion

To sum up the situation, as I see it, both Nvidia and Qualcomm are very competitive with regards to their technology, growth outlook, and profitability. But Qualcomm is clearly trading cheap, while Nvidia is not. Moreover, the valuation dispersion is highly significant, as investors should consider that the attractiveness of every investment opportunity must be a function of the price. Consequently, the investment decision should be easy: Qualcomm is the one to buy.

Be the first to comment