Bet_Noire

Co-produced with Treading Softly

If you’re an avid reader of war histories, fictional accounts of wartime, or even a movie focused on such topics, you may have heard the term collateral damage.

We live in an era of precision drone strikes, surgical strikes, and guided missiles. There was a time when to destroy a target, militaries would lob ordinance in the approximate direction and destroy anything in the area. It wasn’t precise. It wasn’t accurate. It wasn’t even highly effective.

It did create a lot of collateral damage.

World War One and World War Two were extremely different due to the massive technological advancements between the two conflicts and the type of war that occurred.

World War One is famous for the massive trench lines that still scar Europe’s landscape.

World War Two is often defined as a “quintessential total war of modernity”, partly due to the complete disregard for collateral damage. Anything and everything was considered a target. There were massive urban battles like Stalingrad or Berlin, which decimated entire cities and displaced entire civilian populations.

So how does this relate to your portfolio?

The Fed Self-Excuses

The Federal Reserve has long been ruled by a “dual mandate” – aiming to keep inflation around 2% while supporting “maximum employment” for the labor market.

In 2020, the Federal Reserve updated the language of its goals to maintain a long-term target inflation rate of 2% (instead of a consistently present level of 2%). This means they gave themselves a pass to allow inflation to run higher for a short time as it had a long run below the 2% level. This opened the door to inflation levels we’re seeing now. They essentially changed their own goals to allow more inaction.

They also changed the language of maintaining maximum employment to focus on more noneconomic and subjective measures than cold hard numbers.

So while inflation was building, the line was that it was transitory. No big deal. It’ll work itself out. Besides, the Fed thought, we said it’s a long-term target now! No need to adjust the course.

Now we have inflation over 9%, and the Fed is taking out its big guns to fight against inflation. The issue? Your portfolio and your budget have become collateral damage now. After allowing the inflation problem to fester and wreak havoc on your cost of living, the Fed is now swinging wildly with its hammer. Raising rates without regard to the consequences and without even noticing the reality that inflation was already burning itself out.

The Fed Doesn’t Care About Your Portfolio

The Fed isn’t worried about the stock market.

It isn’t worried about your retirement.

The Fed isn’t your friend.

It’s working on its own goals.

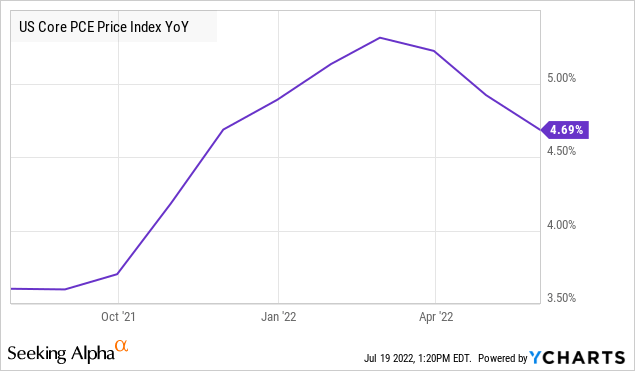

Recession risks are rising. Hiking rates to combat inflation is hurting the economy more than reducing inflation. Yet we recently heard the Fed triumphantly declare its intention to combat inflation even more aggressively, as core inflation has peaked and started declining before the Fed even hiked.

As more and more American consumers find high gas prices forcing them to make more serious budgeting choices, the Fed is kicking the consumer while they are already falling down.

They’re blowing it on their first mandate. Their second one, with the built-in self-made excuse, is no longer on their radar. Employment levels mean nothing if even employed people cannot afford their bills due to the rising cost of living.

Investors who built portfolios tuned to thrive in a world of cheap debt and easy money are seeing their portfolios look like Stalingrad. Beaten, battered, and much of its value decimated because of someone else’s war.

You have a rare opportunity to rebuild, refashion, and re-equip your portfolio.

The Time is Now to Step Out of the Fed’s Way

The Federal Reserve is like a bull in a China shop. At first, it did nothing, thinking that talking away inflation would work. Now it’s raging around stomping all over the economy, which Americans spent trillions to get going again, all in the name of doing anything to stop inflation’s rise.

Volcker would be rolling over in his grave. He took the steps to quell inflation for decades, only for a new generation to rise up and make mistakes that let it comes roaring back to life. He made every American pay the price for his battle, likely thinking it’d only need to happen once.

America went through not one but two recessions before inflation was tamed. Unemployment was sky high. It was not a fun time for anyone as the Fed fought against inflation after years of being lackadaisical.

He was wrong.

The Federal Reserve waited, and waited, and waited. Now they have a full-fledged fight on their hands, and they aren’t looking around before throwing their punches.

You better look out, or you’ll be caught in the middle!

Now is the time to buy an income from sources that will pay you, regardless of what the Fed does. This means buying exposure to the most basic and essential parts of our society and economy.

I personally have been buying shares of companies like Enterprise Products Partners (EPD), which yields 7.5%, or Antero Midstream (AM) which yields 9.0%. Why? Because they move and store Natural Gas and other commodities that we’ve built our entire economy around. Your local utility needs them to keep your lights on, and surely you’ll be paying your power bill.

Speaking of which, I’m also buying up Reaves Utility Income Fund (UTG) shares. It offers a 7.2% yield and pays me monthly. If you’re paying your power bill, you’re giving me money. Why shouldn’t you tap this source of income as well?

Dreamstime

To survive in a world where the Fed is fighting inflation, you need to develop a stream of income that isn’t dependent on them caring about you. You also need to develop a portfolio that can ride the market down while still giving you the money you need to live on a recurring basis.

We enjoyed years of low inflation and calm interest rates after the last major battle against inflation that the Fed took on. We saw the economic impacts during its battle as well.

It’s time to buy income and ride out the storm. Look for income from essential places that won’t stop getting revenue even in the worst of times. Invest in companies that benefit from inflation and companies that benefit from rising interest rates. You’ll also want to watch the other side too. Buy some picks that will benefit when the Fed has realized that it has gone too far and slashes rates back to zero. Now, it is more important than ever to build a portfolio that can provide you with a strong income regardless of what the Fed does. That is what we have been doing.

I’ve given you three ideas today, and I encourage you to follow us for more down the road. Your retirement may depend on it.

Be the first to comment