Dan Kitwood

I have been bearish on Credit Suisse (NYSE:CS) ever since the Archegos Capital Management debacle when the stock was trading at ~$10.

At the time, I have noted the following:

The Archegos Capital episode is a colossal failure of risk management by CS. It demonstrates that it is not yet ready to play with the “big boys” and it needs to scale back its ambitions and focus on fixing its risk management issues. This will likely be a protracted and costly process. I don’t believe, however, that the value of the franchise has been permanently damaged. It is trading at a very wide discount to its intrinsic value.

Having said that, I am not buying the dip yet. I prefer not to try and catch falling knives just in case something else comes out of the woodwork. I also expect better entry points in the next few days or weeks. As always, I remain nimble and may initiate a position depending on pricing and newsflow.

I have been waiting for a long time indeed.

In the last 18 months, the newsflow kept on getting worse. The bear market in equities affected the CS business model disproportionately (compared to peers) on both the Wealth Management (“WM”) side as well as the Investment Bank (“IB”). Consequently, CS simply went into a tailspin whereby its CDS spreads widened and consequently flared up a social media frenzy (Twitter-led) raising concerns about its financial stability. The bank was forced to quickly raise capital (~$4 billion) at a distressed valuation and announce a major restructure that effectively shattered the IB to pieces and disassembled this one by one. The troubles continued with the loss of key staff to competitors and culminated with reported outflows of ~10% of its AUM in the WM division during the early part of Q4’2022.

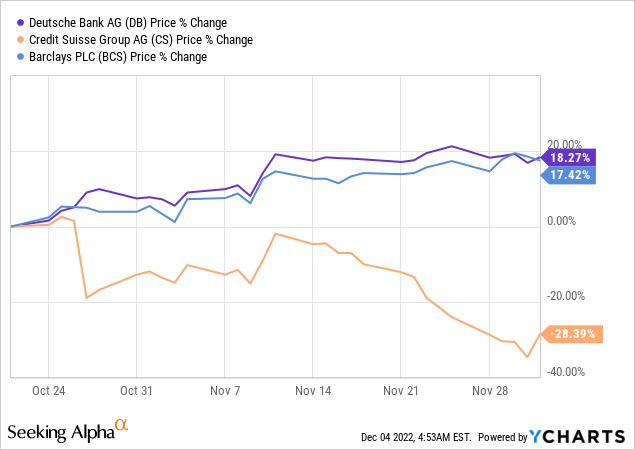

As recent as last month in a SA article, I have urged a strong preference for both Deutsche Bank (DB) as well as Barclays (BCS) in the European banking space. The relative outperformance in ~45 days has been close to 50%.

It was simply too hard to find any type of good news or even a distant light at the end of the tunnel. The share price continued its precipitous decline and is now trading with a 2 handle.

Why am I getting more constructive now?

I always recognized that there may be a time to buy Credit Suisse. The core asset of this bank is a prized WM trophy with an AUM of ~1.5T. It has strong brand recognition and trust globally and especially so in Asia.

The newsflow suggesting that material outflows are happening in Q4 was very troubling, if this was to continue, then the WM would potentially become materially impaired. It also appears that the outflows also led to the liquidity at some of its entities dropping below regulatory requirements. The outflows would also hit revenue and the WM business is predominantly a fixed-cost business. The key reason appears to be the relentless social media rumor mill relating to its financial stability. Many HNW investors were spooked and simply did not want to take a chance this is going to manifest in a European Lehman Brothers moment.

Fortunately, in recent days the newsflow improved significantly. On Thursday, Chairman Axel Lehmann told the Financial Times that client outflows have partially reversed and very few clients have left the bank entirely.

This is an important distinction. The fact that clients did not leave the bank suggests this is temporary and client flows can return very quickly. It is important to understand that once a client closes the accounts and leaves the bank – re-onboarding this client is a protracted (potentially several months) and costly exercise. Clients who leave (i.e. close their accounts) are unlikely to return.

It appears that clients may have only temporarily diversified their funds away due to (unjustified) concerns relating to CS’s financial stability.

I have seen a similar pattern with DB in 2017, where counterparties reduced their trading exposure due to similar fears (i.e. DB CDS spreads also widened materially). The upshot is that once stability returned so were clients’ trades.

I suspect the same is/will be playing out in this case.

Furthermore, a crucial part of the plan is the recapitalization of the bank. Whilst it is highly dilutive as it raised $4 billion whereas the market cap is ~$10 billion, the drag (technical and otherwise) should be now fading away as the capital raise officially completes this week. Note that the capital issue is fully underwritten, so no further risks in this instance, and should contribute to the much-needed stability.

The macro is not helping either

Unlike DB which benefits from exposure to FICC trading, the bear market in equities is also posing significant headwinds in both the WM and IB divisions. CS IB is predominantly geared mostly toward credit markets and capital markets issuances. Also, in the current environment, its areas of strength in the leveraged finance, M&A, and SPAC deal activity are loss-making.

This awakens the contrarian in me. If CS can stabilize the outflows from the WM unit and the external IB environment improves, then the overall picture (and valuation of the stock) should dramatically change.

Final thoughts

CS is not out of the woods as yet by any means but there are some green shoots nonetheless. Most (if not all of the bad news) is already factored in and capital raise is done and dusted.

The key is stemming (and reversing) the outflows in the WM unit. The signs are now more encouraging. At less than 0.2x tangible book valuation, this provides a very interesting risk/reward scenario. The prize is of course owning a leading global WM business at a fraction of book value (these generally should trade at least at book and in bullish markets even higher) so the upside is very material.

Additionally, the drag from the rights issue and capital raise should dissipate this week as well. So technicals may be supportive going forward.

I have been bearish all along in the last 18 months. I am turning more constructive and may tiptoe into a small position in the near future and go from there. I also think that options strategies can be productively utilized to hedge risk and supercharge returns.

After all, Mr. Market may have just given investors a gift. Perhaps it is now the time to own Credit Suisse.

Be the first to comment